BDC Common Stocks Market Recap: Week Ended May 20, 2022

BDC Common Stocks

Week Twenty

Not Good

The week ended May 20, 2022 was – arguably – the worst of the year for BDC sector prices.

In fact, digging back into our records, the (4.5%) drop in the value of BDCZ – the UBS sponsored exchange traded note which owns most of the public BDC stocks – is the greatest we’ve recorded since the week ended October 30, 2020.

Multiple Blows

What makes matters worse for BDC investors – who were flying high as recently as April 20th – is that BDCZ has been down greater than (4%) three out of the last four weeks.

The S&P BDC Index – which we use principally to track “total return” – fell (4.13%).

If it’s any consolation, that’s a tiny bit less worse than the week’s before (4.15%) drop.

Exceptions To The Drops

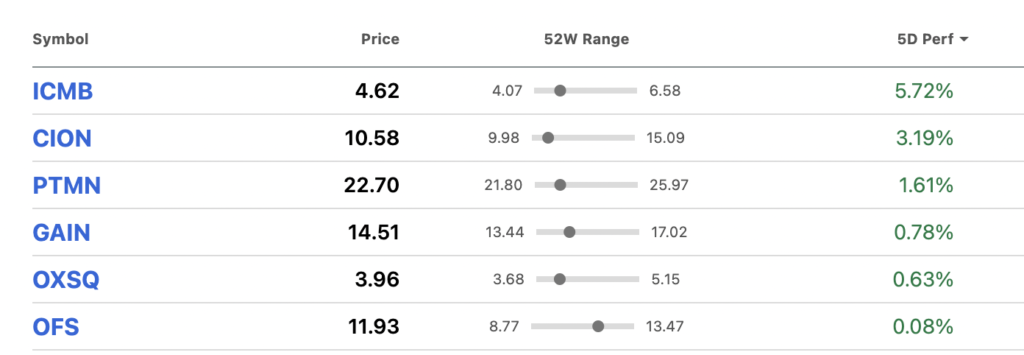

Of the 44 BDCs we track, 36 were down in price this week and – remarkably – 8 were up or flat.

For the record, here are the BDCs which managed to survive the general melt-down:

These are mostly curiosities because the sector trend was all to the downside.

Illustrative Numbers

A week ago we still had five BDCs trading within 10% of their 52 week high price (although none within 5%).

This week there were none.

This week 16 BDCs reached new 52 week lows, versus 11 the week before.

By Friday, 28 BDCs were trading within 5% of their 52 week lows, and another 7 were within 5%-10% of that nadir.

High Anxiety

In another sign of market stress – if one is needed at this point – 21 BDCs decreased by (3%) or more this week, following on 30 the week before.

This is not a retreat, but a rout and is in line with what is happening in the broader stock market.

For example, the S&P 500 was down (3.1%) this week and after flirting with “bear market” levels dropped (19%) off its January 2022 high – now just a distant memory.

The NASDAQ is even further in the red – down (30%) and well into “bear” territory.

Relatively

Nonetheless – and this may be good news or bad news for BDC investors – the sector’s metrics remain far from the levels of the early days of the pandemic two years ago.

Then – as we remember well – prices fell so much that no BDC traded at a price above its net book value.

As of Friday, though, there were still 12 in that category.

Moreover, BDCZ – as the chart below shows – remains far above the levels reached in late March 2020 when everyone assumed a monumental Covid-induced recession was coming – and before the Fed pulled a recovery rabbit out of a hat:

Unfortunately, that’s probably bad news as BDC prices may still have a long way to go before reaching a similar bottom to 2020.

Usual Suspect

This time – in an ironic twist of fate – the Fed is effectively seeking to cause the recession which two years ago it sought to avoid.

The main Fed tool two years ago was a drastic drop in short term rates – which played havoc with BDC earnings.

This time the Fed is on the other foot, drastically increasing rates. That’s excellent news for future BDC earnings but investors don’t care right now and are focused only on the impending recession and it’s expected corollary of much higher credit losses.

Pre-Ordained

As we’ve written about before, there’s a certain Greek tragedy-like inevitability to how the market reacts to the threat of recession – both for BDCs and common stocks generally.

Once sentiment turns dark, no earnings report, no good news, no upbeat prognosis can keep investors from selling at every opportunity, especially following any brief price rally.

Here is the price chart for BDCZ since its April 20 peak:

As you can see, every time BDCZ picks itself up a little, the sellers jump in and push the price further down, with occasional surges in trading volume.

After just over a calendar month, BDCZ has dropped just short of (15%) – well into “correction” and “bear” territory within sight within as little as a week or so.

Improbable

However – and switching from being descriptive to being predictive – we don’t believe – even if we do get this most telegraphed recession in the history of recessions – BDC prices will drop to the level of late March 2020, or the worst of the Great Recession.

Past performance can be instructive but every downturn is different and causes variance in investor behavior.

Last Time Was Different

Already, the 2022 downturn is different than that of 2020. Two years, BDC prices had dropped (39%) from their high on February 17 2020, more than twice the pace of this retreat.

Moreover – although nobody knew it at the time – BDC prices were fast reaching a bottom and were girding themselves for a rally that would see BDCZ increase 123% in price by mid-2021.

In that period BDCZ increased almost twice as the fast as the S&P 500, which was also wearing its running shoes.

Conventional Wisdom

We don’t rule out a mighty rally in BDC prices might eventually occur but the chances that we’ve reached a permanent bottom as of now seems unlikely given the never ending drumbeats of recession which market watchers now can see in every data point, even favorable ones.

This fever is unlikely to break until we actually get the much promised recession – which most observers believe begins in 2023 – or we see both a sustained drop in inflation and evidence of the economy limping through to its proverbial “soft-ish landing”.

Neither scenario seems anywhere near.

Instead – and we’re continuing to be predictive here, which is another word for speculative – we expect the uncertain environment to continue for some time to come.

Cooler Heads ?

This will continue to place pressure on BDC prices, but also give time for BDC “bulls” to weigh up whether the drop in prices is excessive given the fillip the Fed is giving to BDC earnings with higher rates, which are already boosting earnings and will do even more at the next meeting, when a further 0.5% increase is expected. (We may even see a 0.75% boost).

Risk Of Loss

Much will depend on what happens to the state of leveraged credit. Now that IQ 2022 BDC earnings season is complete (except for Capital Southwest’s results), we can see that BDC credit conditions are in good shape almost across the board.

Again, we have the Fed to thank for pumping up the economy in 2020-2021 which gave an opportunity for troubled borrowers to mostly work themselves out by dint of a sale of the business; fresh capital from the sponsor and the PPP program and time to restructure their balance sheets.

No Cracks Yet

By the way, it’s not just the BDC sector. Leveraged loans generally remain in a very good place where credit metrics are concerned, as confirmed by a very recent Fitch Ratings report:

A glance at the BDC Credit Table – and the many articles we write on the subject – will show that the value of underperforming investments is on the low side; very few new non accruals are popping up and those already on the books are getting written down to non material levels.

Tsunami Expected

The recent drop in BDC values implies markets expect ($6bn-$8bn) in permanent losses coming down the pike from what was anticipated just a month ago.

Obviously, we cannot say that’s impossible, but it seems very unlikely for anyone looking at fundamentals, and taking into account the increasing ROA and ROE that BDCs should benefit from.

Our own – admittedly incomplete data – shows total non accruals on the books of 40 BDCs aggregates about $800mn currently.

Do markets really expect that metric to increase ten fold, or worse ?

Undeterred

We also reviewed every analyst EPS estimate for 2023 compared to 2022.

We found that 31 of 42 for whom we had data expected an increase in Net Investment Income Per Share in the very year the recession is expected, 2 are expected to be unchanged and only 9 drop – none of them materially.

Maybe the analysts are being wildly optimistic or do not project recession-caused losses till the actual crisis occurs.

Nonetheless, those key numbers – which jibe with the BDC Reporter’s own dividend projections for 2023 over 2022 – do not suggest that a huge BDC price decline is justified.

Gone Too Far ?

We’re often reminded that the markets are forward looking but that they often overshoot both at the bottom and top.

With BDCZ and the S&P BDC index on a price basis down (15%) already from the 2022 high an argument could be made that investors have looked ahead AND already overshot the likely impact of a mild recession.

On the other hand, fear is hard to control when all about you are losing their heads – to paraphrase Kipling – so we may may yet see further lows.

Yes, But

Nonetheless, given the extended time frame of the run-up to this expected recession, we still don’t expect BDC prices to approach the depths reached in 2008-2009 or in March 2020.

That means less blood in the streets in the months ahead than could have been the case otherwise, but also less opportunity for the modern day Nathan Rothschild investor to rack up huge gains by buying now and selling somewhere between 2024-2026…

Putting It Out There

At this BDC price level – and assuming the economy eventually stabilizes at 2% inflation and with short term rates around the level they were in February 2020- we could see BDCZ reaching $21 at some point – a 20% increase from Friday.

Much else, though, has to happen in-between, which might include further price declines but the BDC Reporter does not yet envisage any catastrophe occurring to BDC balance sheets and earnings even if we get a recession.

Juicy

In fact, this is a good time for long term investors to sharpen their pencils and start looking for some bargains.

By way of example, Main Street Capital (MAIN) – much beloved by investors till recently – is (24%) below its 52 week high; Ares Capital (ARCC) off (21%) – only a few weeks after a successful secondary and Hercules Capital (HTGC) – which reached a new all-time high a few weeks ago – is off (29%).

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.