Capitala Finance: Two Portfolio Investment Exits

NEWS

On August 22, 2018, the parent of Capital Finance (CPTA) – Capitala Group – announced two portfolio company exits.

See press release attached.

The companies were both held by CPTA.

On August 13, 2018, the Company exited its investment in Western Window Systems, a designer and manufacturer of moving glass walls and windows. Proceeds from the exit totaled $23.3 million; $10.5 million for full repayment of the senior secured debt investment, and $12.8 million for the Company’s equity investment. This generated a realized gain of $9.8 million for Capitala.

On July 31, 2018, the Company sold its senior secured debt investment in Kelle’s Transport Services, a provider of temperature-sensitive freight transportation, receiving $13.3 million in proceeds upon exit.

ANALYSIS

Both exits had been in the cards for several weeks.

The proceeds exactly match the valuations ascribed at June 30, 2018 in CPTA’s 10-Q.

Western Window Systems – in which CPTA has been the only BDC involved – was first booked in the IIIQ of 2015 and has consistently been valued at a premium.

CPTA will lose a $10.5mn loan with an attractive 12.3% cash yield, or $1.3mn annually

However, if proceeds from the equity (which has a cost of $3.0mn but was paid out at $12.8mn) are re-invested into yield investments, CPTA should benefit.

Assuming a 10.0% yield, the interest income would be $2.3mn.

The $1mn increase in income – on a pro forma basis – represents a potential $0.06 increase in recurring earnings per share before any Incentive Fees.

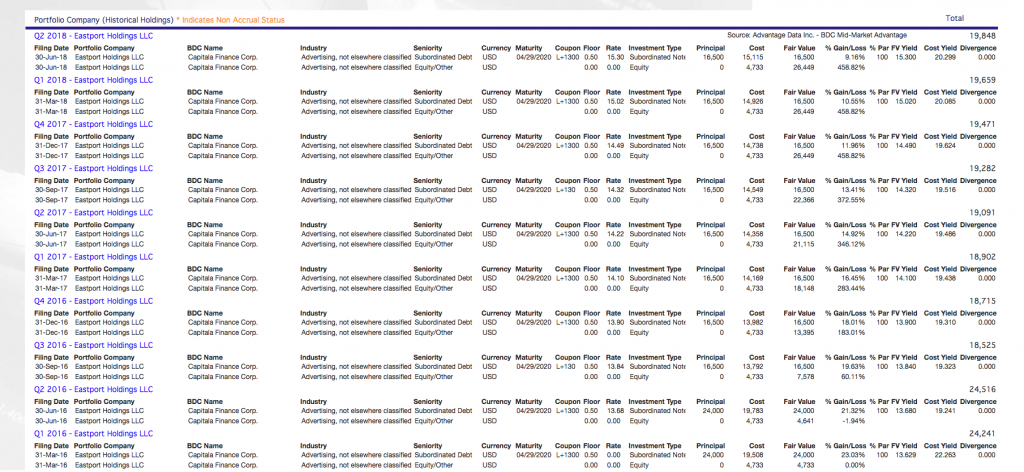

Kelle’s Transport Services was first booked (also a CPTA only transaction) back in 2014, but has a more mixed history.

CPTA initially invested in the logistics company in the form of senior debt, Preferred and equity as this screenshot from Advantage Data shows:

![]()

However, the company encountered financial difficulties, briefly went on non accrual (IIQ 2017) and was restructured/ acquired by a third party.

At that point CPTA’s stated exposure was $17.1mn.

The proceeds from the repayment of its new loan to Kelle’s is $13.3mn, a $3.8mn loss.

However, the restructured loans to Kelle’s had been on very borrower favorable terms (two tranches at 4.0% and 2.2% respectively).

Annual income was just over $0.400mn.

If CPTA re-invests the $13.3mn at 10.0%, annual income will increase to $1.3mn, a $0.900mn increase. That’s $0.056 per share.

In toto – and on a pro forma basis – these repayments could boost CPTA’s Net Investment Income Per Share (assuming reinvestment and no associated expenses) by $0.12 a year.

The current dividend is $1.00 a year.

VIEWS

Hard Times

Although expected, these are positive developments for CPTA, which has absorbed a series of bad loans.

In the June 2018 quarter, the BDC recognized Realized Losses of $22.6mn, bringing accumulated Realized Losses to $88.5mn.

The dividend has been cut twice.

Changes

Management has responded by promising to reduce the BDC’s portfolio risk by investing a greater portion of its loans in lower yielding first lien or unitranche loans.

In addition, the Investment Advisor has committed itself to selling off – where possible – the large number of non income producing equity stakes the BDC holds to increase yield income.

Equity and warrants account for 26% of the value of CPTA’s portfolio at June 30, 2018.

That’s $125mn.

Long List

The BDC Reporter – in a review undertaken few weeks ago – identified 9 material positions that might be sold and re-deployed into yield bearing investments.

One of the 9 was Western Windows Systems.

Another was U.S. Well Services, to which CPTA (and several other BDCs) is both lender and investor.

Recently the oil & gas services company was acquired in a complex going public transaction.

Although CPTA’s equity was not cashed out, the BDC may be able to sell its position in future periods .

As of June 2018, the equity portion of the position was worth nearly $12.0mn.

Outside of these entities, we count $77mn of equity stakes at FMV that might be transformed into yield investments.

Watch Out

We are especially interested in what happens to Eastport Holdings, whose equity stake is valued at 458% of cost and has been growing in value, as this Advantage Data chart shows:

Not to get ahead of ourselves but re-investing $26.5mn at 10.0 would generate $2.65mn or an impactful $0.17 per annum in higher Net Investment Income.

(All the above mentioned assumptions apply).

Both Sides Now

However, CPTA is hardly out of the woods from a credit or earnings standpoint.

Our review of the portfolio identified 4 performing companies which we rate Corporate Credit Rating 3 and Corporate Credit Rating 4.

The former are companies which are under-performing but where the chances of full repayment are higher than an eventual loss.

The latter are companies that are under-performing but where the chances of an eventual loss are higher than full recovery.

Finally, there are non-performing companies which we rate CCR 5 where an eventual loss is highly likely.

CPTA has 3 of those, including American Clinical Solutions, LLC which moved from CCR 3 to CCR 5 in the latest quarter.

Not All Bad

There is some good news in this thicket of Watch List companies.

First, one of the CCR 3 companies was Kelle’s Transport, now repaid.

The other CCR 3 is struggling retailer BlueStem Brands. However, the borrower – which has publicly available financial statements – continues to “hang in there”.

We don’t expect a write-down to CCR 4 or CCR any time soon.

Of the two CCR 4 names one is Cedar Electronics (Cedar Ultimate Parent, LLC in the 10-Q).

This company was restructured in the IQ 2018 and resulted in a major loss for CPTA.

All that remains on the books going forward is a tiny, non income producing position that won’t affect either income or book value.

Question Mark

The most worrying name on the books is CableOrganizer Acquisition, LLC.

Advantage Data records show CPTA has been involved with this online distributor of electrical supplies since 2013, investing debt, preferred and equity.

The equity – which is small – has been written down to zero.

Moreover, the $12.4mn First Lien Term Loan was restructured in the latest quarter into two senior facilities and a Preferred.

That’s caused us concern about the yield producing loans (where $1.5mn of interest income is at risk).

Non Accruals

The 3 non accruing credits, with a FMV just over $25mn, are hard to evaluate and we won’t bore readers with all our research and calculations.

We’ll only say that most of the capital tied up in these non accruals may very well – once each transaction is resolved – get re-deployed into better performing, lower risk loans.

Fluid

Of course, there’s always the possibility that new Performing credits will slip down onto our Watch List.

CPTA’s track record as a credit underwriter has been too weak to allow us undue optimism.

We’ve identified a dozen loans on the books to performing companies that bear yields at 12.00% or over, usually a sign of outsized risk.

However, we’ve not noted from our daily searches into news of these names anything untoward going on.

CONCLUSION

The two repayments CPTA received are first steps in what is likely to be a multi-quarter re-positioning of the BDC’s portfolio.

There are numerous further opportunities ahead, but no guarantee that CPTA will be able to successfully making the shift into a lower risk; interest income focused portfolio.

There may be further credit setbacks to contend with.

Nonetheless, the BDC Reporter decided a few weeks ago that the risk-reward balance seemed appropriate.

We shared our investment stance in an article entitled “Why We Bought Capitala Finance”.

After the latest developments, we are sticking with our initial assessment even though the stock price has been flat in the intervening month. See the chart below:

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.