BDC Daily Update: Tuesday November 2 2021

MARKETS

For a second day all the major indices were up and reaching new heights, as shown above. Earnings have been “better than expected”, even though investors know that the system is gamed in this regard, as analysts tend to aim low in setting expectations, allowing companies a quarterly opportunity to tout their relative success. Also on the horizon is that perennial subject: hearing from the Fed about its future plans. Apparently the markets are optimistic about what Chairman Powell & co might have in store.

Also for a second day, the BDC sector failed to catch the general market wave. BDCZ – the UBS-sponsored exchange traded note which owns most BDC stocks – dropped by (0.5%). That leaves BDCZ trading at $19.90. The other sector indicator we use – BIZD – which is an exchange traded fund managed by Van Eck – was off by a similar percentage.

27 BDCs dropped in price, 14 went up and 1 was unchanged. True, none of the BDCs moved up or down very much. The biggest mover was Stellus Capital (SCM), down (1.8%) a day after hitting a new 52 week high. No BDC reached a new 52 week high.

We’re beginning to wonder if some BDC investors are deciding to take profits after a very long rally, and we may not see the breakthrough in BDC sector prices that we came so close to at the end of October and which the BDC Reporter has been envisaging for many weeks. Still BIZD and BDCZ are still only (1.5%) and (1.9%) away from their 52 week heights so it may be too early to throw in the towel where record breaking is concerned and with only two days of November gone.

NEWS

We listened to Capital Southwest’s (CSWC) conference call and reviewed the attendant transcript. (The 10-Q is still not available but should be published shortly). Here is some of the new information we picked up:

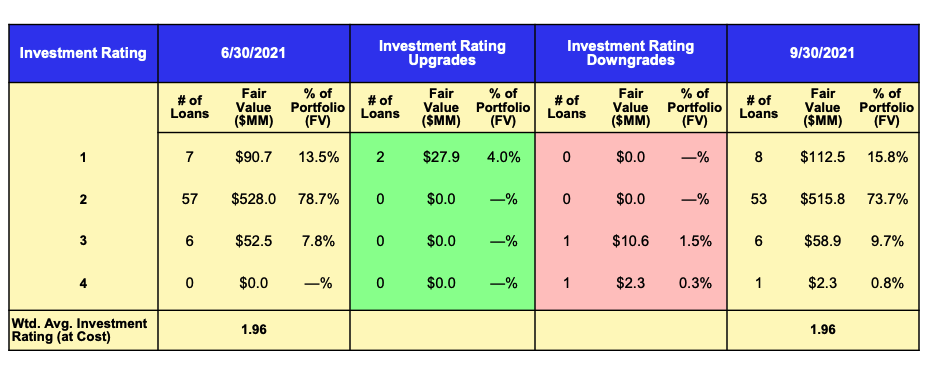

Underperforming companies

“During the quarter, we had 2 loans upgraded from a 2 to a 1; 1 loan downgraded from a 2 to a 3; and 1 loan downgraded from a 3 to a 4. As a reminder, all loans upon origination are initially signed an investment rating of 2 on a 4-point scale, with 1 being the highest rating and 4 being the lowest rating. As of the end of the quarter, we had 61 loans, representing approximately 90% of our investment portfolio at fair value, rated in 1 of the top 2 categories, a 1 or a 2; we had 6 loans, representing 9.7% of the portfolio at fair value, rated a 3; and 1 loan, representing less than 1% of the portfolio, rated at 4“.

Capital Southwest Conference Call comments by CEO Bowen Diel – November 2, 2021

Here is the investment rating table from the BDC’s investor presentation that shows the value and rating of all LOANS in the portfolio. The total loans at FMV add up to $689.5mn , but the entire portfolio is $818.2mn.

If you look at the BDC Credit Table, you’ll see the percentage of underperforming assets has increased from 6.6% to 7.5% of the entire portfolio. Neither last quarter nor now is the value of underperformers elevated. Still, at the end of 2019 – just before the pandemic – total underperformers amounted to only 4.0% of the total portfolio.

New Non Accrual

CSWC’s management was reluctant to share with listeners the name of the new company added to the non-accrual list, but has this to say:

“During the quarter, we placed 1 first lien senior secured loan on nonaccrual with a fair value of $10.4 million or 1.3% of the total investment portfolio. This company is currently working through a restructuring of its balance sheet, so we have decided to place the loan on nonaccrual pending more clarity on the post-restructure loan terms. Based on conversations with the company to date, we expect a portion of this loan to come off nonaccrual in the near term once the restructuring is finalized, which should be completed in the coming weeks”.

Capital Southwest Conference Call comments by CEO Bowen Diel – November 2, 2021

Later on, CEO Diehl added the following ” it’s a company that’s been affected by the supply chain that we’ve all heard about out, out in the market and which certainly we all hope is temporary but real, and just the company’s sales cycle as a result of that in its market has extended. So restructuring this quarter. We think about 1/3 of it or so will come back on accrual and we’ll own equity in the business going forward as it recovers“.

We believe the company in question – which we discussed when we undertook CSWC’s IIQ 2021 Credit Review – is Lighting Retrofit International. As of June 2021 that company had a cost of $14.6mn and an FMV of $12.1mn, mostly in the form of debt. Lighting Retrofit generated – on paper – annualized investment income of $1.6mn, none of which was booked or reversed this quarter.

Loss On Debt Repayment

CSWC addressed the recent realized loss of ($17.1mn) from the early repayment of its 2024 unsecured notes, which required a very large “make-whole” payment to the lenders, repaid 3 years early. Instead, management indicated that future Net Investment Income Per Share would be higher – due to the lower borrowing cost – and would result in a $0.10 per share annual benefit. We ran the numbers and found that CSWC’s shareholders would be $7.7mn better off, but that’s still ($9.4mn) of a one-time cash expense that didn’t need to happen. We’re not sure that’s a reasonable trade-off even if shareholders will be gleeful that their earnings and dividends will be climbing as a result, starting with the calendar IVQ 2021. Here’s what was said in the prepared remarks (no analyst challenged the issue in the Q&A):

“The main driver of the NAV per share decrease was $17.1 million in realized losses on the extinguishment of debt on the full prepayment of our 5.375% note due October 2024. The realized loss consists of a make-whole premium payment of $15.2 million as well as the write-off of related unamortized debt issuance costs of $1.9 million.The refinancing of these notes with a new 5-year 3.375% issuance significantly reduces our cost of capital and increases our annual net investment income run rate by approximately $0.10 per share on a risk-free basis. This was the primary catalyst for our decision to increase the regular dividend by $0.03 this quarter from $0.44 per share to $0.47 per share. We believe this considerable increase in earnings power enhances our market capitalization on a dividend yield basis and allows us to pass the cost of capital savings directly to our shareholders in the form of increased dividends. This transaction also pushes out our nearest debt maturity to 2026, providing significant balance sheet flexibility going forward”.

Capital Southwest Conference Call comments by CEO Bowen Diel – November 2, 2021

No Secondary Planned ?

Otherwise, most of the conference call – and the Q&A covered ground covered in the press release or the investor presentation – and included interesting discussions about the BDC’s strategy from a variety of perspectives. We did note, though, that management almost promised that no equity secondary was in the cards – a big concern amongst some investors yesterday when the stock price dropped sharply – but would continue to carefully tap its ATM program. We say “carefully” as CSWC does not want to raise too much capital too fast and be unable to continue growing recurring earnings per share.

Report Card: Good. Could Do Better.

All in all, we’d describe the IIIQ 2021 performance as “good enough”. Earnings and adjusted net book value are growing and the BDC offers the promise of further realized gains ahead, albeit offset by potential credit losses as well. The balance sheet is strong, with no debt due till 2026 and half all debt unsecured. The SBIC subsidiary – armed with super cheap debentures – should just grow and grow (ten-fold ultimately) from here, and should help CSWC become a $1.0bn plus BDC before long. We estimate CSWC should reach that milestone by the end of 2022 or in 2023. Still, we’re not convinced the early repayment of the 2024 notes was warranted by the economics involved and the increase in the number of non-accruing companies is a material setback. Nonetheless, CSWC seems headed – despite the pressure on loan yields that all lenders are facing – to higher heights where EPS and the regular dividend is concerned.

Less Jingle

Missing, though, from 2022 will be that $0.10 a quarter of special distribution that boosted shareholder returns. That may be partly offset by new realized gains being distributed but total distributions – we expect – will be (20%) lower in 2022 than 2021. Despite the fact that CSWC’s stock price bounced back by 0.66% on Tuesday after Monday’s big drop, this might weigh on the BDC for some time.

After the close, a slew of BDC earnings rolled in. We’ll be reading the earning releases and any 10-Qs that come available in the hours ahead and will report back tomorrow. As always at this time in BDC earnings season, we expect to get overwhelmed by the deluge of new results – and all the metrics to be added to the BDC;NAV Change Table and BDC Credit Table – but we’ll try to keep up.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.