BDC Common Stocks Market Recap: Week Ended October 29, 2021

BDC COMMON STOCKS

Week 43

Paper Thin

As the Duke of Wellington said in a different context, it was a “close-run thing”.

All the way through October BDC sector prices seemed about to match or break their 52 week highs – set in June – but failed to do so.

As late as the last day of the month – BIZD – the Van Eck exchange traded fund which owns most BDC stocks and which we use as one of our price guides – reached $17.67

That was just 3 cents below BIZD’s 52 week high.

The ETF then slumped back to $17.57 to close out the day and the month and failed to support the BDC Reporter’s thesis that a new high was in the cards by the smallest of margins.

BDCZ – that other indicator, which is the UBS sponsored exchange traded note which holds most of the BDC stocks – reached its own peak this month of $2013, or (0.8%) away from the $20.29 high.

In fact, BDCZ fell slightly on the week – using the Friday closing numbers – down (0.15%).

Up And Down

Still – and a little confusingly – 26 BDCs were up or flat price-wise over the 5 day period and 16 were down.

4 BDCs increased by 3.0% or more this week and none dropped by (3.0%) or more.

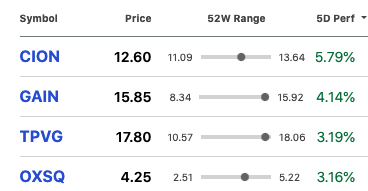

Here are the four outperformers:

Getting To Know You…

Cion Investment (CION) has been rallying all week – as we’ve been mentioning in the BDC Daily Updates frequently.

We assume some investors believe the stock has fallen too much and sells at too great a discount to book after getting publicly listed earlier this month.

Even at $12.60, CION trades at less than the $13.00 of its initial listing.

The story of the newest large-cap BDC is just beginning to be told and that could yet push up the price closer to that of its peers.

For example, Barings BDC (BBDC) and BlackRock TCP (TCPC), which are almost identical in size trade just below and just above net book value respectively.

Should CION trade at its own net book value, the stock price would increase 30%.

No wonder bold investors are plunging into the stock, hoping that the BDC’s first earnings release will support their confidence.

Back To The Sector

At month’s end, most of the sector metrics remain strong – albeit some slightly weaker than the week before.

For example, the number of BDCs trading at or above net book value comes to 17, just down from 18 the week before and 22 in June.

On the other hand, some other metrics are very encouraging.

For some reason, the Wilshire BDC index has not yet calculated the total return for the sector for Friday.

However, as of Thursday already that index – which includes both price changes and dividends received – was at yet another 52 week, YTD and all-time high.

Sky High

Also notable is that 27 BDCs are trading within 5% of their 52 week highs, the highest levels in weeks, but still below the mass enthusiasm of June when 38 BDCs were close to their records.

Another 6 BDCs are 5%-10% off the peak.

Less Beloved

That leaves on the outside looking in some 9 BDCs, more than (10%) away.

For the record, here are the tickers of these less favored BDCs:

AINV, CION, LRFC, GECC, ICMB, MRCC, NEWT, OXSQ and PSEC.

NEWT is on the list because the management decided to cease being a BDC, but fundamentals (and dividends) continue to be strong.

Then There Were Eight

Broadly speaking, the remaining 8 all have performance question marks surrounding them, some of which may get answered this quarter.

AINV – Apollo Investment – is still struggling with its legacy investments in oil & gas; alternative energy and shipping and a huge concentration in a currently troubled industry – aircraft leasing.

Furthermore, the BDC has warned that its incentive fee to the advisor – suspended for a long time due to a “total return” calculation in the compensation agreement – will be charged again, putting into question whether the $0.36 a quarter in distributions being paid can continue to be covered by earnings.

Given those doubts AINV’s stock price has dropped (12%) from the 52 week high set June 14, 2021.

CION we’ve already discussed.

LRFC – Logan Ridge Finance – has a new manager, a new strategy and is turning over its investment assets very fast and is not even paying a distribution again. No wonder the stock is not yet firing on all – or even most – of its cylinders.

Still, good news about the value and liquidity of the portfolio and/or a decent dividend announcement could cause this micro-cap BDC to rise in price.

Many investors are still hanging around expecting LRFC to merge with Portman Ridge (PTMN), which could also boost the stock’s price and shareholder liquidity.

GECC – Great Elm – is on a very unique journey, investing in loans and bonds picked up in the secondary market while also increasingly seeking to own controlling interests in high yielding asset-based financial companies.

Only time will tell if this will succeed, but with many shares being issued to the owners of one of the new financial companies as payment for the purchase of the business, investors are sitting on the sidelines.

Like at AINV, there is a possibility the $0.40 a year dividend (recently cut from $1.00 a year) may get cut again.

However – as with LRFC – GECC is very small, with a market capitalization of $93mn (LRFC is $69mn – according to Yahoo Finance).

In a public BDC universe with a market capitalization approaching $55bn, the relative importance of these tiny players is negligible.

Also on the small size – and also with a relatively new manager and strategy is ICMB – which used to be CM Finance but is now Investcorp Credit Management, albeit with the same day-to-day managers- a BDC with numerous problems at the time of being taken over by the people of Investcorp.

Last quarter, ICMB’s NAV Per Share dropped by (12.7%) – the worst performance by this metric of any public player.

However, management has strongly suggested that the worst is behind us and net book value should consolidate or increase from here.

The quarterly $0.15 dividend has been left unchanged.

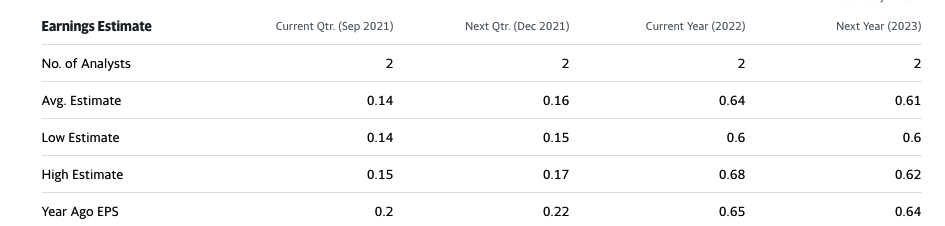

Will ICMB be able to “cover” its dividend going forward from earnings ?

The answer – judging from the analyst earnings consensus for the next two quarters and the year ahead remains frustratingly inconclusive, as this table shows:

As with all the other names discussed, the third quarter results should shed some light on the eventual direction of the BDC and whether shareholders can count on that distribution, already cut thrice in the past 5 years.

ICMB is currently trading (19%) off its 52 week high but at a relatively robust 9.5x its IIIQ 2021 projected earnings annualized.

Hope springs eternal amongst some BDC investors even though ICMB has lost two-thirds of its value since going public in February 2014. The current market cap is $77mn, according to Yahoo Finance.

MRCC – Monroe Capital – has a well regarded Chicago-based asset manager parent, but has multiple credit problems at a time when most BDCs are having a bit of a break from such concerns.

As the BDC Credit Table shows – and using the BDC’s own numbers – a quarter of the portfolio is underperforming and a startling 12 companies out of 91 are non performing.

Again, though, management has made the case that improvements are underway amongst the underperformers and non accruals and we should expect the future to be better than the recent past.

However, earnings – once fee waivers are excluded – do not “cover” the dividend obligation, itself already reduced from $0.35 to $0.25 quarterly at the beginning of the pandemic (a near 30%) drop.

Can an already highly leveraged BDC – GAAP debt to equity of 1.4: 1.00x – fix its portfolio; boost its earnings and maintain the $1.00 a year in distributions ?

The market seems relatively optimistic as MRCC is trading “only” 11% behind its 52 week high and at 10.3x its annual payout. (We’ve found no analyst estimates to share with you).

The market cap of MRCC is $222mn.

OXSQ – Oxford Square – is another tiny BDC with an idiosyncratic strategy that involves heavily investing in CLO equity.

According to BDC rules, CLO investments of this kind are “non qualifying assets” and cannot exceed – along with other non-qualifiers – 30% of the portfolio.

Management – for reasons we won’t speculate about – has thumbed its nose at these limitations and has allowed CLO stakes to account for 39% of the portfolio – a far bigger percentage than any other BDC, and we’ve not even mentioned PSEC yet.

Here is an interesting exchange between Mickey Schleien – the Ladenburg analyst who covers the stock and OXSQ’s management on the most recent conference call – about this over-abundance of CLO investments:

“Mickey Max Schleien Ladenburg Thalmann & Co. Inc., Research Division – MD of Equity Research & Supervisory Analyst

My last question, could you describe your plans, if any, to reduce the fund’s nonqualified asset ratio back down to the statutory limit?

Jonathan H. Cohen Oxford Square Capital Corp. – CEO & Interested Director

Sure, Mickey. As I think you know, all of our nonqualified assets within Oxford Square, our CLO tranche positions, CLO tranche investing as a part of our current strategy at Oxford Square. And as you know also, those investments roll off over time. They are repaid. The deals are called, reset, refinanced, et cetera. That is essentially probably the largest part of that strategy. Although we have and will continue to affect sales where we think it’s opportunistic and appropriate.

Mickey Max Schleien Ladenburg Thalmann & Co. Inc., Research Division – MD of Equity Research & Supervisory Analyst

So over time, as those investments come to maturity, you expect them to roll off and eventually get down to the 30% limit?

Jonathan H. Cohen Oxford Square Capital Corp. – CEO & Interested Director

That, I believe, is our most current thinking, although, again, we’re certainly not opposed to making opportunistic sales where we think it’s appropriate“

We believe Mr Cohen is saying that OXSQ has no intention of bringing its CLO investments under the statutory level.

That may be just as well as the BDC’s regular corporate loans – with a yield of 7.5% – do not cover the cost of OXSQ’s expensive Baby Bonds (ranging in yield between 5.5%- 6.50%), management fees of 1.50% and incremental operating costs.

Income from the CLO investments is keeping the lights on at OXSQ but are not sufficient to even allow the manager to receive an incentive fee in all of 2020 and 2021.

The dividend was reduced in half at the beginning of the pandemic and seems unlikely to be increased as the BDC is essentially fully leveraged and has little liquidity.

OXSQ – which has already reported IIIQ 2021 results – trades (19%) below its 52 week high and has a market capitalization of $211mn.

Biggest

Last but by no means least – in terms of portfolio size and market capitalization – is PSEC – Prospect Capital.

The BDC has $6.2bn in portfolio assets as of June 2021 – more than the other 7 BDCs we’ve discussed (and excluding NEWT) combined and a market value of $3.2bn.

Yet, PSEC is trading (11%) off its 52 week high and (17%) below book.

Unlike many of the BDCs discussed, PSEC did not reduce its dividend when the pandemic came along , maintaining its $0.06 a month ($0.72 a year) payout.

The only two analysts following the BDC are projecting a slightly increasing earnings profile going forward.

Moreover, the BDC has been the busiest player in town – not always with complete success – reducing its cost of debt capital by issuing and repaying unsecured debt and negotiating better spreads on its secured financing.

On the other hand, PSEC is the only one of the larger BDCs still charging a full load 2%/20% management and incentive fees, which keeps earnings for shareholders down and some investors away.

We’re not sure what could be a catalyst for a revived stock price except an increase in the distribution, which seems unlikely.

Management is earning a small fortune in fees and does not seem particularly worried that the BDC’s stock price remains below book value so this quarter’s results may come and go without much noise.

Not Set In Stone

All in all – as we hope this little run-down has demonstrated – every BDC has a different backstory and outlook and any number of outcomes are possible.

We can say with confidence that if IIIQ 2021 results are encouraging most of the players involved could see a price revival that would cause them to join their peers within 10% of their 52 week highs, and which could boost BDCZ and BIZD.

Disappointing results , though, will leave those same BDCs in the price basement as there seems to be – so late in a rally that dates back to April 2020 – a preference for the stronger names developing amongst BDC investors rather than the “everybody is invited” atmosphere that existed in the summer.

Sensible

Those stronger names – like Ares Capital (ARCC), Main Street Capital (MAIN); Golub Capital (GBDC) etc. – are trading up at lofty valuations.

However, for those who believe rallies end only after “irrational exuberance” we’re not there yet.

If anything, the current market approach seems pragmatic and rational, grounded in reported fundamentals and reasonable expectations for the future – not always the case where BDC investing is concerned.

Next Up ?

Will November – and the rest of earnings season – be bring more of the same or will we get a rising tide that will raise all boats ?

It may take the latter for BDC sector prices to break out over their June levels.

How these less favored BDCs we’ve just discussed get treated by investors in the weeks ahead will be telling as to market enthusiasm.

UPDATE ON WEBSITE PROBLEMS

Believe it or not, our newly hired website consultant continues to make progress on fixing the issues that caused us to be unable to send articles like these straight to your inbox. For a little while longer, readers will have to visit the BDC Reporter website for all our content. We’ve tried to compensate by publishing as much new content as possible. That’s ironically a challenge during earnings season because there’s so much to read before even getting to “News,Views and Analysis” and our data tables to update. Generally speaking, though, we’re keeping up but are intimidated by the week ahead when nearly half the BDC universe will be reporting their latest results and holding conference calls. However, as we hope we’ve shown above, there’s a lot to play for and a lot for investors to glean that could change minds and BDC prices. We’ll be pouring out the BDC Daily Updates as fast as we can and offering early hints on the BDC Reporter’s Twitter page as well.

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.