BDC Daily Update: Monday October 25, 2021

MARKETS

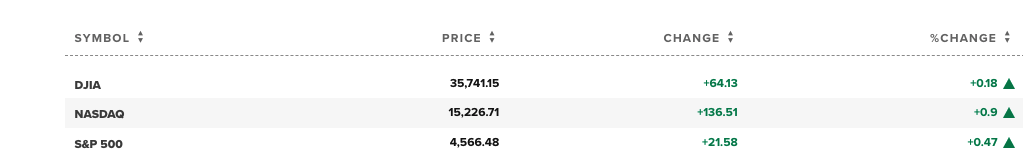

Both the Dow Jones and the S&P 500 rose to new highs on Monday. The NASDAQ moved up 0.9% on the day, to end only (1%) off its own record high. As Yahoo Finance notes, the S&P 500 is up 6% in October and is “headed for its best month since November 2020“.

Generally speaking through October, the BDC sector has benefited – and emulated – the performance of the major indices. Today, though, both the sector funds we track – BDCZ and BIZD – dropped in price, even as the three larger indices continued to climb. BDCZ – the UBS Exchange Traded Note which owns most BDC stocks – closed at $20.07, down (0.07%) on the day. Likewise, BIZD – the “Van Eck BDC Income ETF” – fell (0.11%) to $17.58.

Still, intra-day BIZD reached as high as $17.64 – only (0.3%) away from matching the 52 week high set in June. BDCZ moved up to $20.12, (0.8%) off the 52 week high of $20.29.

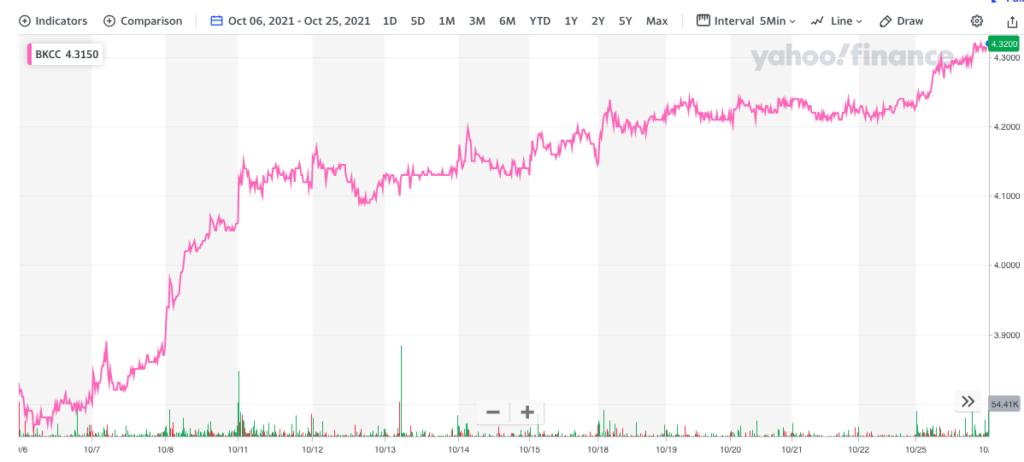

23 BDCs were up in price, 1 was unchanged and 18 were down, which is at variance with the slight drop in BIZD and BDCZ. Par for the course, though, the price moves in either direction were modest. The biggest percentage gainer was BlackRock Capital Investment (BKCC), up 2.13% on twice the normal trading volume.

We’ve been noticing this sudden resurgence of investor interest in BKCC that dates back to October 6, when the stock price reached a nadir. Since then – as this chart shows – BKCC has been climbing fast in price : up 13.2% in less than three weeks.

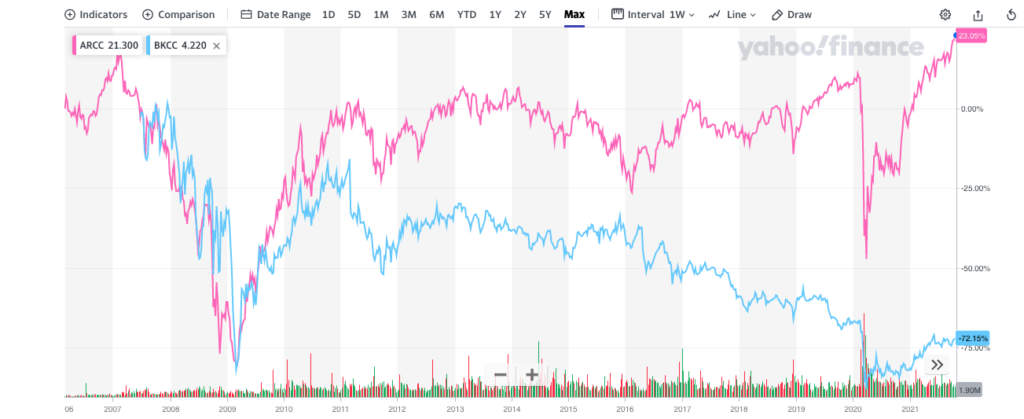

Remarkably, the previously troubled BDC with the famous investment advisor, is now trading only (8%) below IIQ 2021’s net book value per share. As long term market participants will know, BKCC has a long – but troubled past and has undergone at least one significant ownership change and several changes in strategy. The market seems to be betting that the turnaround in the BDC’s fortunes – and in its earnings – has finally been achieved. We’ve been predicting for what seems donkeys years that BKCC – once cleaned up – will merge into BlackRock’s other public BDC : BlackRock TCP Capital (TCPC). Maybe a historic merger announcement is coming ? We’ve been wrong before about the timing of this potential combination, so don’t hold us to this prediction. In any case, there’s some sort of speculation going on. Annualizing the IIIQ 2021 Net Investment Income Per Share analyst consensus comes to $0.32, which means BKCC is trading a PE multiple of 13.5x, higher than what market leader Ares Capital (ARCC) is going forward at 12.1x, using the same ingredients. That’s amusing – and confounding – given the very different paths BKCC and ARCC’s stock prices have trodden over their time as public companies as illustrated below:

We’ve seen a similar surge in BKCC’s price occur back in June, when a high of $4.4400 was reached before a drop back to a low of $3.8000, just before the latest recovery. Maybe investors are positioning themselves for potentially good news, or somebody knows something more. We’ll find out soon enough, with BKCC scheduled to report its latest results on Wednesday November 3, just over a week away.

Anyway, getting back to the ups and downs of BDC stock prices, the biggest loss was experienced by New Mountain Finance (NMFC), which only fell (1.0%).

More importantly – and encouraging f or BDC bulls – is that many individual BDCs keep on posting new 52 week highs. Today there were at least 5 record breakers. These include ARCC, Capital Southwest (CSWC); investor favorite Main Street (MAIN); TriplePoint Venture Growth (TPVG) and Gladstone Investment (GAIN). The good news has been out for months on all these names, but investors continue to nudge them higher.

Tuesday is the first day of BDC earnings season. Will we see that slight jump upwards in BDCZ and BIZD that will cause new 52 week price records to be set, or will investors “buy the rumor and sell the news” ? We’re in favor of the former thesis, but markets are hard to predict.

NEWS

There was very little news of consequence in the BDC sphere on Monday. Prospect Capital (PSEC) continued to update prospectuses for more Inter-Note offerings; WhiteHorse Finance (WHF) completed its secondary stock offering at $15.81 a share. The BDC’s stock price – which closed at $15.56 – has not yet quite recovered from the new equity raised.

Also three different BDCs announced the date of their upcoming IIIQ 2021 earnings release and conference calls. We’ll be updating the BDC Earnings Calendar accordingly.

We did note that FS KKR Capital (FSK) – the second largest BDC – saw its price target reduced by Wells Fargo from $22.0 to $19.0 in a research note to investors – as reported by Benzinga. For what it’s worth, Wells Fargo has an “underweight” rating for the stock.

At the open FSK was trading at $22.57 and has been as high in the last year as $23.44. Essentially, Wells Fargo is projecting that FSK’s stock price will drop by nearly a fifth (19%) from its apex. As one commentator pointed out, the analyst seems to believe FSK’s current regular annual distribution of $2.40 is not sustainable. This only weeks after FSK reported IIQ 2021 “Adjusted Net Investment Income Per Share” of $0.74, and after the BDC’s manager increased the quarterly payout – if only for one quarter – from $0.60 to $0.65.

The analyst consensus for the IIQ 2021 is $0.63 and $0.62 in the IVQ. For all of 2022, though, the prognosis is less positive: $2.54. Maybe that’s one of the reasons for the price target reduction ? Still, even at $19.00 a share, FSK would only be trading at a PE multiple of 7.5x if we use that analyst consensus. Or, maybe, Wells Fargo believes the recurring earnings are dropping even more than its peers…

The $16bn BDC is already trading at a (16%) discount to net book value but – on a pro forma basis – that would be (30%) if the stock price drops to $19.0. Given FSK’s market capitalization of $6.4bn represents about an eighth of the entire public BDC sector, and management hopes to be “an industry leader” this issue of whether the dividend is “safe” or not is a critical one.

Certainly, the BDC itself on its last conference call did not concede that its regular distribution – unchanged since the IIQ 2020 with the exception of that extra $0.05 recently added – is in any immediate danger. In fact, management gave very straightforward guidance to analysts and investors on the call:

“During the second quarter, our adjusted net income was $0.74 per share, which was $0.14 per share above our quarterly dividend of $0.60 per share. Looking forward to the third quarter, while we expect our one-time fee and dividend income to return to a normalized level, we expect our adjusted NAI to be $0.61 per share”.

FSK CEO Michael Forman: August 10, 2021 Conference Call

A little more opaquely, FSK has announced its intention to pay out a dividend equal to a 9.0% return on equity. Based on the net book value and share count at 6/30/2021, we calculate that to be $2.41 annually, just enough to maintain the current distribution level.

For our part, we project an unchanged distribution over the next 5 years. We had previously budgeted for a decrease but have become more optimistic of late as FSK has reduced its percentage of underperforming assets; issued large amounts of inexpensive unsecured debt and merged with its sister BDC – FS KKR Capital II – which should help with operating expenses. Furthermore, the BDC still has room to boost its size – and thus its earnings – by additional borrowings before reaching its target leverage. Nonetheless, we agree with Wells Fargo that the risk of another cut in the dividend (there have been two since 2015) does exist. We’ll be watching closely FSK’s next earnings release and conference call for more clues as to what 2022 might hold.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.