BDC Market Update: Thursday November 4, 2021

Premium FreeMARKETS

As we might have expected, one day after hearing confirmation of the Fed’s tapering plans investors lost the giddy enthusiasm of the day before when all the indices – except the BDC ones – hit new records. On Thursday, the markets were “mixed”, with the S&P and NASDAQ up and the Dow and Russell 2000 down.

At last, both the BDC sector indices we track to measure price performance were in the black. BDCZ – which is sponsored by UBS and owns most of the sector’s stocks – moved up 0.1% to $19.91. BDCZ – which is the only BDC ETF and is sponsored by Van Eck – was up by the same percentage, and closed at $17.45.

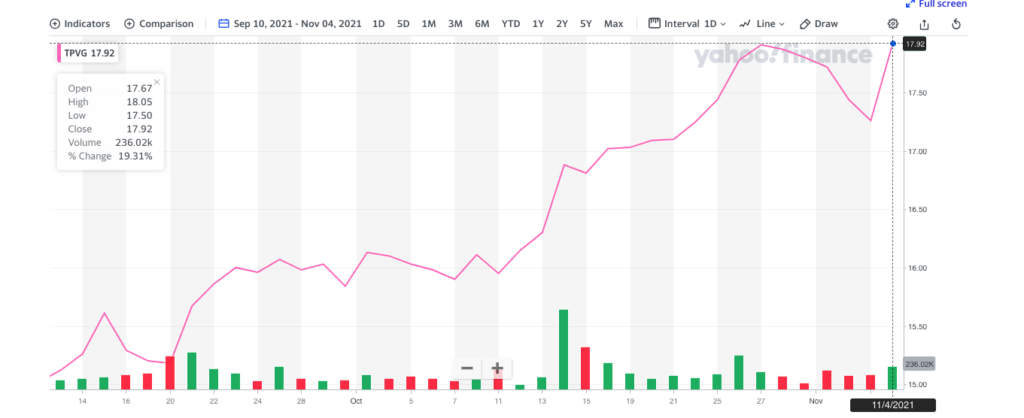

25 BDCs were up in price and 17 were down. Leading the percentage gainers was TriplePoint Venture Growth (TPVG), which gained 3.8%. As we’ve noted before the venture-debt BDC has been on a remarkable upward price run since September 10, as this chart shows: up 19%:

Otherwise, there were no especially price movements on the day – a little surprising given that so many BDCs have just reported results. This seems to suggest that BDC performance to date has been, more or les, in line with market expectations.

On the day, two BDCs reached new 52 week highs- and not for the first time. Barings BDC (BBDC) – which has not yet reported IIIQ 2021 earnings – appears to be attracting investors, reaching $11.33. That’s the highest level since Barings took over the old Triangle Capital, whose business model was imploding. In one of the boldest – and most unusual moves we’ve seen in 20 years of BDC industry coverage, the new manager sold the entire portfolio – lock, stock and barrel – to another BDC, and began again. Judging by BBDC’s stock price that move is paying off in the eyes of the markets.

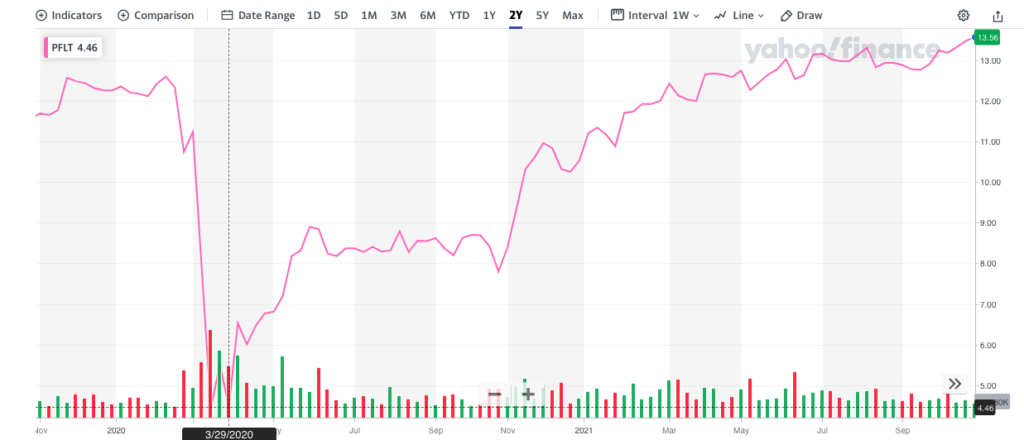

Also at a new 52 week high was PennantPark Floating Rate (PFLT), which reached $13.57. Unlike many of its peers, PFLT managed not to cut its distribution in 2020 and has been rewarded with a stock price higher now than before the pandemic. Here’s a two year stock price chart for PFLT that tells the story:

As we write this, the BDC sector continues to threaten to reach a new 52 week high. BIZD is only (1.4%) behind its $17.70 record. However, there can be no assurance that we’ll be breaking out the champagne and the banners. We’ll just have to wait and see what transpires as the year rushes towards its close and what will almost certainly be 12 months to remember for BDC investors, whatever happens to BIZD and BDCZ.

NEWS

The flood of new earnings releases continues. To date, roughly two-thirds of the BDC universe has reported. We’ve managed to keep up updating the BDC: NAV Change Table and the BDC Credit Table. From the former we can tell you that the average NAV Per Share increase in percentage terms is clearly trending lower. With 26 BDCs NAV data input, the average increase in the IIIQ 2021 is only 0.6%. – the lowest all year and since the recovery began from the IIQ 2020 from the early impact of the pandemic.

Also, while 18 BDCs can boast higher NAV Per Share quarter over quarter, 8 have registered drops. Even when we adjust for net book value impacted by one-time items – like CSWC repaying expensive debt early – that’s more BDCs in the red in this category than we had expected, as we list out in the BDC: NAV Change Table. This may well account for the BDC sector price level not moving up more.Still, 24 BDCs are trading within 5% of their 52 week highs and 17 are trading above their net book value – high by BDC standards.

Whenever we have a free moment, we undertake a deep dive into BDCs that have reported their results; held their conference call and whose quarterly filings are available. Relatively randomly, we undertook a review of Bain Capital Specialty Finance (BCSF) and annotated the BDC’s latest conference call transcript. That BDC’s net book value might not have increased much, but its earnings have improved substantially and – as we discuss at length – earnings “cover” the dividend without the need for waivers from the advisor.

Unfortunately, Apollo Investment (AINV), which has been paying $0.36 in “regular” and “supplementary” distributions for some time and whose fees were reduced temporarily by its “total return” incentive compensation provision, was not able to earn enough to be in the same boat. The BDC reported $0.33 of Net Investment Income Per Share and that was after a small amount of fee waivers. Very soon, the BDC will either have to cut back on its quarterly payouts or increase its earnings by a tenth. Net leverage as of September 30, 2021 was already at 1.51x – one of the highest in the BDC universe – so an EPS boost from growing the portfolio seems unlikely. As always the BDC is probably relying on the hope that its non-core assets (such as in energy and shipping) stop underperforming and can be sold for a decent amount. Here’s a quote from the press release on the subject:

“We remain focused on increasing AINV’s earnings and we believe the combination of upside in our existing portfolio with the redeployment of non and under-earning positions provides a clear path to generating a higher level of earnings.”

Apollo Investment Howard Widra in a press release dated November 4, 2021

On its conference call, AINV spelled out in unusually specific detail how the BDC intends to boost earnings. This is a very long quote but deserves consideration given the explicitness of the calculation:

“We remain focused on increasing AINV’s earnings power. Let me discuss how we think about our baseline earnings and the embedded upside in our portfolio. First, as a result of the stability we expect to continue to see from Merx, during the recorder, we recap the capital structure and receive $6.9 million of interest income from Merx during the September quarter, 2.1 million more than last quarter.

Second, although net leverage was 1.51 times at the end of the quarter. Average leverage for the quarter was 1.46 times, a good baseline for projecting earnings going forward. Third, fee and prepayment income totaled $1.7 million dollars for the quarter.

Although these sources of income can fluctuate from quarter-to-quarter, we expect to generate approximately $3.5 million of fee and prepayment income per quarter on average. As an illustration, in a March 2021 and June 2021 quarters, fee and prepayment income totaled 3.9 million and 5.9 million respectively.

Conversely, although we earned a $2 million dividend from MC during the September quarter, we expect to earn approximately $1 million on average going forward, a level consistent with prior periods. Taking these items in aggregate would produce a baseline of approximately $0.34 per share.

From that $0.34 baseline, there are a number of items we are focusing on to grow earnings in the near-term. First, we continue to generate incremental cash proceeds from the portion of our non-core assets that are non-generating income.

For every $10 million of cash we generate from these non-income producing assets, we can generate approximately $650,000 of annual net investment income, or approximately $0.1 per share. In this regard, we have generated incremental cash each quarter and are very focused on executing some more significant process in the coming — progress in the coming quarters.

Second, we continue to make progress with Merx. Prior to COVID, Merx generated a 13% return on average over a number of years. The current payment level as recently adjusted this quarter is approximately 9%. Although we don’t expect to close this gap completely, we do believe that we can improve the return by either reducing capital and Merx with the same gross dollar return or increasing the cash return by improving the capital structure.

Third, we continue to focus on monetizing underlying assets, specifically Spotted Hawk, dynamic, MC and Chiron. Taken together these assets and a few others account for approximately $230 million of fair value and generate only $16 million of annual income, redeploying those assets that are approximate on euro yield to generate an incremental $2 to $3 million of annual net investment income.

And last we continue to buyback our stock when the price dictates. We obviously hope these opportunities become more-and-more infrequent, but when they occur, the buybacks are both accretive to book value, and moderately accretive to EPS. We believe these items provide additional support to our baseline earnings, and also provide a path to generating the earnings above the baseline”.

Apollo Investment Conference Call November 4, 2021

We’ll leave to our readers to evaluate for themselves whether AINV’s plans to boost its earnings – and cover both dividends – is reasonable, or not. We should point out that the investment advisor – should EPS fall short – always has the option to waive some portion of its compensation – in the same manner as New Mountain Finance (NMFC) is doing or permanently reduce its management fee from 1.5% to 1.0%, following in the footsteps of Goldman Sachs and First Eagle. After all, the advisor is already taking away one-third of net recurring earnings…

Engaged in a similar race to increase its core earnings sufficiently to meet its dividend “liability” is BlackRock Capital Investment (BKCC). This quarter, the BDC – whose turnaround is further ahead than AINV’s – made progress in this regard: reaching adjusted Net Investment Income Per Share of $0.08. That leaves BKCC needing to increase EPS by 25% to meet the $0.10 quarterly/$0.40 annual distribution. Here, the manager’s hope is that deploying more of its unused borrowing capacity will boost AUM and earnings. Unlike AINV, debt to equity is low at 0.57 to 1.00x, and to $200mn in new investments could be added on to the existing $558mn portfolio. We’ll have a go at estimating whether BKCC’s earnings goals are reasonable when we undertake a full review once earnings season has ended.

In fact, the BDC Reporter intends to review, analyze and annotate the conference call transcript of every BDC out there between now and the next earnings season.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.