BDC Common Stocks Market Recap: Week Ended February 4, 2022

BDC COMMON STOCKS

Week 5

Comeback

After a truly miserable January for the major markets – albeit not for the BDC sector – the month of February began brighter.

Admittedly it’s early days, but the major indices are in recovery mode, with the S&P 500 up 1.55%.

The BDC sector – as measured by the price movement of the UBS-sponsored exchange traded note (BDCZ) which owns most BDC stocks – was up 2.63%.

That’s more than twice the prior week’s 1.23% gain.

Record Breaking

We should note a milestone along the way: on Wednesday February 2, 2022 the Wilshire BDC index – using the “total return” feature – reached a new 52 week and all time record high.

The Wilshire index was at 365.012, before closing slightly down from there on Friday at 364.115.

Not Far Behind

BDCZ itself is performing well, but is not quite at its 52 week top of $20.55, ending at $20.27 – just (1.4%) away.

By the way, that other measuring stick we use in our daily updates – the Van Eck sponsored exchange traded fund which owns most BDC stocks with the ticker BIZD – is (2.2%) off its own 52 week record.

It’s All Good

Regardless, all the BDC metrics for the week were plenty favorable.

For example, 42 of the 45 BDC stocks we assiduously track were up in price and only 3 in the red.

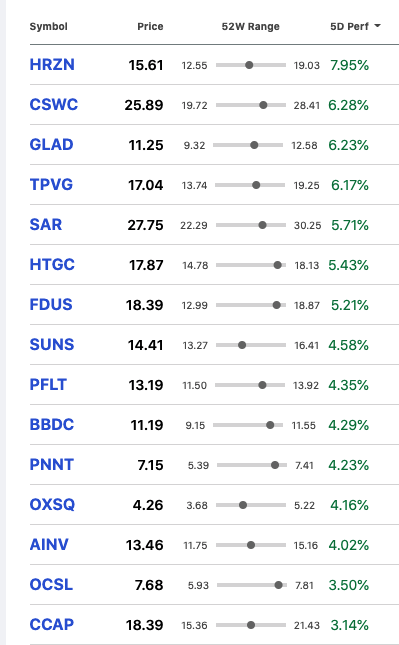

An impressive 15 of the 42 stocks in the black were up more than 3.0% this week, some by very significant percentages.

It’s as if some investors let out a sigh of relief and jumped back into the sector.

Here are all 15 BDC stocks in this category – the largest number we’ve counted since April 2021:

Motley Crew

We pored over the list above to ascertain if there was any commonality amongst the BDCs involved.

We couldn’t really identify any.

There are large cap and very small players; brand name assets managers and no names; specialty strategies and bread and butter lenders.

All of which points to a general “re-rally” – as we’ve taken to call what’s going on.

Piling On

On a related note, there are twice as many BDCs now trading (14) within 5% of their 52 week highs than last week (7) and just 4 two weeks ago.

In fact, 29 BDCs are trading within 10% of the 52 week price record.

Another metric that confirms how drastically the mood has changed in a very short time: there are now 19 BDCs trading at or above net book value per share.

That compares with 15 in each of the two prior weeks.

Don’t Look Away

As mentioned, this reversal of BDC fortunes has occurred in the twinkling of an eye.

BDCZ – for example – was at its 2022 nadir as recently as January 24, 2022.

Since then, and of Friday’s close BDCZ is up 7.2%.

Better Than All The Rest

We’re especially impressed – as an observer – about how much better than the major indices the BDC sector has performed in 2022 to date.

Typically – as we’ve mentioned too many times to count – the BDC sector is the wagging tail of the major markets.

This year it’s different, as this YTD chart comparing BDCZ to the S&P 500, Nasdaq and the Dow Jones, shows:

Remember: the chart only shows price changes over the period. If we used “total return” the BDC performance would be even better.

Why ?

We don’t believe there’s any great mystery here.

Even though LIBOR/SOFR is still trading close to zero, investors are looking ahead to the much promised/threatened multiple increases in the Fed Funds rate.

The calculation is that loan yields – tied as they are in almost every case to what the Fed says they should be – will shoot up.

Currently, LIBOR/SOFR is at 0.11%. A year from now, the markets expect that the reference rate will be 1.25%-1.50%.

Like fast moving tanks over flat terrain, investors expect LIBOR/SOFR to quickly overtake whatever the level is of most BDCs “LIBOR floors”, allowing them to charge more for all their existing loans and those to be booked in the future.

Both Sides Now

Adding to the potential gains, the huge shift in recent years from relying on LIBOR-tied revolver financing to a far greater reliance on fixed rate, unsecured note debt will mean very little in the way of offsetting borrowing costs.

There’s nothing for the BDCs to do – just take in that higher income while paying much the same on their borrowing.

Visionaries ?

No wonder that sophisticated players like market leader Ares Capital (ARCC) has been loading up with unsecured debt for a long time.

Last time we checked virtually all their outstanding borrowings were fixed in nature, with its revolvers serving more like back-up lines than a central financing source.

All Around

However, it’s not just the large cap players who’ll benefit should interest rates rise.

Look down the list of public BDCs and you’ll find even some of the smallest players are well equipped for what lies ahead.

Thankfully, the SBA has been generous in recent quarters granting new licenses to borrow cheaply with ten year SBIC debentures.

A significant number of BDCs can boast borrowing funds in this way for a decade for a yield cost just above 1% !

The BDC Reporter understands the market’s calculation of what should happen to rates, and how BDCs should benefit.

Un-Assuming

We’d be failing in our duty, though, as BDC financial curmudgeon (we prefer “truth teller”) to warn that matters may not go as planned.

After all, investors are looking a year or more into the future. Some observers are projecting Fed Fund rate increases reaching into 2023 and then into 2024 and beyond, with the LIBOR/SOFR rate following along.

The BDC Reporter will put it’s hand up and question the Fed’s commitment to a long and harsh program of unrelenting interest rate increases, like some periodic delivery of castor oil for our own good.

Certainly so far – with inflation breaking all sorts of multi-decade records, the Fed has mostly resorted to predicting rate hikes rather than doing anything, presumably trying to talk down the challenge.

Alternative Scenario

If the pandemic does abate shortly and the global economy gets its operations under control that might take much of the wind out of the inflation sails even before higher rates begin and take the Fed off the hook of a policy that they’ve not implemented in many years.

Should something like that occur – and if short term rates peak out somewhere under 1.0% (below the average “floor”) – investor enthusiasm could cool fast.

We’re not taking anything for granted, nor should BDC investors.

Each Like A Snowflake

Also, we should also point out that even if rates do rise sharply and quickly, the impact by BDC will vary widely in terms of potential incremental earnings.

A rising tide may raise all boats but some will benefit greatly while others will be barely affected.

A good look at the micro-economics of your favorite BDCs is recommended, and much reading of the footnotes in the filings and of the terms of loan and financing arrangements.

Week Two

These risks and opportunities are all in the future.

In the short run, the BDC Reporter will be more focused on the second week of earnings season and gauging how a number of BDCs ended up 2021 – which was a very good year by almost every measure.

The results so far – but with only 5 BDCs having reported their IVQ 2021 numbers – are reassuring, and in line with our expectations and those of the markets.

Catch the BDC Reporter’s Daily Updates to determine if this continues in the week ended February 11, 2022.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.