BDC Daily Update: Tuesday October 5, 2021

Premium FreeWhat’s Been Happening

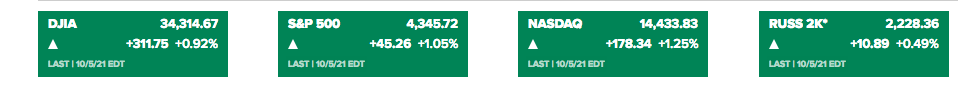

MARKETS

The major markets cannot decide themselves on which way to go. After a “murderous Monday” – to quote ourselves – there was an across the board price rally, as the green boxes above will testify. All the top indices were up and NASDAQ – hardest hit the day before – was the biggest percentage winner. Of course, markets always go up and down, but the current indecision by investors as to which way to head seems more acute than usual.

In any case, the BDC sector followed the lead of the major markets, but in a less pronounced manner. BDCZ – the UBS Exchange Traded Note which owns most BDC stocks – closed at $19.85 – up 0.49%. Our other price weathervane is BIZD – the only BDC exchange traded fund – and that jumped to $17.08 at the close, an increase of 0.65%. So far – with three business days gone – October is going well as far as BDC prices are concerned. On a 52 week basis, the two indices indicate the BDC sector is just a little over (3%) bgelow its highest point.

23 individual BDCs were up in price, 4 were unchanged and 14 were down. Even more than in prior days, price changes in percentage terms were very modest. Just before its quarterly earnings announcement, Saratoga Investment (SAR) was the biggest winner – up 1.73%. Not unreasonably as matters turned out, investors were guardedly optimistic SAR would have good news to impart after the close about its results in the quarter ended in August. At a close of $29.44, SAR was trading close to its 52 week and all time high of $29.80. That peak was reached intra-day on Tuesday. The worst performer in percentage loss terms on this day was SLR Senior Investment Corp (SUNS), down (1.15%). Still, the BDC is only (4.7%) behind its own 52 week high.

Besides SAR, Ares Capital (ARCC) once again reached a new 52 week and all-time high. The latest record price set intra-day was $20.81. The BDC Reporter likes to point to the current enthusiasm for ARCC’s stock as an indication that BDC investors could yet drive the sector to higher levels than what was achieved in mid-June. By the way, in June ARCC peaked at $20.10. The current highest price in October is 3.5% greater.

Some 30 BDCs are still trading within 10% of their 52 week highs, half (0%-5%) off and half between (5%-10%) behind. A little disconcerting is that 11 BDCs are not in that august group. A number of players lifted by the rising sector tide have fallen back somewhat. When we scan down the list, many of the under-achievers make sense given their fundamentals. Included therein are names like Great Elm Capital (GECC); Oxford Square (OXSQ) and Investcorp Credit Management (ICMB) – all whose recent earnings performance and/or change in net asset value – has engendered concerns about the sustainability of their earnings and distribution. Then there are “special situations” like Newtek Business Services (NEWT), whose stock price was impacted by its decision to give up its BDC status and – probably – slash its distribution in 2022. Or Logan Ridge Finance (LRFC), which is in transition under a new manager who is turning over the portfolio at a breakneck pace. Then there are several BDCs still in turnaround mode where the market is in a Missourian “Show Me” mode: Apollo Investment (AINV); BlackRock Investment (BKCC); Monroe Capital (MRCC) and PennantPark Investment (PNNT).

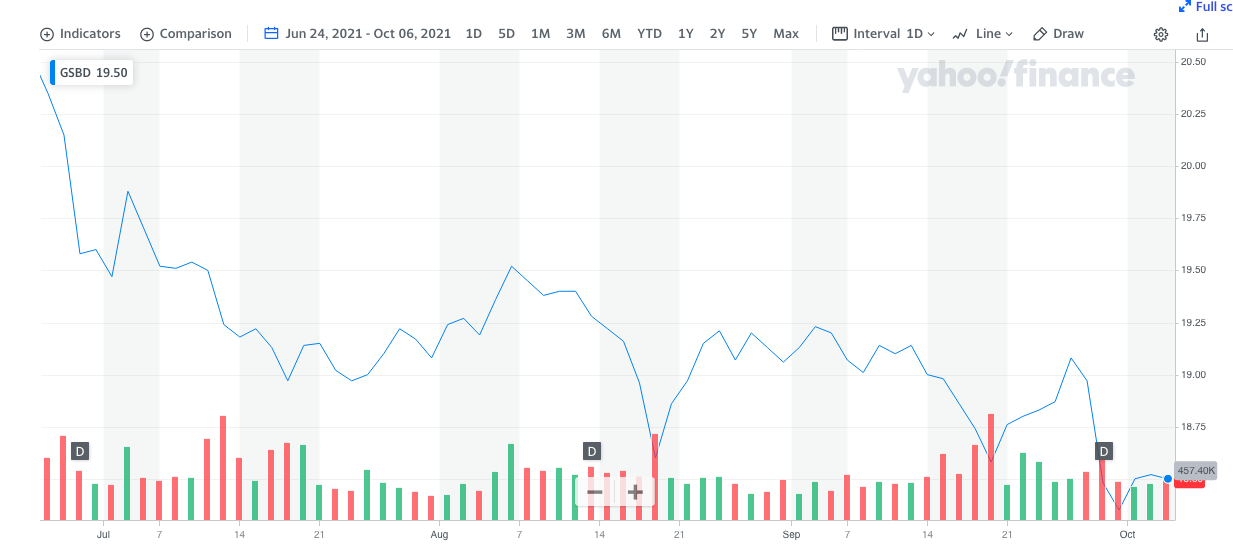

The two surprise names – both of whom are performing well at the moment and have not reduced their distributions during the pandemic or afterwards – are Goldman Sachs BDC (GSBD) and Prospect Capital (PSEC). The former is trading (10.4%) below its 52 week high, and as this chart shows – has dropped almost continually since June 24, 2021:

On the other hand, the BDC is still priced at a 15% premium to book value, so it’s not yet time to ring any alarm bells. However, we can’t help remembering that no so many years ago when GSBD was paying out the same dividend as today – and was much smaller in size – the stock traded at high as $25.3, 37% higher than today…

PSEC has a coterie of devoted retail fans, but is still trading (14.6%) below its 52 week high and at a (19%) discount to net book value. PSEC peaked in June – like GSBD and the sector generally – and has been consistently declining in price since. Admittedly, this large cap BDC has a high compensation structure and questionable valuations, but that has not kept investors away in the past. Moreover, of late the BDC has been reducing borrowing costs; boosting its liquidity and reporting above average improvements in NAV Per Share.

We’ll be curious to see when BDCs like GSBD and PSEC report IIIQ 2021 results – assuming they’re positive – will get a second wind where their stock price is concerned. We’ll get a clear idea in the weeks ahead.

NEWS

The biggest news of the day is that a new public BDC has arrived on the scene. On Tuesday, formerly non-traded Cion Investment Corporation was publicly listed on the NYSE. The ticker is CION. The BDC’s arrival coincides with a 2 for 1 reverse stock split and an upcoming shareholder vote that would allow CION to leverage itself up to 2:1 from 1:1 currently. Also, the BDC’s compensation arrangements with its investment advisor as a public company will be different than before. Unusually, compensation costs in the form of management, incentive and capital gains fees will be lower, in line with the bulk of its peers. With $1.7bn of investment assets CION fits in the BDC Reporter’s large-cap category in which there are 20 public players already.

Inauspiciously, CION’s stock price did not fare well on its first day. 182,440 shares were traded and the price dropped from $13.00 at the open to a intra-day low of $11.09 – a (15%) drop – before pulling itself together a little and closing at $11.85. That represented a less diastrous (9.9%) drop. The adjusted June 30 2021 NAV Per Share is $16.34, which means CION is trading at a (27.5%) discount to book value. Unfortunately for CION’s newly public shareholders that places the BDC in the bottom 3 of the now 42 public BDC universe by this metric.

We’ve done a considerable amount of reading to catch up with the CION story, which is nearly a decade long and also involves Apollo Group (APO). We’ve reviewed all the latest filings, read the Investor Presentation; the latest annual and quarterly filings and much more. There is too much information to communicate here, so we promise to prepare – as soon as possible – a CION primer. Stand by please.

Also on Tuesday – after the close – Saratoga Inveastment (SAR) reported those quarterly results referenced above. The fast growing mid-sized BDC more than surpassed analyst expectations where earnings were concerned. This caused SAR’s stock price – which as we’ve seen was already at a very high level – to jump in after-market trading, as Seeking Alpha reported:

- “Saratoga Investment (NYSE:SAR) stock gains 2.8% in after-hours trading after the firm’s fiscal Q2 adjusted net investment income beats consensus and grew from both the previous quarter and the year-ago quarter.

- Adjusted net investment income per share of $0.63 for the quarter ended Aug. 31, 2021 exceeds the $0.50 consensus and compares with $0.56 in the previous quarter and $0.48 in the year-ago quarter”.

We’ve been too busy studying up on CION to undertake a full review of the earnings and the just published SAR 10-Q. We do note, though, that the BDC’s AUM – those EPS results notwithstanding – dropped at the end of August versus the close in May. Furthermore, the increase in NAV Per Share in the past 3 months was robust, but hardly spectacular. NAV Per Share increased by nine tenths of one percent in the quarter.

The BDC Reporter will undertake a fuller quarterly review of SAR – including a look at the latest credit conditions – shortly. In the interim, we’ll be interested to see if SAR’s stock price can break over $30 a share on the back of its ever better earnings and rising NAV Per Share. Annualizing the most recent Adjusted Net Investment Income Per Share – sometimes a dangerous exercize – SAR is earning $2.52. At $30.0 a share, the current earnings multiple would be 11.9x. That’s relatively high by BDC standards, but not the highest we’ve seen. If you believe that SAR is only going higher from here where EPS and NAV are concerned, the BDC might even seem like good value at $30, and “only” trading at a 4% premium to book. By contrast, that other mid-sized BDC favorite – Capital Southwest (CSWC) is trading at a 58% premium to book. Just for fun, if we apply that NAV percentage premium to SAR’s latest result, the BDC would trade for $45.8 !

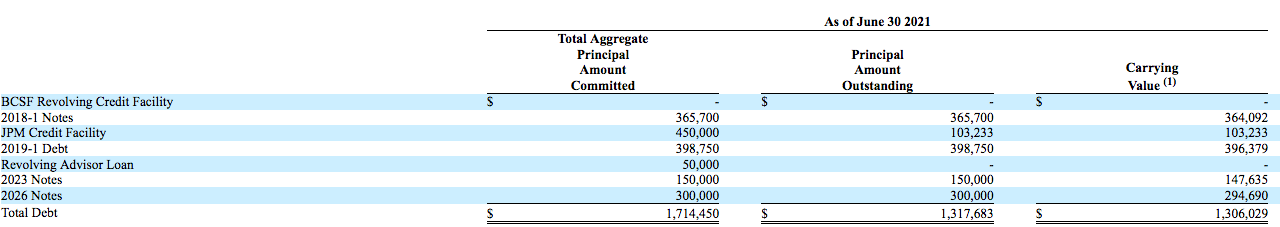

Finally, Bain Capital Specialty Finance (BCSF) joined the large group of BDCs tapping the unsecured debt markets. Like the BDCs who have been down this road before them, BCSF was able to raise a considerable amount of capital -$300mn – at a highly attractive yield – 2.550%. The issuance was for a conventional 5 years.

Here is the BDC’s financing table for the quarter ended June 30, 2021:

BCSF has been vague about the use of proceeds, so we don’t know which existing debt might get repaid from the proceeds of this latest issuance. We do know, though, that the yield on the latest unsecured notes are lower than the 2023 notes (8.5%) and the 2026 notes (2.950%, and just booked in March of this year).

Also, the cost of this new capital is competitive with what the BDC pays for the JPM revolver, which is priced at LIBOR + 2.375%. With 3 month LIBOR just under 0.1500% and when you factor in the unused line fee, secured and unsecured debt capital have very similar costs. Only a few BDCs are able to borrow on an unsecured basis at a yield equal or better than secured, and BCSF – in this instance – seems to have joined the club.

This is also a nice counterpoint to the very expensive unsecured debt BCSF issued at the height of the pandemic Jjune 2020), in what seems now with the benefit of hindsight, like a panicked move. Just 15 months later, BCSF’s cost of unsecured debt capital is 70% lower than in the summer of 2020.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.