BDC Daily Update: Monday October 18, 2021

Premium FreeMARKETS

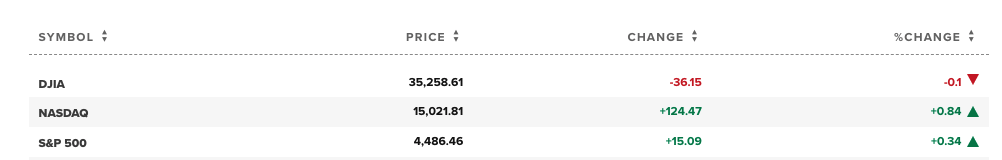

U.S. investors could not make their minds up on the first day of the third week of October. As a result, the indices were “mixed”, but did not stray too much in either direction. The S&P was up 0.34% and the NASDAQ – less important for our comparison purposes – increased 0.84%, while the Dow Jones dropped (0.1%).

The two BDC price indicators we use – BDCZ and BIZD – one a UBS sponsored Exchange Traded Note and the other a Van Eck-backed ETF – were just modestly up by 0.2%.

On the day 21 BDCs were up in price, 1 was unchanged and 20 were down. As per the recent usual, individual BDC price volatility was modest, with Newtek Business (NEWT) top of the leader table with a 2.10% gain and thinly traded PhenixFIN (PFX) down by the biggest percentage at (2.03%).

Ares Capital (ARCC) continues to reach new price heights, a little move upward at a time. On Monday, ARCC hit a new intra-day high of $21.12, up 1 cent from the prior high. The biggest BDC is currently trading at the close at a 16% premium to book value. By the way, 19 BDCs overall are trading at or above book value out of 42.

We also checked in with newly public Cion Investment (CION), which continues to underwhelm where its stock price is concerned. After coming to the public market at $13.00 a share, the BDC closed on Monday at $11.92 – off (0.83%). That’s towards the bottom of its trading range since coming to market of $11.09-$13.64.

BDCZ, which closed at $19.91, is just (1.9%) off its 52 week high set in June and having a very positive start to October. BIZD is (1.5%) off its own highest price in the past 52 weeks of $17.70. One day of investor enthusiasm could bring us to the new highs for the BDC sector that we’ve been foreseeing since the summer.

NEWS

“If at first you don’t succeed, fail, fail again” – to coin a phrase. That seems the mantra over at Prospect Capital (PSEC) which for the umpteenth time sought to tender for some of its expensive unsecured notes in advance of the redemption date with little success. A few days ago, PSEC offered to repurchase from investors up to $81mn of its 2024 notes which yield 6.375%:

“The consideration to be paid for the Eligible Notes is $1,077.50 for each $1,000 principal amount of Eligible Notes, plus accrued and unpaid interest on the Eligible Notes, if any, from the applicable last interest payment date up to, but not including, the settlement date, which date is expected to be October 20, 2021″.

PSEC press release, October 18, 2021

The market response was a very cold shoulder, with just $149,000 validly tendered. We know the capital market folks at PSEC are highly sophisticated and in the debt markets more than any other BDC. What we don’t understand is why the BDC is not able to fashion tender offers that are more successful, wasting time and resources for a negligible gain. Maybe we’re missing the bigger picture ? If any reader has any insight please let us know.

Otherwise, there was no other news worth reporting on Monday.

CREDIT

If regular BDC news was hard to find, we’ve more to report on the credit front. We updated the BDC Credit Reporter – for the first time in a while – with developments at two underperforming companies. The first one involves two public BDCs (First Eagle Alternative or FCRD and FS KKR Capital or FSK) when we downgraded the marvelously named Yak Access LLC to CCR 4 on our 5 point scale. That means the odds of an eventual loss are greater than that of full recovery. However, the amounts at risk are modest.

Far more important is what is happening at a company called Teligent, Inc., which filed for bankruptcy last week. Very few BDC-financed companies have been filing for court protection this year, so that’s interesting in and of itself. Also notable is that Ares Capital (ARCC) is both lender and the dominant equity holder in the company, which has been in trouble previously and now faces a probe by the FDA. ARCC has a great deal of capital invested in the bankrupt business – all in second lien – and the outlook is grim. Given the importance of the transaction to ARCC, we’re republishing the full article from the BDC Credit Reporter below:

Teligent, Inc: Files Chapter 11

October 18, 2021 BDC: ARCC

Let’s not bury the lead here: Ares Capital (ARCC) has a big problem with its investment in generic pharmaceutical manufacturer Teligent,Inc. As Reuters – and many other sources report – the company filed for bankruptcy on October 14, 2021. Vladimir Kasparov, managing director at Portage Point Partners – an interim management firm – has been appointed chief restructuring officer.

In a court filing, Kasparov said the company, which manufactured topical pharmaceutical products and other generic drugs, pointed to a 2019 warning letter by the FDA as an initial event leading to the bankruptcy. The letter, which stemmed from an inspection of Teligent’s plant in Buena, New Jersey, identified several violations of good manufacturing practice regulations and required the company to take steps to come into compliance.

Nate Raymond in Reuters – October 14, 2021

Optimistically Mr Kasparov hopes to find a buyer for the troubled business, and has lined up a $12mn Debtor In Possession (“DIP”) line of credit to provide interim liquidity. The company is public, so there’s plenty of information for anyone who wants to read more.

However, our focus is on the impact of underperforming companies on the BDCs involved. In this case, the only exposure is that held by ARCC, which amounted at June 2021 to $73.8mn at cost. (That may go higher if the BDC supplies the DIP, as we’re assuming). All that exposure is in second lien debt, which is already non performing for over a year and which is discounted (44%-45%). The BDC also owns 91% of the equity, but there’s no cost involved as this was received in an earlier restructuring.

Cutting to the chase – after reviewing the stated financial condition of the borrower; the amount of debt involved; the position on the balance sheet the ongoing problems with the FDA, and the very short leash in terms of DIP financing made available, the BDC Credit Reporter believes a complete write-off is possible for ARCC. That would be just over an additional ($40mn) to write down and off – assuming the DIP monies get out intact. Overall – as noted above – ARCC holds $73.8mn -all of which could turn into a realized loss.

In the short term, we expect ARCC to book an additional unrealized loss of unknown amount in the IIIQ 2021. Given the company’s limited cash availability, we’re guessing a final resolution will occur by the IQ 2022, and we’ll be able to assess if we’re being too conservative. Given the regulatory problems, we don’t think so.

Teligent retains a CCR 5 rating. For a sense of context ARCC’s total equity at 6/30/2021 was just over $8bn and total net realized losses in all of 2020 – the worst year in a long time – were ($166mn). Or, in other words, if ARCC’s investment does go to the wall, this will be a significant loss for the well regarded BDC. Income, though, will not be affected as all the debt is already non performing.

@2021 BDC Credit Reporter

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.