BDC Market Agenda: Thursday April 29, 2021

Premium FreeWhat’s Been Happening

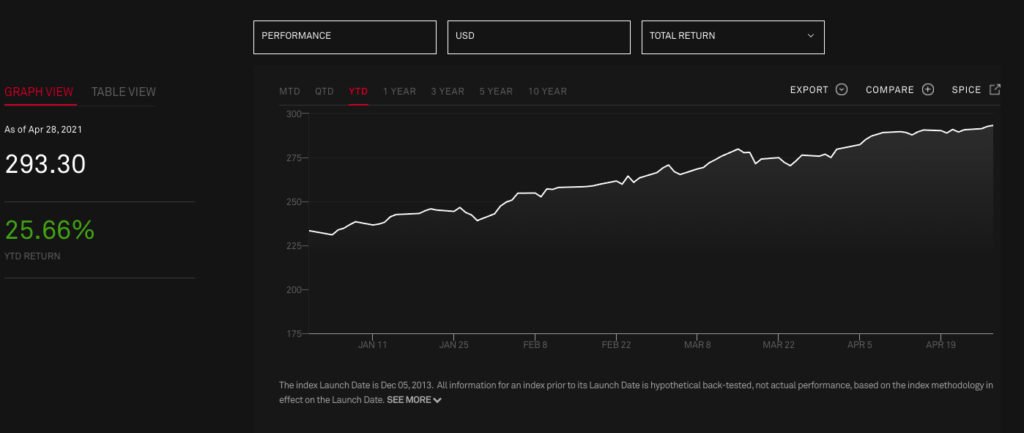

As has happened for several days in a row, the S&P BDC index – on a “total return” basis – reached another all-time, 1 year and year-to-date high at the close on Wednesday April 28, 2021. As the chart below shows, said index reached 293.30, up from 292.70 the day before. In 2021, the BDC sector is up 25.7%.

30 BDCs were up in price, or unchanged, and 13 were down. However, of the three BDCs that have reported IQ 2021 earnings the only big winner in price terms was Horizon Technology Finance, up 4.57% on the day – the most of any BDC. Oxford Square was up modestly at 0.81%, whiles Ares Capital fell off (1.17%), the fourth worst daily price performer. We have now listened to the conference calls of both Horizon and Ares, which occurred in the early hours of Wednesday, and have comments to offer on both. Furthermore, we’ve read both BDCs 10-Qs and begun the tedious, but necessary process, of reviewing each company in their portfolios to identify the underperformers; the likely write-offs and the prospective value recoveries. We have some commentary on that subject as well. In terms of news, though, the only (barely) notable item was a Form 25-NSE filing by Horizon regarding the removal from public listing of its Baby Bond with the ticker HTFA, which we’d previously removed from the BDC Fixed Income Table.

- Ares Capital (ARCC) IQ 2021 Conference Call Transcript: As mentioned above, the BDC Reporter both listened to the conference call and reviewed the quarterly filing. We’ll hold off any detailed credit review, but we’ve already been through the 350 company portfolio – as we had done recently with the IVQ 2020 statements – identifying and grading the underperformers and counting up the non performers. BTW, according to the BDC itself

“As of March 31, 2021, loans on non-accrual status represented 3.3% and 2.2% of the total investments at amortized cost and at fair value, respectively. As of December 31, 2020, loans on non-accrual status represented 3.3% and 2.0% of the total investments at amortized cost and at fair value, respectively”.

Converting those percentages into dollars, ARCC had $516mn of non performers at cost, and valued at $339mn. That’s a FMV discount – an important indicator of potential recovery for what are assets still in transition – of (34%) – a relatively high number for loans that are not paying their way. By contrast, the IVQ 2020 corresponding numbers were $525mn and $341mn. If that sounds like very little change, you’re right. Non performers are intractable assets that can – literally – take years to resolve.

More progress has been made in the amount of total underperformers on the BDC’s books – which includes the non-accruals. As the BDC Credit Table shows, ARCC’s self-assessed valuation of 1 and 2 rated investments on their 4 point scale (which are the underperformers) dropped to $1.854bn from $2.163bn, a 2% improvement down to 11.9% of the portfolio, from 13.9%. As we anticipated after our recent two part review of ARCC’s IVQ 2020 portfolio – click here and here – the net movement in value in this important category is positive and accounts – in part – for the 2.8% increase in NAV Per Share over the prior quarter. As importantly – and called out by management itself – ARCC’s NAV Per Share has now recovered all the value lost in the dark days of 2020. As the BDC: NAV Change Table shows, in the IQ 2020, that metric dropped (10.0%), a massive percentage in such a diversified portfolio.

Otherwise, we have little to add about ARCC’s IQ 2021 fundamental performance as the numbers can speak for themselves. Core EPS was below the unusually high level of the IVQ 202, but that was expected , and outstripped the conservative numbers offered by the analysts. As we’ve discussed NAV Per Share was up, with a little boost from selling new shares above book in the first secondary offering the BDC has undertaken in years. Liquidity is abundant, with ARCC boasting of ending the quarter “with nearly $5.2 billion of total available liquidity and a debt-to-equity ratio net of available cash of $285 million of 1.02x, down from 1.17x at the end of the fourth quarter. While our leverage ratios will vary over time, depending on activity levels, we will continue to work to operate within our stated target leverage range of 0.9x to 1.25x“.

We calculate every quarter on a pro-forma basis – using actual leverage and comparing against a BDC’s stated “target leverage” – how many more assets funded by debt would be needed to reach their target. In ARCC’s case, that’s roughly $1.5bn of additional borrowings and investment assets, based on the current net asset level. Clearly, ARCC – which is constantly pruning its debt structure and which has established an almost perfect laddering of its unsecured debt – has all the resources needed to plow forward.

Interestingly, this brings us to the dividend. Once again – and despite another quarter of “over-earning” the quarterly payout, ARCC announced an unchanged $0.40 quarterly dividend for the second quarter 2021. At the same time, the BDC indicated “un-distributed” taxable income – i.e. earnings achieved but not distributed to shareholders – was as follows, and re-iterated the external manager’s philosophy in this regard:

“We currently estimate that our spillover income from 2020 into 2021 will be approximately $454 million or $1.04 per share. We believe having a strong and meaningful undistributed spillover supports our goal of maintaining a steady dividend throughout market cycles and sets us apart from many other BDCs that do not have any spillover”.

In our opinion, the position ARCC has taken regarding distributions is unfortunate and – at least in our eyes – controversial. Essentially – at a time when the BDC’s coffers are full; credit conditions improving and the market very active – the BDC is holding onto what is due to shareholders thanks to subtleties in the BDC rules which otherwise envisage all taxable income be paid out to shareholders. By no means is ARCC alone in this, but that does not make this hold-back – certainly of this size – appropriate. Given the time value of money, this is materially deleterious to shareholders, and artificially – and temporarily – boosts net assets. Admittedly, many analysts and investors like the “smoothing” effect of retaining income for multiple quarters so we’re in the minority. Still, we’d be more impressed if the external manager delayed its own compensation in the same proportion as that applied to shareholders to demonstrate that “shareholder friendliness” BDCs pride themselves on. Anyway, we still expect – but cannot rightly quantify – that the BDC will have to make some sort of supplementary dividend payout later in 2021. Not because they want to, but to follow the rules.

- Horizon Technology Finance (HRZN) Conference Call Transcript: As was the case where ARCC is concerned, we’ve little to add about the venture-debt BDC’s results, which were excellent in most every regard. We still propose to compare the BDc Reporter’s earnings preview against its actual performance. The in-depth look we took into ARCC yesterday has delayed the article, which we’ll complete today if all goes to plan.

The only point we’d make at this stage – partly because management is quiet on the subject – is that the BDC once again booked substantial realized losses. In all of 2020 – even as HRZN’s stock price went through the roof – HRZN’s P&L revealed ($14.7mn) in net realized losses, and ($4.2mn) the year before. (In 2018, there were $0.6mn in net realized gains). In IQ 2021, the net realized loss was ($5.2mn). In total- since the beginning of 2019, those realized losses – despite the occasional gain on the sale of equity and warrants – total up to ($24.1mn). That’s equal to 9% of all the equity raised. “Distributable earnings” since inception are ($59mn), or 21% of all equity capital at par.

What HRZN has not yet been able to deliver since going public in October 2010 is to achieve a reliable flow of net realized gains from the large number of equity stakes in some very interesting venture-capital backed growth companies. Over time this means that we’re in a “swings and roundabouts” situation, with what is gained from recurring income being lost – partly or fully – in loan and equity investment write-offs. Currently, the market does not care and is pushing the stock price to its highest levels ever. However in the past that has been a concern and could be again in the future.

Coming Up

After the close, we’ll be getting the earnings releases of BlackRock Capital Investment (BKCC) and Hercules Capital (HTGC). Click here for the BDC Earnings Table. We expect mostly good news from the latter, but are not quite sure what BKCC might have on offer. Here’s a link to what occurred in the IVQ 2020. So far – and admittedly we’ve only just begun – BDC earnings season has gone smoothly and to expectations. Maybe BKCC will be the first exception ?

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.