BDC Daily Update: Thursday October 7, 2021

Premium FreeWhat’s Been Happening

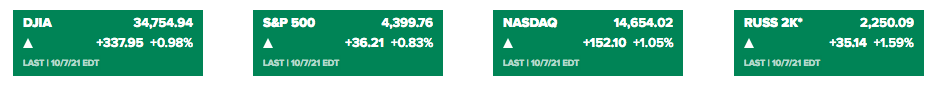

MARKETS

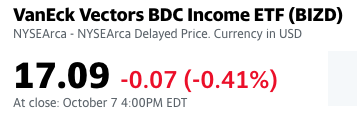

Sometimes – for no clear reason – the major indices go one way and the BDC sector another. This is not a common event as there is considerable correlation over time. However, on Thursday the divergence occurred, with all the major indices – as shown above – in positive territory and the BDC sector in the red – as reflected in the stock price of BDCZ – the UBS Exchange Traded Note which owns most BDC stocks – and BIZD – the BDC exchange traded fund. Volume in both cases was close to normal.

BDC sectoral weakness on the day was reflected in the fact that only 13 BDCs increased in price, 2 were unchanged and 27 were in the red. The number one BDC stock in the black was BlackRock Investment (BKCC), up a modest 1.84%. Just to be sure, we checked if there was any news involved in this modest price nudge upward but nothing has been heard from the BDC since late August.

Of the day’s losers, the largest percentage price decrease was for one of the smallest, least traded stocks – PhenixFIN (PFX), off (1.59%) on very low volume. PFX – and indeed all BDC stocks – continue to exhibit very low price volatility at a time when the major indices – and their constituent stocks – seem to be hyper-active.

We were curious how the new BDC on the public block – Cion Investment (CION) – would fare in its third day as a public company. Not so well, seems to be the answer as CION dropped to $11.80, from $11.94 the day before and $13.00 when the public doors were first opened. (Remember, when reconciling these numbers with the BDC’s financial statements that a 2:1 reverse stock split was instituted in September in anticipationj of the public issuance). Trading volume was higher than average. We wonder – if the price drop continues – whether panicky CION investors – some of who’ve been locked up for nearly a decade in the non-traded stock previously – will panic and sell, sell, sell. The advisor does have a stock buyback program announced, but that might not be a factor if desperation occurs.

Also being tracked by the BDC Reporter is Saratoga Investment (SAR) following its announcement of earnings way above the 7 analyst consensus. Right after the eaqrnings were posted the stock jumped in the after-market, and gained 2.8% intra-day, reaching a new 52 week and all-time high of $30.25. However, we also pointed out that assets under management dropped – all those pesky repayments – and NAV Per Share increased by less than 1%. Investors seem to have noticed and SAR dropped in price to close on Thursday at $29.37, below its pre-announcement price.

On the other hand, Ares Capital (ARCC) continues to attract investors. On Thursday, the largest BDC reached yet another highest price for the year and – we believe – for its history: $20.91. However, ARCC dropped back to $20.79 at the close, up 0.05% on the day. Still, we’d argue that the strength of ARCC is a good sign for the industry where prices are concerned.

Overall — and readers will be tired of hearing us say so – the sector remains close to its 52 week highs, and 30 of 42 BDCs are within 10% of their highest price in the last 52 weeks. As we’ve noted before – and illustrate below with a stock chart for BDCZ between May 25 and October 7 – BDC sector prices have fluctuated very consistently within a very narrow range 6% for several months:

NEWS

There was little market moving news on Thursday. However, Gladstone Investment (GAIN) quietly filed a two sentence 8-K, which we reproduce in full below:

On October 7, 2021, Julia Ryan gave notice that she was resigning as the Chief Financial Officer of Gladstone Investment Corporation (the “Company”),effective December 3, 2021. The Company is currently searching for Ms. Ryan’s replacement.

Ms Ryan has been a fixture at GAIN for the past 6 years – serving currently as the CFO – and has been regularly featured on the BDC’s quarterly conference calls. Here is a link to Ms. Ryan’s biography on the GAIN website. Furthermore, her tenure has coincided with a remarkable turnaround in GAIN’s fortunes and stock price. The latter has doubled in price since 2015. We expect the departure is a loss to the BDC and its principals and the 8-K wording suggests GAIN will be looking outside the Gladstone Companies complex for a replacement. Thankfully Ms Ryan will still be around for one more round of the earnings conference call.

Elsewhere, SAR filed an 8-K of its own, detailing highlights of the just-signed new secured Credit Facility with Encina Lender Finance (“Encina”). Here are the key terms, plucked from the filing:

“The Credit Facility is evidenced by the Credit and Security Agreement, dated as of October 4, 2021 (the “CreditAgreement”), by and among theBorrower, the Company, as collateral manager and equityholder, the lenders party thereto, Encina, as administrative agent for the secured parties and thecollateral agent, and U.S. Bank National Association, as collateral custodian for the secured parties and as collateral administrator. The Credit Facilityprovides for borrowings in U.S. dollars in an aggregate amount of up to $50.0 million. During the first two years following the closing date, SIF II mayrequest an increase in the commitment amount from $50.0 million to up to $75.0 million. The terms of the Credit Facility require a minimum drawnamount of $12.5 million at all times during the first six months following the closing date, which increases to the greater of $25.0 million or 50% of the commitment amount in effect at any time thereafter. The term of the Credit Facility is three years. Advances are available during the term of the CreditFacility and must be repaid in full at maturity. SIF II may request an extension of the maturity date by an additional one year, subject to the agreement ofthe lenders.Advances under the Credit Facility are subject to a borrowing base calculation, with advance rates on eligible loans ranging from 50% to 75%.The Credit Facility has numerous eligibility criteria for loans to be included in the borrowing base. Advances under the Credit Facility bear interest at afloating rate per annum equal to LIBOR plus 4.0%, with a LIBOR floor of 0.75%, and with customary provisions related to the selection by the Lender andthe Company of a replacement benchmark rate. The Borrower must pay an unused fee on the amount by which the commitment amount exceedsoutstanding principal amounts on each day at a rate per annum equal to 0.75% if usage is less than 50% of the commitment amount, or 0.50% if usage isless than or equal to 50% of the commitment amount. The Borrower’s obligations to the lenders under the Credit Facility are secured by a first prioritysecurity interest in substantially all of the Borrower’s assets. In addition, the Borrower’s obligations to the lenders under the Credit Facility are secured by apledge by the Company of its equity interests in SIF II, which is evidenced by the Equity Pledge Agreement, dated as of October 4, 2021 (the “EquityPledgeAgreement”), by and between the Company and Encina, as collateral agent for the secured parties”.

The new Encina revolver has replaced SAR’s long standing relationship with Madison Capital Funding (AUM: $12.7bn) that dates back to when the new advisor came on board to take over what was then a failing GSC Investment. As SAR’s management admits, the Madison facility has not been much used by the BDC in recent years, except for short periods. Financing has been supplied principally by SBIC debentures, unsecured debt raises and equity issuances. Apparently – as reported by SAR’s management – the switch was made principally for the lower cost of debt involved – 100 basis points. On the other hand, the new lender requires SAR to draw a minimum amount at all times – reaching up to $25mn. That ensures the lender some minimum income level, but will require SAR to juggle its finances somewhat.

Although SAR will be paying less for the Encina borrowings, the terms remain expensive by comparison with most BDC standards for secured debt. The cost of the debt, when you factor in the spread, the floor and LIBOR will be near 5.0%, and goes higher when unused line fees get factored in. This was not missed on the recent SAR conference call, where an analyst couldn’t get help noticing that SAR can borrow more cheaply unsecured (both SBIC and private notes) than secured. The analyst went so far to ask why SAR didn’t drop having a secured revolver and just finance itself exclusively with unsecured debt and cash ? This just goes to show that unsecured debt has become so relatively inexpensive that it’s now seen as a possible replacement for the traditional secured revolver.

However, SAR’s CEO Christian Oberbeck made clear that an all-unsecured financing arrangement was not in the cards in his sensible answer to the analyst, shown here:

“Well, I think a couple of things. I mean we are cash heavy right now on top of that, too. So there’s a lot of variability just because of the way our business works. But importantly, I think we talked about it a little earlier in one of the other questions, what we get from a revolving credit facility is flexibility. So if we have — if we want to raise some bonds, if we have a given position, right? And then we’ve got — let’s say, we’ve got $10 million of cash, and we’ve got $50 million of commitments we want to make and we don’t necessarily want to raise a bond at this moment in time, we have a swing line of credit to help us bridge that. and gives us some time to more optimally approach whatever marketplace we’re interested in.

So — and part of the reason it costs more is it’s flexible. The bonds, you go to market point in time, you issue a fixed amount of bonds over a fixed period of time with fixed terms. This is something that it’s variable. We can decide to draw it or not draw, and that gives us a lot of flexibility. That’s something we’ve had all along. It goes with our whole mindset of having a very flexible approach to being able to do business.

I think going back to last year, when there was a lot of big problems in the marketplace last — the spring of 2020, we had an undrawn revolver that we could have done a lot of business with, and it allowed us to enter a number of conversations that did result in deals. We were able to issue a bond in June of 2020. But if we hadn’t been able to issue that bond, we have the flexibility to draw on our revolver and fund those deals. So there’s a flexibility component that allows us to do our business and we think better than running cash heavy”.

In the long term – and in the greater scheme of things – this switching of secured lenders will probably have very little net impact (after all, a 1% savings on $25mn is $250,000 and SAR’s annual interest bill is over $20mn). Nonetheless, we’re intrigued that management made the change after so many years and for a facility rife with its own high cost and borrowing limitations and with a much less well known lender.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.