BDC Market Update: Tuesday September 21, 2021

Premium FreeWhat’s Been Happening

MARKETS

A roller coaster kind of day for the major indices – after Monday’s reverses – with the indices up and down. Mostly – at the end – the move was to the downside, although the NASDAQ and the Russell 2000 managed to remain in the black. Investors have not yet been convinced that the debt problems of the Chinese real estate developer will not have undue ramifications. Plus, the Fed is reporting in on Wednesday, which tends to put some investors decisions on hold, even though it’s been only a brief time since we last heard from the leaders over there. Then there’s the unresolved issue of debt ceiling.

With all that said, BDC sector investors – after following the crowd out of the exits yesterday – were more sanguine today. The BDC ETF with the ticker BIZD ended up 1.07% ahead, and was much above that intra-day. BDCZ – the UBS Exchange Traded Note which also speaks to overall sector performance – went up 1.10%. In both cases trading volumes were modest, reflecting no great conviction.

35 individual BDCs were up in price, which is nearly as many were in the red the day before. There were 2 BDCs unchanged in price and just 4 that actually registered a drop. That’s a pretty good sign of investor confidence given the overall atmosphere.

No BDC stock dropped more than (3.0%) and only two increased by more than 3.0% – TriplePoint Venture Growth (TPVG) and Saratoga Investment (SAR). That means 39 BDCs just oscillated in price in a narrow range.

As always, the markets could go either way in the days ahead, but we still don’t detect much of the Sturm und Drang associated with major BDC price pullbacks.

NEWS

As we were writing this update, we saw that Barings BDC (BBDC) has done it again: undertaken another unexpected acquisition of a BDC. This time the acquiree is non-traded Sierra Income. (Last time BBDC acquired publicly traded MVC Capital – a transaction that appears to have gone well so far). This is a very exciting news story at a very slow time of the year for much of anything new. We’ll be delving into the transaction as early as tomorrow or the day after with a full fledged article.

In more mundane, but still important news, Main Street Capital (MAIN) reported today that two of its lower middle market (“LMM”) portfolio companies have recently been sold. More importantly, those sales resulted in two substantive realized gains. Here are some of the details:

NRI Clinical Research was sold to a “sponsor backed strategic acquirer”.

“Founded in 1977 and headquartered in Los Angeles, California, NRI conducts clinical trials for pharmaceutical companies and contract research organizations through its five clinical research sites with a focus on Phase II and III metabolic disease trials”.

Here is the investment information for the company as of June 2021, as shown in Advantage Data:

The cost – as shown – was $5.764mn at mid year and the FMV $14.839mn.

In its press release MAIN indicated that the final proceeds will be even higher than what was already booked: “Main Street realized a gain of $8.8 million on the exit of its equity investment in NRI. This realized gain, together with a distribution received from NRI during the current quarter, represents total realized value in excess of Main Street’s fair market value for this investment as of June 30, 2021“.

For a full synopsis of the history of the investment, see the press release.

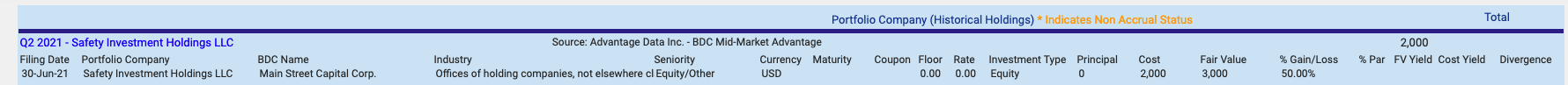

Second is Safety Holdings (dba SambaSafety), which had a cost of $2.0mn as of June 2021, and which Advantage Data calls Safety Investment Holdings LLC.

Apparently matters have turned out even better than what MAIN expected when making its most recent valuation: “Main Street realized a gain of $4.5 million on the exit of its remaining equity investment in SambaSafety, with this realized value representing an increase of $3.5 million above Main Street’s fair market value for this investment as of June 30, 2021″.

Everything else being equal, these above expectations gain point to a higher NAV Per Share at MAIN going forward.

These two realized equity gains confirm our thesis – first mentioned nearly a year ago – that certain BDCs are likely to benefit materially from the red hot M&A market. This is especially true for BDCs which have invested a goodly portion of their available capital in equity interests of varying sizes in companies. Obviously MAIN is one of the BDCs in this category, but there are several others who stand to benefit as more and more companies change hands. As we’ve already seen – both in terms of unrealized and realized equity gains showing up in BDC portfolios – there are multiple other beneficiaries. A non comprehensive list would include Gladstone Investment (GAIN); Fidus Investment (FDUS); Capital Southwest (CSWC) and Crescent Capital (CCAP).

These sorts of successes do not happen all in one go and we expect that MAIN – and most of the others mentioned above – will continue to record new equity gains – both realized and unrealized – in the second half of the year. With the possibility of a rush to sell companies in the months ahead in advance of increased capital gain rates, the impact on some BDCs which deliberately and consistently invest in the equity of portfolio companies could be substantial.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.