BDC Portfolio Company Receives Capital Infusion

Premium FreeAccording to news reports DigiCert, the secure sockets layer (SSL) certificate provider, will get strategic growth investments from Clearlake Capital Group and TA Associates, and both firms will become equal partners in the company. According to the article in Channel Futures: “Clearlake is a private investment firm, and TA is an existing investor and global growth private equity firm. DigiCert will continue to be led by CEO John Merrill and the current management team, who are investing alongside Clearlake and TA in the transaction. Terms of the growth investments are not being disclosed.The transaction is expected to close in the second half of 2019, pending customary regulatory approvals and closing conditions”.

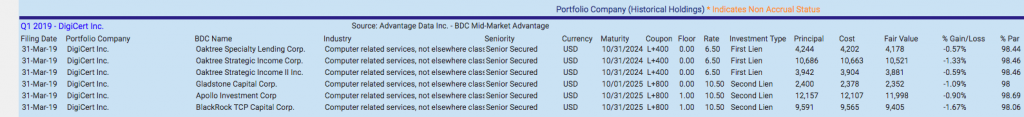

According to Advantage Data records, there are 6 BDCs with $42.8mn of exposure, in both first and second lien.Exposure dates back to as late as 2014, but most BDCs have been involved since IVQ 2015.

Although the debt is valued at or close to par, the capital infusion appears to be a credit positive event and should improve the lenders position further, or result in a repayment of one or both facilities.

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.