BDC Common Stocks Market Recap: Week Ended March 25, 2022

BDC COMMON STOCKS

Week 13

Back In The Saddle

The BDC sector increased in price for a second week in a row.

BDCZ – the UBS sponsored exchange traded note which owns most BDC stocks and which we use as a price guide – increased by 1.80%.

While the week before, the BDC sector lagged the major indices, this time BDCZ was almost exactly in line with price growth at the S&P 500, which was up 1.79%.

Like the week before, most BDC stocks were in the black – 39 of 46.

One And Only

In fact, the only individual BDC to take it on the chin where price is concerned was Logan Ridge Finance (LRFC), off (6.5%).

We wrote about the non-dividend paying BDC which recently announced its year end 2021 results on March 21 and March 22, and we are not particularly surprised by the drop.

With no dividend resumption on the horizon; a lower reported NAV Per Share for a third quarter in a row; some residual credit problems and a lack of clarity about how its Baby Bond and publicly traded convertible debt will be refinanced in May, there is much to worry about.

Here is the BDC’s YTD price chart:

This is nearly a one year low for LRFC and leaves the tiny BDC trading at 56% of net book value – the biggest discount of any public BDC we track.

Fingers Crossed

However, we can’t help pointing out that even as this late date – and with LRFC’s AUM under $200mn – the manager could yet finagle a Great Escape.

Much has to happen, including the sale at current values or better of multiple equity stakes; the arranging of a new, enlarged and decently priced secured debt facility that will boost the size of the portfolio; the repayment of the Baby Bond/Convertible without incident and no new major credit slip-ups. Of course, a boost in interest rates wouldn’t hurt.

We suggest reading our annotation of the IVQ 2021 earnings conference call where the path from loss making to (modest) profitability is laid out and analyzed.

Stranger things have happened, but BDC investors are not yet convinced the new advisor can deliver and may just be content to draw its compensation while shareholders remain in the red both at the operating and bottom line.

Brighter Side

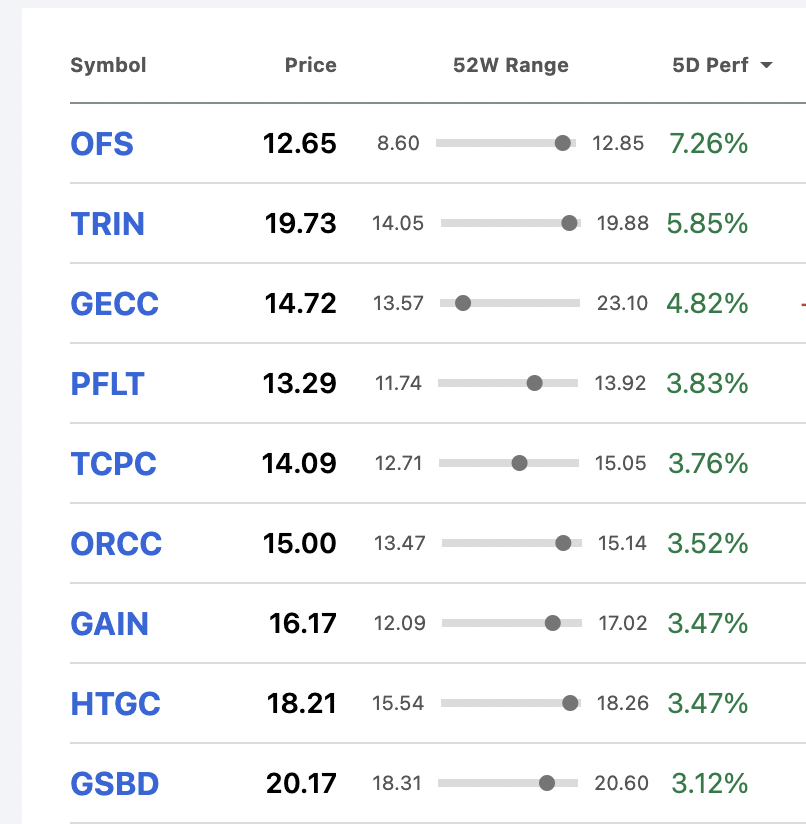

On the upside, there were 9 BDC stocks (roughly a fifth of the total up 3.0% or more, as this table drawn from Seeking Alpha shows:

There’s every sort of BDC on that list, and all sorts of back stories.

Record Breaking

We’re impressed with how many BDCs on the list are trading close to their 52 week high.

In fact, this week 4 different players reached that 52 week milestone – a telling number during what is supposed to be a troubled market.

14 BDCs are now within 5% of their 52 week highs and another 16 between 5% and 10% – or two-thirds of the universe.

That’s the highest we’ve seen in weeks and since the invasion of the Ukraine and worries about inflation/rates/the economy caused a generalized pullback.

At the moment that seems to be fading – both for the major indices and for the BDC sector.

In The Black And Close To The Top

As of Friday, BDCZ was up 1.2% in 2022 YTD.

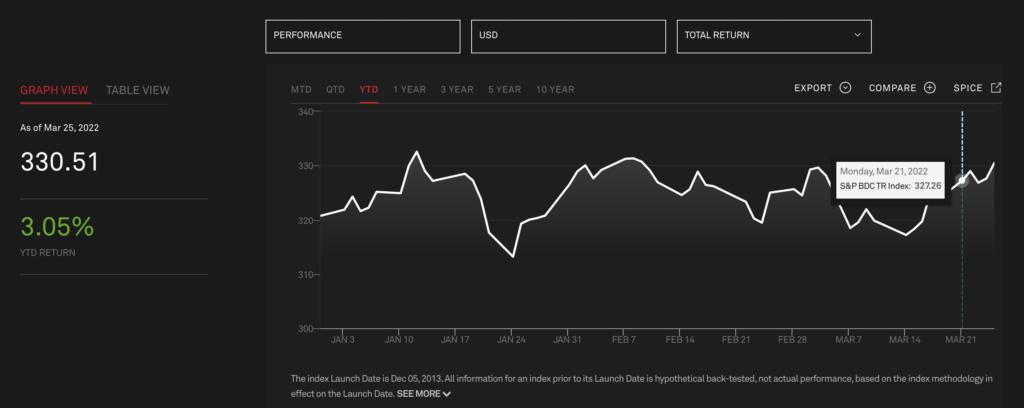

Furthermore, the S&P BDC Index (which we are using instead of the Wilshire BDC Index because the latter is down for “maintenance”) is up 3.05% on a total return basis.

As the YTD chart of the S&P BDC index shows, we’re not quite back at the highest point achieved back on January 12, 2022, when the index reached 332.57, or in early February and March.

However, at a closing price of 330.51, the S&P indicator is only off (0.6%) from its highest level…

Tough Sledding

We won’t pretend, though, it’s been an easy first quarter of the year to be invested in BDC stocks.

Notwithstanding the performance of the S&P BDC index, slightly more sector stocks have been in the red than in the black in these first 13 weeks.

Moreover, there have been some relatively large price drops during this period, led by Horizon Technology Finance (HRZN), off (12%) and with single digit losses (6%-7%) from well known names like Capital Southwest (CSWC); Main Street (MAIN);Saratoga Investment (SAR) and Barings BDC (BBDC).

Investors, though, will take comfort that all those BDCs fundamental performance and outlook are strong, and the red ink has more to do with short term profit taking after huge price run-ups in 2020-2021 than any deep seated concerns.

If we do get a further BDC rally expect to see some or all those biggest percentage price losers revive in the months ahead.

Rather In Than Out

Overall, though, investors who stayed long BDC stocks during these turbulent times have fared pretty well even as many pundits in the broader markets have preached that the long term bull market is over, and all we have to look forward to is some level of price crash.

Of course, that may be round the corner, but with the first quarter almost at a close there are no clear signs in the tea leaves of imminent destruction.

There are positives and negatives, but the former appear to be in the ascendant. Here are some of the main trends:

Less Busy

Based on what we’ve heard from BDC managers on nearly four dozen conference calls and from what’s happening in the broader leveraged loan markets, which we constantly investigate for clues, we expect that IQ 2022 investment activity will be significantly lower than in the IVQ 2021.

That’s partly because last year’s financing level was unusually high and the fact that the first quarter is typically the slowest of the four quarters. Add to that the impact of the Ukraine war, which has tamped down deal doing for the moment. Not helping is that the uncertainty about how much interest rates will rise is making the structuring and pricing of new leveraged buyouts more complicated.

Lower Fees

BDCs that have book substantial income from turning over their portfolios at a rapid pace (especially venture lenders) may see their Net Investment Income Per Share modestly impacted.

As an example, we notice that the analyst consensus for Hercules Capital (HTGC) was for NIIPS of $0.34 in the IQ 2022 90 days ago, but has dropped to $0.31. (IVQ 2021 NIIPS was $0.35).

There’s a similar process underway at HRZN, although not at TripePoint Venture Growth (TPVG).

However, most BDCs will be happy to contend with less portfolio turnover, which was reaching absurd levels last year.

Opportunity Knocks

Furthermore, the current market turmoil, is likely to benefit BDCs as borrowers that might have tapped the syndicated loan market turn to direct lenders with deep pockets.

In many cases, we expect to see terms and loan spreads on new deals be more lender-friendly that at any time since 2020.

If that continues more than a few weeks, the result will be higher investment income and EPS even before we get into a discussion of when and how much floating rates rise.

Good Enough

Credit conditions – despite worries about oil prices and such – remain favorable, even when putative increases in borrowing costs are considered.

Admittedly, much of the data from S&P, Fitch and Moody’s that we’re looking at is backward looking, but leverage and interest coverage levels are well off their highest levels.

We’ll be looking for signs of stress in BDC IQ 2022 portfolios such as larger discounts or more non accruals.

Common sense would dictate that the credit picture should weaken, but that does not mean a material impact on BDC earnings will result.

Shrinkage

In the short run, we expect investment values will be lower when calculated on March 31, 2022 than at 2021 year-end. This might end the 7 quarter streak of the BDC sector recording positive increases in NAV Per Share, but any red ink should be very modest.

Booster

Finally – and looking further down the year – higher floating rates seem certain to happen. By the IIQ of 2022 we may witness material benefits to BDC top lines and bottom lines as “floors” are quickly passed.

Investors – like the BDC Reporter – are likely expecting an unexciting IQ 2022 where BDC results are concerned but a rapid improvement thereafter, which probably explains why the sector is trading so close to its highs.

Elephant Outside The Room

The big unknown in all this is whether investors looking at the inverting yield curve in the bond markets and earnings in the rest of the year begin to countenance that a recession is slouching this way in 2023 or 2024.

If that should happen – and we’re already hearing those sort of warnings from various pundits and institutions – the current rally would go into reverse, and fast.

Judging, though, by BDC prices in recent weeks and YTD – both as a group and for individual stocks – that sentiment is very much a minority view.

For the moment, the way ahead for 2022 – with a little over 9 months to go – points to higher BDC prices – and a new 52 week high if BDCZ just increases 1.2%.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.