BDC Common Stocks Market Recap: Week Ended February 11, 2022

BDC COMMON STOCKS

Week 6

Jinx

We can’t help noticing that every time the BDC Reporter makes a sanguine statement like “the BDC sector seems headed to new price heights” something happens in Eastern Europe or inflation gets ramped up to record levels.

That was the story this week. Shortly after the BDC Wilshire Index reached a record all-time level on a total return basis and after BDCZ reached a 52 week price record, troubling news came out from the Ukraine, reversing recent gains.

On Friday alone, BDCZ – the UBS sponsored exchange traded note which owns most BDC stocks – reached a 52 week high of $20.58 intra-day before closing at $20.13 – down (2.2%) in minutes.

That closing price was (0.70%) down for the week.

Likewise, the Wilshire BDC Index ended up (0.75%) off the prior Friday’s close.

Of course, all the major indices were down as well and by a greater percentage.

For example, the S&P 500 fell (1.89%) in the last 5 days and a good deal more from its intra-week high when investors were not worrying about war and rampant inflation.

Affected

The number of individual BDCs that increased in price or were unchanged ended up being outnumbered by those that ended up in the red: 26 to 20.

Moreover, the number of BDCs trading at or above net book value per share decreased from 19 last week to 17 as of Friday.

Above Notwithstanding…

Nonetheless, the sudden change in the market mood came too late to make a great dent in what has been a good start to 2022 for the BDC sector.

Two more BDCs reached 52 week highs during the week.

Tops

Leading the way – and important given its massive importance to the sector’s capitalization – was Ares Capital (ARCC), which reached $23.00.

ARCC published record breaking results during the week AND increased its distribution level.

[The BDC Reporter undertook an in-depth review of the market leader’s conference call in a Premium article].Higher Payout

Similarly, the other record breaker – PennantPark Investment (PNNT)- increased its payout to shareholders.

Holding Strong

For the week there were still 14 BDCs trading within 5% of their week highs, just like the week before.

Roughly two-thirds of BDCs were priced within 10% of their 52 week price records.

Exception To the 46 BDC Rule

In fact, there was always one “troubled” BDC, going by proximity to their 52 week low price and that was Great Elm Capital (GECC), a very small BDC that accounts for less than 1% of the sector’s market capitalization.

Still Here

If BDC investors are spooked about the prospect of a European war and the sort of inflation we’ve not seen in 40 years there’s little sign in the week ending data tea leaves.

Which is not to say that when if and when hostilities begin we won’t see a run for the exits.

No Problem

Ironically, the inflation news and the resultant tough talk about raising rates by a full 1% shortly or 7 increases of 0.25% in 2022 alone is good news for BDC investors and supports the current price level.

That 1% boost in short term rates would almost immediately translate into higher investment income for most every BDC (assuming LIBOR/SOFR would be above 1.1%) and only a modest increase in borrowing costs.

In most cases, 80% or more of any incremental net earnings would benefit shareholders.

The 7 increases – albeit taking longer to take effect – would push the base LIBOR/SOFR rate to 1.85% and make 2023 BDC earnings ring out.

“Bring on those rate hikes” we can hear BDC managers saying.

“Turnaround is fair play”.

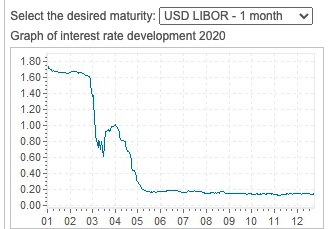

In January 2020, 1 month LIBOR dropped from 1.734% to reach as low as 0.127% in a New York minute, as this chart shows:

The average yield in 2019 had been even higher – 2.22%.

That means LIBOR – which is the base rate for virtually all leveraged loans – fell by more than 90% in recent years.

Even today, the 1 month LIBOR – which we’re using only to illustrate our point knowing full well the banks are using a similar but equal measuring stick – is at 0.13%.

For many BDCs, this drop in LIBOR has resulted in a 20% or greater lower return on loan assets.

Should we have a sudden come-back the economics of leveraged lending – and especially where BDCs are concerned – will be greatly improved.

Still A Maybe But Less So

Of course last week we felt it incumbent on us to point out that what the pundits say the Fed might do where short term rates are concerned and what will actually occur are often not the same.

We continue to be skeptical that the Fed can “tame” inflation with hikes in rates, or that they’ll even try, but we’re just guessing as much as the next person.

This week’s high CPI, though, has raised the political risk both for the Fed and the Biden Administration of seeming to not take inflation seriously enough, so the odds improved of an accelerated return to historic LIBOR levels.

Everybody Knows

BDC managers and analysts are very much aware of what might lie ahead.

On every conference call transcript we’ve read, someone has asked the managers what the impact of higher rates might be.

All point to higher income once rates pass above their “floor” rates, some of which could be breached with LIBOR/SOFR as low as 0.75%.

Back To Basics

Leaving aside what rates may or may not do in the short and medium term, the second week of BDC earnings season has continued to support the high price level of the sector.

As we’ve been reporting in our Daily Updates to Premium subscribers, the latest NAV Per Share results have been encouraging. With 13 BDCs now having shared their IVQ 2021 numbers, 11 have an increase in NAVPS, 1 is unchanged and only 1 is down.

Even the BDC in the red – Capital Southwest or CSWC- would be in the black if not for paying out a huge non-recurring special distribution in December.

This is the seventh quarter in a row where virtually all BDCs are reporting better NAVPS – an unusually long streak.

Ever More

Moreover, BDCs are raising their distributions all over the place. Besides ARCC and PNNT who we’ve already discussed, there’s been good news in this department from Barings BDC (BBDC); Capital Southwest (CSWC) Gladstone Investment (GAIN); Oaktree Specialty Lending (OCSL) and Saratoga Investment (SAR)

On Friday, soon-to-be-a-bank Newtek Business Services (NEWT) announced their “forecast” that their IIQ 2022 dividend would be $0.65. That’s the same level as the IQ but 16% above the level of a year ago.

Uncut

Maybe of equal importance, no BDC has shocked its investor base with an unexpected dividend cut. Yes, Apollo Investment (AINV) promised to pay only $0.35 per share on its next distribution, but that was only ($0.01) lower than before and left the door open for higher payouts later in the year. This Seeking Alpha author seems to think so.

At a time when interest rates have been low – despite all the talk about the future – the BDC sector is one of the only corners of the markets where payouts have been rising.

Not Over Yet

Of course, markets are always looking ahead. In the case of the BDC sector, though, and even leaving out the prospect of higher base rates, further dividend increases are in the cards even amongst some of those BDCs that have already raised payouts already.

Furthermore, the trends in credit continue to be favorable. As a glance at the wealth of data in the BDC Credit Table shows, there have been little or no new loans going on non accrual and several coming off, one way or another.

Furthermore, the value of underperforming assets is declining across the board, reducing the risk of new non performing investments down the road crimping BDC earnings.

Valuable Stakes

Also, many BDCs of all shapes,sizes and strategies are benefiting from higher values for some of their equity stakes. In many cases, this is resulting in material realized gains booked.

The recent success of PNNT is largely due to this phenomenon, and GAIN, CSWC, GLAD and SAR have also cashed in.

Even BDCs one does not always associate with realized gains have had success. For example, in 2021 ARCC recorded net gains of $283mn, equal to 30% of their Net Investment Income for the year.

Likewise, in the IVQ 2021 Golub Capital (GBDC) reported $14.5mn in realized gains, equal to one-third of its net investment income as well.

Starry Eyed

Normally when matters are going well in the BDC Reporter, we get philosophical and remind ourselves – as Carly Simon would say – “these are the good old days”.

Or, in other words, appreciate that this is as good as it gets.

This time round, though, there may be even brighter days ahead for a sector that has two years of the wind to its back.

We’re not even sure that a bloody war in Europe – if contained – could derail matters.

Or are we jinxing the BDC sector again ?

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.