BDC Daily Update: Wednesday October 13, 2021

MARKETS

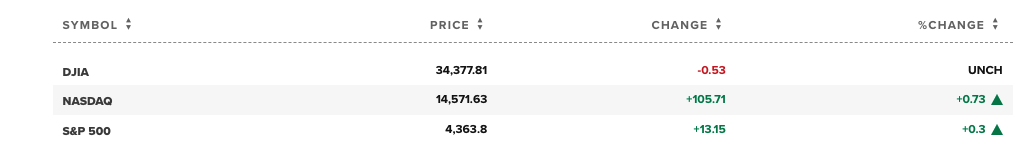

The major indices, which have been retreating in price in recent days, managed to – mostly – change the narrative on Wednesday. Both the S&P 500 and the NASDAQ were up and the Dow Jones stood pat. Fed minutes suggested what the market had already surmised: bond tapering might happen sooner rather than later. Yet, the risk free rate dropped slightly.

Anyway, the BDC sector – which has been quietly marching to its own drummer of late – moved up again price-wise. BDCZ – the UBS Exchange Traded Note which owns most public stocks – moved up 0.47% to $19.83, just a couple of days after paying out its quarterly distribution. BIZD – the BDC ETF – climbed to $17.37, or an increase of 0.64%.

30 BDCs increased in price, 2 were unchanged and 10 were down, reflecting the generally upward direction. The biggest percentage loser in price was Cion Investment (CION), off (1.4%), exactly one day after posting the biggest percentage price increase. We expect this up and down action will continue for some time till investors hear from the newly public company when earnings season comes round, and are able to size up its prospects better. Furthermore, a huge number of shares that were previously locked up when CION was a non-traded BDC suddenly able to trade places a lot of pressure on the stock.

Gladstone Investment (GAIN) was the biggest gainer, up 2.47%. That was predictable enough given the BCc’s announcement – which we reviewed yesterday – of an increase in its regular monthly payout and a larger “special” distribution.

Also notable is that Crescent Capital (CCAP) – also fodder for the BDC Reporter’s last Daily Update – booked an even higher price on Wednesday and a new 52 week and all time price record: $21.48. However, by day’s end CCAP was at $20.45.

BDC sector prices are very close to breaking a new 52 week record, with BIZD only (1.8%) below the $17.70 high reached a few months ago, and BDCZ is (2.3%). If you add back the recent dividend to BDCZ’s stock price, that index is only (0.3%) away from the mid-June 2021 high of $20.29. A couple of good days could see that price record broken.

NEWS

There was no tangible BDC news yesterday, except that Logan Ridge Finance (LRFC) has been updating its prospectus for up to half a billion dollars of potential debt or equity capital to be raised. This could be just routine updating or – potentially – the precursor to an attempt to issue new unsecured debt (or some sort of other instrument such as preferred) aimed at refinancing its two Baby Bonds inherited from Capitala. These are CPTAL and CPTAG. The latter is a convertible and cannot be called till 5/31/2022. The former, though, can be redeemed at any time.

LRFC has had considerable success in the IIIQ 2021 selling off assets, which had amounted to $59mn as of August 16 (the last conference call date). Add to that the $26mn held in cash and any further proceeds received from asset sales, LRFC could possibly repay CPTAL with cash. However, if the BDC is to have any success going forward new debt capital will have to be raised. Otherwise, LRFC’s portfolio – already small at $228mn in fair value – could shrink to $150mn, or even under $100mn. Even the most optimistic BDC manager could not argue with a straight face that investors could achieve a decent ROE on such a small AUM base.

Something has to happen at LRFC between now and May of next year. Market conditions are favorable and progress has been made in the short period since Logan Ridge has taken over. Still, judging by LRFC’s stock price since July 1, 2021 – when the handoff from Capitala occured, investors – after an initial bout of enthusiasm – have pushed the stock price down. As the chart below shows, the BDC sector – in the form of BIZD – is up 2.6% in the period, while LRFC is (0.8%) down. More dramatically, from a height of $218.50 on August 17, 2021, LRFC has dropped (12%) as of Wednesday’s close.

The BDC trades at a (40%) discount to book. That’s the biggest discount of any BDC tracked on the BDC: NAV Change Table. The new manager has a tough assignment. However, after our recent review of LRFC’s portfolio – undertaken company by company – we came away relatively hopeful that the BDC can be effectively turned round or sold on. Much of the credit damage has been done already, and there are several equity stakes that are valued well over cost which , if sold, could boost LRFc’s income and attract new capital. The next couple of quarters will be decisive for LRFC’s newly minted stewards, so watch this space.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.