BDC Round-Up: Week Ended August 10, 2018

Premium FreeWORD FROM THE EDITOR

We’ve certainly confirmed that when BDC earnings season is in full swing, the BDC Reporter has a hard time publishing much of anything.

That’s partly because we’re actually reading every press release, Conference Call transcript (where available) and dipping into the quarterly filings where possible on your behalf, and ours.

It’s also partly because we are also writing brief commentaries about the performance of each reporting BDC in our Daily News Table (see Subscriber Tools).

We’re not a financial news site, so we don’t bother just summarizing the numbers as you’ll find on sites like Seeking Alpha.

Given our resources and all the homework we’re doing in the background, we offer our unique mixture of analysis and opinion in these paragraph long commentaries.

We’ve also taken to sharing our BDC-by-BDC earnings projections, comparing actual to our 2018 projection and offering up our 12 month outlook.

So, if you’re looking for running color commentary as BDCs fess up to their latest results, return regularly to the Daily News Table.

We like to think that’s a pretty unique resource and one of the good reasons for subscribing.

Who else out there is reading EVERYTHING and providing numbers, insights and projections for 46 different BDCs ?

Coming up in the next few weeks will be a deeper dive – and many more full length articles – as we scrub the quarterly filings and review BDC portfolio progress.

However, we’d like to take the opportunity of this BDC Round-Up to point readers to the most interesting items and trends we’ve culled from the huge data dump we’ve just absorbed as IIQ earnings season winds down.

In no particular order…

No (Unexpected) Disasters

As we noted last week when earnings season was just getting going, there have been no major financial meltdowns by any reporting BDC.

We expected less-than-stellar results from several players, including ABDC, BKCC, KCAP and MCC and were not disappointed.

However, no BDC – even those listed above – reported the sort of jump in under-performing investments that usually results in a price meltdown.

Dividend Announcements: No Retreat

Building on the prior point, no BDC used the opportunity during this earnings season to reduce its dividend, as is so often the case.

Admittedly, we rate the Dividend Outlook for all 46 public BDCs and have only 2 marked more likely than not to DECREASE in the next 12 months.

Nonetheless, we started earnings season with 16 BDCs AT RISK of a cut.

Nobody slipped up this quarter and when we undertake a fresh analysis when the season is over, we’d guessing the AT RISK number for the period through June 2019 will shrink dramatically.

Very Few New Non Performing Portfolio Companies

This is necessarily an early call – as we’ve yet to review each BDC portfolio name by name – but very few BDCs reported new loans placed on nonaccrual in the quarter.

We’re going to keep a list of how many came on and how many came off.

Right now – and looking down the BDCs we’ve reviewed – there are no more than a handful of new names in the non accrual category.

That does not mean that there are not multiple BDCs still struggling with numerous under-performing players that have been on the books for some time.

Moreover, this dearth of new non accruing loans has also something to do with the willingness of lenders to restructure, rejig and refinance to avoid borrower payment default.

Obviously that’s good news for the here and now but may not help us so much as a divining tool for the future.

We remember how BDC portfolios were squeaky clean in early 2017 too…

Mass Adoption Of The Small Business Credit Availability Act

Ever more BDCs have used the opportunity of second quarter earnings release to inform shareholders of their decision to adopt the higher leverage allowed under the Act.

Each announcer has qualified the decision with different limitations and financial terms, but the numbers are growing.

As of Friday August 10, 2019 – by our count – 30 of 46 BDCs are somewhere along the spectrum from having received only Board approval to having shareholder approval to move ahead right away on the new limits.

Within that 30, 7 are still in process of getting shareholder consent.

We consider that essentially a done thing as no BDC has yet met with a rebuke from its owners when they were asked.

So far, we count only 3 BDCs that have definitively closed the door on adopting the new law.

2 other BDCs are going away – ACSF and CCT – which leaves the potential number of BDCs that could eventually choose the new limits to be 41 out of 44.

Huge Increase In BDC Assets In The Cards

As we get a clearer picture of which BDCs will be taking advantage of the Act – and learning more about their “Target Leverage” intentions – it’s getting clearer how monumental the increase in BDC assets might be.

We’ve been calculating the extra assets/debt that BDCs are planning on (versus just the hypothetical number) and have already counted $15.555bn in prospective new assets.

While readers are taking that in, add to that the likelihood that many BDCs -thanks to bigger asset sizes – will have larger 30% non-qualifying asset baskets.

Historically many BDCs have used this huge loophole to invest capital into highly leveraged off balance sheet vehicles or finance companies.

Just quantifying those increases is very difficult given poor disclosures.

We’ll only say that early indications suggest incremental billions of dollars of indirect leverage will be added in this way.

Finally – and refreshingly – a number of BDCs are still growing the old fashioned way: by raising new equity, which will also result in more BDC assets once the monies are deployed an leveraged up.

Everybody’s Complaining About Everyone Else

On just about every Conference Call we’ve listened to BDC managers have continued a multi-year long litany about market conditions.

There are too many lenders, offering too loose terms and rock bottom pricing.

We hear the same sort of complaint in every sub-segment of the market, including the lower middle market.

Nonetheless – and with all that spare capital jingling in their pocket – most every BDC is finding a way to book new loans, while underscoring that they are being “selective”.

Here is a typical example, gleaned from Apollo Investment’s (AINV) Conference Call transcript but which could have been lifted from two dozen different prepared remarks:

…middle market lending remains competitive and issuers continue to take advantage of this environment. Most deals continue to have aggressive structures and pricing. This borrower-friendly environment is due in large part to robust capital formation in the middle market debt space.

Despite this challenging environment, we believe the combination of our strong origination platform, broad product suite, and deep sponsor relationships allows us to compete more successfully than many others. We believe that given our size relative to our funnel of investment opportunities, we can find attractive opportunities in today’s market.

That said, we expect only to put capital work if it makes sense for our shareholders in the long-term. We remain focused on credit selection, while patiently deploying capital…

Nobody on the Conference Calls seems to connect the dots as to what the future might bring with the huge wave of capital coming from the Small Business Credit Availability Act and the already red hot market conditions.

Nobody Is Following The Leader

A few weeks ago Goldman Sachs BDC (GSBD) seemed to set a new standard for the BDC Sector when reducing its Management Fee – subject to shareholders approving higher leverage, which they did – to 1.0% from 1.5%.

Who would follow the “vampire squid” and lower base fees to ensure shareholders a better return from growing balance sheets by using only debt ?

So far, the answer is no one.

The newest and most earnest entry into the market – Barings BDC (BBDC) – will be charging a 1.0% Management Fee but only temporarily.

Many other BDCs have since adopted the new leverage rules and offered no concessions at all to shareholders, who have signed up anyway.

A few players have offered a 1.0% Management Fee but only on assets over the prior threshold.

That’s the case at Ares Capital (ARCC), TCG BDC (CGBD) and Garrison Capital (GARS).

Effectively – where GSBD is offering shareholders a lower base fee on 100% of assets and right away, these other BDCs will be discounting the fee on a fifth or so of the portfolio and not for some time.

Of course, most BDCs adopting the new rules are not budging one little bit while being in line for increases of 50%-100% in their compensation.

What a great time to be a BDC External Manager !

Crowded With Big Fish

Keep what we said in mind above when we discuss this next point:

What was once a backwater of the asset management world has become the new Klondike, with virtually all the larger firms establishing a presence.

We’ve seen KKR make the biggest move of all with its partnership with FS Investments and the multiple BDCs under its tutelage.

Still, the famous barbarian at the gate has to share everything 50/50.

BlackRock,Inc. has acquired and renamed TCP Capital (TCPC) – without any demur from the BDC’s supposedly independent board members who do not seem to have considered any other alternatives.

Now the largest money manager has not one but two BDCs under its umbrella.

There is also the Carlyle Group, Goldman Sachs, Apollo Global, Ares Management, Golub Capital (which sold a minority stake), New Mountain, OakTree Capital, TH Lee and many other firms with multi billions of dollars under management.

(The principals of Medley referenced the consolidation in the sector as one of the reasons for its three way roll-up of Medley Capital (MCC), Medley Management (MDLY) and Sierra Income this week).

If that wasn’t enough, we hear that GSO Blackstone, now amicably divorced from FS Investment, is planning to join the BDC ranks with a $10 bn fund.

Any kind of rush always makes the BDC Reporter nervous, especially where credit is concerned: a sector where getting money out the door is much easier than getting it back.

Of the dozen large asset managers that we count on the BDC scene only a quarter were even around during the Great Recession.

Of the three that were, only Ares Management (parent of ARCC and the soon-to-be-liquidated American Capital Senior Floating) can point to a track record worth boasting about.

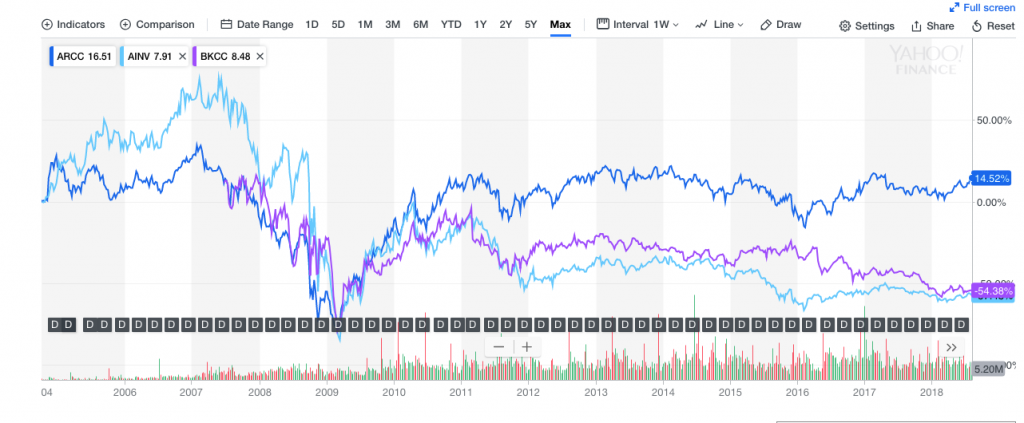

A chart is reportedly worth a thousand words. Here is the long term stock chart for ARCC, AINV and BKCC:

Both the BDC Reporter and investors should reserve judgment about the long term success in middle market lending of firms that made their fortunes in very different arenas until we’ve worked our way through a full cycle.

Those of us with white hairs on our head remember that the market leaders before the last recession included American Capital, Allied Capital and MCG Capital.

We ask – rhetorically of course – where are they today ?

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.