Multiple BDCs: Doubts Increase About Future Of Retailer

Premium FreeAs Advantage Data records show, the same four BDCs – three public and one not traded – have held the debt of retailer Bluestem Brands for years, all in the Term Loan that matures November 6, 2020. Unfortunately, the retailer has also been under-performing for many of those years – since IQ 2016 by the standards in our five point company rating system. We’ve been flagging the retailer in articles since April 2017. We wrote the following at the time:

While the Company may be able to stave off a default in the next few quarters, we worry about 2018 and beyond. Not helping the Company’s cash flow will be the heavy loan amortization schedule and other debt service charges. We are giving the Company a Corporate Credit Rating of 4, which means we believe the chances of Bluestem not returning to lenders and investors original expectations of their performance is more likely than not. As for the Term Loan, we don’t expect a default for a couple of quarters, but could foresee the need for a restructuring or even bankruptcy (and a modest potential Realized Loss) should the slide in consumer quality persist.

Since we began publishing the BDC Credit Reporter in early 2019, we’ve written on four occasions about Bluestem. The most recent article was on January 30, 2020, following the double barreled news that one rating group is ceasing to rate Bluestem’s debt and another just issued a downgrade to “Speculative Status“. Increasingly, 2020 appears to be the year that the retailer – which has been struggling hard to turn itself around from a business standpoint – may have to restructure its balance sheet to move forward. Typically that means an out-of-court restructuring agreed between creditors and the company or a Chapter 11 filing, but there are multiple other possibilities. We have no reason to believe that a liquidation is a prospect.

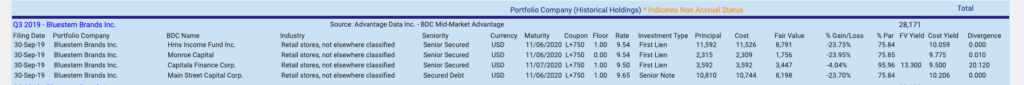

The three BDCs affected are (in descending order of debt outstanding) are Main Street Capital (MAIN); Capitala Finance (CPTA) and Monroe Capital (CPTA). Along for the ride is MAIN’s non-traded sister BDC : HMS Income. There’s an aggregate of $28.2mn invested at cost. As the Advantage Data record below shows, three of the four lenders have marked the debt down by (25%). For reasons unknown (there may be a risk sharing arrangement that’s not showing in the filings), CPTA has only discounted its position by (4%).

This is a publicly traded loan so quarterly valuations are typically guided by market prices. Currently, the discount on the debt is (28%), down from the (25%) showing in Advantage Data’s records as of September 30, 2019. That discount may grow with the latest developments and depending on how the company addresses the $64,000 question of when and how its Revolver and Term Loan will be refinanced.

For the BDCs involved, most important – besides what happens to the value of their capital advanced – will be the impact on the investment income earned from the 2020 Term Loan, priced at LIBOR + 750. At the current 1 month LIBOR rate, that’s an all-in loan yield of 9.155%.

With BDC earnings season round the corner and with 3 public BDCs with Bluestem exposure, we thought that bringing readers up to date would be helpful. Here is the full latest article from the BDC Credit Reporter:

From the BDC Credit Reporter January 30, 2020:

Just in case you didn’t know, it’s the companies themselves who pay for their credit ratings from groups like Moody’s and S&P. (That’s different than at the BDC Credit Reporter, whom nobody pays). We were reminded of this economic fact of life on hearing that Moody’s has “withdrawn’ the ratings of retailer Bluestem Brands. The rating firm – usually prone to long discussions in its regular credit reports – was succinct on this occasion: “Moody’s has decided to withdraw the ratings because of inadequate information to monitor the ratings due to the issuer’s decision to cease participation in the rating process“. No other explanation was given.

Apparently S&P Global has not been any kind of succor. That rating group downgraded the company on January 28, 2020 to CCC- from CCC..Here’s the crux of the matter as S&P sees it: “

“Bluestem’s revolver and term loan are due this year and we believe the likelihood that the company will undertake a restructuring in the near term has increased. The company’s $200 million asset-based lending (ABL) facility matures in July and its term loan (roughly $400 million outstanding) comes due on Nov. 7, 2020. In our view, Bluestem does not have a clear refinancing plan and we believe it is increasingly likely that the company will pursue a holistic debt restructuring to address its maturities given its weak operating performance. If the company pursues a restructuring or exchange that provides its lenders with less than they were originally promised under the security, we would view it as distressed and tantamount to a default”.

We’ve written on three earlier occasions about Bluestem, starting back in the spring of 2019. As far back as June 2019, we had a Corporate Credit Rating of 4 on the company – on our five point scale. More recently, when we began projecting out which BDC-financed under-performing companies were most likely to default in 2020, Bluestem was one of our first additions. Now there seems to be a consensus building that the company will not be able to avoid either a “distressed debt exchange” or a Chapter 11 filing in the months ahead.

For the 4 BDCs involved – all in the 2020 Term Loan, which is structurally subordinated to the Revolver (as far as we can tell) – that’s bad news. Not helping is that S&P is only projecting a 45% recovery rate in event of default. That implies ultimate losses of over ($15mn) over cost, or about ($6mn) more than already provided for at September 30, 2019. Then there’s the $2.7mn of annual investment income at risk of interruption…

We expect to be revisiting Bluestem – and its intractable balance sheet inside a retail sector in seemingly permanent crisis – before long.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.