Golub Capital BDC : IVQ 2020 Review

We’re writing this review of Golub Capital’s (GBDC) calendar IVQ 2020 results in advance of the BDC’s conference call, which is scheduled for Tuesday February 9 at 1 p.m. See the BDC Earnings Calendar. Having read the earnings press release, the Investor Presentation (not available on the website yet as we wrote this) and the 10-Q– not to mention the preliminary results published in January – there’s unlikely to be much more that the BDC’s managers can tell us which is not already known. This quarter GBDC got its groove back – so to speak – from an origination standpoint, securing $527mn in new commitments to companies. The prior quarter the corresponding number was $141mn and in the universally slow, post-pandemic calendar IIQ 2020, just $14mn. The result – despite healthy repayments – was a portfolio that increased over 6% at FMV. Given that the portfolio yield was flat, the growth in income GBDC reported this quarter over last was largely due to having more loans on the books. Net Investment Income Per Share – once adjusted for the merger with its sister BDC and other items – was $0.29, up 1 cent over the level of the prior two quarters. We can now see one year out – and after the drop in LIBOR and the Rights Offering – GBDC’s recurring earnings, on a per share basis, are running (12%) below the pre-pandemic level as is the “regular” distribution. Leverage is slightly higher now than year ago, but nothing material, and well within the BDC’s target leverage.

From a credit standpoint, GBDC’s points to two less loans on non accrual this quarter (down to 7 and with an FMV of $53mn) but that’s largely due to restructuring companies like restaurant chain Rubio’s with debt for equity arrangements. We expect to learn more on the conference call but realized losses were modest in the quarter: just ($2.4mn). Still, GBDC has booked realized losses for 4 quarters in a row – unusual for this BDC – and for a total of ($23.5mn) or ($0.15) per share by our count. Total underperforming assets in the portfolio continue to shrink, just maybe a little more slowly than we might have expected. We’ve already updated the BDC Credit Table with the key numbers: underperforming investments at FMV fell somewhat slowly to $859mn from $895mn in the prior quarter and $1,199mn at the height of the crisis. Still, to put these underperforming asset numbers in context, note that before the pandemic the underperformers amounted to $411mn. That means credit troubles remain twice as high as in 2019. How many of these troubled companies will work their way down to a default and a permanent loss is the central question. GBDC, though, is not yet back – like most of America – to “business as usual”.

NAV Per Share for GBDC – like almost every BDC so far – was up, to reach $14.60, up from $14.33, but still way off the $16.66 at December 31, 2019. GBDC claims 75% of the unrealized losses incurred in March 2020 have been recovered. That’s good news, of course, but also suggests there’s only modest unrealized gains to be grabbed from reversing the damage of the pandemic. NAV Per Share is unlikely ever to return to its prior heights given the permanent impact of the dilution caused by the Rights Offering. Maybe some realized gains down the road might help, but those are hard to hope for, let alone quantify.

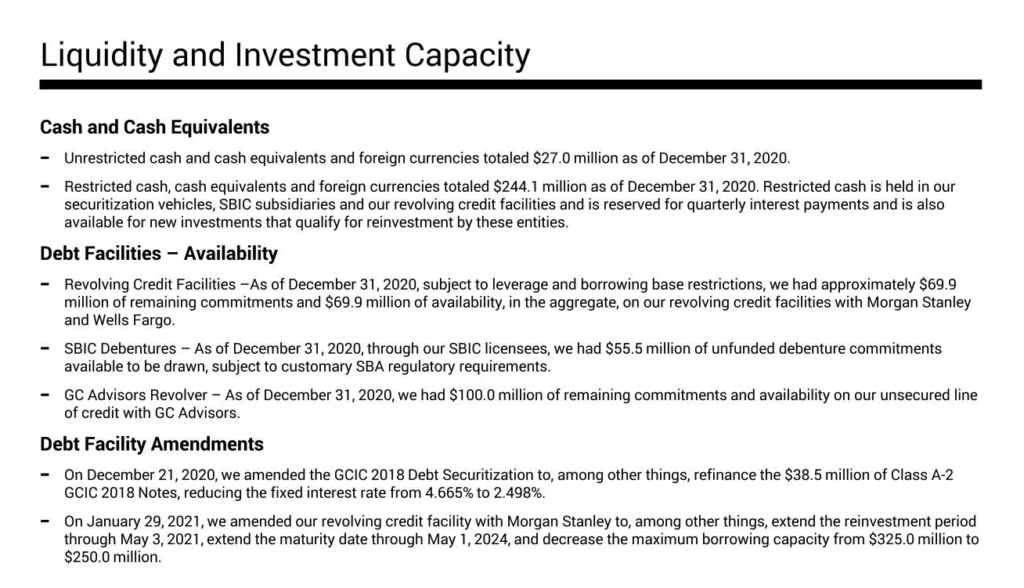

The only area of concern to the BDC Reporter at this stage is – curiously – the BDC’s liquidity. GBDC recently raised its first unsecured debt to the tune of $400mn, so we expected liquidity to be ample. However – going by the numbers given in the Investor Presentation – reprinted below – the picture given is not fully encouraging:

Let’s set aside the “restricted cash”, which is earmarked for the CLO securitizations and is not necessarily available to pay bills and make loans. Also less than ideal is the availability under the SBIC debentures, which can only be used under very particular conditions.Then there’s the announcement above that the Morgan Stanley revolver has only been extended – in terms of being used for new business – till May 3 , 2021.What’s more, the facility limit has been reduced to $250mn. In the Investor Presentation the amount drawn under the facility is $280mn, implying that GBDC will have to come up with $30mn of cash to pay that loan down. Essentially that leaves just the unrestricted cash of $27.0mn; $24mn of unused availability under the Wells Fargo Revolver and a $100mn “GC Advisors Revolver”.We worry a little when the bulk of a BDC’s liquidity comes from advances to be made by the external manager or one of its sister entities. Maybe there’s something we’ve missed or GBDC is about to issue another unsecured note that will boost its liquidity.For the moment, though, and until the matter is clarified – and remembering the BDC is committed to making many Revolvers of its own available to portfolio companies – we’re rating Liquidity as FAIR in the BDC Performance Table.

As to the BDC’s dividend outlook for 2021 – already initiated at an unchanged $0.29 for the first quarter – we don’t see much chance of an increase in the cards. GBDC has done a creditable job recovering from a good deal of the damage wrought by the pandemic and lower LIBOR, but shareholders are unlikely to see the net asset value per share or the recurring earnings or the prior $0.33 regular payout achieved in 2019 return. This might be as good as it’s going to get for GBDC for some time. We could be proved wrong if GBDC does raise more debt capital – or even new equity – as well as steering away from any tangible credit losses in the months ahead. Maybe the conference call will provide some insights after all into the BDC’s plans and prospects.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.