BDC Daily Update: Wednesday October 20, 2021

Premium FreeMARKETS

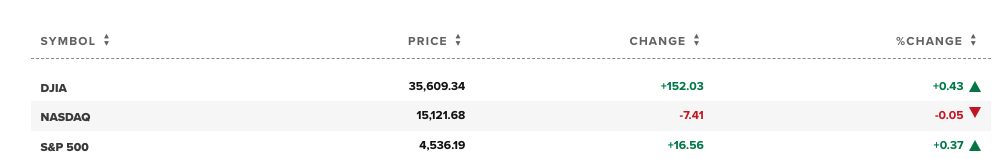

Some of the major indices are back to breaking price records. On Wednesday, the Dow Jones reached an all-time high intra-day, before falling back slightly. Admittedly, the NASDAQ dropped slightly, apparently on Netflix profit-taking. However, the S&P 500 was up for a sixth day in a row as the general mood remains bullish in contrast to September’s skittishness.

This generally optimistic mood carried over – as it has all month – to the BDC sector. BDCZ – the UBS Exchange Traded Note which owns most BDC stocks – moved up 0.14%, closing at $20.01. The other daily indicator of where the sector’s prices are headed – BIZD, the Van Eck-sponsored ETF – was up to $17.54, a 0.23% increase.

Both indices are very close to their 52 week highs. BIZD – for example – reached $17.58 intra-day – only (0.7%) off its June 2021 peak. BDCZ was (1.2%) off its own highest point intra-day.

On the day, 22 BDCs moved up in price, 4 stayed put and 16 dropped. There was only one major mover in terms of price percentage chain and that was Newtek Business Services (NEWT) and for a very obvious reason, as we’ll discuss below. NEWT was up 3.42%. However, the BDC is the exception to the rule. As we’ve seen for weeks now, BDC price increases – and decreases – are very modest as investors are very gradually pushing up prices.

Still, with roughly three weeks gone in the month BDCZ – if we adjust for a recent quarterly dividend – is up 4.0%. Another interesting data point: over the last 1 month period – according to Seeking Alpha data – 36 BDCs are up in price. The gains range from 0.2% to 12.0% (TriplePoint Venture Growth – TPVG). Even the BDCs left behind are not far from the peloton. 3 are within 1% and the biggest percentage drop is by Investcorp Credit Management BDC (ICMB), off (3.3%).

On Wednesday, OFS Capital (OFS) moved up 1 cent intra-day to reach a new 52 week high, after breaking the record on Tuesday. Also noteworthy is that Stellus Capital (SCM) joined the club of BDCs reaching new heights, with a top price of $13.95. That’s now 5 BDCs that have posted new 52 week highs this week alone.

No less than 27 BDCs (versus 24 as of last Friday) are within 5% of their 52 week highs. Also 20 BDCs – nearly half the universe of stocks we track are trading at or above book value – sometimes very far above. We are at or close to a multiple year record by this metric.

In brief, the BDC “re-rally” – as we call this phenomenon – is clearly underway. What we don’t know is whether this burst of enthusiasm takes us much further, or not. The next few days and weeks – as BDC earnings season breaks out in a week – will tell the story.

NEWS

There were several MAJOR developments on Wednesday. First, the previously mentioned NEWT announced its IVQ 2021 dividend. The amount that will be paid out in December is $1.05 per share. There was nothing unexpected about the announcement or even the amount as NEWT’s management is regularly “talking up” its distribution. Nonetheless, the growth in the payout compared to 2020 is a wonder to behold in an industry where most players are happy to pay the same dividend quarter after quarter, or offer smidgeons of improvement year over year. Here is an extract from the NEWT press release that makes our point best:

“The payment of the fourth quarter 2021 dividend would represent a 123.4% increase over the fourth quarter 2020 dividend of $0.47 per share. With the payment of the fourth quarter 2021 dividend, the Company will have paid $3.15 per share in dividends in 2021, in line with the Company’s previously stated 2021 dividend forecast, which would represent a 53.7% increase over dividends paid in 2020”.

Newtek Business Services press release- October 20, 2021

Of course – as all our readers know – NEWT will not be a BDC for much longer and shareholders should not expect these sort of massive payouts to continue too far into 2022. However, for one of the last times while the company is wearing its BDC mantle, investors were excited – as we’ve seen – and pushed up the price to close at $29.35.

Cynics will point out, though, that NEWT’s stock has never recovered from management’s decision to seek greener pastures as a holding company. As the chart below shows, NEWT was trading over $38 a share just before the news broke…

Management is playing the “long game” and must be delighted to be on the verge of becoming a nationally chartered bank with such strong earnings.

The second major development – and happening less often these days than we might have expected with half the BDC universe trading above book – WhiteHorse Finance (WHF) announced its intention to issue new shares in an underwritten offering.

The press release does not tell us much about the amounts involved or the price. That’s all underway and should be known in the next day or two. However, the prospectus that accompanies these ventures does has fresh information for anyone interested:

“Preliminary Estimates of Certain Financial Highlights•

As of October 20, 2021, the Company estimates NAV as of September 30, 2021 to be in the range of $15.44 to $15.48 per share.•

As of October 20, 2021, the Company estimates net investment income(1) for the three months ended September 30, 2021 to be in the range of $0.355 to $0.375 per share.•

As of October 20, 2021, the Company estimates core net investment income for the three months ended September 30, 2021 to be in the range of $0.362 to $0.382 per share.•

As of October 20, 2021, the Company estimates net increase in net assets resulting from operations for the three months ended September 30, 2021 to be in the range of $0.37 to $0.41 per share”.

Extracted from WHF’s Prospectus dated October 20, 2021

We did a fast compare and contrast with WHF’s IIQ 2021 NAV Per Share and the analyst consensus for recurring earnings in the current quarter. This suggested that the former has increased, but only slightly, from its $15.42 level. The analyst consensus for earnings – and we’re not sure if that’s Net Investment Income Per Share or the non-GAAP adjusted number the BDC prefers – is $0.37.

WHF has 20,996,294 shares outstanding. Just in the IIQ 2021, the BDC sold 124,252 shares at a average price of $15.81. Just before the news of this secondary was announced WHF was trading at $16.22, but has been as high as $16.72. In the after-market – as investors seek to guess what the eventual new shares will be priced at – the stock price has dropped back to $15.85.

For what it’s worth, the BDC Reporter’s long term price target for WHF is $18.60. Built into that price is the assumption that even 5 years out the BDC will be earning $1.55 per annum – and paying an equal amount of dividend – and will trade at a 12.0x multiple. If we use the midpoint of the IIIQ 2021 estimated “core net investment income” and annualize, recurring earnings are $1.488, and the actual distribution for 2021 is $1.550. Using that 52 week high referenced above of $16.72 and dividing over the 2021 distribution, WHF has traded as high as 10.8x. Rightly or wrongly, the BDC Reporter is presuming both stable earnings/dividend AND a higher multiple in the years ahead.

We’ll be discussing WHF further as we learn more about the progress of the offering.

In less momentous news for BDC investors – but worth noting – Hercules Capital (HTGC) announced the appointment of a new independent director. The new Board member –Pam Randhawa – is a “thought leader” – we love that term – and sports a handsome resume. Here’s an extract:

“Ms. Randhawa has over 20 years of business leadership experience in the healthcare and life sciences industries and brings to Hercules a wide range of expertise ranging from policy, corporate strategy, product development, advanced analytics and marketing for Fortune 500 companies, startups and government entities. Since 2013, she has served as Chief Executive Officer and Founder at Empiriko Corporation, a company that has developed a novel in vitro biomimetic platform to accelerate small molecule drug development and is developing a point-of-care diagnostic platform for personalized immunologic/genetic biomarker and drug monitoring. Prior to founding Empiriko, Ms. Randhawa was President and Co-Founder of AgroGreen Biofuels, an alternative biofuels technology company. She has held several executive positions with major healthcare technology companies, including McKesson Corporation (NYSE: MCK), Phase Forward (acquired by Oracle), InfoMedics and Sermo.

Ms. Randhawa currently serves on the Board of Directors of the Massachusetts Life Sciences Center and as Vice Chair of the Board of Directors of the Massachusetts Biotech Technology Council (MassBio).

Ms. Randhawa received her Bachelor of Science degree in Economics from the University of Rajasthan and her Master in Public Management degree from Carnegie Mellon University.”

Hercules Capital Press Release – October 20, 2021

By the way all three BDCs discussed above: NEWT, WHF and HTGC are trading above book value: 75%, 5% and 49% premiums respectively.

WEBSITE PROBLEMS

Regular readers will know that we are having “technical difficulties” : unable to send out our latest articles in email form and having to publish all articles as free as the system cannot distinguish between free and paying subscribers. We met – virtually – with a crack software specialist today and are hopeful that a satisfactory resolution is round the corner. In the interim, you can find all our October content by navigating to the website to keep up with the BDC rally and the many interesting developments underway. We appreciate your patience as we learn more about how the sausage is made in a website than we ever cared to know.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.