BDC Daily Update: Monday October 4, 2021

Premium FreeWhat’s Been Happening

MARKETS

After a bounce back Friday – which was the first day of October – we had a murderous Monday where the major market indices were concerned. As you can see above, NASDAQ suffered the worst loss in price percentage terms (“carnage” occurred according to the overly dramatic headline writers), but the other indices took a significant hit as well. According to the pundits – pointing to the tech-heavy NASDAQ, we’re experiencing a “rotation out of technology stocks amid rising bond yields“. That claim notwithstanding, the 10 year yield closed at 1.48%, down from 1.56% last week.

We received two very diferent readings in the BDC sector from the two indices we follow. BDCZ – the UBS Exchange Traded Note which owns most of the sector’s stocks, was down (o.30%). By contrast, BIZD – the only BDC ETF – rose 0.12% on the day. In any case, the BDC sector performed far better than the market at large, which has been a frequent occurence of late.

The individual BDCs we track were relatively evenly divided with 19 increasing in price (18) or remaining unchanged, while 22 dropped in price. Once again, we noted the modest price volatility in both directions, with Capital Southwest (CSWC) posting the biggest increase in price on a percentage basis at 1.43%. The greatest percentage loss was New Mountain Finance (NMFC), but the drop was only (1.77%).

The BDC sector – if we use BDCZ as a measuring stick – remains only (2.6%) off its 52 week high. After two days of October – one up and one down – BDCZ closed on Monday 0.8% above the end of September, which was last Thursday.

NEWS

The most important news of the day was a dual unsecured debt raise by FS KKR Capital (FSK). The monster sized BDC – with $14.7bn in portfolio assets at FMV tends to do everything in big numbers for obvious reasons. On Monday, the second largest BDC raised $500mn from issuing unsecured debt due in 2024 and $750mn in 2028. As always, the BDC Reporter – and everyone else – rushed to see what sort of yield the BDC had to pay. We expected to be impressed – after all this is a huge BDC and KKR is involved – and we were. The admittedly unusual short term 2024 maturity debt was priced at 1.650%. The 7 year maturity notes – also a little unusual as most unsecured debt financings are 5 years long – was priced at 3.125%. (That’s almost as long and almost as inexpensive – when all fees are considered – as SBIC debentures).

Clearly, the new debt will help lower FSK’s average cost of borrowing, which was 3.38% as of June 2021 – including unused line fees. Furthermore, the percentage of unsecured debt on FSK’s balance sheet will increase from an already substantial 48% of total debt.

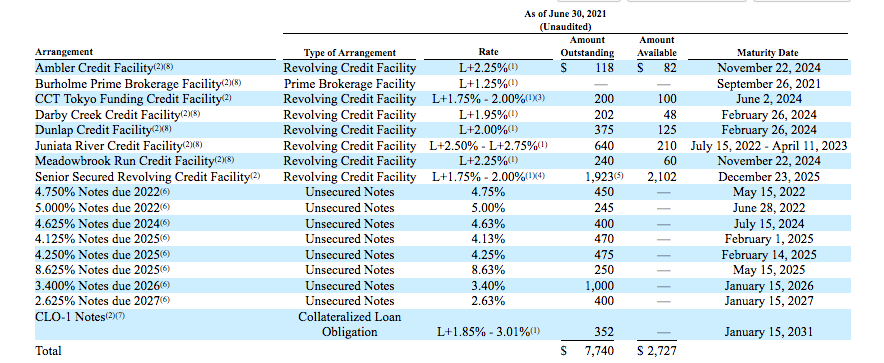

As this chart lifted from the latest 10-Q, FSK has a nicely laddered liability structure that includes both multiple secured and unsecured debt facilities, now extending all the way to 2028:

Most important of all for anyone looking forward, FSK’s liquidity will increase substantially. Notwithstanding the “amount available” above, FSK claimed $1.9bn of “available liquidity” as of mid-year 2021. Now – everything being equal – total liquidity will jump 64% to $3.2bn. By the way, the BDC Reporter calculates that with a target leverage range that reaches up to 1.25x – and with IIQ 2021 actual debt to equity of 1.01x – the BDC requires $1.85bn in additional assets under management financed by debt to reach its maximum size. Clearly, with this latest financing FSK has more than enough available financing at hand. Whether FSK’s management will choose to push against the outer limits of its self imposed target leverage any time soon is unknown.

We’ll be curious to see if FSK stops here where unsecured debt issuance is concerned. With yields for fixed income financing so low, we wonder if the BDC will follow Ares Capital’s (ARCC) lead and essentially build a balance sheet funded almost exclusively with covenant-lite, low cost, medium term unsecured debt. Secured facilities would still exist but amounts drawn would be very low and exist principally as short term bridge financing. After all – as we now see with the 2024 note pricing – FSK can now borrow more cheaply with unsecured debt than with secured. Furthermnore, should short term rates eventually rise (do you know anyone who isn’t predicting as much ?), having locked in unsecured debt yields will be even more valuable. (We have not heard from FSK that they’re intending to swap fixed rate for floating rate as somer of its peers tend to do).

All in all, this latest debt raise seems like an unalloyed benefit for FSK and its shareholders: lowering borrowing cost; extending maturity dates; diversifying financing sources; strengthening the balance sheet and – potentially – setting up the BDC for a spreads widening should floating rates rise. Moreover, the amounts involved are relatively high and that should be reflected in lower interest expense going forward almost immediately.

In more routine news, PennantPark Floating Rate (PFLT) announced a $0.095 monthly distribution for October 2021. That’s $1.14 a year in distributions. Worth noting is that PFLT has managed to pay that same distribution since March 2015. Unlike some of its BDC peers, PFLT was able to maintain an unchanged distribution even when the Fed lowered short term interest rates at the beginning of the pandemic, which also dropped LIBOR and wreaked havoc on lenders investment income.

Likle a host of other BDCs, PFLT is paying out more in distributions than is being earned in terms of net investment income. In the most recent quarter, the payout amounted to $11,050,041 while Net Investment Income Per Share was $10,279,327. For the fiscal year 2021, that ends in September, the analyst consensus is that NIIPS will be $1.05. Even in FY 2022, the projected NIIPS is $1.12. – just short of the earnings needed. Still, PFLT still has some level of spillover taxable income ensuring that dividends received like the one announced on Monday do not include a return of capital.

Will PFLT be able to maintain its $0.095 monthly distribution into 2022 ? We think so, despite the industry-wide pressure on loan spreads. Management has set itself a target leverage of 1.5x debt to equity, but is “only” leveraged 1.13x currently. (Even less if you net out cash on the balance sheet). We imagine PFLT will eventually “earn” its dividend by growing its portfolio by as much as a fifth. Another source of potential incremental income is the BDC’s JV with a Kemper subsidiary. Recently PFLT increased its capital commitment to the JV from $230mn to $275mn. The yield on PFLT’s overall portfolio is 7.5% according to its latest earnings release, but is 12.5% or higher where the JV is concerned so even a little growth goes a long way to boost the BDcv’s earnings.

Investors don’t seem concerned about PFLT’s future earnings or distribution. As this chart shows, the BDC’s stock price is trading above its pre-pandemic high, and has reached as high as $13.50. At Monday’s close PFLT was at $12.96.

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.