BDC Market Agenda: Monday April 19, 2021

Premium FreeOn The Docket

We’ve covered the latest pricing trends of BDC common stocks and public unsecured debt in our week-end recaps, which can be found here and here if anyone missed them. With the opening of the markets just half an hour away, we’re very intrigued to see what happens to BDC common stock prices with IQ 2021 earnings season just a week away. We are in the midst of a very buoyant market, but have to wonder how much further prices can go after an amazing run that began – depending on your perspective – in late March or Halloween of last year. On the other hand, BDC fixed income prices are expected to remain very stable this week and in the weeks to follow. Otherwise, there are two BDC news items we’ve noted and an update on our promised preview of Horizon Technology’s IQ 2021 results, the first player scheduled to report:

- Owl Rock Capital (ORCC) Prepares To Raise New Unsecured Debt/Publishes Preliminary Results: ORCC is back in the capital markets seeking to raise unsecured debt, according to several related filings. The amount sought is $300mn for 5 years and the risk free rate + 220 bps. That would come in just over a 3.0% yield as the 5 year Treasury is at 0.84%. Investment grade ratings from S&P, Moody’s and Fitch are expected.

At the same time – following the rules – the BDC disclosed its preliminary IQ 2021 key metrics:

As of April 19, 2021, Owl Rock Capital Corporation (the “Company”) estimates that its net asset value per share as of March 31, 2021 was between $14.75 per share and $14.89 per share, up from $14.74 as of December 31, 2020. As of March 31, 2021, the Company’s total debt portfolio was approximately $11.0 billion in aggregate par amount, up from $10.8 billion as of December 31, 2020. As a result of this portfolio growth, estimated debt to equity as of March 31, 2021 was 0.92x up from 0.87x as of December 31, 2020.

These disclosures suggest a mid-point percentage growth in NAV Per Share to $14.82, a very modest half a percentage point. Likewise, the FMV of the BDC’s portfolio has increased less than 2.0%, and probably less on a cost basis.

Last quarter Net Investment Income Per Shares (NIIPS) was $0.29, and is projected by the analysts – who tend to aim low – to be $0.30 in the IQ 2021. ORCC did not offer a IQ 2021 preview of this important metric. The BDC, though, did announce a $0.31 dividend for the first quarter of this year, suggesting that – like last quarter – the “regular dividend” might still exceed the BDC’s NIIPS. This is even more likely given that in the IVQ 2020 the external manager was still partly waiving some of its compensation, to the tune of $8mn or $0.02 per share in higher NIIPS. What the current, unsubsidized, NIIPS running rate has reached is a seminal matter that has not been answered in these disclosures.

Last year ORCC was committed to paying multiple “special” distributions which caused its total 2020 payout to reach $1.56. We are assuming that in 2021 we’ll only be seeing the “regular” distribution or $1.24, which will reduce shareholders payments by (21%). However, even that $1.24 may be questionable as the year progresses, but that’s a discussion for another time.

BTW, ORCC closed on April 16, 2021 at $14.34, just off a 52 week high of $14.42. At the closing price, the BDC is trading just (3%) below its mid-point IQ 2021 NAV Per Share estimate and 11.7x the analyst consensus for NIIPS of $1.23 in 2021. The yield is 8.6%.

Still, the BDC is trading (25%) below its pre-pandemic highest price.

We will discuss the new unsecured note offering in a day or two when the transaction is closed and will circle back to ORCC’s earnings power and other issues after its upcoming earnings release.

- Bain Capital (BCSF) Files 2021 Proxy: The BDC will be holding its regular shareholder meeting on May 27, 2021. As per most other BDCs, BCSF is seeking votes on directors and selling common stock below book value, if thought to be necessary by the Board.

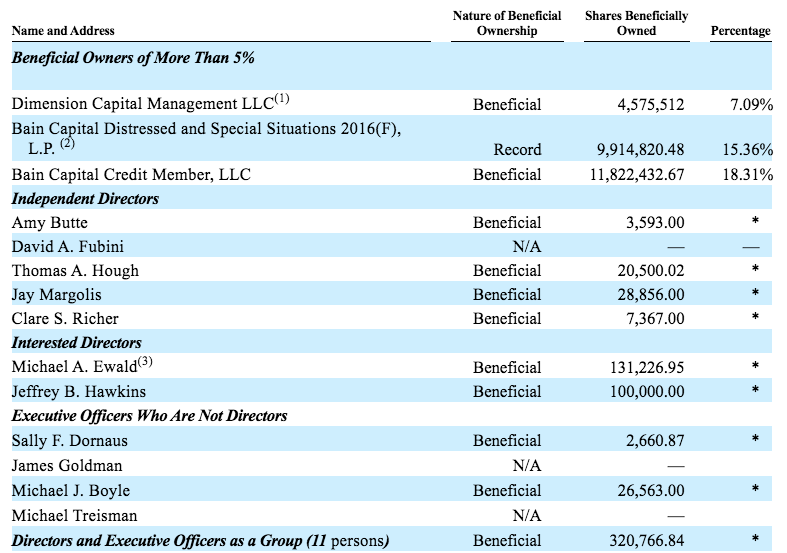

For anyone interested we’ve extracted the insider ownership table from the Proxy – one of the few pieces of useful information in a document filled with much boilerplate language.

We’d say the shares owned by “Executive Officers Who Are Not Directors” might be a little disappointing to some BCSF shareholders.

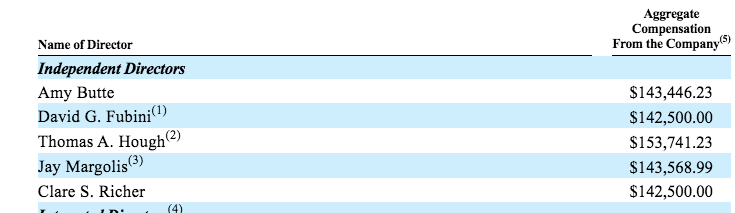

Here’s how much “independent” directors are paid for the record:

Share ownership in this group seems low as well.

Premium Article

As promised, we’ve written a long-ish article previewing Horizon Technology Finance’s (HRZN’s) IQ 2021 results, and what factors might move the stock price. Our premium subscribers will already have received the article in their inbox.

Next up for a preview is Ares Capital (ARCC) unless we get distracted by other developments.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.