Capitala Finance: Stock Price Drop UPDATE

Background

On August 6, 2019 the BDC Reporter wrote an in-depth Premium article about Capitala Finance (CPTA).

We expressed concern about the status of the BDC’s relationship with the SBA following credit losses in the wholly-owned SBIC subsidiary.

Main Point

Here is a brief extract”

..we’re concerned about the net worth of the SBIC subsidiary.

Should that net worth – even if calculated on a cost basis – turn negative, there could be an interruption of income from Fund III, as the SBA has the right to require.

Down The Road A Bit

Furthermore – and longer term – we pointed out that the SBIC subsidiary will have to wound down – having reached its contractual maturity – affecting the balance sheet and earnings:

CPTA will have to come up with substantial amounts, equal to 38% of the current overall portfolio, just to repay the SBIC debentures.

Management has not addressed how this might be handled.

If no further SBA monies come available, the BDC’s portfolio and earnings might shrink in an effort to right size the balance sheet.

With Net Investment Income Per Share already in line with the distribution, the risk – albeit a medium term one – is that earnings will be reduced and the payout cut.

Fuel To Fire ?

Finally, we reviewed the CPTA portfolio and highlighted 7 under-performing companies that could impact future results.

Summed Up

The BDC Reporter’s conclusion was as follows:

We don’t want to be worry warts, but after CPTA were themselves surprised by the outcome of the AAE investment and the huge drop in book value that ensued, investors need to be on guard.

We’ve seen recently the very sudden parting of ways between a troubled Medley Capital (MCC) and the SBA, a subject the BDC Reporter spent a good deal of time discussing.

The SBA is a creditor and will act to protect its interests.

In this case, the SBA has first dibs and contractual rights over a substantial portion of CPTA’s portfolio, which could move the BDC’s performance needle substantially.

On the other hand, our concerns – which have little public data to support them because so little key data is available – may be overblown.

This will become clearer over the next few quarters as both the out-performing and under-performing companies (15 by our count) reach clearer resolutions.

The upside is a consolidation of the status quo, and greater comfort that CPTA can maintain or even modestly grow its earnings.

The downside, though, could be a material meltdown in the BDC’s book value, earnings and dividend paying capability.

We have now made the full article available to all readers.

Price Performance

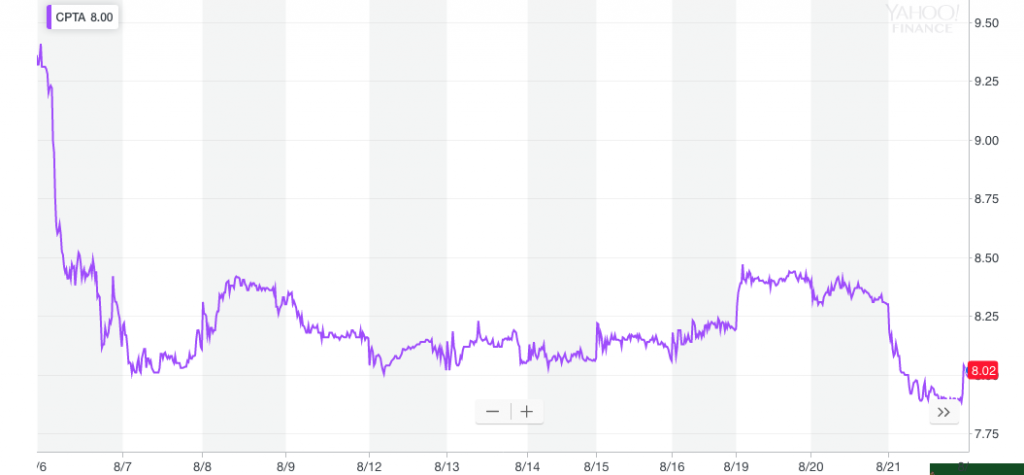

Since the publication of the article, CPTA’s stock price has dropped by as much as (16%), as the chart shows:

The drop is more remarkable given the 45% increase in the stock price that preceded the August 2019 downshift, which began on December 26 and far outpaced the upward move of the sector as a whole.

At time of writing CPTA has dropped to a price of $7.76, a level not reached since March 2019.

VIEWS

Without any update on either the BDC’s finances or credit problems or its relationship with the SBA, it’s impossible to tell whether the stock price drop will continue.

The next reporting period is 10 weeks or more off.

When investors learn more, CPTA’s price could drop further if income from the SBIC subsidiary is cut off or threatened to be interrupted and/or credit troubles increase at the BDC more generally.

We will be tracking both performing and under-performing companies for an early heads up.

On the other hand, if CPTA’s potential problem with the SBA appears resolved – or likely to be so – the stock price could climb back.

Just returning to the 2019 highest level would cause the price to jump by nearly 30%.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.