BDC Common Stocks Market Recap: Week Ended October 31, 2025

Premium FreeBDC COMMON STOCKS

Week 44

Wall Street on Friday tagged a three-week win streak and also closed out October with a six-month positive run, underscoring the U.S. market’s remarkable recovery from April’s lows.

As widely expected, the Federal Open Market Committee on Wednesday cut its key policy rate by 25 basis points and said it would end the central bank’s balance sheet winddown.

For the week, the benchmark S&P 500 index (SP500) gained +0.7%, while the blue-chip Dow (DJI) added +0.8%. The tech-heavy Nasdaq Composite (COMP:IND) surged +2.2%.

seeking alpha: wall street breakfast November 1, 2025

Like A Pancake

The main indices may have continued to march on – as shown above – but BDC investors were not so moved.

BIZD – the only BDC sector exchange traded fund – moved up, then down and ended up in exactly the same place as the Friday before, at a price of $14.33.

The S&P BDC Index was not that much different, dropping a minuscule (0.1%).

Same-ish

22 BDCs increased in price and 24 were down.

Amongst the BDCs in the red 4 moved down (3.0%) or more and only 1 increased by 3.0% or higher.

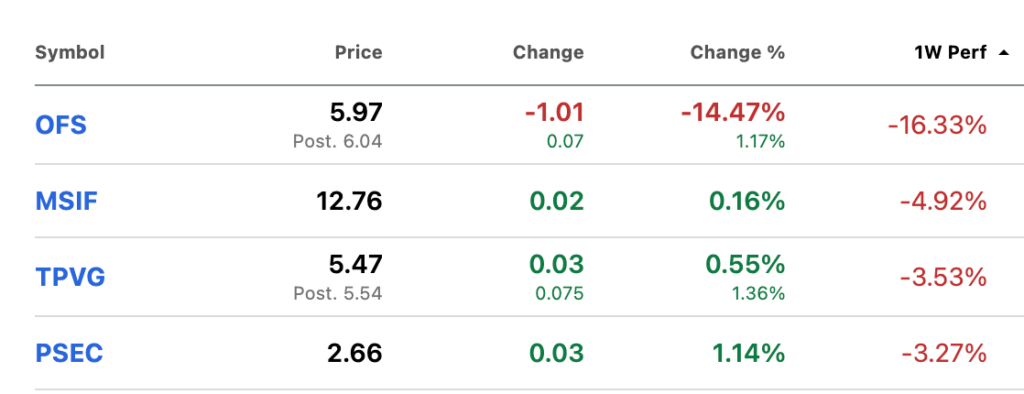

Let’s start with the former:

Except for OFS, none of the disparate names above figured in the BDC news feed this week.

Our guess is that the red ink tells us something about what the market expects to hear when each BDC reports their IIIQ 2025 results.

Going by the fundamentals, none of these BDCs have covered themselves in glory of late, so the skepticism seems warranted.

However, surprises can happen or we’d be out of business.

Dramatic Drop

However, the Story Of The Week – if we had such a feature – is what happened at OFS Capital (OFS) – one of the four BDCs that reported its IIIQ 2025 results this week.

We wrote at length about the BDC for a number of reasons.

First, management finally decided – after many quarters of “under-earning” its $0.34 quarterly dividend – to cut the regular payout in half.

A (50%) dividend reduction is unusual in the BDC sector but given the OFS metrics of recent quarters – including a sharp decrease in the BDC’s NAVPS – was no great surprise, or that (16.3%) price drop would have been bigger.

Second, we have been expressing concern about the BDC’s liquidity position for some time now.

In a nutshell, there appears to be a risk that OFS might not be able to refinance all its debt obligations and continue to meet its regulatory asset coverage limits.

Various disclosures made in this quarter’s 10-Q for the first time only increased our level of concern.

For all the details – and for a discussion about how OFS might address the matter – check out the article we wrote.

In any case, OFS closed the week at a price of $5.97, but briefly reached $5.25 earlier in the day.

The current yield is 11.4% which suggests there are still plenty of optimists around, even though the stock price has dropped (45%) since March 2022.

All Alone

As mentioned, only one BDC moved up significantly in price this week and that was Horizon Technology Finance (HRZN), which jumped a mighty 10.9%, to close at $6.48.

Two weeks before the venture debt BDC traded at a 52 week and all-time low of $5.71.

The catalyst for this drastic change of fortune was the BDC’s IIIQ 2025 results, which saw both Net Investment Income Per Share (NIIPS) and Net Asset Per Share (NAVPS) increase.

The former jumped 14.3% and the latter 5.5% quarter over quarter.

Positive changes in those metrics are often enough for many investors to jump in with both feet, looking to be part of a turnaround.

Trading volume at one point reached 2.5mn shares, more than three times the usual amount.

All this for one of the smallest public BDCs with a market cap under $300mn and whose stock price has declined by more than two-thirds in the past 4 years.

Over at our sister publication – BDC Best Ideas – we warned that HRZN’s sudden improvement was based on shaky ground.

Here’s what we had to say about earnings:

“The 18.6% all-in yield achieved – as management candidly admits on the conference call – is way above the normal yield level of about 14.75%. The on-boarding yield is even lower – 12.2% – and unchanged. If we adjust the BDC’s Net Investment Income for either of those yields, HRZN’s recurring income would have been lower in the IIIQ 2025 than in the IIQ 2025. We calculate that instead of a Net Investment Income Per Share (NIIPS) of $0.32, the adjusted NIIPS would be $0.19. That’s well below the $0.33 a quarter of dividends paid”.

BDC Best Ideas

Furthermore, the increase in NAVPS mostly related to merging a previously under-performing HRZN portfolio company with another business – supported by a big equity cheque from the BDC.

That resulted in an equity mark-up for the combined business – Shengrow aka Soli Organic – and a corresponding boost to net asset value.

If the combination does not work out a good deal more capital than was invested before might need to be written down.

Is HRZN at a turning point or was this a false dawn?

WHERE WE ARE

Deja Vu

Given that the sector did not budge in price terms this week and the number of BDCs trading at or above book remained the same at 8, there’s not much changed since we last wrote.

This in a week where the Fed cut rates by 25 basis points, as was almost universally expected – save from Stephen Miran who favored twice as large a cut.

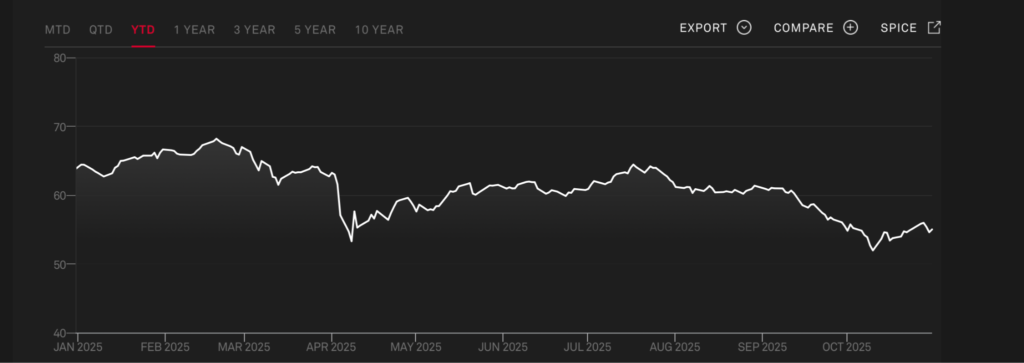

Maybe BDC investors “front run” the two rate reductions we’ve had by bringing down BDC sector prices since their high on July 17 by (15%).

See the chart below:

Maybe investors are just waiting for more reveals from a host more BDCs.

This week, though, did not tell us much that was new.

All Good

Ares Capital (ARCC) and Hercules Capital (HTGC) – the two heavy hitters to report – continued to perform as expected.

Both increased their NAVPS and maintained their dividend payouts.

OFS was expected to under-perform and HRZN’s good results don’t move the sector needle much given the size of the BDC.

Sad But True

Still, we are only two months away from the end of 2025 and the sector returns are pretty miserable if compared to most anything.

The S&P BDC Index is down (13.76%) in price terms and (6.16%) on a total return basis.

The respective numbers for the S&P 500 – boosted by those AI/technology stocks – are 15.5% and 17.9% in the black.

According to Seeking Alpha, only 3 BDCs that have been trading all year are up in price.

Better Than Nothing

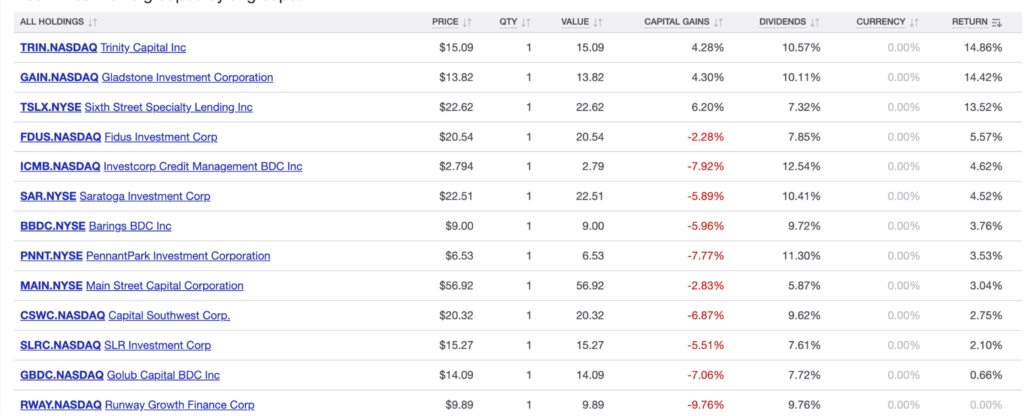

Thankfully – as we now point out every week – many more BDCs are “in the money” or unchanged for the year when distributions received are concerned.

This week, the number comes to 13.

WHERE WE ARE HEADED

Familiar Theme

Where we are not headed – in the opinion of the BDC Reporter – is towards some sort of systemic credit crack up in the public BDC sector – the only segment we can speak to with research aforethought.

This was confirmed again by the IIIQ 2025 credit results of ARCC whose underperforming investments – including non-accruals – remained yet again at below their historical averages.

[This behemoth of a BDC seems to have slipped on the banana peel of lending to a soccer team conglomerate and might take a ($50mn) loss therefrom – as discussed at the BDC Credit Reporter – but that’s next to nothing in a BDC of its size].HTGC reported excellent credit results as well. The total number of non-accruals in their multi billion portfolio increased from just 1 to just 2. Even that new non-performer was removed subsequent to quarter end.

Even OFS- for all its travails – added only 1 non-accrual and structured away an existing non-performer.

Nobody we’ve heard from this week, or in the run up to earnings season, has rung any alarm bells or raised any red flags or whatever it is we expect would presage a credit downturn.

A Little Help

In fact, lower interest rates are beginning to show up in better interest coverage metrics for the BDCs.

Tariffs may be eroding the profitability of some companies for all we know but only a handful of names amongst the 10,000 BDC-financed businesses have yet been laid low by the dramatic changes underway in the global trade system.

Nor have any market participants seem to have pulled back from either being a lender or borrower when the opportunity has arisen, keeping all segments of the market active.

Maybe this is the Poseidon Adventure and there’s a rogue wave headed towards us, but nothing is showing on the radar.

That Other Familiar Theme

As a result, we continue to expect that the expected future direction of interest rates will continue to be the factor to most influence BDC prices going forward.

This week was a seminal one in this regard.

As our readers all know, the Fed Chairman – even as he announced a 25 basis point rate reduction this week – repeatedly warned that another one could not necessarily be penciled in for December.

The futures market continue to predict a cut will occur but the certainty level has dropped very sharply from the mood before the latest 2 reductions.

In 2026, another 100 basis points in cuts are expected by the markets but only 25 basis points by the Fed itself.

This means that end of 2026 the median Fed Funds rate could be anywhere from 3.0% to 3.4%.

For the full discussion, click here.

Base Rate

Of course, BDCs don’t directly lend or borrow off the Fed Funds rate but off SOFR, currently at 4.04% overnight.

At the extreme, that could drop to 2.75% if we get one cut in December and four next year.

Should that happen, the BDC sector will have incurred 175 basis points in SOFR reduction since 2025’s rate reductions began.

According to calculations we’ve made at BDC Best Ideas that’s the sort of anticipated rate reduction that triggered the recent price implosion of the BDC sector.

Should that become the accepted wisdom – even if its months in advance of the actual reductions – BDC prices might “re-test” their prior lows.

After all, the S&P BDC Index has moved up nearly 6% from a nadir reached on October 10.

Another Alternative

If the Administration bends the Fed to its will – and the Fed Funds rate drops to 1.0%, another BDC price decline could be in order.

The markets don’t really believe that Zero Interest Rates can be restored by fiat, but should that change…

On The Other Hand…

Our opinion – and that of a growing number of Fed governors, economists and commentators – as watching CNBC or reading Bloomberg will show you – is that the rationale for lowering rates is seeming weaker and weaker with every passing day as the economy continues to chug along; the markets are at red hot highs and inflation remains high.

No wonder Chairman Powell has expressed doubts about the next move.

The Fed has given the Administration two cuts but may regret giving more unless the unemployment numbers go haywire.

December 2025 may bring the first pushback and who knows what happens after Mr Miran and the President do not get their heart’s desire?

It’s been said before a lot this year but we are in uncharted waters here.

Nobody can really predict what rates will be in 2026, so we won’t bother.

Carrying On

The good news for the BDC sector – as we’ve argued before – is that most of the public BDCs remain on track to generate robust risk adjusted returns on equity under any interest rate scenario.

In fact, we’d argue that the long experience of the managers; the diversified portfolios assembled; the modest leverage employed and the low level of historical losses make public BDCs the sharpest knife in the Private Credit drawer right now.

We concede, though, that BDC ROEs ranging from 8%-14% per annum may not be very exciting in a world where the S&P 500 is going gang busters, but that may not last forever.

Every dog has its day.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.