BDC Common Stocks Market Recap: Week Ended November 19, 2021

BDC COMMON STOCKS

Week 46

Pullback ?

This was the week that BDC common stock prices went off the boil, just as BDC earnings season was coming to a close.

BDCZ – the UBS Exchange Traded Note which owns most BDC stocks and which we’ve used for years to measure sector price movement – fell to $19.86 – a (1.3%) drop.

Just to make sure, we also looked at what happened to BIZD – the Van Eck sponsored exchange traded fund which holds many of the same stocks and which has greater volume – fell (1.5%).

As if that wasn’t enough, we also checked out the S&P Wilshire Index – which offers up “total return” calculations which are more appropriate for long term investors – was down (1.5%).

Supporting Metrics

Of the now-45 BDCs we track, only 13 managed to increase in price while 32 were down.

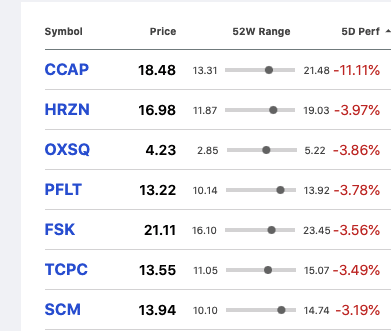

7 BDCs dropped by (3.0%) or more in price during the week, and only 2 increased by 3.0% plus.

No Good Deed

Leading the percentage losers, was Crescent Capital (CCAP): off (11.1%).

The BDC was harshly punished by the market for undertaking a secondary stock offering at $21.33 a share.

Given that the BDC’s 52 week high was $21.48, that was an impressive price and a slight premium to the $21.16 IIIQ 2021 NAV Per Share.

Before the equity announcement CCAP was flying high, trading at all-time levels.

Nonetheless, the markets have punished the stock in the last few days, which is down to $18.48, (13%) below the price at which the new stock was underwritten.

At this price, CCAP is trading at 10.9x its 2021 total distributions and 11.1x projected 2022 earnings and now at a (13%) discount to net book value per share.

Even the promise that Sun Life, the ultimate owner of CCAP’s external manager, would be buying $10mn of the stock in the open market starting in December did little to assuage investors.

Line Of Fire

The other (3.0%)+ losers – by ticker – were a mixed bag of BDCs, each with their own reason for a loss of shareholder confidence.

See the list taken from Seeking Alpha:

Briefly

Horizon Technology Finance (HRZN) – as we discussed in the BDC Daily Update earlier in the week – has seen much profit taking after an earlier surge in price.

PennantPark Floating Rate (PFLT) – also previously discussed – disappointed investors where NAV Per Share was concerned thanks to a major new non accrual popping up.

Stellus Capital (SCM) had a planned share offering of its own planned and then pulled was also in the red.

Exceptions

Two BDCs did fare well this week. Cion Investment (CION) reassured a market not familiar with the new BDC, and increased by 10.2%, including reaching a new 52 week high on Friday.

Monroe Capital (MRCC) seems to have convinced investors that its credit turnaround is for real, and jumped 7% for the week, hitting a new 52 week high on Thursday.

(By the way, 6 BDCs – including the two afore mentioned – reached new 52 week highs this week).

Looking Forward

We’re still waiting for Golub Capital (GBDC) and PhenixFIN( PFX) to report their results through September 2021.

Nonetheless, BDC earnings season is effectively over and the analysts have been busy updating their financial models and re-calibrating their expectations.

Roughly speaking – and remembering that analysts tend to undershoot on EPS expectations – earnings projections in total for 2022 are equal to 2021.

However – as always – there is a wide variance in expected performance by individual BDC, with many expected to both increase recurring earnings and their distributions next year, and quite a few others to remain flat or drop only modestly.

We checked the earnings projections for 2022 for the top 4 BDCs by size (ARCC, FSK,ORCC and PSEC) and found 2 were expected to remain the same, one to drop and one to increase.

(We’ll undertake a full review of 2022 vs 2021 earnings once the season is over and all players have reported).

We may be at “peak earnings” right now, and that could last through 2022.

Down The Proverbial Road

However, if there is a run-up in short term rates starting in 2023 with LIBOR jumping over 1.0% (currently a minuscule 0.09% for a 1 month setting), BDC earnings could move up thanks to higher loan yields, fixed borrowing costs and still low credit losses.

Will investors wait around for something that might or might not happen so far down the road, or take profits now and take a second look if and when the interest rate environment changes ?

This last week seems to suggest profit taking might be the likeliest scenario but a few days do not represent enough of a trend.

Hedging Ourselves

For our part, we’ve been projecting since the summer that a 5%-10% increase in BDC sector prices over the June high level is the likeliest outcome before the year is out.

Frankly, that prospect seems a little less likely after weeks of BDCZ being unable to break to new highs. (BIZD did reach a new high point, but the increase was minimal).

Furthermore – and possibly related – earnings season has resulted in a few more BDCs than we expected not being able to increase NAV Per Share than we projected and (like the example of PFLT) several BDCs have fessed up to new non performing portfolio companies, even as the general credit backdrop is favorable and still healing.

Question marks remain over several BDCs – including some very large ones – ability to “cover” their dividends with earnings, despite much progress being made this quarter.

No Storm Clouds Sighted

On the other hand, within the context of a still “hot” overall stock market (the S&P 500 is within 1% of its all-time high set intra-day just last week), there are no obvious catalysts for a general pullback in BDC prices to “correction” territory (10% down), or worse.

In fact, we expect BDCZ to remain within a price band of $18.9 – $20.3 for the rest of 2021.

Putting that into perspective, even at a closing price of $18.9 (the low end of the range), BDCZ will have gained 16.5% in 2021 and on a total return will be around 25% – a very good year by anybody’s standards.

We’ve closed closed out week 46 of 2021, so we’ll find out in a very brief space of time if that’s how matters turn out.

Round The Next Corner

Looking out a little further – and without the benefit of IVQ 2021 results to guide us – the first part of 2022 also looks favorable as far as we can tell.

Projecting out to mid-year 2022, we expect that the Wilshire BDC Index total return will be higher than the current level, even if BDCZ cannot find its way to a new high.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.