BDC Market Update: Wednesday November 3, 2021

MARKETS

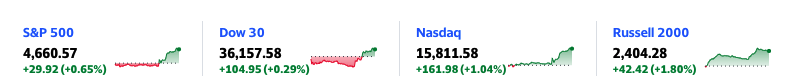

The Fed has spoken, tapering is to begin and the markets seem to be delighted, with the S&P 500, Dow 30 and NASDAQ all at 52 week price highs. Also at a record level, according to CNBC, is the Russell 2000.

All the above notwithstanding, BDC sector prices could not get a break. Once again the two major instruments that we track to measure price performance were in the red, as earnings season rolled on. BDCZ – the UBS-sponsored exchange traded note which owns most BDC stocks – dropped a solitary cent, or (0.06%), to reach $19.90. The Van-Eck sponsored exchange traded fund with the ticker BIZD fell 2 cents to $17.43, after reaching $17.53 at the intra-day high.

Of the 42 BDC stocks we track, 19 were in the black, 3 were unchanged and 20 were in the red. The biggest percentage mover to the upside was Capital Southwest (CSWC), up 4.2% to $27.03. Management of the BDC would like to believe that the price jump is related to their decision to take a big hit to NAV by absorbing the “make-whole” premium by redeeming their 2024 notes prematurely, and using the lower cost of capital to increase their regular distribution to $0.47 a quarter from $0.44. Chances are just as good that investors who fled the stock just before earnings were reported are – mostly – flocking back. Still, at its $27.03 closing price, CSWC remains below the level of $28.23 registered just before a major shareholder moved out of the stock, causing a near (10%) drop in price.

Otherwise, all the rest of the BDCs did not move much at all: the biggest percentage change 1.3% – both up and down. As has been the case for days, the BDC sector is not reaching new record territory, but is not falling all trhat much below those June highs either.

Two BDCs reached new 52 week highs today. One was Barings BDC (BBDC), which has not yet reported results, and closed at $11.30. The other was Sixth Street Specialty Lending (TSLX), which did report results AND three different distributions scheduled for the Christmas period, including a $0.50 per share supplemental. That might explain why TSLX reached a new record of $24.10. As this chart shows, TSLX not only broke its 52 week price record but reached a new all-time price level:

NEWS

We’ve spent every waking minute reviewing the earnings releases and other data from Sixth Street Specialty Lending (TSLX); Monroe Capital (MRCC); TCG BDC (CGBD) and Gladstone Investment (GAIN). After the close, we’ve also heard from Bain Capital Specialty Finance (BCSF); TriplePoint Venture Growth (TPVG); New Mountain Finance (NMFC); SLR Investment (SLRC); SLR Senior Investment Corp (SUNS).

Initially, we’ve been inputting the NAV Per Share data for every BDC and what information we can into the BDC Credit Table. Regarding the latter, with NAV Per Share from 19 BDCs, we notice that the average percentage increase is 1.7%, below the IIQ 2021 average increase of 2.2%, and 2.5% in the IQ 2021. With nearly half the BDCs reporting (we’re including Gladstone Capital’s – GLAD – preliminary number in all this), net book value growth momentum seems to be waning for the sector. That’s as might be expected with performing loan values having returned to close to par levels – as was the case before the pandemic – for some time now.

The biggest increase in this metric is GLAD, up 8.7%. We don’t have the particulars at this stage so we’ll defer any analysis. Second is venture-debt lender and investor TriplePoint Venture Growth (TPVG), whose NAV Per Share jumpred 6.8%. This is what the press release said on the subject:

“Generated a record $29.0 million of net realized and unrealized gains, resulting in a net increase in net assets resulting from operations of $38.9 million, or $1.26 per share”

TriplePoint Venture Growth Press Release – November 3, 2021

The BDC’s President said the following: ““We continued to generate sizeable gains from our equity and warrant investments, resulting in substantial NAV accretion“.

Also benefiting from the increased value of some of its equity investments was GLAD’s sister company – Gladstone Investment (GAIN), up 4.8%.

Across all the BDCs we’ve reviewed so far, the bulk of NAV Per Share improvement has come from higher valuations for equity stakes (common, warrants, preferred). As long as the broader markets continue to remain buoyant – as seems to be the case both for private and public entities- higher equity values should boost BDC NAV Per Share.

Still, some BDCs have performed a little less well by this metric than we would have hoped for. For example, BlackRock Capital (BKCC) – completing a long winded “turnaround” of its portfolio saw its NAV Per Share increase by 7.6% in the IIQ 2021, the third best result. This quarter,though, BKCC’s NAV Per Share is only 1.3% up, below the interim sector average. We’ll learn more about why that’s the case when the BDC holds its conference call on Thursday.

For a second quarter in a row, SLR Senior Investment (SUNS) has recorded a declining NAV Per Share. From the IQ 2021 to the IIIQ 2021, SUNS is down from $15.91 to $15.73. That’s only a (1.1%) drop, but goes against the general trend. The reasons are pretty clear- the BDC is distributing more than in its earnings and net realized and the BDC is making a small loss in the realized and unrealized gain on assets column. This quarter, SUNS sister BDC – SLR Investment Corp (SLRC) also saw its NAV Per Share drop: from $20.29 to $20.20. Net assets dropped by ($4mn) for the same sort of reasons as at SUNS.

Healing

Overall, though, the NAV Per Share data paints a picture of a BDC sector well on the mend from the pandemic. As of the close, 18 BDCs are reporting higher net book values per share than in the IVQ 2019. Investor enthusiasm – as we know – is high as well, with 23 of 41 BDCs (Cion Investment – CION – does not get counted) reporting higher prices now than at 12/31/2019 and all are above their year end 2020 prices.

Generally speaking what data we’ve assembled from BDC’s filings suggest credit quality continues to improve. Most of the BDCs that share their investment portfolio ratings (each with a different system) show underperforming assets as a proportion of the total dropping. In several cases, underperforming assets are at – or close – to pre-pandemic levels. Furthermore – as we’ve discussed – many BDCs have potential realized gains to harvest in the future that should mitigate or exceed any losses that might occur and to a far greater degree than in the pre-pandemic period.

Fly In Ointment

Nonetheless, we can’t help noticing that several BDCs have reported new non-accruals this quarter. The numbers are far from alarming but such different players as Capital Southwest (CSWC); Horizon Technology Finance (HRZN) and Gladstone Investment (GAIN) have each added one non-performer in the IIIQ. Most of the time the blame has been laid at the feet of the current environment with its logistical nightmares; rapid surge in input prices and the lingering impact of Covid.

We’re far from claiming that the credit tide has turned given that we’re still wading through the existing data and more than half the industry has yet to release its latest information. Moreover, we cannot deny that several BDCs are still moving non performing companies back to performing status without major restructurings and booking material losses (see ARCC and MRCC). Nonetheless, we’ll be keeping a close eye on credit changes throughout the rest of BDC earnings season – and beyond. Nothing lasts forever and after 6 quarters of improving credit metrics a reversal – even if modest – is not unthinkable.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.