BDC Preview: Week of January 22 – January 26, 2019

Premium FreeMarkets: Shortened by the MLK holiday, this will be the fifth week since the BDC sector hit a multi-year nadir just before Christmas Day. We’ve had 4 weeks of a sharp and steady rally ever since for BDC common stocks – and till last week – for BDC Fixed Income. Not to mention pretty much all non-investment grade credit and the major indices. Nothing lasts forever – or not even very long – where market rallies are concerned. BDC common stocks are up 12.4% in those four weeks but – thanks to the precipitous decline which began in September and accelerated in early December – are only back to the level of December 4. We’ll be looking out to see if the Wells Fargo BDC Index can break out to exceed the December 3, 2018 level of 2,535 – the last peak before the December melt-down. As of last Friday, the index was at 2,496. That’s only 1.6% away. If the market does not move up to that level within a week or two, we’ll begin to wonder if this rally has petered out. That’s in the future but the BDC Fixed Income rally is already out of breath, judging from last week’s closing median price, now down below book value. As Premium subscribers will know from our BDC Fixed Income Market Recap – and from looking at new data we’ve been adding to our world famous BDC Fixed Income Table – more debt issues went down in price last week than went up. Of course, one 4 day week is not definitive, but bears watching for both BDC common stocks and debt. We’ll also be keeping an eye on the broader market because, whether one likes it or not, BDC prices are heavily influenced by the general moves of sentiment across all investments. There may be non-correlated sectors out there, but the BDC sector is not one of them.

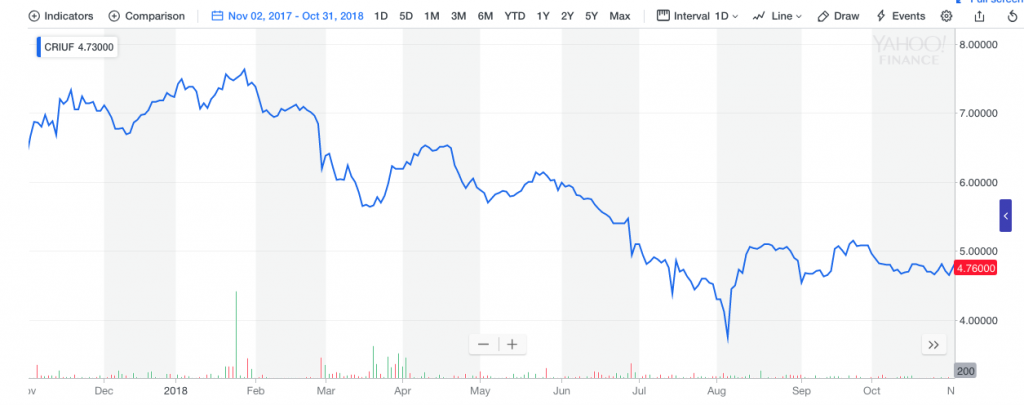

Earnings: In our last Preview we indicated there were no earnings coming due, forgetting MVC Capital’s (MVC) fiscal year end in October 2018, which was released on Monday January 14, 2019. Apologies for the oversight. We reviewed the press release and read the 10-K. There was no Conference Call as the external manager does not bother, which is at variance with every other public BDC. Nonetheless, there was nothing very surprising in the results that we had not previously been aware of. Net Asset Value Per Share dropped to $12.46 from $12.62 the prior quarter, and $13.24 a year before. In dollar terms Unrealized Depreciation dropped by $14.5mn over the fiscal year. The biggest contributor was the drop in the value of MVC’s biggest investment – the Crius Energy Trust units received as part of the prior year’s sale of portfolio company U.S. Gas and Electric (USGE). Some of the proceeds were in cash but some were in the Crius units and in debt to USGE – now a subsidiary of Crius – a listed Canadian company. The USGE debt was also written down by $1.1mn this fiscal year. These are worrying developments, but because we seek to track all BDC Watch List companies and because Crius is public, not hard to see coming. Here’s the stock chart for Crius over the past 12 months:

Also down in price is another MVC owned public investment: Equus Total Return (EQS). We’ll spare readers another chart, but EQS lost a fifth of its market value in FY 2018, resulting in $2.1mn of further markdown on MVC’s own books. On the private side, portfolio company MVC Environmental – an oil patch business – was written down by $6.4mn. As of now, the $10mn invested in debt and equity in the company has been written down to $0.9mn. On the other hand, there were a couple of successes. One was in MVC’s Private Equity Fund – which we covered in our Twitter News Feed. The other was a write-up of MVC’s troubled investment of long standing in Custom Alloy Corporation. This started out as a $24mn subordinated debt and preferred investment in 2007. Over the years – and after a restructuring in November 2017 and a new senior loan in February 2018 – total exposure at October 2018 was up to $32mn in first lien, second lien and Preferred. This year MVC wrote up Custom Alloy by $6.0mn and received – after year end – the repayment of a small first lien loan and a $1.4mn second lien loan. Still, total exposure exposure remains around $30mn. Given the opaque MVC valuation system; the fact that the company serves the volatile “natural gas pipeline, power generation, oil/gas refining and extraction, and nuclear generation markets” and the large exposure, Custom Alloy remains firmly on our Watch List.

For the year, after spending most of its $100mn generated from the USGE sale and much share buy-back activity, MVC was able to eke out a positive Net Operating Income (their term) – sort of. Nominally MVC earned $3.75mn on $22.9mn of revenues. That was nominally better than the year before when a loss of ($5.6mn) was recorded. However, as a glance down the 10-K shows – don’t bother with the earnings release which omits key numbers – a couple of items helped make that gain positive. In the year, MVC reversed $2.1mn of incentive compensation previously accrued, and the Investment Advisor waived $2.2mn of fees. Adjusting for those items the “real” NOI was negative ($0.5mn). On the other hand, the BDC did incur one-time costs of ($1.8mn) for debt extinguishment, so one could argue the NOI was really $1.3mn. In either case, MVC remains a long way off years after announcing its intention to refocus itself on being a yield income (versus mostly an equity investor) BDC from its stated goal. With almost all its cash used up; the very high cost of borrowing and multiple problem investments (MVC Environmental is only one of many), it’s very hard to see how MVC covers its own costs on a GAAP basis, let alone generates enough income to pay for the nearly $11mn a year in dividend payments. (From a cash standpoint, the situation is even worse as much of the income booked is in Pay-In-Kind form while the expenses are not. The cash deficit – and we’re ballparking here – may be in the several million dollar range annually). In the interim, shareholders are essentially being paid their own capital back with every $0.15 per share quarterly distribution. That’s worked for years, but what happens if Crius stops making unit distributions, and USGE defaults on its interest or some or all of the other troubled loans on the books go on non accrual ? Admittedly, with no outstanding lender to report to and only a covenant free Baby Bond to worry about that’s not due to 2022, MVC has no immediate threat to its business as usual, but should shareholders join them on this long journey downwards ?

This week, unless we’ve missed something, should also be BDC earnings release free. From the week of February 4, though, BDC earnings season will begin in earnest.

Medley Capital Merger: Last week, we wondered aloud if and when dissident shareholders might raise their hand even as Medley Capital (MCC) continued soliciting shareholder approval for its merger into sister non-traded BDC , along with Medley Management (MDLY). Shortly thereafter, FrontFour Capital Group made its case against the three-way merger in no uncertain terms, first to an institutional shareholder rights group and next to its fellow MCC common stockholders. We wrote an article intra-week reviewing the main points and adding the BDC Reporter’s own view about the likelihood of this revolt succeeding. Like most resistance movements these days, we concluded the chances of success were small. This week we’ll see if FrontFour – or any of the several other dissatisfied larger shareholders – take any further action. FrontFour has already appealed to the Delaware Chancery Court. Maybe others will take that route ? (It’s unlikely as there is a reason BDC insiders choose jurisdictions like Delaware and Maryland. Very management friendly). Or maybe a “white knight” will appear ? MCC’s stock price perked up last week on this type of speculation, ending at $2.95. If there is a credible challenge to the merger, expect MCC’s stock price to jump a dollar or two.

KCAP Financial Externalization: Last week, KCAP Financial (KCAP) finally released its Definitive Proxy Statement spelling out just what shareholders are being asked to vote about in regards to the change in how the BDC is managed. Much of the content had already been made public in prior press releases and a shareholder presentation. We read the Proxy and gained further insights into the process involved of bringing in a new Investment Advisor. Shareholders with skin in the game will want to review the Proxy to decide how to vote, although chances are this change – thanks to the one time payment proffered by the new external manager – is a done deal. Of course, that would change if somebody came along to challenge the transaction. That seems unlikely, so we don’t expect much to happen this week except more campaigning for shareholder votes by KCAP.

Advantage Data Webinar: For the BDC Reporter at least, the highlight of the week ahead will be participating in Advantage Data’s webinar : “What To Expect This Filing Season”:

The following approaches to analyzing future BDC earnings will be explored:

– Predicting BDC markdowns using historical BDC data – Applying live loan pricing to BDC-held assets

– Industry-level analysis

– BDC-level analysis of what to expect

BDC equity took a beating in line with US equities, but unlike liquid credit markets, the extent of the pain may not yet be clear for BDCs. Given most BDCs won’t file earnings until February, the true extent of the damage is still unknown. The best way to gauge the impact of the market stress on BDCs before they report it themselves is to aggregate data from a number or sources and analyze from various different angles.

This webinar will analyze the data available to look for clues of what you can expect this coming BDC filing season.

The BDC Reporter will be chiming in, leaning heavily on the research we’ve been doing into developments underway since last earnings season in BDC portfolio companies, both those performing and under-performing.

There will be both a presentation and time for Q&A.

The webinar is free and all you have to do is sign up at this link.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.