BDC Daily Update: Thursday October 14, 2021

Premium FreeMARKETS

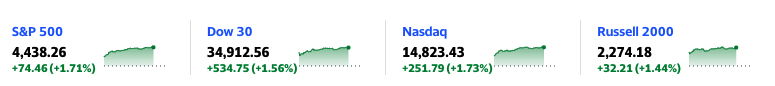

All the major indices jumped sharply forward in price on Thursday, as shown above. As Yahoo Finance noted “…the S&P 500 registered its biggest daily percentage gain since March 5, the Nasdaq notched its biggest since May 20 and the Dow its biggest since July 20″. Apparently, investor concerns about the future of the economy were dissipated by a strong jobs report. A good showing for early IIIQ earnings helped as well.

The BDC sector, though, did not participate much in the general merriment. BDCZ – the UBS Exchange Traded Note which owns most of the stocks and is one of our guideposts, barely moved up: from $19.93 to $19.84. BIZD – the only BDC ETF which also owns most BDC stocks – was flat, unchanged at $17.37.

Nonetheless, the BDC sector remains very strong price-wise, with both BDCZ and BIZD only a little beneath their 52 week highs. So far in October BIZD is up 3.4%, BDCZ 1.1% (but 3.1% after adjusting for the just paid quarterly distribution).

In another kind of sign of incipient strength – the leading BDC – Ares Capital (ARCC) – reached another 52 week high on Thursday: $21.11.

NEWS

There were a couple of notable BDC news developments on Thursday. PennantPark Investment (PNNT) issued $165mn in new unsecured notes. The debt, which matures in November 2026, was priced at a yield of 4.0% and was institutionally placed. As we’d anticipated – and noted in the BDC Fixed Income Table for some time – the proceeds will be used – in part – to pay off the BDC’s public Baby Bond with the ticker PNNTG. That security, with total outstandings of $86.3mn, has a maturity in 2024 and is costing PNNT 5.5%.

At a stroke, PNNT will save itself $1.3mn a year in annual interest expense for the next 3 years, or close to $4.0mn.

The rest of the proceeds will pay down the BDC’s secured Truist Credit Facility, which had a balance of $316mn as of September 30, 2021. The cost of the secured debt remains lower than the new unsecured debt (not always the case these days) at 2.5%. This will temporarily – till the proceeds are re-deployed – offset some of the savings to be derived from replacing the Baby Bond.

On a pro-forma basis – and like many BDCs – PNNT’s debt financing will be increasingly a mix of secured and unsecured after this transaction. We calculate that total debt with amount to $616mn, of which 41% will be secured (all in the Truist Credit Facility) and the rest split between SBIC debentures, an earlier issue of 2026 notes and the new 2026 notes. This strengthens PNNT’s balance sheet. The BDC has over $1.1bn, but less than a quarter is financed by secured debt. This makes PNNT far less vulnerable should asset values drop in the future, and far less reliant on traditionally jumpy and demanding secured lenders.

We also heard from WhiteHorse Finance (WHF), which announced a “special dividend” of $0.135 for the IVQ 2021. No “regular” distribution has yet been given for the period – typically done when earnings are released – but that’s expected to remain unchanged at $0.355. Assuming that IVQ “regular” payout occurs as expected, WHF will have paid out $1.550 in 2021. That would be higher than the 2020 number of $1.5450, but still slightly below 2019 – when LIBOR was much higher – of $1.6150.

Looking forward, the analyst consensus for WHF’s Net Investment Income Per Share in 2022 is $1.49. That suggests the BDC might have some problem next year matching 2021’s total distributions. However, we calculate that the BDC retains – even after this latest “special” – another $0.05 per share of undistributed taxable income. Add that to the projected earnings and WHF might yet match its 2021 performance – second best in its history, and substantially above the $1.42 per share in distributions paid out very consistently every year between 2012-2018.

WHF closed at $15.83 (but has been as high as $16.72). At the current price – and if we’re right about the total 2021 distribution – that’s a price/dividend multiple of 10.2x. Or, restated, a yield of 9.8%. To get WHF to trade over its 52 week high, the multiple would have to increase to 10.8% (and the yield drop to 9.3%). Could that happen ? We think the odds are good, judging by BDC sector comparables and the very steady distribution history WHF offers. In fact, in our own 5 year model, we’re projecting that at some point WHF will reach a price to dividend (including any specials) of 12.0X. (For the sake of comparison – although they’ve very different BDCs but have a history of steady payouts in common – ARCC’s highest price to dividend is 12.9x. Golub Capital (GBDC) – despite cutting its dividend last year – has traded in the last 52 weeks as high as a multiple of 14.0x its current payout).

WEBSITE PROBLEMS

Yes, we’re continuing to have website problems. Our website manager is trying to get emails of articles sent out again automatically , as before. Also, we are seeking to ensure the weekly recap of all articles returns.

For a period overnight and early in the morning the whole site was down but – as you can see if you’re reading this – the BDC Reporter is up and running.

We promise to find a solution soon. All hands are on deck.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.