Apollo Investment: IIIQ 2021 Credit Review

Premium FreeApollo Investment : IIIQ 2021 Credit Review

We reviewed Apollo Investment’s (AINV) calendar IIIQ 2021 earnings release, 10-Q, investment presentation and conference call transcript to prepare the Credit Review. In addition, we’ve added profiles of underperforming companies from the BDC Credit Reporter.

ANALYSIS

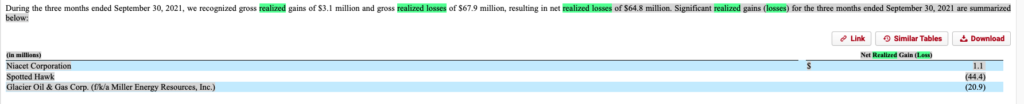

Realized Gains Or Losses

AINV recognized net realized losses of ($64.8mn) in the IIIQ 2021:

The principal losses were both “non core”, long standing energy investments: Spotted Hawk (SHD) and Glacier Oil & Gas for a total of ($65.3mn). This was slightly offset by a realized gain from the sale of second lien debt in Niacet Corporation for $1.1mn.

According to AINV: “During the quarter, Spotted Hawk completed a restructuring of its balance sheet, our second lien position, Tranche A, was converted to equity in our third lien position in Tranche B was canceled. Both of these positions were previously on nonaccrual status“.

The second lien debt of Glacier was written down from $36.9mn to $15.0mn. The equity at cost of $30.1mn remains valued at zero.

Both SHD and Glacier remain on AINV’s books.

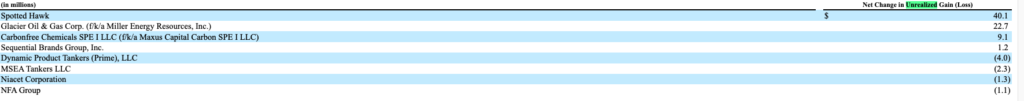

Unrealized Gains Or Losses

During the three months ended September 30, 2021, AINV recognized gross unrealized gains of $81.8 million and gross unrealized losses of $12.8 million, including the impact of transferring unrealized to realized gains (losses), resulting in net change in unrealized gains of $69.0 million.

Here are the main changes:

The gains at SHD and Glacier were reversals of the realized losses mentioned above, as was the loss at Niacet.

As was the case the quarter before, the most notable improvement in value came to $9.1mn at Carbonfree Chemicals (aka Maxus Capital Carbon) a company that we have rated CCR 4, and whose debt has entirely been converted to debt in prior periods.

Here’s what AINV said on its latest conference call:

“Regarding Carbonfree, as a reminder, our investment … consists of an investment in the company’s proprietary carbon capture technologies and an investment in the company’s chemical plant. Carbonfree is benefiting from strong interest in carbon capture, utilization and storage as part of broader ESG trends. We believe Carbonfree is a leader in this space as evidenced by partnerships announced during the quarter, which demonstrate market acceptance for its technology.”.

AINV IIIQ 2021 Conference Call Transcript

At the end of September 2021, AINV had invested $78.7mn in Carbonfree and the latest FMV was $45.2mn, up from $36.2mn in the IIQ 2021. No income is generated. The credit rating remains CCR 4.

Sequential Brands, despite being downgraded from CCR 4 to CCR 5 in the quarter due to the bankruptcy of the company, increased in value by $1.2mn, as the ultimate outcome of the investment becomes clearer.

Another “non core” investment – MSEA Tankers – was written down by ($2.3mn) for reasons unknown.

NFA Group, a UK investment – which remains valued over par, dropped ($1.1mn), probably due to currency changes.

Also notable is that the BDC’s investment mix in Merx Aviation Finance (Merx) changed significantly in the quarter. First lien debt increased to $275mn from $191mn, while equity dropped from $120mn to $36mn. Despite the higher income entailed, the overall value of Merx did not materially change.

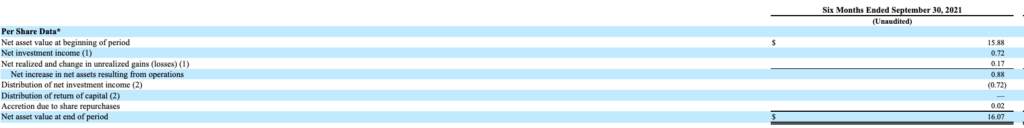

NAV Per Share Change

For the first 6 months of AINV’s fiscal year 2021, NAV Per Share changed as follows:

Net Investment Income was equal to distributions, while changes in assets increased by $0.17 per share and stock repurchases boosted by $0.02. 89% of the increase in net assets per share came from net realized and unrealized gains.

Total Losses

To date, since coming to market in 2005, AINV’s aggregate “Accumulated Over-Distributed Losses ” (as per the terminology used in the 10-Q) are ($1,053mn), or 50% of equity capital at par. This is essentially unchanged from the prior quarter.

Since the end of 2019, AINV’s NAV Per Share has dropped (12%) and (19%) since the end of 2017.

Underperforming Companies

At the end of IIIQ 2021, investment assets had an aggregate cost of $2.809bn, and an FMV of $2.612bn, a (7.0%) discount.

We focused upon a company by company review of the 144 company portfolio, up from 140 in the prior period.

Based on the valuation of the AINV investments and other publicly available information, we have identified 13 companies that are under-performing, and 131 that are performing as expected, or better.

Non Accrual Names: CCR 5

Of the under-performing, according to AINV’s 10-Q, loans to 6 companies are on non accrual.

The companies involved are Ambrosia Buyer; KLO Holdings (consisting of loans to 9357-5991 Quebec, Inc and KLO Acquisition); Glacier Oil & Gas; Solarplicity Group; Sequential Brands ; and Vari-Form Inc .

Following its restructuring SHD was removed from the non accrual list this quarter as no debt is outstanding and Sequential Brands was added.

According to AINV: “As of September 30, 2021, 2.0% of total investments at amortized cost, or 1.1% of total investments at fair value, were on non-accrual status.”.

This represents $28mn of investments at FMV.

Of the 6 non performing companies, 2 are non material ( 9357-5991 Quebec, Inc and Vari-Form) and the remaining loans on non accrual are at : Ambrosia Buyer ($9.3mn); Sequential Brands ($11.5mn), Solarplicity UK ($2.2mn) and Glacier Oil & Gas ($4.9mn). Please note that the amounts given represent only the fair market value of loans that are non performing, not the entire investment.

Worry List: CCR 4

There are 6 companies which are rated Corporate Credit Rating 4 – our Worry List – where the likelihood of loss is greater than that of full recovery. Here are brief descriptions of each name and whether we expect any change in value – i.e. “trending” – in the IVQ 2021 which might affect – positively or negatively – AINV’s net book value. These are but common sense guesses and should be treated as such.

The companies are Carbonfree Chemicals; Golden-Bear 2016-R LLC; Pelican Energy; Renew Financial, SHD and Dynamic Product Tankers.

(Many of the CCR 4 names are AINV “Control” investments which gives the BDC broad powers on deciding how and when to be paid, and makes estimating when a default might occur difficult).

As we’ve seen, Carbonfree has increased in value recently but its long term outcome still remains unclear. However, given six quarters of increasing valuation, there is a prospect that AINV may make back some or all its long standing $79mn invested in the plant. We expect a further increase in value in the IVQ 2021.

Golden Bear is discounted by (36%) in value – roughly unchanged. At the moment, we have no reason to expect any material change by year’s end.

Pelican Energy is an equity investment discounted by (97%) and which generates no income. The valuation is unchanged from the prior quarter at $2.170mn. Again, there is no catalyst we are aware of for a change in the IVQ 2021.

Renew Financial consists of preferred stock positions – all non income producing – discounted by (64%), similar to the prior quarter. No change anticipated.

SHD has been discussed above. Given management’s eagerness to dispose of the long standing and troublesome investment, we expect something may change by year’s end 2021, but could as readily extend into 2022.

Dynamic Product Tankers is a shipping company that AINV owns 85% of the equity of and provides unsecured debt to. The $22mn unsecured Term Loan remains valued at par and continues to charge a subsidized 5.16% rate to the shipper. The equity has dropped from $25.5mn to $16.1mn in the past 6 months. At the moment, we’re not anticipating any further change in value up or down, but information is very sparse.

Watch List: CCR 3

At the moment, there is only 1 under-performing company on our Watch List with a CCR 3 rating – where the odds of full recovery are higher than that of loss.

This was Sonar Entertainment. The total amount invested has dropped to $5.7mn – probably due to principal repayments – but is discounted by ($1mn).

Last quarter Magnate Holding Corp (aka MYCOM) was rated CCR 3 but its debt is now discounted by less than (10%). As a result, Magnate is back to being rated CCR 2.

Balance Sheet Impact Of Underperformers

AINV does not undertake its own internal investment rating system.

We calculate the fair market value of all under-performing companies to be $182mn ($183mn in the IIQ 2021) or 7.0% of the entire investment portfolio at FMV and equal to 17.5% of net book value.

Investment Outlook

Based on available public information, the BDC Credit Reporter projects a credit outlook for every materially important underperforming company rated 4 or 5.

That amounts to 10 names.

Ambrosia Buyer – a newer troubled company – is in the midst of a major battle between its lenders. The $9.3mn debt is second lien and we could – as a result – envisage a full write-off. On the other hand, the dispute should get resolved at some point, and AINV may extract something from the situation. See the BDC Credit Reporter’s IIIQ 2021 update.

Carbonfree has a value of $45.2mn and is not expected to generate income but may increase in value on the back of its interesting technology. AINV controls the business, so this investment could remain on the books for an indefinite period and assessing true value will always be difficult. For these purposes, we are estimating an exit value of $60mn. See the BDC Credit Reporter’s IIIQ 2021 update.

Dynamic Product Tankers is valued at $38.1mn overall, down from the prior quarter. We’re guessing the $22mn in debt outstanding will be money good but the $16mn in equity value could yet drop to $10mn. See the BDC Credit Reporter’s IIIQ 2021 update.

Glacier Oil & Gas (in which AINV has invested $45mn) has a current value of just $4.9mn. Of course, a turnaround is always possible, but we’re assuming an ultimate write-off, as valuations have continued to drop even as energy prices have soared. See the BDC Credit Reporter’s IIIQ 2021 update.

Golden-Bear 2016 is also hard to evaluate, but has a value of $10.8mn. For the moment we expect both the current income and value will remain unchanged. The most recent BDC Credit Reporter update dates back to June 2, 2021.

Renew Financial (aka Renewable Funding LLC) – which is related to Golden Bear – is something of a mystery and has a value of $6.4mn in junior capital. We assume an eventual write-off. See the BDC Credit Reporter’s IIIQ 2021 update.

SHD Oil and Gas ($70mn invested) has a remaining value of $32.2mn. $25mn is assigned to the first lien debt and $7mn to the equity. AINV is keen to dispose of this non-income producing investment so we’re assuming only the last tranche of debt will have value and ($7mn) more will be written off. See the BDC Credit Reporter’s IIIQ 2021 update.

Pelican Energy’s $2.2mn of current fair market value is – more likely than not – going to be written to zero once this investment gets resolved after nearly 10 years already on the BDC’s books. Given the low FMV, the BDC Credit Reporter has not undertaken any coverage.

Sequential Brands – as discussed – is in transition. This quarter, the BDC chipped in new first lien monies to assist with the sale of the business, bringing total exposure to $19.1mn at cost. That debt is performing, with only the second lien on non accrual. That has a cost of $12.6mn and a FMV of $11.5mn. We’re more optimistic than we were previously and project a full recovery for AINV on both debt tranches. See the BDC Credit Reporter’s IIIQ 2021 update which discusses the issue in greater detail.

Solarplicity UK has a remaining value of $2.2mn, following realized losses over the years. We are assuming a complete write-off at the end, as discussed in the BDC Credit Reporter’s IIIQ 2021 update.

Overall, we could envisage eventual net losses of further fair market value from all the underperformers of ($21mn). That includes a very speculative ($9mn) loss on Ambrosia Buyer. Otherwise, the loss might aggregate only ($12mn). Keeping net losses low are the positive expectations for Carbonfree (a $15mn further increase in value) and a small uptick at Sequential Brands.

At ($21mn), this very roughly estimated net loss – to about ($0.32) a share, which would bring NAV Per share to $15.75 from $16.07.

At time of writing AINV trades at $13.18 share.

Income Impact

Although there are 13 AINV underperformers, the amount of income at risk of being interrupted going forward is modest.

That’s because 6 companies have some or all their income producing investments on non accrual and 3 are all non-income producing equity or preferred stakes.

The biggest potential loss of income comes from $22mn advanced to Dynamic Product Tankers ($1.1mn of annual income); and the $24.7mn Tranche C senior debt of Spotted Hawk ($3.0mn).

On the other hand, AINV should benefit from the eventual disposition of many now non-income producing investments that could be re-deployed into yield producing assets.

We calculate – using the same assumptions as given above about the ultimate fate of each investment – that AINV might generate as much as $6.0mn in additional annual investment income from its underperforming investments. This amounts to about $0.09 per share of income gained.

Conclusion

Compared to its peers, AINV has a large number of underperforming companies – many of which have remained stubbornly on the books for years. There has been no great positive leap forward in 2021 as we had hoped for in this regard, with the exception of Carbonfree. In fact, many long term difficult credits (SHD, Glacier) continued to lose value even as most assets in the marketplace – and in the performing segment of AINV’s portfolio – increased in value. The result has been ($65mn) in realized losses in the first six months of the BDC’s fiscal year, and NAV Per Share (12%) lower as of September 2021 versus December 2019. On the other hand, in terms of absolute fair market value dollars at risk based on the BDC Reporter’s estimated eventual losses, any further downside is limited, just a prospective (2%) drop in net book value. Likewise, even in a worst case, AINV does not stand to lose much in the way of income. In fact, the BDC may eventually boost its earnings once all the investments are sold off/refinanced or liquidated. In the interim, though, AINV is in a sort of limbo : unable to cash out of the several long standing underperforming assets and re-deploy the funds into yielding investments, but not at great risk of substantial NAV or income loss either.

(We will remind readers that our estimates of possible ultimate realized losses or recoveries are very, very tentative, due both to the typically uncertain outcome and the very modest disclosures offered up by the manager).

Impressive – from a credit standpoint – are the very few “core” companies on the underperformers list: mostly Sequential Brands, Ambrosia Buyer, and Sonar Entertainment – all of which may yet get exited without material loss. This suggests – from a credit viewpoint – that the manager’s switch several years ago to mostly providing senior secured loans to middle market companies is working. Nonetheless, despite their best efforts and the most favorable market conditions in years, AINV’s advisor has not been able to successfully turn around the “non core” company investments that have plagued the portfolio for half a decade or more. Much as we’d like to suggest otherwise, no sudden improvement in this regard seems on the cards, but that may prove irrelevant as the bulk of assets are performing as hoped for.

Finally – last but not least – another factor that could materially impact AINV’s NAV going forward is how the manager – with huge discretion in this regard – chooses to value its Merx Aviation investment. An increase in the value of the aircraft leasing business could boost NAV Per Share and offset in part or in full all the likely further write-downs of the BDC’s legacy underperforming and non-performing companies.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.