BDC Daily Update: Tuesday October 26, 2021

Premium FreeMARKETS

Once again, the major indices are breaking new price records – continuing a very “hot” trend in October. Two of the major indices – the S&P 500 and the Dow Jones – reached new intraday record highs. The NASDAQ was also up, and only (1%) below its own 52 week and all-time high. The only exception was smaller stock oriented Russell 2000 – which often marches to its own drummer – down (0.72%). The Russell notwithstanding, these are heady days for many investors.

Curiously – and for a second day in a row – the BDC sector had more in common with the Russell than the other indices. Or, in other words, the sector indices both dropped in price. BDCZ – the UBS Exchange Traded Note which owns most BDC stocks and which we use as one of our daily price guides – fell to $20.04, down (0.15%). BIZD – the Van Eck sponsored BDC ETF, which is our other lodestar – fell (0.11%) to $17.56.

All our readers – and most everyone involved with the BDC sector – will know that this leaves both BDCZ and BIZD achingly close to their 52 week highs, but no cigar. BIZD is just (0.8%) away and got even closer intra-day. BDCZ is a bit further out: (1.2%).

This day was notable for being the first day of BDC third quarter 2021 earnings season (sorry, we don’t count Saratoga Investment’s (SAR) one month earlier earnings release as being part of the “season). Two BDCs reported before the close and one after. More on that below.

4 BDCs reached new 52 week highs today. First there was Ares Capital (ARCC) – one of the reporting players and a BDC that is reaching a new high almost every day. Also at a new peak is – arguably – the most popular BDC with retail investors – Main Street Capital (MAIN). Another retail favorite is also on the list – Gladstone Investment (GAIN). Finally, TriplePoint Venture Growth (TPVG) continues its price ascent. So far this week 5 BDCs – including the four above – have hit new 52 week highs.

When we reviewed overall individual BDC price action, only 11 were up on the day, and none by much with TPVG leading this small pack with a 1.95% increase. There were 2 BDCs whose price were unchanged and 29 that were down. However, the deficits were relatively small, with the biggest percentage loser being Crescent Capital (CCAP), off (2.14%).

There’s certainly a BDC rally underway, but in question is what stage we’re at: the beginning, middle or end ?

NEWS

Expectations are very important where investing is concerned. Today, all three reporting BDCs generally demonstrated in their earnings releases and conference calls (2 of 3) that performance in the third quarter was in line with was expected by the thousands of investors watching from the stands.

Let’s begin with ARCC, whose “Core EPS” – the BDC’s favorite metric for recurring earnings – was $0.47, just ($0.02) per share higher than the always safe “analyst consensus”. Given that ARCC is paying out a regular distribution of $0.41, this demonstrated that earnings – albeit a good deal in non-cash pay-in-kind income – comfortably “covered” the dividend.

As always – based on a review of the 10-Q and the earnings and the tone of the conference call – ARCC seems very much under control, with all the metrics we use to take the temperature of any BDC in good shape. One of the favorites is NAV Per Share, which increased by 2.0%. Admittedly that was half the percentage increase booked last quarter but since the pandemic ARCC can rightly boast of increasing net book value per share by 5%, and since the end of 2017 – when we began tracking this metric for every BDC – by 11.2%. See the BDC NAV Change Table.

We were most impressed by the seeming continuing improvement in ARCC’s credit quality, as reflected by the ever lower absolute dollars and percentage of the portfolio underperforming, as rated in the BDC’s 4 point system. As we show already in the BDC Credit Table. Underperforming assets at FMV amount to $1.211bn, down from $1.650bn last quarter and $2.816bn at the height of the pandemic. Those underperforming investments – as a percentage of the portfolio – are at 6.9%, down from 20.3% in 2020.

Non accruals – that misleading but much discussed matter – are down in just one quarter from $326mn to $177mn. As a percentage of the total portfolio, non performers account for just 1%.

“This quarter, 4 companies were removed from nonaccrual, and there were no new additions. In short, we feel really good about the overall health and credit quality of our portfolio…In multiple instances this quarter, debt positions that were held at discounts to par just last quarter, along with some that had been on nonaccrual in the past, were repaid at par”.

Ares capital Conference call October 26, 2021

With everything headed in the right direction on credit – and after booking a $150mn realized gain in the quarter – we also got the impression that ARCC may not satisfied with slowly growing the BDC by dint of “at the market” (ATM) stock sales for very much longer. Not deducting for cash, leverage is at 1.17x – spitting distance from the BDC’s 1.25x debt to equity leverage target. That leaves very little room for AUM growth without growing the equity base. We know ARCC already undertook an equity offering back in late July – just after its last earnings release. That went very well but any investment capacity created has already been used up.

The BDC has expanded its investment team, and is increasingly willing to add non-sponsored companies to its portfolio roster. As a result, the volume of prospective business in the large cap market is very high – boosted by the general “go-go” environment for deal doing. It would seem strange for ARCC not to move heaven and earth to meet the “market opportunity” available and undertake another equity offering very shortly, especially as the stock is at that all-time high mentioned. Let’s see what happens in the next few hours or days.

Oxford Square Capital (OXSQ) is a very different BDC than ARCC, and with a much smaller footprint. Still, the idiosyncratic BDC – half corporate lender, half CLO equity holder – performed well compared with the prior quarter. Net Investment Income Per Share (NIIPS) increased as did NAV Per Share, up 2.4%. (Unlike ARCC, though, OXSQ’s NAV Per Share remains 4% behind the level pre-pandemic and the monthly dividend was reduced in mid-June 2020 from $0.067 to $0.035).

Although on paper OXSQ’s GAAP earnings are not “covering” its dividend that may not be the case where taxable income is concerned. That might explain why the advisor has already announced an unchanged distribution through March 2022.

At time of writing, OXSQ’s 10-Q was not available, so evaluating credit performance is hard to do definitively. However, we couldn’t help noticing that the number of debt investments on non accrual increased to 3 from 2 in the prior period. (In both the IIQ and IIIQ there was 1 immaterial preferred investment, also on non accrual). The value of the non performers is down to $3.7mn from $7.8mn. At $3.7mn , these non performing assets represent an immaterial less than 1% of the entire portfolio.

While ARCC has more liquidity (over $6bn) than it can deploy, OXSQ has very little. No surprise, therefore, that management indicated that its target leverage multiple is roughly 0.75 : 1.00x. That’s more or less the current level of leverage and keeps OXSQ at one of the lower levels of debt to equity in the sector. Anyway, investors seem to have been satisfied with the BDC’s results, pushing the stock up 1.0%. Still, the BDC remains (20%) behind its 52 week high. By way of contrast, ARCC increased 0.42% on the day, while reaching that previously mentioned all-time and 52 week high intraday.

After the close, a BDC with a very different model than both ARCC and OXSQ – reported results: Horizon Technology Finance (HRZN). The venture-debt BDC’s conference call does not happen till tomorrow and we’ve not yet had the opportunity to review the 10-Q, so we’ll defer most commentary till tomorrow. However, at first blush, all the signs suggests HRZN had the very strong quarter investors seemed to be expecting, given that the BDC’s stock price has been steadily climbing back toward its prior 2021 heights since September 29, as this chart shows:

Based on after-market price action – and helped by the announcement of a $0.05 special distribution for 2020 and unchanged monthly dividends through March 2021, HRZN might well increase in price at Wednesday’s opening. Although the BDC is already richly priced (trading at a 47% premium to the latest net book value), we could see the stock increasing by greater than 4.7% to reach a new 52 week high and all-time high.

By the way, HRZN’s total distribution level of $1.25 in 2021 is equal to what was paid out in 2020 and $0.05 above the 2019 level. Yet, on this minuscule amount of dividend improvement HRZN’s stock price has increased by 32% since the end of 2019 and its NAV Per Share has dropped slightly (2%).

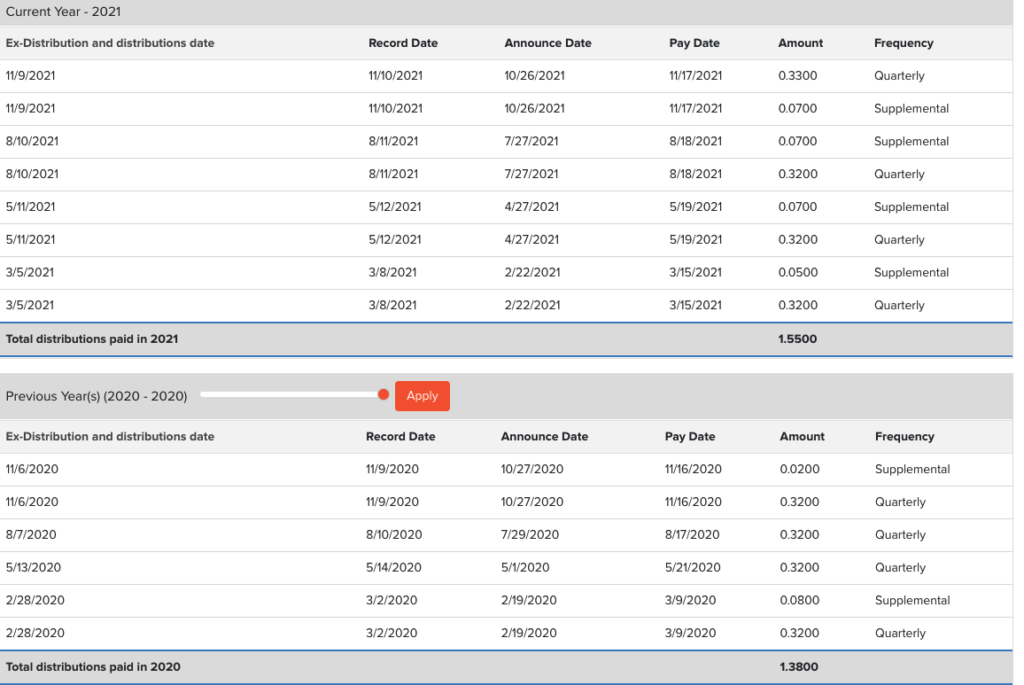

Speaking of special dividends and venture debt BDCs: Hercules Capital (HTGC) announced a supplemental distribution of $0.07 per share for 2021 to go with the previously disclosed “regular” IVQ payout of $0.33. The record date for this bonus is November 10 and the payment date November 17.

As this chart, taken from HTGC’s website, shows the BDC’s total 2021 distribution payout is $1.5500, up from $1.3800 in 2020 and $1.3940 in 2019 (not shown). That’s a 12.3% increase this year and 11.2% over 2019.

HTGC peaked intra-day at $16.40 in February 2020, just before the pandemic. At that point, the BDC was effectively trading at 11.8x its just completed 2019 dividend and 11.9x the prospective 2020 result. Since then , the leading venture-debt BDC has seen its price reach as high as $17.75. That means the price to 2021 dividend multiple has been as high as 11.5x this year. That’s encouraging in a way and suggests the market is not particularly overheated but is rationally pricing out the higher distribution. Anyway, the effective dividend yield in 2021 at the current market price of $17.55 is 8.8% – which also suggests that despite trading at a premium to book value, HTGC remains fairly priced.

In a couple of days, HTGC will be releasing its IIIQ 2021 results and we’ll have another chance to determine if the BDC’s higher dividend trend is likely to continue into 2022 and beyond. In our own projections, we have the total distribution increasing modestly further over the next 5 years to $1.6000, a modest 3% uptick. We’re wondering now if we’ve set the dividend projections too low…On the other hand, the markets for venture lending and investing have been especially buoyant of late and that might not continue for another half decade.

In non-earnings, non-dividend news Portman Ridge Finance (PTMN) filed an 8-K announcing an unusual transaction. We’ve reprinted the bulk of the 8-K below:

“On October 22, 2021, we entered into a purchase and sale agreement with two wholly-owned subsidiaries of JMP Group LLC (collectively, the “Sellers”), pursuant to which we will purchase $18.1 million of portfolio assets from the Sellers in exchange for $1.4 million in cash and 556,852 shares of our common stock (which shares were sold at a price equal to their net asset value). Certain of our affiliated funds and a third party will also purchase interests in the same portfolio assets from the Sellers for cash at the same price and on the same terms as us in connection with the transaction. The closing of the transaction is subject customary closing conditions“.

Portman Ridge 8-K October 26, 2021

Given that PTMN is currently trading at a (17%) discount to net book value, this share issuance should be beneficial for the BDC – on paper. However, the filing is silent on which assets are being purchased, what income (if any) will be derived therefrom and many other pertinent details that inquiring mind s might want to know.

This new share issuance comes shortly after PTMN resumed its share repurchase program last quarter. Here’s what was said on the last conference call in August on the subject:

“On the corporate front, we were pleased to reinstitute our share repurchase program following the closing of the Harvest transaction. During the quarter, we repurchased $380,000 of shares, and subsequent to quarter end, we’ve repurchased an additional of $1.2 million of shares“.

Portman Ridge Conference Call transcript – 8/6/2021

We also wonder what material benefit can be derived from such a minor addition of assets ? At June 30 2021, PTMN had $586mn of cash and investment assets. The $18.1mn will add just 3% to those assets. We’ll just to wait till PTMN holds its next conference call to get a better understanding of the rationale for this transaction.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.