Medley Capital: Dissident Shareholder Argues Against Merger

Just a few weeks before the shareholders of three Medley Capital related entities vote on a three way merger, a major shareholder of Medley Capital (MCC) is trying again to stop the transaction from happening. In this case FrontFour Capital has been seeking to get the support for a No vote recommendation out of a leading shareholder corporate governance organization. FrontFour is one of several MCC shareholders not happy with what’s about to happen. Today – January 15, 2019 – another shareholder complained publicly, by way of press release. In this in-depth article we review FrontFour’s arguments against the merger and offer our own opinion; look back at how the BDC Reporter has been informing its readers for years of the conflicts of interest involved in the governance of MCC and conclude with our realistic prognostication as to what is likely to happen. It’s a complex, sometimes bitter, but very illuminating insight into how the BDC sausage is made. On this occasion, we are making the article available to all our registered readers given the importance of the subject , both for the shareholders and all BDC investors.

NEWS

On January 14, 2019 FrontFour Capital Group, LLC (“Front Four”) made a presentation to Institutional Shareholder Services (ISS).

The presentation opposed the merger of Medley Capital (MCC) with Sierra Income and Medley Management Inc (MDLY).

FrontFour is described by Bloomberg as follows:

FrontFour Capital Group LLC is an employee owned hedge fund sponsor. The firm primarily provides its services to pooled investment vehicles. It also caters to investment companies. The firm manages separate client-focused portfolios. It also manages balanced mutual funds. The firm invests in the public equity and fixed income markets of United States and Canada. It primarily invests in value stocks of companies. The firm also employs an event-driven and opportunistic strategy. It employs bottom-up fundamental analysis to create its portfolios. The firm employs a combination of in-house and external research to make its investments.

ISS is “the world’s leading provider of corporate governance and responsible investment solutions”.

The presentation is attached.

Previously, FrontFour had issued an “Open Letter” to MCC’s shareholders on December 13, 2018 in the form of a press release, which is also attached.

The press release concluded as follows:

We believe the best path forward for MCC shareholders is to vote down the proposed transaction and for MCC to commence a corporate windup or sale process on a standalone basis. This course of action will not only ensure shareholders maximize value but also take the assets out of the hands of a management team that has destroyed value over time. Simply put – management and the Board of Directors have failed shareholders.

ANALYSIS

How We Got Here

The arguments contained in the presentation – and previously in the press release – are “based on publicly available information”.

Or in other words, FrontFour has never received an inside look at MCC’s books or portfolio.

FrontFour indicates the firm reached out to MCC as early as August 2018 to express its concerns but made no progress.

A telephonic interaction with MCC’s Special Committee of the Board – rather than the sought after face to face discussion – was held on November 13, 2018.

Reportedly representatives of the management were in attendance.

No progress was made and a subsequent recapulatory letter was received from MCC’s general counsel “essentially rehashing the prior discussion with no substantive information”.

Shortly thereafter FrontFour chose to go public about its concerns for MCC shareholders regarding the merger on December 13, 2018, as mentioned above.

FrontFour – at that point – owned 2mn shares in MCC or 3.7% of outstanding shares and the stock traded at $3.30 a share.

The latest presentation does not update FrontFour’s current ownership of MCC’s stock.

Main Points

The principal arguments contained in the presentation are as follows:

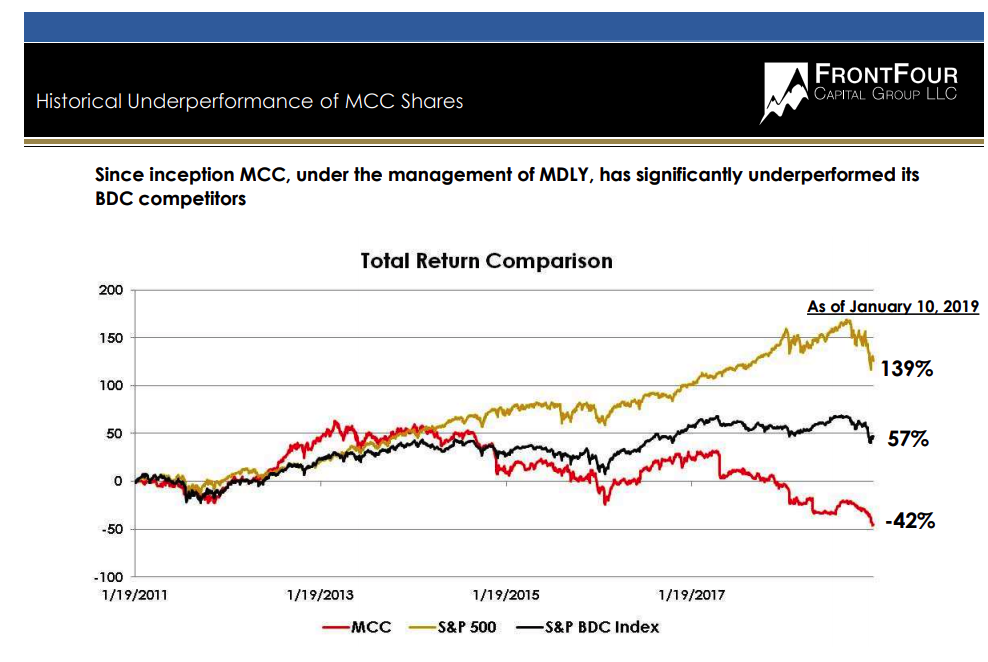

- Medley Management – and its controlling shareholders Brook and Seth Taube – have mismanaged MCC over the years, resulting in significant underperformance versus its BDC peers. See page 3.

Besides the share under-performance, MCC shareholders have also been subject to multiple dividend cuts.

In fact, FrontFour argues that dividend reductions should have been even greater, but have been retained at an artificially high level versus recurring earnings to support MDLY and the interests of the Taubes.

As a result, some of the distributions represent MCC shareholders just receiving a return of capital rather than their share of Taxable Income.

2. The insiders of MCC – including the Taubes and the independent directors – did not pursue the best available offers for the BDC’s shareholders when a decision to make a change was made, according to FrontFour:

Also important to note that potential bidders for MCC on a standalone basis were effectively blocked by MDLY to engage with MCC: ― Broadhaven and Goldman Sachs in 2017 through 2018 were hired by MDLY to pursue strategic alternatives. During this process over 31 confidentiality agreements were signed. Importantly the proxy statement states… “Under those standstill provisions, potential bidders agreed, except as requested or consented to by MDLY, not to take certain actions regarding strategic transactions or management or control of MDLY, its subsidiaries, Sierra or MCC and, subject to an exception to permit confidential requests for waivers following the public announcement of an acquisition transaction, not to request waivers of those standstill provisions, in each case during the relevant standstill period.”

― The fact that MDLY had carefully considered and evaluated, with the assistance of legal and financial advisors, various potential strategic alternatives, including the robust and extensive sales processes to date run by MDLY for approximately 12 months. However, to our knowledge MCC NEVER pursued alternative transactions and was essentially restricted from doing so by MDLY.

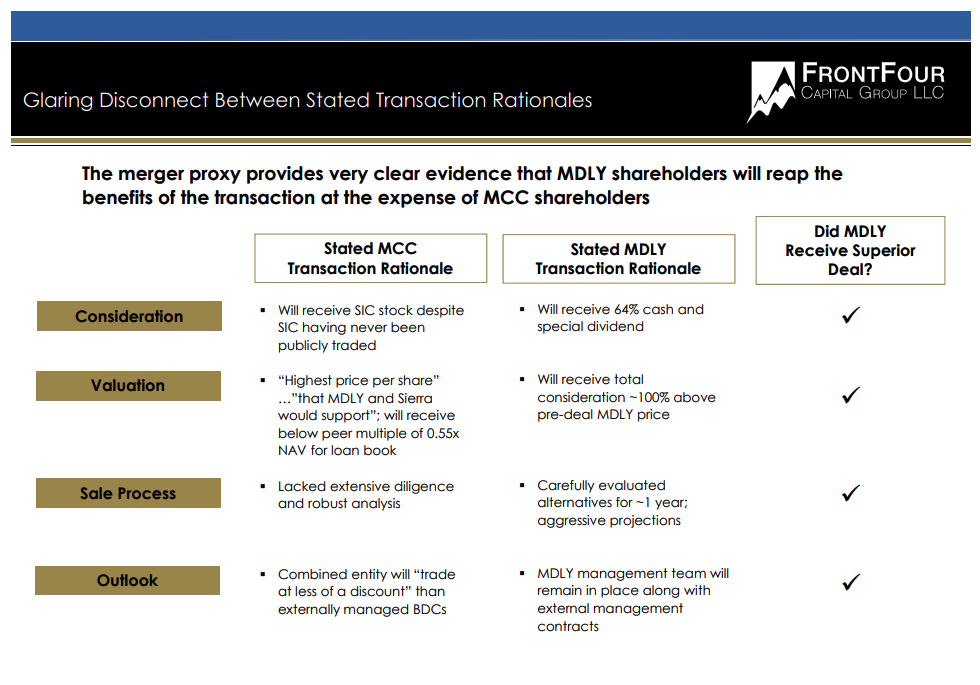

3. The transaction that was agreed upon – the tripartite merger – was structured to be beneficial to the MDLY shareholders – principally the Taubes – at the expense of MCC shareholders.

4. The projections of post-merger performance by the combined entity are unrealistic and overstate income to be generated by MDLY.

The presentation includes a table extracted from a presentation made by Barclays – as adviser – to the Board of MDLY delineating estimated income between 2019-2021.

As the slide below shows, Barclays projected “Other” income – presumably from MDLY’s asset management activities- would increase from $12.4mn in 2017 to $40.5mn in 2021.

As a proportion of total income the Other component was estimated to increase from 24% to 53% of Base Management Fee revenues.

We had not seen this data before having not reviewed all MDLY’s public disclosures.

However, we are familiar with MDLY’s non-BDC asset management business, and the projections do appear unreasonably – if not absurdly – optimistic.

Bottom Lining It

As a result of all the above, FrontFour has decided to vote against the proposed merger and proposes all other MCC shareholders should follow suit.

In addition, FrontFour argues the Investment Advisory agreement MCC has with MDLY should be cancelled.

The BDC should seek a buyer for the assets and the external management contract.

The presentation estimates the total value MCC shareholders could receive $5.10-$6.76 per share.

At time of writing MCC’s stock opened at $2.88.

VIEWS

Basics

Believe it or not the above represents a highly simplified version of the FrontFour presentation, which over 17 slides contained a great deal of information, opinion and directives.

We’ve skipped over a great deal of content pertaining to the purported behavior of the Taubes prior to the establishment of the Medley organization (see page 13).

Deja Vu

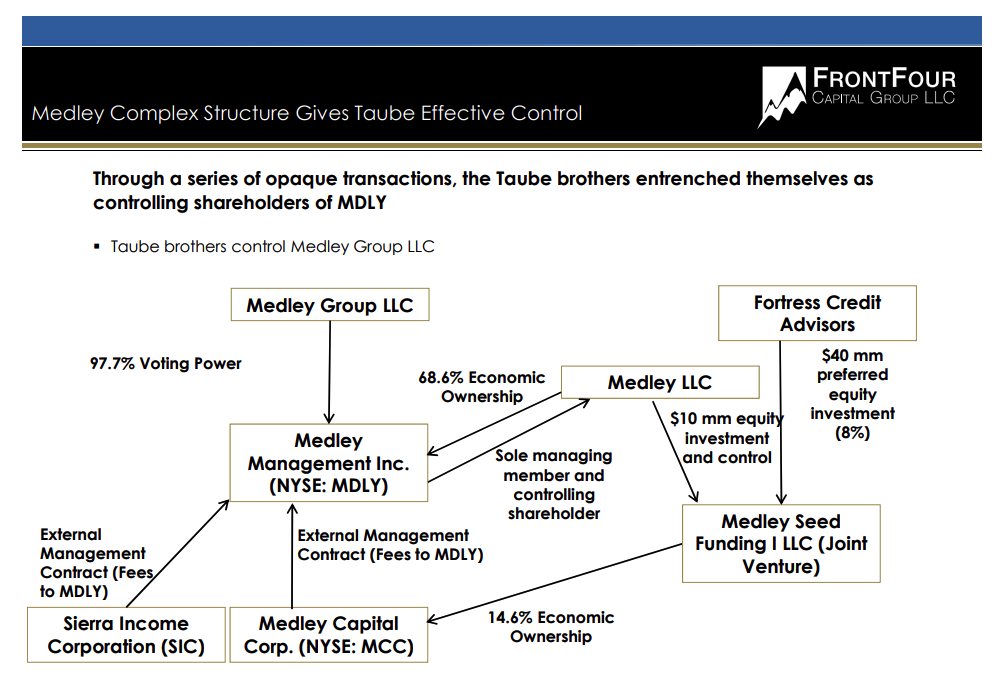

On the other hand, we were very interested in FrontFour’s description of how MDLY set up a special purpose vehicle with Fortress Credit Advisors to invest in the shares of MCC.

This vehicle – Medley Seed Funding I, LLC – was ostensibly intended to generate a steady return for the Fortress investors therein and for MDLY, with the indirect benefit to MCC of a frequent buyer of its common stock.

However, as the Taubes retained voting control over this vehicle, they increased their voting control over MCC’s stock.

Been There. Discussed That.

This was old news to the BDC Reporter, but we were gratified that FrontFour had recognized what we’ve been discussing for over 2 years on these pages.

We wrote about the subject as far back as September 2016, shortly after Medley Seed Funding I was established and started to buy up MCC stock.

Innocently – at first – we thought the Taubes were investing their own capital in the vehicle and in MCC.

By February 2017, we had realized what was going on, which we described in great detail in the blandly titled: “Medley Capital:Insider Purchases“.

We can’t help but quote from our commentary at the time, which turned out to be frighteningly prescient:

…We have to admire the chutzpah of Medley Management’s principals and investment bankers, and the financial creativity involved.

The SPV allows the Taubes-who control Medley Management- to acquire effective control of several million shares of Medley Capital without any direct investment of their personal capital.

Instead, the public shareholders of Medley Management are putting up $10mn (across all the SPVs) and the Fortress investors $40mn.

The purchase of MCC’s stock in this way boosts the stock price by adding a major buyer (as the ever increasing share count by Medley Seed Funding I referred to above shows).

We’re presuming-moreover-that the SPVs control of the stock helps to counter any challenges from “activist” shareholders at Medley Capital, as occurred in 2016.

In several subsequent articles we discussed the evolution of the program – which was expanded by the parties in June 2017 – and eventually resulted in MDLY – and the Taubes – controlling 15% of MCC, as reflected on page 2 of the FrontFour presentation.

If nothing else, this dip into our archives suggests that the insiders at MCC/MDLY seem to have preparing for several years for what has now transpired even if all the details were not pre-ordained.

Our Stance

We agree with FrontFour that the proposed merger is flawed.

For what it’s worth, we sold our position in MCC – acquired on the assumption that an acquisition by a third party was inevitable as the unwinding of the Medley Seed Funding transaction came ever closer with every dividend cut- on first learning of the three way merger.

At the time, we thought MCC might sell for $5.27, within the price range in the FrontFour proposal.

Right off the bat the terms of the proposed merger transaction did not meet our smell test – even though most of the details were not provided – and we exited.

All this was spelled out to our readers in the explicitly titled: “Breaking News: Why We Sold Medley Capital“.

Here are the main reasons we sold out at the time, which will sound eerily familiar to anyone reading FrontFour’s arguments:

We decided to sell our position in MCC for the following reasons:

- Our initial premise – although correct in that MDLY has taken action – has not played out as expected.

- An initial review of the proposed merger – and without benefit of the Proxy which might be weeks away – suggests MCC shareholders will not gain much from the transaction.

- The proposed merger leaves the insiders at Medley Management – who are responsible for the massive destruction of shareholder value at MCC – still in charge.

As a reminder, here is the stock chart for MCC, which shows that the stock price has dropped by four-fifths in the last 5 years:

4. The latest results of MCC – published concurrently with the merger announcement – suggest the financial performance of the BDC continues to deteriorate.

Book value per share was reduced again to $6.43 from $7.02

Net Investment Income Per Share has dropped by three quarters since the March 2018 results to $0.02, yet the dividend was maintained at $0.10 a quarter.

5. A brief review of Sierra Income’s latest 10-Q is not wholly encouraging, with over a fifth of portfolio investments marked as under-performing to varying degrees.

6. The ultimate completion of the merger remains questionable – even though insiders have loaded up on shares in various ways – given that the structure – in our opinion – seems unduly favorable to the unitholders of MDLY, and far less so to the shareholders of Sierra Income and MCC.

In that regard, we point readers to the respective stock price of MDLY and MCC following the news.

At time of writing MDLY, which closed at $3.50, is trading over $5.00 a share, an increase of over 40%.

MCC, which closed at $3.38, has traded between $3.44-$3.70. As we write this, MCC is at $3.46, or up just 2%.

We fear that the stock price could drop even further. At a 10x multiple of current earnings MCC is worth only $0.8 a share.

Unbroken

Nothing that has occurred subsequently has changed our view – including a review of the MCC Proxy, which added many details, and FrontFour’s critique.

The stock price of MCC – after a brief period of elation – has dropped from $3.68 when we sold to as low as $2.59.

Going Forward

However – and there’s always a “however” in the complex world of Wall Street with hundreds of millions of dollar in play – we still believe the merger transaction will proceed.

Notwithstanding the flawed process; the strong arguments against the lopsided financial arrangements involved ; the question marks about the earnings of the combined entity and the likelihood that other parties might pay a much higher price; all the shareholders involved are likely to bless in requisite numbers the consummation of the merger.

In fact, FrontFour is conceding in its presentation that the Taubes benefit from having a shareholder base consisting of retail investors:

MDLY is taking advantage of MCC’s less sophisticated, retail-heavy shareholder base as institutional investors are less inclined to own BDCs

That same sentiment can probably also be applied to the Sierra Income shareholders who – whether they know it or not – have the most to lose from the deal.

Hard Truth

The MCC/MDLY insiders with their support from the laughably termed “independent” directors; ownership through Medley Seed Funding and built-in benefits of incumbency over all three firms have a huge advantage.

Even if ISS advises against the transaction, we wonder how many shareholders – both institutional and individual – will be moved ?

History Books

Both the BDC Reporter and the principals of MCC/MDLY have witnessed prior battles similar to this one and in almost every case the home court advantage has caused activist shareholders to fail.

BDC corporate governance is set up – in this case and throughout the sector – to greatly benefit the insiders – typically the External Manager – who sets the jurisdiction, write the bye-laws, selects ALL the directors, typically serves as Chairman; pegs the compensation and – effectively – decides who will be allowed to acquire the business.

Shareholders – in most cases – have to accept whatever they’re offered.

Long List

The BDC Reporter has been around for multiple transactions of this type including Oxford Square’s (then TICC Capital) attempt to sell itself to Benefit Street; Full Circle‘s sale to Great Elm Corporation (GECC) ; the two Fifth Street BDC sales to Oaktree (OCSI/OCSL) ; the quiet transfer of management rights at FS Investment, now FS KKR Capital and many more.

We are reminded on each occasion of what a serious game is being played here and how most of the rules are written with the incumbents rather than the shareholders in mind whatever else you might be told Virginia.

Missing

On this occasion, another element is missing: a viable alternative.

We agree with FrontFour that – if given the opportunity – other asset management groups could be found who would pay more for MCC’s stock and management contract than what is proffered in the three-way merger.

However, no third party has come forward – presumably having read the corporate governance tea leaves and looking at the likely polling.

MCC shareholders are being asked to reject the merger and wait for the very same individuals and organizations that they have just spurned to find an appropriate buyer.

No Going Back

However, MCC’s insiders have been careful to burn their boats and make a No vote prospectively painful.

(Fifth Street used similar tactics).

The BDC Reporter noted on September 28, 2018 that MCC – well in advance of the coming shareholder vote – deep sixed its Revolver financing.

We could not help surmising at the time that this might be related to ensuring the merger proceeded as required.

From the BDC Reporter’s standpoint, the optics of canceling a key loan agreement before the future of the BDC has been officially determined are not good.

In a way, MCC’s decision could be seen as an attempt to force the hands of shareholders to vote in favor of the merger with Sierra/MDLY by making impossible – or at least more difficult – the maintenance of the status quo, should that be the shareholders ultimate decision.

So far no other challenger/activist has appeared to make a so-called “superior offer” to MCC shareholders, but the possibility still exists.

Maybe the Board and Investment Advisor are seeking to ensure an untrammeled path to the merger with its sister companies.

On The Day

Of course, anything can happen, but without a bona fide and generous offer or two from well known asset managers chances are those MCC (and Sierra) shareholders that bother to vote will take the path of least resistance and agree to the merger.

That may not be fair or appropriate but probably remains within the boundaries of the rules as they are currently written.

It’s another black eye for BDC corporate governance, which has a long history of the same.

But with a fragmented BDC retail shareholder base; a below average number of institutional shareholders, a complaisant stock exchange and regulatory environment and not enough BDC Reporter subscribers (lol) that’s what you get.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.