BDC Market Agenda: Tuesday April 13, 2021

Premium FreeOn The Docket

There’s no breaking news out of the 43 public BDCs, except for a couple of routine filings from Owl Rock and Prospect Capital. However, the state of the market is worth commenting about, and we do below. Finally, we provide what we hope is our last status report about our pending credit review of Ares Capital. The more we dig, the more we learn and the more complex the picture becomes for the BDC leader where credit status is concerned.

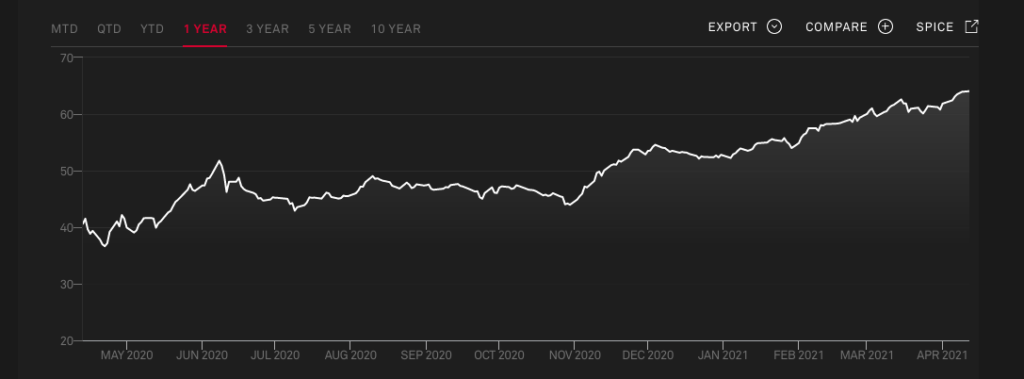

- BDC Sector At Or Close to Record Highs: After peaking at an intra-day 52 week high of $19.49 on Friday April 9, 2021 BDCZ – the UBS Exchange Traded Note which owns most BDC stocks – dropped back to $19.09 at the close on Monday April 12. That’s just (2.1%) below the price peak. The S&P BDC index – on a price basis, though, is up to a new YTD and 52 week high as of Monday’s close (64.05). See the table below for a chart worth a thousand words.

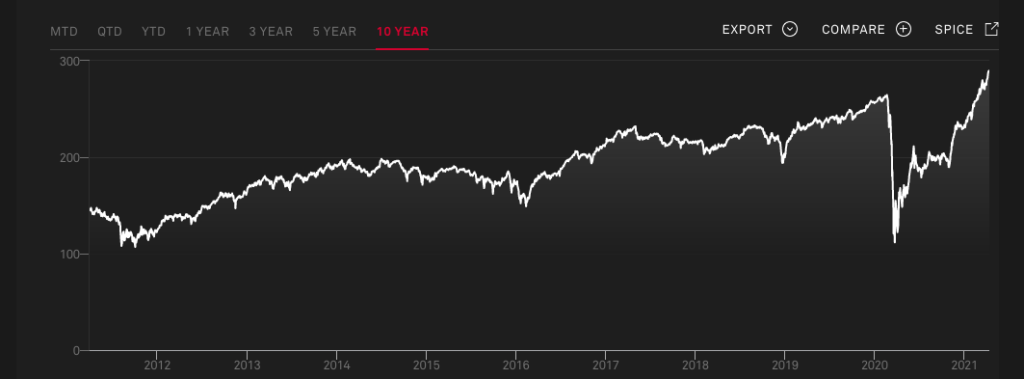

Likewise for the same S&P BDC index on a total return basis, we were – once again – at an all-time high. See the chart below:

All this to underscore that the BDC sector one year after experiencing the “worst of times” since the Great Recession is now in the “best of times” where sector prices are concerned.

Seeking Alpha data by individual BDCs corroborate that conclusion with 42 out of 43 BDCs up in price over both a 2021 YTD and 52 week time frame.

Bucked by this recent surge in prices – and using “total return” data- we count 34 BDCs out of 39 in the black over a three year time frame, or 87%.

Over a 5 year time frame, the number is 32 out of 37 in business over that entire period, or 86%.

Finally, over a ten year time horizon, 20 of 22 BDCs have achieved a positive total return, or 91%.

Yet a year ago, thanks to that March plunge, the S&P BDC index on a total return basis had given up all the gains of the nine prior years…

This is volatility writ large but with a happy ending for anyone taking their chips off the table today.

2. Owl Rock Capital (ORCC) Refinances On Balance Sheet CLO Securitization: In what seems a routine move, the $10bn+ in assets BDC refinanced one of its secured financing sources: a CLO securitization.

The prior CLO facility allowed for re-borrowing as assets were paid off till January 2022. Now ORCC has until 2025 to use the re-investment ability. Furthermore, judging by a comparison of the disclosures of the prior and new arrangement, ORCC will be paying less for the senior tranches of debt involved in the CLO than before.

3. Prospect Capital (PSEC) Issues New Inter-Notes For Various Periods.

Here are two interesting disclosures copied from this latest prospectus:

“During the period of February 11, 2021 through April 8, 2021, we issued $22.8 million in aggregate principal amount of Prospect Capital InterNotes® for net proceeds of $22.5 million. During the period of February 18, 2021 and April 8, 2021, we issued 2,020,490 shares of our 5.50% Series A1 Preferred Stock and 37,768 shares of our 5.50% Series M1 Preferred Stock, excluding shares issued via the Preferred Stock Dividend Reinvestment Plan, for net proceeds of $47.9 million”.

As always we remain surprised that PSEC puts such a huge effort to issue InterNotes for such little capital raised. At the same time, we’re impressed that the BDC is selling its idiosyncratic and illiquid preferred stock – which sits very low in the BDC’s balance sheet – in such quantities. That’s good for PSEC shareholders presumably. We’re not sure – based on our analysis – that the preferred shareholders will fare so well if PSEC faces any material credit troubles, but in the hunt for yield issuers are in the driver’s seat.

Credit

We have completed our table showing every underperforming Ares Capital (ARCC) underperforming portfolio company we’ve been able to identify (now 32) and begun writing our credit review. We’re reminded as we plough through BDC’s own data about portfolio performance how much performance deteriorated during 2020 versus the end of 2019 thanks to the impact of the pandemic. Notwithstanding that the BDC is trading close to an all-time high, the dollar volume of underperformers remains high even after an improvement in the IVQ 2020 data. Is that worrisome for the future or will the portfolio “heal” without much in the way of additional realized losses (2020 was the worst year in the last 3 for the BDC) ? We will try to provide clues to that answer by getting into the weeds and detailing where the principal risks of income and capital loss remain and quantifying the almost unquantifiable. Expect a company by company assessment of the biggest potential trouble spots as well as some good news.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.