BDC Daily Update: Wednesday November 17, 2021

MARKETS

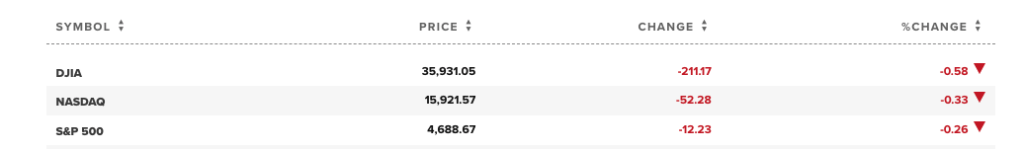

The markets – we are told – continue to be worried about inflation, resulting in a down day for the indices across the board, as shown above. On the other hand, we are also reminded that these same indices remain close to their all time highs and – in the case of the S&P 500 – are well up for the month of November.

The BDC sector – also close to a record 52 week high – slumped as well in price today. BIZD – the Van Eck sponsored exchange traded fund that owns most of the sector’s players – fell ($0.05) to $17.48, a (0.3%) drop. BIZD is just (1.5%) off a 52 week high set earlier this month. BIZD is down (0.5%) in November.

31 BDCs were in the red and 24 were in the black on the day. The only BDC to move in price by more than 3% in either direction was Horizon Technology Finance (HRZN), which dropped (5.2%). Just two days ago, HRZN was the biggest percentage gainer in the BDC sector, up 4.3%. Since peaking just 48 hours ago at a 52 week high intra-day of $19.08, HRZN has dropped (9%). Maybe a secondary is in the offing and market makers are aware and are selling off their positions ? Anyway, today’s volume was 5x the normal level of shares exchanged.

NEWS

First Eagle Alternative Credit (FCRD) has undertaken an add-on to its existing Baby Bond with the ticker FCRX. $40mn has been issued with a possible $6mn of underwriter over-allotments to come. FCRX matures in May 2026, but can be redeemed from May 2023. With this new issuance, the total outstandings on this Baby Bond will be $109mn. The add-on is priced at a premium to par, resulting in a yield to maturity of 4.75%.

The proceeds from the add-on will be used – according to the draft prospectus we’ve read – to repay outstandings under another Baby Bond – ticker FCRW. That debt matures 10/30/2023 but became redeemable since the end of October this year. The yield on the Baby Bond is 6.125% and total outstandings at September 30, 2021 were $52mn. After the pay-off of FCRW, FCRD’s debt will consist of a secured revolver and the 2026 FCRX Baby Bond. The revolver had a balance at the end of the IIIQ 2021 of $102mn, and had an all-in cost of 3.5%, and a hefty non-usage fee that varies between 0.5% and 1.0% on the unutilized amount. The total facility commitment is $150mn, but can be increased. As noted, the 2026 unsecured notes will total $109mn and FCRW will be repaid after a short period.

This will leave the BDC’s financing roughly evenly split between secured and unsecured, and with nearly $50mn of available liquidity under the secured facility. That should be enough to fund the modest portfolio growth required for FCRD to reach its target leverage of debt to equity of 1.2x. At the end of the quarter, the BDC was already at 1.13x, leaving the need for additional borrowing to acquire new assets at $14mn.

FCRD’s latest portfolio has an FMV of $402mn, but $93mn is invested in a joint venture (First Eagle Logan JV), leaving just over $300mn to serve as collateral for the revolver. (There are also loans with a FMV of $8mn on non accrual ). This suggests FCRD should have no problem with its revolver availability. Furthermore, the minimum net worth covenant of $140mn means the BDC’s net asset value would have to drop by about (30%) before being breached. (In the face of major losses, lenders had to agree to lowering the minimum number from $175mn to the current standard. This occurred on April 14, 2020).

All in all, this latest tweak to FCRD’s borrowings will reduce borrowing costs and ensure a relatively bullet proof debt structure for the next couple of years till the one year term out period for the Revolver is reached. At that point – or just before – FCRD will be seeking to extend – and possibly increase – its Revolver. Also possible is that in May 2023, the manager will seek to redeem FCRX for even less expensive unsecured debt with an even further more distant maturity than 2026. For the moment – barring a renegotiation of the pricing on the Revolver – which is relatively high – FCRD does not seem to have an opportunity to further improve its borrowing costs or its balance sheet for the next couple of years.

For all BDCs the cost of debt capital is important. That’s especially the case for FCRD whose current yield on income producing investments is only 6.9%. (versus 7.1% at year end 2020). We calculate – very roughly – that the pro-forma cost of borrowing over $200mn in secured and unsecured (and taking into account the unused line fees) should be around 4.25%, once the debt settles. Net of the management fee and ignoring any operational cost, the net spread that shareholders will receive is approximately 1.65%. That’s pretty narrow even after raising this more inexpensive debt. This might be as “good as it gets” for FCRD right now, but the advisor must be looking down the road to improve this critical metric.

For the record, FCRD achieved a net investment income per share of $0.11 in the IIIQ 2021 and the analyst consensus for 2022 is an unchanged annual number of $0.44. NAV Per Share is $6.50, down from $6.52 in the IIQ 2021 and still (15%) off the level at the end of 2019. Compared to its pre-pandemic level, FCRD ranks 6th worse in the BDC: NAV Change Table. Still, the BDC trades at $4.70 at the open, close to its 52 week high of $4.89, and a (27%) discount to net book value per share. At the latest price, the BDC trades at a price to projected earnings of 10.7x. The yield is 8.5%.

Yet Another…

After the close, WhiteHorse Finance (WHF) “announced that it will redeem its 6.50% Notes due 2025 (Nasdaq: WHFBZ) (the “Notes”). The Company will redeem 100%, or $35,000,000 aggregate principal amount, of the issued and outstanding Notes on December 17, 2021 (the “Redemption Date”), following which the Notes will be delisted from the Nasdaq Global Select Market. The redemption price per Note will be $25 plus accrued and unpaid interest otherwise payable for the then-current quarterly interest period accrued to, but excluding, the Redemption Date. The Company expects to fund the redemption of the Notes with the net proceeds from additional indebtedness it intends to incur”.

This is not an unexpected development. What is unclear is whether WHF will go the way of PhenixFIN (PFX) recently and issue public debt shortly with which to redeem WHFBZ. Or will monies be institutionally placed ? Or will some other sort of financing occur for the $35mn of WHFBZ debt involved ? We’re guessing that new unsecured institutionally placed debt will be raised to match 4 prior issues already on the books, as availability under the Revolver was limited as of September 2021: just $25mn.

WHFBZ yields 6.5%. The most recent private offering in December 2020 – with a maturity in 2026 – was placed at a yield of 5.375%. We’d guess that WHF could raise new unsecured debt at a rate below 5.0% going forward, which should help lower the BDC’s cost of borrowing.

Earnings

After the close, PennantPark Floating Rate (PFLT) and PennantPark Investment (PNNT) reported IIIQ 2021 results. We’ve updated the BDC: NAV Change Table and will get to the BDC Credit Table shortly. More on PFLT and PNNT tomorrow.

Now we’re just waiting till November 29, 2021 for Golub Capital’s (GBDC) fiscal year-end and quarterly results and we’ll be done with BDC earnings season.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.