BDC Market Agenda: Monday July 12, 2021

Premium FreeWhat’s Been Happening

The first day back of the week saw both the NASDAQ and the S&P 500 reach new heights. Not surprisingly – as we’ve sought to show in earlier articles – the BDC sector followed suit. BDCZ – the UBS Exchange Traded Note which owns most of the public BDC stocks – was up 0.8%, to a price of $20.12. 33 of the 41 stocks we track were up in price, 8 were down and none were unchanged; reflecting broad based gains on this day at least. With that said, there were no great moves one way or the other for individual stocks in percentage terms. The biggest gainer of the day – which was Stellus Capital (SCM) – went up only 2.6%. Likewise, the biggest percentage loser was tiny Great Elm (GECC) – off (2.7%).

At this point, BDCZ sits only (0.8%) away from its summit price set in June. With the main indices at record highs, and with BDC earnings season right around the corner, it’s hard to countenance the sector’s prices dropping out of bed based on recent performance. We’ve been as low as $19.46 in the last month – (4.1%) off the 52 week high. That’s not much of a pullback. Investor confidence remains high across the board, even if many remain on vacation and otherwise engaged.

As to BDC earnings season, the BDC Reporter has finally caught up with all the earnings announcements made to date for the IIQ results, and updated the BDC Earnings Calendar with all the known information about dates of releases and subsequent conference calls. 18 BDCs have set their reporting dates but 22 have not as yet. So far, the start date for those BDCs with a June quarter end seems to begin – as is often the case – with Ares Capital (ARCC) – on July 28th. The following week is loaded down with earnings releases, so beware.

On the BDC news front, there wasn’t much of significance. Prospect Capital (PSEC) issued and priced $150mn of Perpetual Preferred stock. The yield paid was 5.35%. The press release said ” In addition, Prospect has granted the underwriters a 30-day option to purchase up to an additional 900,000 shares of Series A Preferred Stock solely to cover over-allotments. This offering is expected to close on July 19, 2021, subject to customary closing conditions”. The BDC did not have any specific long term unsecured debt issue as a target for repayment, indicating the funds raised would be used.

We’re not sure what the BDC’s managers are seeking to do. As of March 31, 2021 debt to equity (which includes the Preferred in the debt calculation as per BDC rules ) was only 0.61 to 1.00x, well below the “target leverage” of 0.85x PSEC has set itself. PSEC had $454mn of unused availability under the Revolver, which only costs 2.3% all in (LIBOR + 2.20%). Moreover, PSEC has only pledged a quarter of its investment assets to support the Revolver and could – in theory – borrow even more than is currently the case. We’re not sure how the BDC’s manager or its shareholders benefit from raising preferred equity capital at this stage. We may learn more when the BDC announces IIQ 2021 earnings and holds its conference call.

Otherwise, the only other news was that a director of Oxford Square (OXSQ) – Richard Neu – has resigned from the Board and has been immediately replaced. He has been replaced by Barry Osherow. Here is Mr Osherow’s stated background:

“Mr. Osherow is currently at Level Equity Management, LLC (“Level Equity”), a private investment firm focused on rapidly growing software and technology driven businesses, and is a partner in and manages Level Equity’s structured capital funds. Prior to joining Level Equity in 2016, Mr. Osherow was with Enhanced Capital Partners, Inc., as Managing Partner and Investment Committee Member of the firm’s SBIC fund. Prior to that, Mr. Osherow was a member of the founding team of Oxford Square Capital Corp. (formerly known as Technology Investment Capital Corp.) and served as Principal and Head of Direct Lending. Previously, Mr. Osherow was an Associate in the Private Equity Group at Wit Capital (which became SoundView Technology Group) focused on raising private equity for technology and Internet businesses and was a member of the founding team in 1996. Mr. Osherow also previously served as Vice President of Business Development at Spring Street Brewing Company and as an Associate with Lehman Brothers. He graduated from Babson College with a B.S. with a concentration in International Business. Mr. Osherow was selected to serve on the Board due to his more than twenty-five years of experience as a finance executive and extensive credit experience with middle-market companies”.

We have nothing constructive to add.

BDC PORTFOLIO COMPANY CREDIT NEWS

The BDC Reporter regularly trawls publicly available information about developments at portfolio companies that are, or have been, underperforming. There were several newsworthy items today:

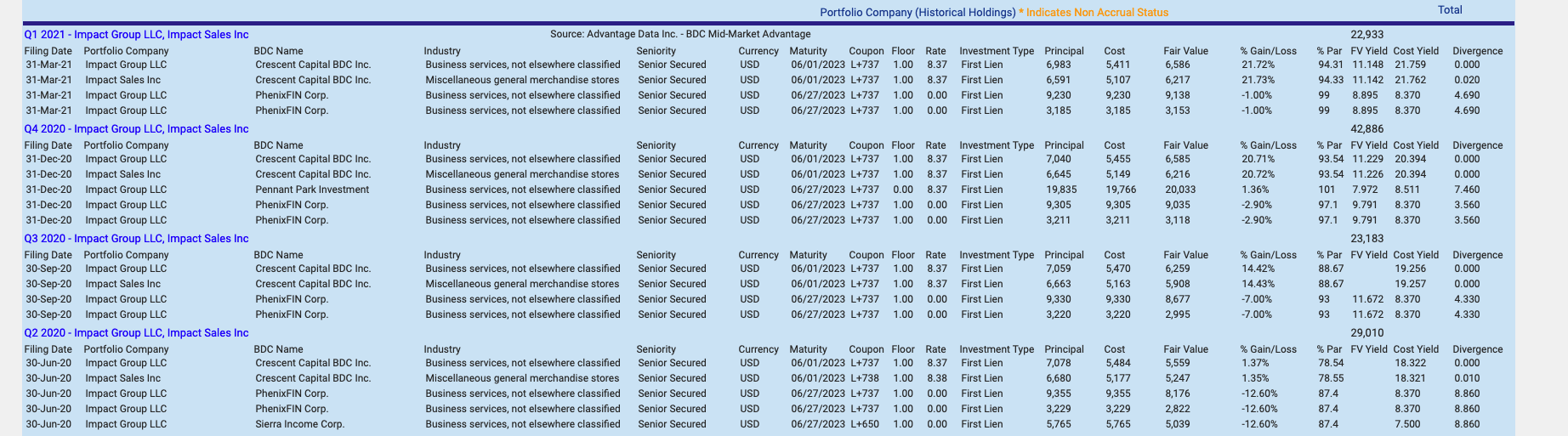

Impact Group (aka Impact Sales) has been acquired by the Acosta Group. This will impact two BDCs with first lien debt outstanding to Impact: Crescent Capital (CCAP) and PhenixFin (PFX). At 3/31/2021 total exposure at cost was $22.9mn, according to Advantage Data. All the investment was in senior debt due in 2023 and yielding (after a 1% floor is considered) 8.37%. For a few quarters, Impact Group was on the BDC Reporter’s underperformers list but was valued at a premium by CCAP in the most recent quarter, probably on the anticipation of fees due on repayment. PFX valued the debt at a (1%) discount to par. Both BDCs should have been repaid in full, and this should be reflected in the IIIQ 2021 results. See the Advantage Data table below:

BTW, for CCAP, Impact Group was a transaction inherited from Alcentra, which the BDC acquired.

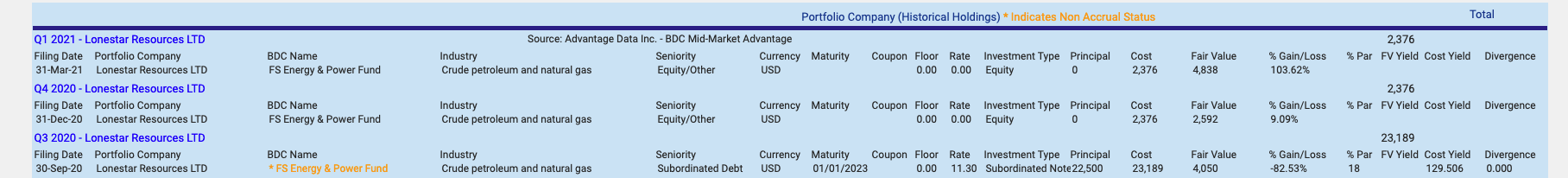

Lonestar Resources To Be Acquired by Penn Virginia In All-Stock Merger: Yes, Virginia troubled energy equity investments can sometimes work out for the best. In any case, that seems to be the case for FS Energy, which recently converted its subordinated debt in Lonestar, with a cost of $23mn into equity. That equity is now likely to become part of Penn Virginia. At 3/31/2021, the equity was valued at $4.8mn from $2.5mn the quarter before and may go higher after the merger is completed. Of course- as has often been the case in the past – this may be a case of going from the frying pan to the fryer. Time will tell, but this merger should show up in FS Energy’s valuation in the IIIQ 2021. Whatever happens, though, FS Energy looks unlikely to recoup most of the capital originally advanced.

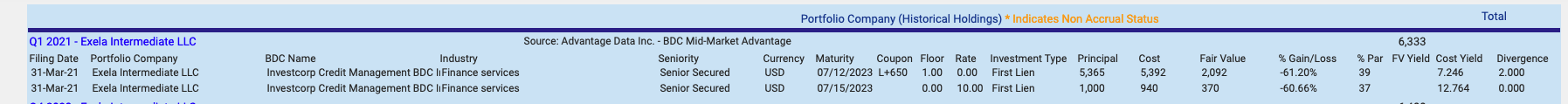

Exela Intermediate Raises Equity Capital: The under-performing technology company – whose debt is valued at a substantial discount as of March 31, 2021 – has surprised everyone by launching an At The Market capital raising program. This is very good for the debt holders of the business who now look to be repaid in full. This was all colorfully covered by Petition – a first rate bankruptcy-focused newsletter who had the following to say in their typically colorful way:

“Anyway, the company raised $85mm under a $150mm program it initiated as of June 30 and intends to use the proceeds to reduce debt and, in turn, interest expense. The company’s $1b of ‘23 senior secured notes priced in the high 60s early this week before jumping past 71 at week’s end. Speaking of bananas…this chart ⬇️. JFC. 🍌🍌🍌

And the $324.mm first lien term loan B continued its rocket-like upward trajectory from June (in which it was up 25.4%). On July 1, the frikken paper was around 65 cents on the dollar. Now…this:

🍌🍌🍌🍌🍌So, clearly the ATM credit enhances the debt but one has to wonder how the equity might react to millions in dilutive issuance…? Hahahaha, LOL, this is frikken 2021, you muppets! Of course it went up!! On the back of some WSB love on Reddit, the stock climbed 44% this week. Love these markets!”

The only BDC with exposure seems to be Investcorp Credit Management (ICMB) who now seems likely to be able to write up its position in the 2023 debt by $4mn. Maybe that’s why ICMB’s stock has been on fire for the last few days…Here is the latest exposure data from Advantage Data:

Limestreet Bay Ventures LLC: An environmental and financial disaster is occurring in the U.S. Virgin Islands, also pointed out to us by Petition and very much in the news. According to the WSJ, the oil refinery has been closed down by the EPA – and its inadequate financial resources = since June. A bankruptcy filing is possible as this report suggests:

“The refinery has lost investors hundreds of millions of dollars since restarting and Limetree Bay Ventures—its managing company—has dissolved, according to a report last week from Reuters. The refinery also faces four class action lawsuits from local residents seeking compensation for property damage and medical expenses related to recent accidents, the St. Thomas Source reported Thursday.

Financial analysts who have looked at the circumstances facing the refinery say it might not be able to recoup its losses, even with oil prices returning to pre-pandemic levels as economies reopen and travel rebounds, making bankruptcy a likely possibility.

ArcLight Capital purchased the refinery out of bankruptcy in 2016 for $190 million, but the plant has never run smoothly, Reuters reported.The private equity firm was previously Limetree’s largest shareholder, but has removed the company from its portfolio entirely, the report said, with the firm selling its last Limetree shares in April.”

You have to admit that all sounds very bad, and suggests that the only BDC with exposure – non-traded FS Energy – is in for a world of hurt. At March 31, 2021 the ill fated energy-focused BDC had $300mn in exposure to Limestreet Bay Ventures in the form of equity, preferred, subordinated debt and senior bonds. All the debt is on non accrual and the total investment was valued at $151mn, or a 50% discount. We’re not close enough to this situation to say anything with great certainty, but we’d not be surprised if a complete write-off is in the cards. This cannot be good news for the shareholders of FS Energy – who’ve already seen their $3bn invested in common stock in the BDC get written down to $1.5bn. If another $150mn goes the way of all flesh, that would cut FS Energy’s remaining net book value by another 10%.

If nothing else, this seems to be another reminder to BDCs – and their shareholders – to diversify by sector and by company. Oh, and don’t invest in energy…

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.