BDC Daily Update: Tuesday October 12, 2021

Premium FreeMARKETS

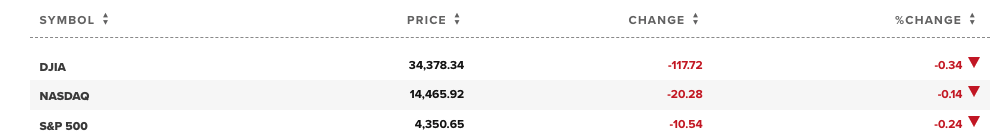

The three major indices – the S&P 500, Dow Jones and NASDAQ – fell once again on Tuesday, as the table above illustrates. However, the BDC sector went its own way, building on relative strength in earlier sessions. BDCZ – the UBS Exchange Traded Note which owns most BDC stocks and which we use daily to measure price performance – was up 0.55% to $19.74. BIZD – the only BDC exchange traded fund – increased 0.35%. These are not huge upward moves by themselves, but notable in contrast to the major indices, which the BDC sector trends to slavishly imitate most of the time.

Of the 42 public BDC stocks we track, 33 were up in price, 2 were unchanged and 9 were down. The biggest percentage increase in price was recorded by newbie – Cion Investment (CION), up 2.27% to $12.17. This is in contrast to prior sessions since CION became publicly traded and which has seen the stock price drop as low as $11.09. Still, “one swallow does not make a summer”, so it’s too early to say the BDC has found its market feet as yet.

The biggest percentage price loser was PennantPark Investment (PNNT) – off just (1.06%). As we’ve seen for many days now, individual BDC price volatility has remained muted in every direction.

One BDC did post a new 52 week high on Tuesday. That was Crescent Capital BDC (CCAP), which reached a high of $20.05. As this lifetime chart of CCAP as a public company (listed February 3, 2020) shows – after participating in the general pandemic-caused slump in March of last year, the BDC has been on a unrelenting upward price rise since.

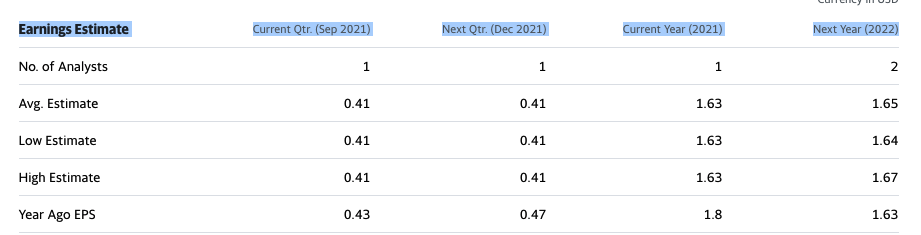

Currently, CCAP is trading at a price/annual distribution multiple of 12.2x, and 96% of net book value per share. The analyst consensus is for continued growth in earnings through 2022, albeit very modest:

NEWS

The biggest news of the day is that yet another BDC has announced an increase in its distributions. Not terribly surprisingly given its recent good performance, this was Gladstone Investment (GAIN). The BDC both increased its regular monthly distribution – much beloved by many investors – and declared a “special” distribution for the IVQ 2021:

“MCLEAN, Va., October 12, 2021—Gladstone Investment Corporation (Nasdaq: GAIN) (the “Company”) announced today that its board of directors declared the following monthly cash distributions to common stockholders, increasing monthly distributions from $0.07 to $0.075 per share, or approximately 7%. The Company also announced its plan to report earnings for its second fiscal quarter ended September 30, 2021.

The Company will also pay a supplemental distribution of $0.09 per share to holders of its common stock in December 2021. The board of directors will continue to evaluate the amount and timing of any additional, semi-annual or incremental, supplemental distributions in future periods“.

Previously in 2021 GAIN announced a $0.03 and $0.06 special distribution. Along with the December $0.09 special just announced, that means GAIN will have paid out $1.04 in dividends in 2021. Despite the increase in the regular dividend, this still represents – technically speaking – a worst performance than last year. Besides cash distributions, shareholders received a “deemed distribution”. In total that amounted to $2.08, twice this year’s level. Nonetheless, we expect GAIN shareholders are delighted at this continuing growth in its regular distribution.

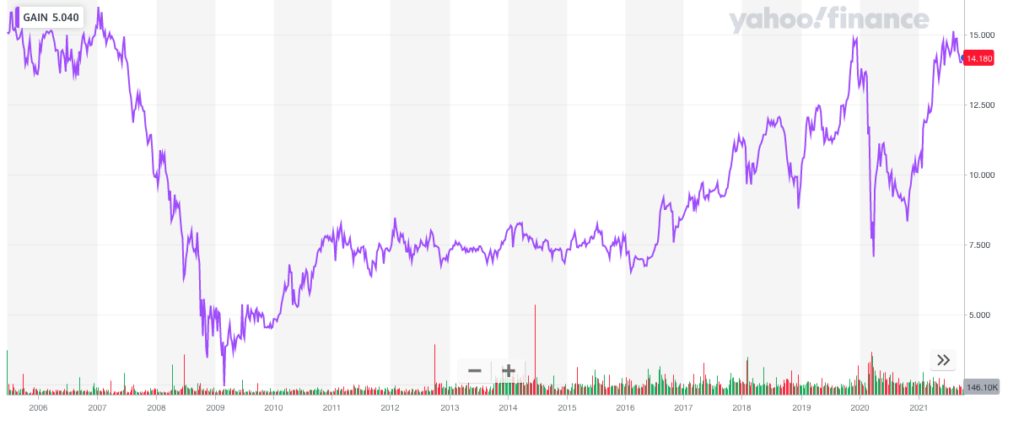

GAIN is currently priced at $14.18, not too far off its 52 week high of $15.16. The $1.04 in distributions paid in 2021 represents a yield of 7.3%. GAIN is trading at a 12% premium to net book value, and is not far off the stock’s all-time highs set back in 2007 (!), just before the Great Recession and the defection of its then-senior lender caused a slump that is only now just being recovered from 14 years later. That’s one of the most extraordinary – albeit long winded – turnaround stories in BDC history. Here’s a lifetime stock chart of GAIN as illustration:

Sister BDC Gladstone Capital (GLAD) also reported its last distributions of 2021. Here the news was more routine. GLAD maintained its monthly payout at $0.065. That brings the total for the year to $0.78. Both the regular monthly payout and the total distribution remain behind the 2020 level. Through March 2020, GLAD was paying $0.07 a month in distribution, but – like many of its peers – blinked when the pandemic came along and LIBOR dropped like a stone. The distribution was dropped to $0.065, where it remains 7 quarters later. This coincides with the BDc’s earnings outlook, which remains flat at $0.79 for both this year and next:

The BDC closed Tuesday at $11.33, 14.5x the 2021 distribution; a yield of 6.9% and a 33% premium to net book value. By the way – unlike GAIN – GLAD has never recovered price-wise to its pre-Great Recession level. The stock price today is half of what it was back in 2005-2006.

As is often the case these days, there was more capital markets activity where unsecured debt is concerned. FS KKR Capital (FSK) issued a press release announcing the completion of its $1.250bn issuance of notes due in 2024 and 2028. This was news we had already covered previously.

On Tuesday we learned what FSK intends to do with some of the capital raised: reduce its borrowing costs:

“On October 12, 2021, FSK issued a notice of redemption providing for the redemption of its 5.00% senior notes due 2022 (the “2022 Notes”) in full on November 11, 2021 (the “Redemption Date”) for 100% of the aggregate principal amount of the 2022 Notes, plus the accrued and unpaid interest through, but excluding, the Redemption Date (the “Redemption”). All of the 2022 Notes will be redeemed in connection with the Redemption.

FSK expects to use a portion of the net proceeds of the Offering to fund the Redemption, including the payment of all accrued interest and costs and expenses in connection with the Redemption. The remainder of the net proceeds from the Offering will be used to repay outstanding indebtedness under FSK’s financing arrangements”.

TECHNICAL DIFFICULTIES

We’ve been having problems of late with the website which some of you may have noticed, and which seems to be related to an update of WordPress, which this publication is written on. The problems involved include readers not receiving emails of published articles and of the weekly round-up newsletter.

Have no doubt that we are working to resolve the matter and hope to declare victory on these pages shortly. Till then we apologize for any inconvenience.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.