BDC Commons Stocks Market Recap: Week Ended December 3, 2021

BDC COMMON STOCKS

Week 48

Questioning

Last week – with the sudden advent of the Omicron variant – we wondered whether we’d reached an “inflection point”.

Or, said otherwise, would market prices – including the BDC sector – drop unreservedly in the face of this new, but hard to quantify, threat ?

One week on, the answer is unclear as investors swing back and forth about the implications of Omicron for the markets.

The S&P 500 was up in price two days and down three days – same as the two BDC sector vehicles we use – BIZD and BDCZ (respectively an exchange traded fund and the other an exchange traded note, which both own most BDC stocks).

By the close on Friday, BDCZ was off (0.5%).

That’s a third week in a row in the red, but hardly a bloodbath.

(BTW, the S&P 500 was down (3.4%) in this period).

Mixed

Many of the other metrics we look at weekly were equally not clear cut, but did tend to lean to the negative.

For example 20 BDCs increased in price or were unchanged over the week, but 25 dropped in price.

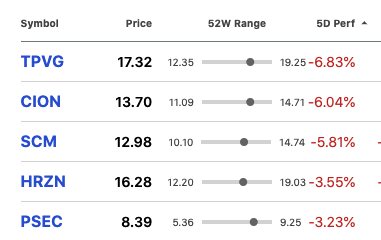

2 BDCs increased 3.0% or more in price (BXSL and BCSF) but 5 dropped (3.0%) or more. See below:

Tellingly, only 1 BDC reached a new 52 week high during the week (CION) compared to 4 the week before and 7 in the week before that.

Here at the beginning of December 12 BDCs continue to trade within 5% of their 52 week high, yet a month ago there were 29 in that category.

Where We Are

In this week 48 of 2021, BDCZ remains up 20.8%.

The Wilshire BDC Index – which uses slightly different constituents and calculates a “total return” is up 34.4%.

All but two BDCs (GECC and GSBD) have increased in price in 2021 YTD.

At this stage – and with just 4 weeks to go – the BDC sector seems set to have a very good year, barring a last minute price collapse brought on by Omicron or something similar.

Glass Half Empty

On the other hand, the chances of a last burst of investor enthusiasm bringing BDC sector prices to a new record high for the year seems to be diminishing fast.

At this point, BDCZ would have to jump 3.5% to match its 52 week high and BIZD 3.3%.

Unless we get news that Omicron is essentially harmless, we don’t see sector prices surging by that sort of margin – if at all.

Back To Basics

As we’ve noted in prior Recaps, the good news for BDC investors is that fundamentals remain strong.

This week we heard from one of the last BDCs to report IIIQ 2021 results: Golub Capital BDC (GBDC).

As discussed in the Daily Updates, GBDC hit all its marks: increasing NAV Per Share; decreasing underperforming assets and – most importantly – upping its quarterly distribution.

Big Picture

As the BDC NAV Change Table shows, 31 of 45 BDCs reported higher net book value per share than the quarter before.

The average increase was 1.1%.

This continues a sector 6 quarter streak of higher NAV Per Share, albeit the lowest percentage increase.

Down The Road

We expect that – barring a market meltdown that would drag down the value of investment assets – we should continue to see the BDC sector’s NAV Per Share metrics continue to improve, albeit modestly.

More Paid Out

Even more impressive is the outlook for BDC dividends in 2022 versus 2021. At the moment we’ve identified 20 BDCs that we expect will pay out more to shareholders than they did in 2021 in the coming year.

(This number includes Saratoga Investment (SAR), which increased its quarterly payout once again this week to $0.53 from $0.52, and could yet go higher. See the Tuesday Daily Update for a further discussion).

Exceptions To The Rule

In fact, only Newtek Business (NEWT) is projected to pay out less – and only because of its change of legal status and dividend strategy.

(There are 2 BDCs paying no dividend at all – LRFC and PFX – and that might continue into 2022. Both are elusive about the subject, which does not engender confidence. On the other hand, bothhave tiny AUM and market capitalizations).

Taking Advantage

Most of all, virtually all BDCs continue to benefit from what the BDC Reporter has dubbed the “Great Refinancing”, which is lowering the cost of debt capital for years to come.

This week NEWT announced its intention to repay some of its expensive unsecured notes, which yield 5.75%.

Although the BDC is busy changing its corporate form and preparing to get shareholder approval to do so, management recognizes that the markets are open, and relatively expensive existing unsecured debt can be shed.

We expect that by this time next year (and probably long before) both NEWT’s Baby Bonds – NEWTL and NEWTZ (which can be redeemed from February 2022) – will have been redeemed.

Another

In the same vein, when SLR Investment (SLRC) and SLR Senior Investment Corp (SUNS) announced their proposed merger this week, one of the benefits mooted by the manager to investors was the likely lower cost of borrowing that should ensue.

Rule Of Thumb

At this stage – and with long term rates still very low despite all those inflation worries – most every larger cap BDC can raise unsecured debt at yields ranging from 2%-3%, and smaller or less well performing players at 3%-5%.

Those are incredibly low rates, especially for medium term monies with virtually no covenants. (Where available, SBIC debt is even cheaper).

Furthermore, there is no end in sight to the Great Refinancing, which should continue unabated as opportunities arise in 2022.

In fact, some BDCs are not waiting around to refinance more expensive unsecured notes when they become redeemable, but are doing so to pay down secured debt facilities because the differential in cost is minimal or non-existent.

Optimistic

With so much in BDCs favor (and we’ve not even discussed many other favorable trends) it’s hard to imagine – short of an apocalyptic period as we witnessed in early 2020 or in the summer of 2011 or in 2007-2009 – too great a drop in BDC sector prices.

In the short run, much of anything could happen, but for the year ahead, the BDC Reporter continues to be optimistic.

Even 2023 – especially if rates rise by 1.0% or more – looks promising from this distance.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.