BDC CREDIT REPORTER-COMPANY ALERTS

Premium FreeWEDNESDAY July 20, 2016

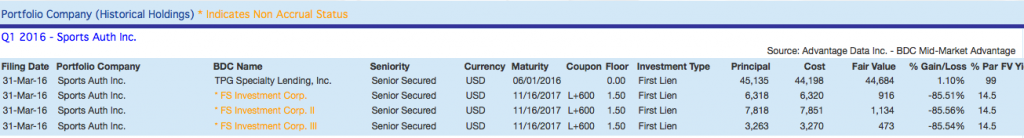

Sports Authority Liquidation Almost Complete. BDC Losses May Be Lower Than Anticipated.

- Sports Authority liquidation drawing to a close, but final conflicts remain between lenders, landlords and suppliers.

- WSJ reports most senior lenders have been fully repaid. However, lenders are “still owed $240mn”.

- Hard to determine whether BDC lenders to bankrupt firm will book any Realized Loss at end of day. See Investment Ownership below.

- BDC Credit Reporter expects TSLX will be repaid in full, and Franklin Square funds loss-if any-will be lower than valuation at March 31, 2016.I

- TSLX, FSIC, FSIC II, FSIC III

THURSDAY July 14, 2016

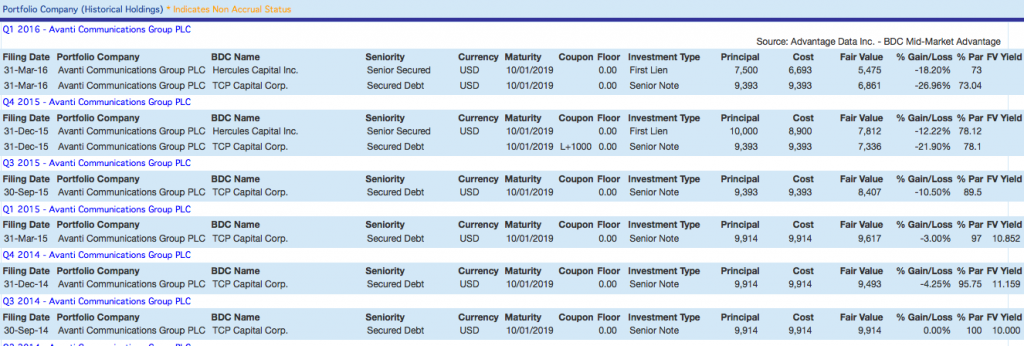

AVANTI COMMUNICATIONS FACES LIQUIDITY SHORTAGE. SEEKS NEW CAPITAL OR SALE

- UK-based publicly traded satellite services company Avanti Communications (LSE:AVN) may be facing liquidity crisis.

- According to trade news reports, Company needs to raise $50mn in cash by fall.

- Company liquidity said to be declining fast: cash on hand has dropped by 50% in last 3 months through end of June.

- Reportedly: Board and management seeking to major cost reductions over the next 3 years.

- Company has announced intention to raise additional equity capital if possible and has put business up for sale.

- Two BDCs with exposure to Company: Hercules Capital (HTGC) and TCP Capital (TCPC), both in senior debt due 2019.

-

Source: Advantage Data (www.advantagedata.com) - BDC exposure already written down between 18-27%. Senior bond trading at 30% discount currently.

- BDC Credit Reporter says: ” Both Hercules and TCP Capital may face prospect of Realized Losses on Avanti Communications investment “

- BDC Credit Reporter published first Alert on Company back on May 25th, 2016 when stock hit record low.

- See Company File from BDC Credit Reporter’s database of under-performing companies.

WEDNESDAY July 13, 2016

WARREN RESOURCES AGREES RESTRUCTURING AGREEMENT WITH ALL CREDITOR GROUPS

- Bankrupt oil company Warren Resources moved one step closer to exiting Chapter 11 with an agreement amongst all creditors, in 8-K filing.

- The Amended Restructuring Support Agreement sets out debt to be restructured, forgiven and division of equity interests amongst creditors.

- The terms are in line with earlier versions of Restructuring Support Agreement and make possible a court approved bankruptcy exit in September.

- Included is a $20mn Debtor In Possession Facility (DIP), to be funded by existing senior lenders and eventually rolled into new senior debt of post-Chapter Company.

- BDC Credit Reporter reviewed weekly DIP budget, which shows operational cash flow break-even and $30mn in BK expenses funded by DIP and cash.

- No material change expected in impact on BDC lenders to Company-all in senior debt-as discussed in prior article on June 3, 2016.

- BDC lenders should book substantial fees for DIP financing even when writing off a portion of their debt exposure in the anticipated debt for equity swap.

- BDC Credit Reporter says: ” Worried that even after restructuring and huge debt forgiveness Company may not be cash flow positive if oil price stays down and new drilling stays low”

- FS Energy, FSIC II, FSIC III, FSIC

TUESDAY July 12, 2016

- Medley Capital (MCC) portfolio company Essex Crane Rental Corp. entered into 6th Forbearance Agreement with lenders on 6-23.

- As part of terms, Essex agreed to no longer draw on its Revolver and use incoming cash to pay expenses.

- Borrower also agreed with lender plan to liquidate all its assets at public auction, effectively ending the business.

- Proceeds to be received are unknown, but were considered preferable to sale of business and other options.

- Medley Capital arranged $30mn secured Term Loan to Essex Crane in mid-2014, retaining $20mn.

- Loan was carried at par till IVQ 2015 when placed on non-accrual, written down by over 80%. IQ 2016 value: $3.7mn.

- MCC likely to book Realized Loss in IIIQ. Unrealized value unlikely to be material in IIQ.

- Our View: Big-if not unexpected- setback for MCC given speed of write-down and likely 80%+ write-off of “senior secured” investment.

-

Ownership data from Advantage Data - MCC

MONDAY July 11, 2016

- Caesar’s Entertainment Corporation (CZR) has tentatively agreed merger terms with Caesar’s Acquisition Company (CACQ).

- Merger of two non-bankrupt entities subject to satisfactory completion of Caesar’s Entertainment Operating Company (CEOC) Chapter 11 plan.

- CEOC re-organization may fail on dispute between its junior debt holders and Caesar’s Entertainment re: fraudulent conveyance.

- The formal CEOC reorganization plan to be adjudicated in early 2017.

- BDC Credit Reporter reviewed the Caesar companies press release and SEC filings of July 11.

- Conclusion: ” The tentative CZR-CACQ merger agreement increases likelihood of Chapter 11 plan being accepted by judge”.

- That’s good news for BDC lenders to all Caesar’s entities due to their senior position on the respective balance sheets.

- However, complexity of deals and no resolution till 2017 suggests huge legal bills will reduce cash availability for 6 months plus.

- See earlier article for BDC exposure to Caesar’s.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.