BDC Market Agenda: Tuesday April 20, 2021

Premium FreeOn The Docket

As BDC stock prices continue to hang just below their rally highs, there was little news to report, except for a sudden drop in Horizon Technology’s stock price and fuller details on Owl Rock Capital’s latest outing to the capital markets. Regular readers will know that we had previously discussed both BDCs.

- Horizon Technology Finance’s (HRZN) Stock Price Drops: On Monday, HRZN dropped (8.09%), far and away the most of any individual BDC and on a day when BDCZ – representing the sector – was off only (0.2%). The trading volume was high and came as ex-dividend date for the BDC ($0.10) came and went. From a recent high of $17.56, the stock is now at $15.91, an overall high-to-low drop of (9.4%). Of course, we had written about HRZN shortly before the slump and had these musings about the BDC’s upcoming earnings season to share with our subscribers:

“HRZN is a very “hot stock” in a very charged up BDC sector. We’ll be interested to see if management – and the fundamentals – will be able to support the seemingly high expectations the market has for what remains a small BDC with high income and asset concentration (about a fifth of both are held in 5 companies). The BDC deserves its day in the sun after some fallow years, but these markets can turn on a dime or on an errant result, so this is likely to prove a very interesting earnings season for HRZN and its shareholders”.

Apparently – and to no great surprise – many investors have decided that caution is the better part of valor and have taken their money off the table now the dividend has been acquired and with earnings only a week away. We expect – based on experience – that we’ll see more of the same for other high flying BDC stocks in the weeks ahead. The most important question, though, is whether investors will flock back if and when HRZN and its peers report unblemished results or has the BDC sector “jumped the shark” ?

- Owl Rock Capital (ORCC) Pricing Term Sheet For New Unsecured Notes: Yesterday, we noted that ORCC was back in the market, preparing to issue new unsecured debt. We’ve now seen the pricing term sheet which gives the key details of the latest financing. The BDC is seeking to raise $500mn for 5.5 years ending in January 2017. The pricing is 2.625%, or benchmark Treasuries + 193 bps. As previously known, the new monies will be used to repay existing secured debt facilities. (Unfortunately, the pricing term sheet is not available on the BDC’s website as yet. We use BamSec as our daily research tool for every conceivable BDC filing and found the document there).

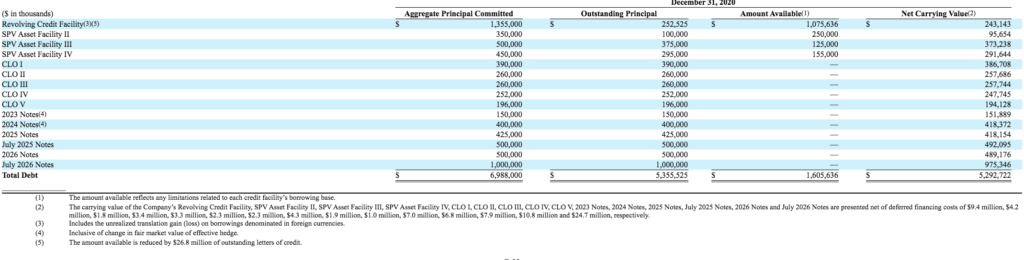

Clearly, the first point to make is that ORCC is raising a substantial amount of money at a very low rate for the medium term period involved. To put the numbers into context, the BDC currently has $5.3bn of borrowings outstanding, so this new debt represents almost a tenth of the total. Furthermore, ORCC was in the market only a few months ago – in December 2020 – and raised $1.0bn at a yield of 3.40%. The BDC’s oldest unsecured debt tranche was issued in 2017, matures June 1, 2013 and yields 4.75%. Another debt offering made in 2019, and coming due in 2024, was priced at 5.25%. This latest debt is far and away the most inexpensive unsecured offering yet and fits into a nicely laddered set of debt obligations coming due between 2013 and (now) 2027. See this table below, copied from the latest ORCC 10-K:

Also notable – and mentioned by the BDC itself in the prospectus – is that the borrowing cost of the secured debt to be repaid from the note proceeds is 2.1%. That means the differential between borrowing unsecured and secured is only about half a percentage points, although the former comes with a much greater degree of flexibility.

Unknown at this point is whether ORCC will swap its fixed interest rate for a floating one as was the case in prior note offerings and what that might make the effective rate paid, which could be lower – at the moment – from the 2.625% headline yield.

With the BDC’s yield on income producing pegged at 8.3% as of year end 2020, the spread between lending rate and cost of capital for the $500mn involved is 5.675%. Net of the 1.5% management fee (1.0% if ORCC’s debt to equity is over 1:1, which is not yet the case), and 17.5% of net earnings Incentive Fee, shareholders will net a 3.65% pro-forma return on the $500mn in yield bearing assets to be purchased with this new capital. Our calculation leaves out the impact of incremental operating costs or any non-income generating investments and the likelihood that future portfolio yields will be lower than at 12/31/2020. Still, even at a 3.5% net margin, $500mn generates $17.5mn of Net Investment Income. That’s $0.045 on an annual Net Investment Income Per Share basis. Typically when we drill down from gross yields down to what should be dropping down to shareholders the “contribution margin” is only 2.0%-2.5%. Or less. This will certainly be a fillip to the BDC’s earnings in the long run as the portfolio expands, even if in the short run interest expense and debt arrangement costs will swell, affecting IIQ 2021 results.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.