BDC Common Stocks Market Recap: Week Ended March 6, 2020

Premium FreeBDC COMMON STOCKS

Stranger Things

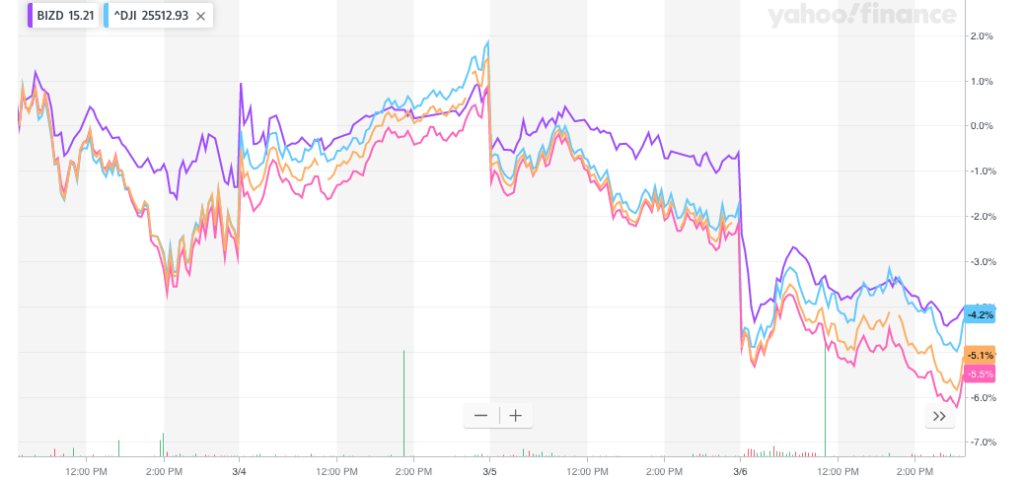

Only upon preparing for the Recap did we fully appreciate what an unusual few days the markets went through ending on March 6.

Although, the BDC sector and the indices were deeply in the red on the last couple of days, overall we were up where prices are concerned.

For example, the S&P 500 was up 0.6% and BDCS – the UBS Exchange Traded Note which owns most of the common stocks in the sector – was up by 1.7% overall.

BIZD– the BDC sector’s main Exchange Traded Fund – was also up 1.6% over the five days.

Won’t Be Left Behind

That speaks to the strong FOMO (Fear Of Missing Out) of investors after the substantial price drops of the week before.

The result was a big leap forward in the beginning of the week by BIZD – for one – jumping up as high as 7.4% through intra-day Wednesday.

Towards week’s end, though, FOMO was replaced by fear of a widening pandemic (“FOWP” ?) and the prospect of a global recession as buyers became sellers.

Still, even on Friday the “clever money” or the machines or something caused prices in all the indices – including the BDC sector – to move up sharply at the end of the day.

This is volatility writ large as investors run back and forth, seemingly closely packed together, because the shape of all the charts is essentially the same.

Mixed Up

Anyway, the indecisiveness of investors is reflected in many of the other metrics we discuss weekly.

Two-thirds of individual BDC prices were up on the week, versus NONE the week before.

In fact, 12 were up by 3.0% or more as shareholders had multiple second thoughts about abandoning their favorite players/payers.

Most impressively – and following GOOD results for the IVQ 2019 – Horizon Technology (HRZN) jumped 15.7%.

Moreover, the number of BDCs trading within 5% of their 52 week low decreased sharply from 35 to 24.

Even the number of BDCs trading above book value – a number that usually does not move much during ordinary times – increased to 11 from 9.

Both Ways

However, this was not a one way street.

At least 8 BDCs reached new 52 week lows, which were also all-time lows in many cases, during the week.

Especially punished were BDCs that had put up weak results, or are expected to, like BlackRock Investment (BKCC); THL Credit (TCRD) and Harvest Capital (HCAP).

Big Drop

The exception to the rule was Newtek Business (NEWT), which also came crashing down despite GOOD results and a higher NAV.

Maybe investors see darker times ahead for the BDC in the sad new world of lower rates and lower credit demand.

More likely, though, is that NEWT has been favored by momentum investors till recently and with the Big Mo gone so are some of its buyers.

Latest Results

Almost forgotten – but not by the BDC Reporter – in the maelstrom of the week was the tail end of BDC earnings season.

There were 9 BDCs reporting IVQ results this week. See in the Tools section the BDC: Results Summary Table.

You’ll see that there was a mixed bag where overall performance was concerned, as rated by the BDC Reporter:

Four were GOOD, two were MIXED and three were POOR.

Maybe not surprisingly for those of us who’ve been following these BDCs for a long time, the worst performers were BKCC; Capitala Finance (CPTA) and THL Credit (TCRD).

Coincidentally or otherwise all three have undergone M&A transactions in the last few years.

Pay Less

We’ve given up formally trying to project the dividend outlook for all 45 BDCs.

However, the sustainability of the current regular distribution at all three firms is deeply questionable.

TCRD seems to be admitting that a cut is coming but is unsure as to when and how much.

BKCC has cut its distribution to $0.14 a quarter only recently so must be loath to cut again any time soon.

Ditto for CPTA, which has reduced its payout three times in a row in recent years but is currently earning far less than the $1.0 a year distribution.

Just for a lark we looked down the list of 45 BDCs we track and identified 12 (including the 3 above) that are candidates for a dividend cut in the next twelve months.

That’s quite a turnabout from a few months ago when additional assets funded thanks to the Small Business Credit Availability Act (SBCAA); increasing LIBOR and a still strong economy resulted in very few BDCs at risk of cutting payouts.

In what seems like the twinkle of an eye – but is actually several months – all those favorable winds have abated and are actually blowing in the other direction.

Unsuccessful

As importantly, though, many BDCs seeking to “turn around” multiple distressed investments in their portfolios have failed to do so, causing loss of income and NAV to bleed on.

The BDC Reporter loves to keep lists of all sorts of BDC-related things.

We keep track of all the BDCs that are self-admittedly in “turnaround mode” – some dating back for years. We have counted 10.

Reviewing that group for this article, we find that 9 of the 10 have – so far – failed to stop ever lower earnings and book value per share.

Method

We trot out such data in the context of a darkening economic background brought on by Covid-19.

The global health crisis – not even yet called a pandemic by the World Health Organization – has begun so recently that even BDCs reporting results this week had little new data to report.

As you’d expect lenders are on the phone asking questions to borrowers, and poring over their initial underwriting to look at issues like global supply chains; sector exposure and upcoming debt maturities.

(We own a wood products company here in Los Angeles and have received our own banker inquiry. Like most – but not all – companies, we had little impact to report except many more hand sanitizers on the sales floor and other HR precautions).

Round One

However, there is clearly a first wave of damage being inflicted on several sectors of the economy.

In fact, at the BDC Credit Reporter, we’re drawing up a common sense list of sectors or segments that are already on the frontlines from our database of under-performing BDC companies, which roughly totals $10bn at cost.

Chosen were Automotive; Beverage,Food & Tobacco; Energy; Hotels & Casinos; Restaurants; Retail and Shipping.

(We’ve got a long way to go to fine-tune our industry and segment methodology so consider these approximations at best).

The database shows that all under-performing companies in these seven sectors amount to $4.7bn at cost and $3.2bn at FMV.

That suggests nearly half under-performing BDC companies will have to contend with the first wave of supply interruptions; less foot traffic in restaurants, malls and in city centers; less travel; less transport and much lower energy prices.

Vulnerable

Not to be the Voice Of Doom but anyone who’s been paying attention must know that most every company a BDC lends to – whether under performing or not as of December 31, 2019 – is highly leveraged and has little room for maneuver.

We were seeing even before Covid-19 changed the equation plenty of “idiosyncratic” company failures following relatively modest drops in sales and profits thanks to a competitive landscape for everything and high debt service requirements.

Many borrowers may be “cov-lite”, but that won’t make much difference if interest and principal payments can’t be made.

Our Jim Cramer Moment

To be candid – and to tie these comments about credit risks with this week’s stock price performance – we can’t help feeling that investors are being exceedingly complacent.

The bulk of investors seem more intent on not missing a rally opportunity than looking into the abyss of what might happen if Covid-19 plays out in the U.S. as it has in China and now Northern Italy.

We’ve (Maybe) Only Just Begun

The BDC Reporter, though, would like to point out that we are very far from historic price bottoms.

In fact, BDCS – as representative of BDC sector price performance – remains substantially above the two most recent market meltdowns in February 2016 and December 2018.

In both those cases, stock prices dropped further on much less tangible prospects of a downturn in the economy.

To reach the December 24th 2018 low, BDCS still has (6.5%) to drop.

Should that occur BDCS will be (17%) down from the February 20 2020 high just before the current rally began and close to “Bear Market” territory.

One More Example

BDCS is a sector indicator but let’s look at an individual BDC.

In this case, let’s use Ares Capital (ARCC) – the largest player and very popular with retail and institutional investors alike.

At its current price – and despite a (10%) drop in the last few days – ARCC would have to drop another (28%) to reach its low point in February 2016.

Up And Down

Unfortunately – if we do get a full blown pandemic and an economy that grinds to a halt – the impact on BDC portfolio companies – and thus on BDC stocks – is likely to be much worse.

We understand – and pray – that the “worst won’t happen” but there is a reasonable and growing chance that it will, which makes the markets upside enthusiasm so disconcerting.

There may be a 10% upside for BDC stocks but there is a potential downside – if the Great Recession is any guide – of up to 80%.

Investors who will wear a mask to pick up their newspaper at the front door are prepared to tolerate much more risk where their capital is concerned.

Refocus

Anyway, with another uncertain week ahead -and with only 5 more BDCs to report earnings – we’ll be turning more of our attention to BDC portfolio companies, both under performing and performing.

We’ll be trying to assess – and it won’t be easy – which BDCs have the most solid portfolio construction and which not.

The answer to that question may be very important in the next couple of quarters.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.