BDC Common Stocks Market Recap: Week Ended October 22, 2021

BDC COMMON STOCKS

Week Forty Two

Chugging Along

With three weeks gone, October has been very good to BDC common stock investors.

Once again the two sector indices that we track – BDCZ and BIZD – were up in price.

(BDCZ is the UBS Exchange Traded Note which owns most BDC stocks and has been around in one form or another for a decade.

BIZD is the Van Eck Exchange Traded Fund, which has a large following, but also owns most BDC stocks, and dates back to 2013).

Record Broken

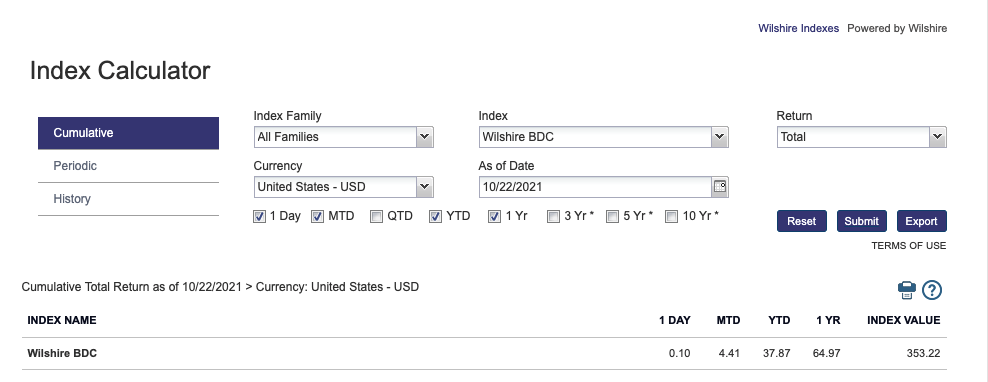

Most importantly of all, the Wilshire BDC Index closed Friday at yet another MTD, YTD and all-time high on a “total return” basis.

As the screen shot above shows, on a YTD basis the BDC sector has churned out an amazing 37.87% return.

Supporting Cast

All the other metrics we rely on to get a sense of perspective of BDC sector performance continue to scream out “rally!”

31 of the 42 individual BDCs we track were up in price or unchanged this week and only 11 were down.

Furthermore, while 4 BDCs increased by 3.0% or more, only 1 dropped by (3.0%) plus.

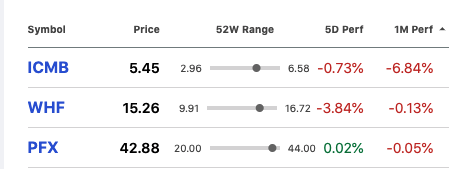

Even that loser – WhiteHorse Finance (WHF) is not representative of much as the BDC undertook a secondary stock offering this week.

That does, typically, cause a short term drop in a BDC’s stock price, but does not suggest any fundamental weakness – quite the contrary.

Looking at our data table, and not counting WHF – no BDC has dropped by (3.0%) or more in price in 4 consecutive weeks.

If we look at price movement over a 1 month period, 39 BDCs are up in price.

In The Red

Here are the three BDCs left behind, and only Investcorp Credit Management BDC (ICMB) has recorded a material drop:

More Positive Numbers

As of Friday 18 BDCs are trading above net book value and 25 are trading within 5% of their 52 week high.

Also indicative of rising investor enthusiasm is that 9 different BDCs reached new 52 week highs this week alone, sometimes multiple times.

Readers of the BDC Reporter’s Daily Updates will know the names involved, led by the biggest BDC of all Ares Capital (ARCC), which reached a new 52 week and all time high price of $21.16 on Friday.

Switching back to the BDC Wilshire Index – but using their price return calculation – the BDC sector is up 4.38% in October alone (4.41% on a total return basis).

Looking Forward

We believe this investor enthusiasm for most everything BDC is related to both the rising tides in all the major markets (the S&P 500, Dow Jones and NASDAQ are all at or close to their 52 week and all-time highs) and hopeful expectations for earnings season.

The IIIQ 2021 results will begin to be rolled out from Tuesday October 26, 2021, with 5 BDCs on the docket.

See the BDC Earnings Table which has a useful calendar with the date of every announced BDC earnings release and the date and time and all the details of each corresponding conference call.

So far, 32 of the 42 BDCs have set a release date, so the calendar is not yet complete.

Starting Point

As of Friday, BIZD was sitting only (0.6%) and BDCZ (1.0%) behind their 52 week highs.

We’ll be curious to see whether BDC sector prices will push higher as results come in or whether the market – as so often happens – has run ahead of the news and will slump back, even if the bulk of BDC results are good ?

This next week and the following, where 15 BDCs report, will tell the story.

For our part, we expect to see BDC prices overall to rise further, as much as 5%-10% over the level of mid-June when the last peak occurred.

That will require both the broader markets to remain strong and BDC results to meet or exceed analyst expectations in most cases.

Last quarter, 40 of 42 BDCs increased their NAV Per Share. Indeed the sector has seen generally positive increases in this metric for 5 quarters through June 2021.

In the BDC NAV Change Table we’ve included our projection as to whether we expect an increase or decrease in NAV Per share in the IIIQ versus the IIQ. At the moment, we again project 40 of 42 BDCs will post an increase.

However, we’ll be the first to admit – much more so than earnings – this is a metric that’s very difficult to project and we offer our estimate with that qualification in mind.

We suggest readers check back regularly all next week as the BDC Reporter in its Daily Updates brings you the IIIQ 2021 results as they come in, and we get an early idea if our optimism – and that of BDC investors as a group in recent days – is justified.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.