Charlotte Russe: Total Liquidation Planned. Three BDCs Impacted.

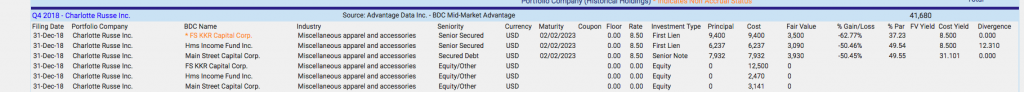

Premium FreeOn March 6, 2019 Charlotte Russe – the women’s clothes retailer – gave up its plans for a Chapter 11 reorganization and moved to liquidate the company. The company had filed for bankruptcy – for the second time in recent history – in February 2019, with an initial plan to close some stores but remain operational. However, that ambition did not last long and management announced its decision to hire a specialist firm to sell off all inventory, furniture and fixtures and close its 416 stores. The sale of its “intellectual property” (presumably the Charlotte Russe name) is ongoing, according to news reports. This harsh, but not unexpected end for Charlotte Russe, will be hitting three BDCs hard: FS KKR Capital (FSK), Main Street Capital (MAIN) and non-traded HMS Income. Total exposure at cost is $42mn, in the form of debt and equity. See the chart below from Advantage Data:

The lenders have been involved with Charlotte Russe from 2014, or even earlier where MAIN is concerned, and were caught up in the earlier Chapter 11 bankruptcy. At that time, more funds were advanced and some debt converted into equity as lenders took control of the retailer in an attempt to resurrect its fortunes. That’s a great strategy when it works, but less so when the business cannot find its footing. Exposure in 2014 was $28mn and topped out at $54mn in the IVQ 2017. Since then – and after booking partial Realized Losses – about $23mn of the capital advanced was in the form of debt and the rest in equity. The latter had been written down to zero by IVQ 2018 and the debt was discounted 50% to 62% – depending on the BDC . FSK has been more conservative in its write-down percentage (62%) than MAIN and sister fund HMS Income (50%). None of that may make any difference as we expect the lenders will have to write off their entire position, but that’s just our estimate. A news report indicates Charlotte Russe had $160mn worth of inventory but once big discounts are offered and the liquidator and administrative costs paid, and those employees and managers necessary to complete the process, very little is likely to trickle down to creditors. We’re not sure if an ABL lender has a superior claim to whatever proceeds might that might be left. In any case, the BDCs involved will be losing assets earning about $2.0mn of annual investment income till September 30, 2018. If we’re right about not receiving any material proceeds from the liquidation, another $10mn of fair market value will be recorded and the total Realized Loss will be $42mn, plus any losses booked in earlier periods. The liquidation is said to take two months so the final reckoning may not show up in the Realized Loss column till the IIQ 2019 results. Overall, BDC lenders have managed to dodge most of the depredations of the retail apocalypse, but not this time.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.