BDC Common Stocks Market Recap: Week Ended September 9, 2022

BDC COMMON STOCKS

Week 37

Makes More Sense

Frankly, we were bemused in our last Market Recap by the third week in a row of lowered BDC stock prices.

The broad-based sell-off did not jibe with the ever improving outlook for future earnings and distributions in BDC-land.

(To sort of make our point, Blackstone Secured Lending Fund – BXSL – kicked off this week by increasing its third quarter 2022 distribution by 13% over the previously announced level of $0.53).

Of course, BDC stock prices do not operate in a vacuum – caught up in the shifting sentiments of stock market investors more generally.

Changed

This week, those sentiments – which had been unusually dark for several weeks – shifted substantially to a more optimistic mindset.

The S&P 500 increased by 3.65% in the four business days involved, and all the major indices followed suit to varying degrees.

For our part, BDCZ – the UBS-sponsored exchange traded note which holds only BDC stocks and serves as our market weathervane – increased 2.2%, up three days out of four, and ending at $18.23.

Supportive

The rest of our regular metrics only confirms the picture of a sharp upward move:

38 of the 43 BDCs we track were in the black and only 5 in the red.

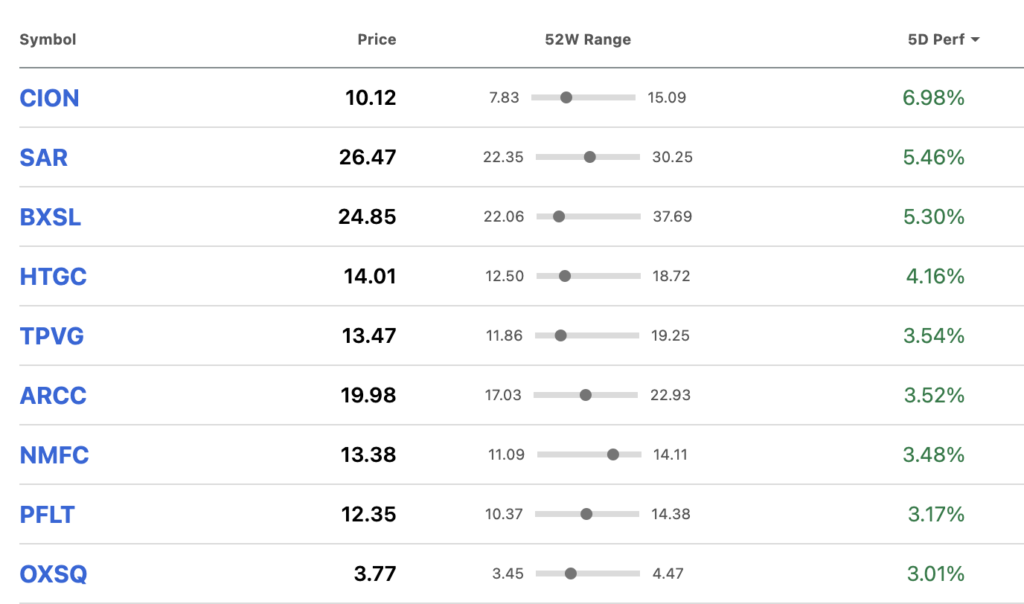

What’s more, 9 BDCs moved up 3.0% or more in price and only 1 dropped by (3.0%)+.

Here are the nine outperformers of the week – a mish mosh of small, medium sized and huge BDCs:

In just those few days the number of BDCs trading at or above book value jumped back to 15, after falling to 12 the week before.

Wider Lens

Of course, one week’s price performance – in any direction – does not mean much of anything in this highly volatile environment where investors worldwide are trying to know the unknowable about the future of inflation; GDP; interest rates and whether we’re shortly to face a devastating recession or just a mild slowdown.

We like to take a slightly longer term assessment of where the BDC sector stands and that’s mostly reassuring.

For example, BDCZ is now down “only” (9.1%) in all of the 37 weeks of 2022 – not even “correction” territory.

Technically speaking BDCZ was never in a “bear market”, if you compare its worst price level against the year end 2021 starting point.

All In

Even more encouraging for the buy and hold investor, the S&P BDC index – which calculates a “total return” that includes both price changes and distributions received – is down just (4%) this year.

This suggests that BDC investors – despite regularly going from hot to cold and back again like everyone else – are not unaware of the improving outlook in BDC fundamentals.

Despite a very turbulent external environment, even at the lowest points this year, there has never been the wholesale rush for the exits experienced not so very long ago at the beginning of the pandemic.

By way of contrast, at its lowest point in 2022 BDCZ still traded 72% higher than the nadir of March 2020.

Tough

We have to concede,though, that for investors in individual BDCs making a buck has been difficult.

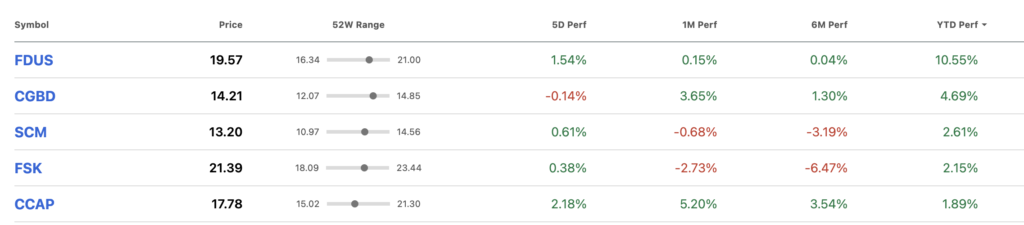

The Seeking Alpha data we look at indicates only 5 BDCs have posted an increase in price this year:

Maybe more pertinent is that half the BDC universe has dropped (10%) or more in this first two-thirds of the year, including 8 by more than (20%).

Painting A Picture

Looking forward, though, there is room for optimism – especially if you agree with us that BDC earnings and distributions are headed higher for most players.

Down the road, and around a corner or two, could be a BDC sector with record payouts and a Return On Equity like we’ve not seen for a decade or more thanks to the Fed engineered higher rates, which promise to be with us in some form for years to come.

Eventually – once the fear of a mighty recession recedes or if one occurs and we come out the other side – the markets will – as they’ve always done before – return to the valuation levels that have obtained before.

(“Before” was not that long ago. All the way to April of this year, most every BDC was trading at or close to new 52 week or all-time price highs).

Playing With Numbers

Indulge us for a minute and let’s assume BDC earnings and distributions in the quarters ahead increase by 20% or more.

Let’s apply that 20% increase to what BDCZ was trading for at its apex in April, which would amount to $24.8.

That would bring BDCZ to an all-time high price from its prior record of $23.9.

More importantly, if that did occur, BDCZ would gain 36% over the current level.

Impossible you say ? At the moment that’s probably right given the multitude of uncertainties, but in a not-too-distant future that’s a plausible outcome.

Everything Happens For A Reason

After all – and as we argued last week – a fundamental shift is occurring in the cost of debt capital as the Fed shifts its strategy – and BDC lenders are one of the beneficiaries. This is a case of being in the right place at the right time and follows a decade where the same Fed – by deliberately keeping rates low – depressed BDC earnings.

We admit that over time some of the economics that are favoring BDCs right now will erode. The reference rate will not stay at whatever height it reaches for ever. Borrowers – once they’re back in the driver’s seat – will demand lower loan spreads. The inexpensive unsecured fixed rate debt the BDCs piled up in 2020-2021 will eventually need to be refinanced and at much higher yields.

Even then, though, the BDC economics of 2024 or 2025 will still be more favorable than in 2021.

Round The Corner

In any case, that’s a long way off and in the shorter term BDC earnings and distributions are headed towards a Golden Age that even a Fed-induced recession may not fully undermine.

How long can markets worry when a whole sector – with very few individual exceptions – is likely to report record profits, possibly lasting for years ?

We don’t know the answer about the timing and we concede that a 2008-2009-like crack in the financial system could send us all off in a different direction.

Nevertheless, we’d argue there’s a good chance that – notwithstanding all the bleak talk on your favorite financial channel – the BDC sector could find its way to new heights before long.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.