Cion Investment Corporation: A Primer On the Newest Public BDC – Part II

In Part I, the BDC Reporter reviewed the history of Cion Investment Corporation (CION) – the latest BDC to go public – and its strategy and performance over the last nine years. We assessed – in a very preliminary way that might be subject to change as we become more familiar with the BDC and the data – how well CION has done through June 2021 – the date of its last reported results. In Part II, we propose to discuss what the BDC – in its new public wrapper – might look like going forward. To date – either for regulatory reasons or otherwise – has not provided any guidance except affirming the IVQ 2021 dividend distributions already announced earlier, but which will change due to the 2:1 reverse stock split implemented in September. That cut the number of shares outstanding in half, which has the effect of doubling the dividend per share received.

PRINCIPAL CHANGES

Same Old

In most ways, CION – which has been active in the debt markets for nine years – will not operate differently than before.

Based on the Investor Presentation attached, management intends to maintain its strategy of focusing principally on senior debt investments in what we’d describe as upper middle market U.S. borrowers.

As before, CION will both lead and participate in “club deals” with other lenders.

(Unlike many other BDCs, the BDC is not run by an asset manager with multiple other similar funds that allows for underwriting an entire transaction without the use of third party partners).

Expect to see CION’s name alongside other BDCs like Barings BDC (BBDC) , Ares Capital (ARCC) and Capital Southwest (CSWC), just to name a few from the “Key Partners” listed in the CION Investor Presentation:

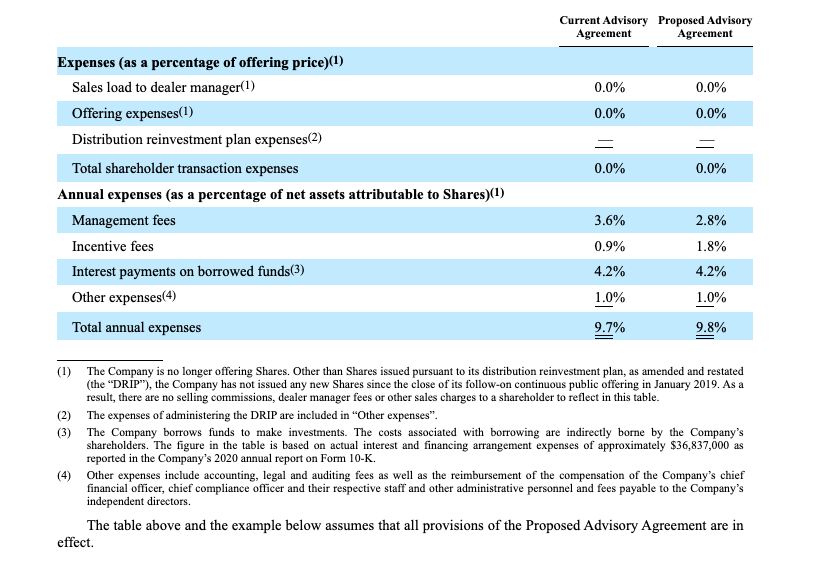

However – besides the already mentioned reverse stock split – there are two important changes coming up.

Higher Leverage

First, the BDC’s shareholders are being asked to approve the reduced asset coverage rule that allows a BDC to increase debt to equity leverage from 1:1 to 2:1, by reducing asset to debt coverage from 200% to 150%.

A preliminary proxy was published in September and will – in all likelihood be approved.

After all, with very few exceptions, all other BDC Boards and shareholders have enthusiastically embraced the higher leverage limit, even if the ultimate result might be greater than otherwise losses down the road and far greater management fees for any advisor involved.

Management has already announced its intention to target – once the approval is received – debt to equity of 1.25 : 1.00.

That’s very much what most BDCs of the size of CION are aiming for, although a bold few are going even higher.

Based on the BDC’s net assets as of June 2021 of $926mn, we calculate CION would allow itself to borrow – in one form or another – up to $1.158bn.

At the moment, total debt is $796mn, which implies – on a pro forma basis – that debt could be increased by $362mn, or 45%.

That increase would also boost the size of the investment portfolio from $1.724bn to $2.086bn, a 21% increase.

If this sort of growth is implemented CION will clearly face a challenge finding enough attractive deals to boost its size by a fifth.

Still, the team at the BDC have a long track record by BDC standards and have already proven their capacity to assemble a coherent multi-billion portfolio.

In the first half of 2021, CION has booked 28 new deals.

Maybe transaction sizes will increase going further, or the BDC will devote some capital to other vehicles.

JV Misstep

While we’re unsure of the details, CION’s first attempt at sponsoring an off balance sheet joint venture – a typical public BDC ploy – did not work out as hoped.

CION SOF, which was an 85/15 partnership with BCP Special Opportunities Fund I (BCP), was established on May 21, 2019.

“[CION] and BCP contributed a portfolio of loans to CION SOF representing membership equity of $31,289 and $4,470, respectively, in exchange for 87.5% and 12.5% of the membership interests of CION SOF, respectively”.

“In December 2020, the Company and BCP elected to wind-down the operations of CION SOF. On January 28, 2021, CION SOF sold all of its remaining debt and equity investments to the Company. On March 18, 2021, CION SOF declared final cash distributions and on March 19, 2021, distributed all remaining capital to the Company and BCP”.

“(ii) Effective upon the Company’s shares of common stock being listed on a national securities exchange, the Incentive Fee will be calculated as set forth below:

The first part, the subordinated incentive fee on income, will be calculated and payable quarterly in arrears based upon the Company’s “pre-incentive fee net investment income” for the most recently completed calendar quarter. The subordinated incentive fee on income will be subject to a hurdle rate, measured quarterly and expressed as a rate of return on the net assets of the Company at the beginning of the most recently completed calendar quarter, of 1.625% (6.5% annualized), subject to a “catch up” feature. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income (including any other fees, other than fees for providing managerial assistance, such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies) accrued during the calendar quarter, minus the Company’s operating expenses for the quarter (including the base management fee, expenses reimbursed to the Administrator under the administration agreement and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with payment-in-kind interest and zero coupon securities), accrued income that the Company has not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. The calculation of the subordinated incentive fee on income for each quarter is as follows:

· No subordinated incentive fee on income is payable to the Adviser in any calendar quarter in which the Company’s pre-incentive fee net investment income does not exceed the preferred return rate of 1.625% (the “hurdle rate”).

· 100% of the Company’s pre-incentive fee net investment income, if any, that exceeds the hurdle rate, but is less than or equal to 1.970% in any calendar quarter (7.879% annualized) is payable to the Adviser. This portion of the Company’s pre-incentive fee net investment income is referred to as the “catch-up.” The “catch-up” provision is intended to provide the Adviser with an incentive fee of 17.5% on all of the Company’s pre-incentive fee net investment income when the Company’s pre-incentive fee net investment income reaches 1.970% in any calendar quarter.

· 17.5% of the amount of the Company’s pre-incentive fee net investment income, if any, that exceeds 1.970% in any calendar quarter (7.879% annualized) is payable to the Adviser once the hurdle rate is reached and the catch-up is achieved (17.5% of all pre-incentive fee net investment income thereafter is allocated to the Adviser)”.

“The Note Purchase Agreement contains other terms and conditions, including, without limitation, affirmative and negative covenants such as (i) information reporting, (ii) maintenance of the Company’s status as a BDC, (iii) minimum shareholders’ equity of 60% of the Company’s net asset value as of the year ended December 31, 2020 plus 50% of the net cash proceeds of the sale of certain equity interests by the Company after February 11, 2021, if any, (iv) a minimum asset coverage ratio of not less than 200%, or 150% if the Company obtains the requisite shareholder approval and the Company’s common stock is listed for trading on a national securities exchange, (v) a minimum interest coverage ratio of 1.25 to 1.00 and (vi) an unencumbered asset coverage ratio of 1.25 to 1.00, provided that (a) first lien senior secured loans and cash represent more than 65% of the total value of unencumbered assets used by the Company for purposes of the ratio and (b) equity interests or structured products in the aggregate represent less than 15% of the total value of unencumbered assets used by the Company for purposes of the ratio. As of and for the three months ended June 30, 2021, the Company was in compliance with all reporting requirements”.

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.