BDC Common Stocks Market Recap: Week Ended April 1, 2022

BDC COMMON STOCKS

Week 13

No Joke

The BDC sector – and the major indices – were up for a third week in a row.

We can say – looking at all the data we’re about to roll out – that yet another spurt in the long standing BDC rally is underway.

Let’s start with BDCZ – the UBS sponsored exchange traded note which owns most BDC stocks – which closed at $20.59.

That was up 1.3% for the week, better than the S&P 500 which only moved up 0.1%.

Record Breaking

Moreover, BDCZ reached $20.60 earlier on Friday April 1, 2022 – a new 52 week high.

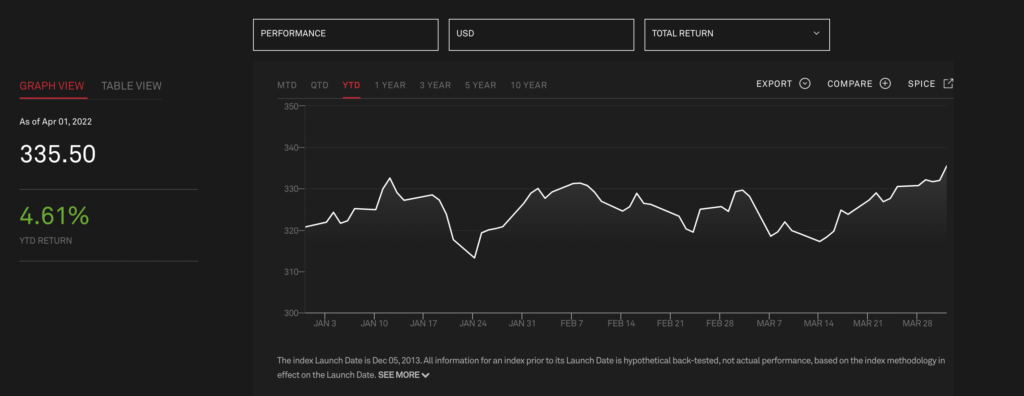

The S&P BDC Index – calculating a total return – was also at a new high for the 2022 YTD and for the last 12 months:

By the way, this index is also at its 10 year high.

Piling On

There’s more:

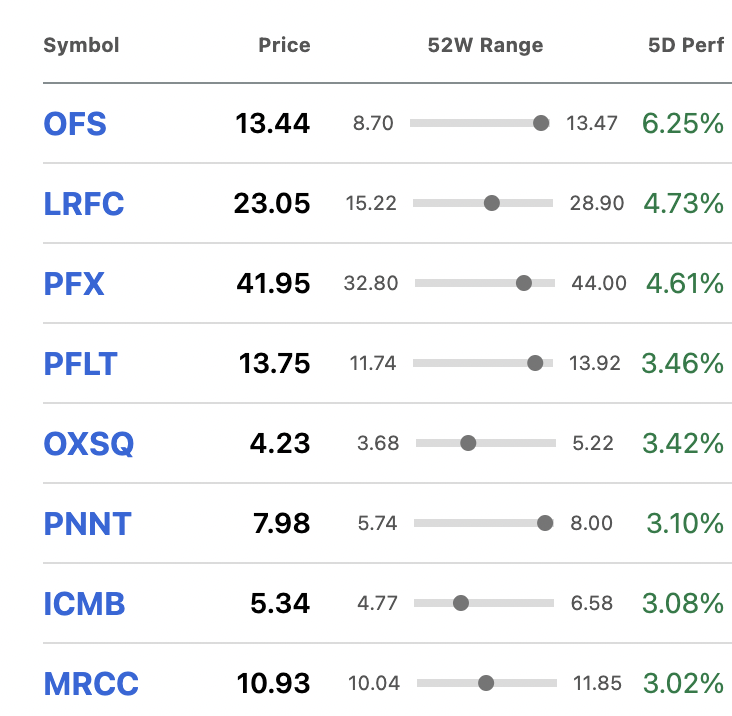

39 BDCs out of 45 – now that SLR Senior Investment Corp, with the ticker SUNS has been merged into SLR Investment Corp SLRC.

Of those stocks in the black, 8 were up 3.0% or more.

Only 1 BDC stock fell by (3.0%) or more. That was Cion Investment (CION), which had been on an upward tear and remains up nearly 20% on a 30 day basis.

5 Month High

Another favorite metric we trot out every week – the number of BDCs trading at or above net book value per share – reached 20, up from 18 the week before and the highest level since mid- November 2021.

This metric was at 15, just 3 weeks ago…

Most telling of all, 16 BDCs are trading within 5% of their 52 week highs in a week where 7 players breached their 52 week highest price.

Where We Stand

For the month of March alone, BDCZ increased 1.6%.and the S&P BDC total return index 1.95%.

On a YTD basis – as of April Fool’s Day – BDCZ is up 2.6% and the S&P BDC index, that we showed above , is up 4.61%.

Over these 3 months and one day, 27 individual BDCs are up in price and 18 are down.

2022 YTD Winners

5 BDCs have increased by more than 10% in price alone over this relatively short period, less by OFS Capital (OFS), which jumped 29%; PennantPark Investment (PNNT) 21% and Fidus Investment (FDUS).

We’d say the first two names are come-back stories: BDCs that underperformed in prior periods but are recovering both in terms of results and investor sentiment.

FDUS had a moment of doubt early in the pandemic but has been performing well for many quarters, and recently boosted its dividend more than already expected.

The lower middle market focused BDC, which shot up price-wise between 2011 and 2013 and then slumped for years as momentum investors bailed is back to a price level not seen since 2014.

Just a 10% or so price hike and FDUS will be at an all-time record level.

Rough With The Smooth

Of course, it’s not been all wine and roses for BDC stocks.

Three have dropped more than (10%) in 2022.

Leading the pack – and as you’d imagine given what has happened over there – is Great Elm (GECC), off (21%).

At its lowest ebb GECC was down (27%), but has picked itself up of late.

Down (15%) is Blackstone Secured Lending Fund (BXSL) – (23%) at its nadir.

Here we blame previously illiquid shares becoming tradable and lowering the price despite excellent results for this very large BDC.

Nonetheless, BXSL is valued at 11.7x projected 2023 earnings and a 9% premium to net book value, underlining that there’s no reason for its shareholders to panic.

Irrational Exuberance

As we noted for FDUS, it’s quite common for BDC stocks to become briefly very popular and trade at stratospheric prices before falling back to earth.

We’ve seen similar stories at Goldman Sachs BDC (GSBD) and this year at Horizon Technology Finance (HRZN), which is down (12%).

Something happened to the smaller sized venture debt BDC – which had climbed hugely in price during 2020 and 2021 – in November 2021.

Since then, HRZN’s stock price has dropped as much as (25%) despite no comparable change in actual financial performance or outlook.

The BDC currently trades (27%) below its 52 week high.

Looking Forward

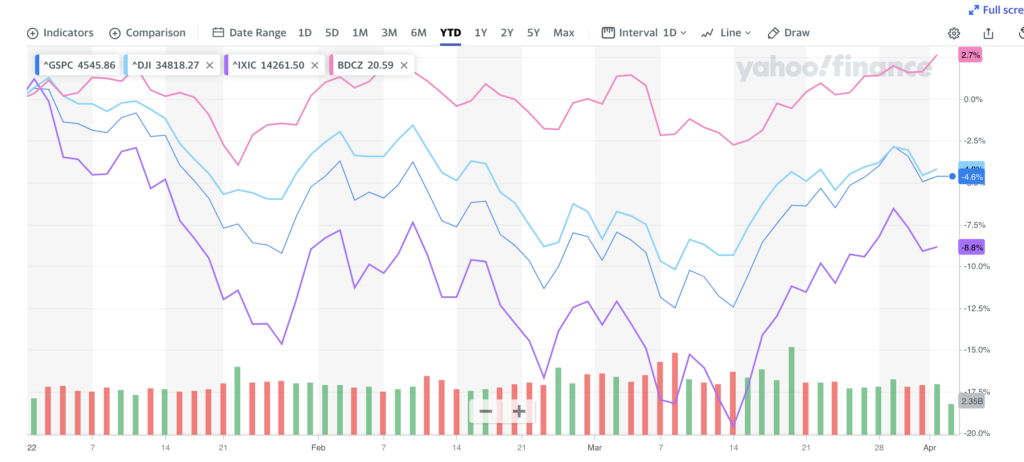

The BDC sector as a whole continues to outperform the major indices, but the gap has narrowed.

Still, the S&P 500 index is trading (5.7%) below its 52 week high at a time when BDCZ and the S&P BDC total return index are at new records.

All the major indices are down this year, while the BDC sector is up:

Set To Go

As always we expect the popularity of BDC stocks has to do with the almost universally solid dividend performance achieved and expected, as well as investors positioning themselves for expected higher earnings as short term rates rise as promised by the Fed, and generally expected by the market participants.

Not Yet

No material gains from this last source, though, will show up in the sector’s IQ 2022 results (due in a month) and only a little in the IIQ 2022.

In fact, we wouldn’t be surprised to see overall NAV Per Share and earnings drop in the IQ 2022 over the IVQ 2021 results before improving in the second half of the year.

Important Question

We wonder if investors will look beyond any “transitory” – to borrow the term the Fed used to use about inflation – drop in performance, should we be right that the next set of results may look lackluster ?

A temporary loss of confidence – or any number of other challenges in the broader environment – might put an end to the current rally but the longer term outlook – thanks to that quintupling of short term rates – points to BDC prices capable of reaching yet new highs.

Ending On A Positive Note

As this 2 year chart of BDCZ shows, the sector has been in rally mode – to varying degrees and with pauses along the way – since April 2020 and with no end in sight.

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.