BDC Common Stocks Market Recap: Week Ended May 6, 2022

BDC COMMON STOCKS

Week 18

Not Reflective

The numbers do not tell the story.

For the week, the BDC sector – as measured by the UBS sponsored exchange traded note with the ticker BDCZ – was up a modest 0.42%.

The S&P BDC Index – total return – increased just 0.19%.

The S&P 500 index was down just (0.21%).

Wild

However – as market participants know only too well – day to day price movements were much more extreme, both up and down.

For example, BDCZ started the week falling intra-day by (2.6%).

Likewise, on May 5, BDCZ was down (3.4%) from the prior day’s close at its lowest point, before moving up.

By the week’s end, though, BDCZ broke a 4 week streak of downward prices.

Low Point

At the nadir on May 5, 2022 BDCZ was (7%) off on a year-to-date basis and nearly (10%) below the sector’s highest point, reached as recently as April 20.

However, as of Friday, BDCZ was down only (4.1%) in 2022 and the S&P BDC index – which includes dividend received – only (1.4%).

To compare and contrast, the S&P 500 index is down (13.5%) this year, and the NASDAQ and Russell 2000 even more.

Of Concern

Notwithstanding the modest increase in the price of BDCZ this week and the still high level on a YTD basis, cracks are appearing in some individual BDC prices.

By our count, 11 of the 44 BDCs we track (we’ve just dropped Silver Spike – SSIC – from coverage), are trading within 5% of their 52 week lows.

Furthermore, while there were 16 BDCs trading within 5% of their 52 week highs at the beginning of April, there are now only 3.

Using a new statistic we’ll be trotting out regularly, only 14 BDCs can boast of having a higher stock price at May 6, 2022 over the level at year-end 2021. If we eliminate the BDCs up less than 1% over this period, the number is just 10 – a quarter of the coverage universe.

In The Red

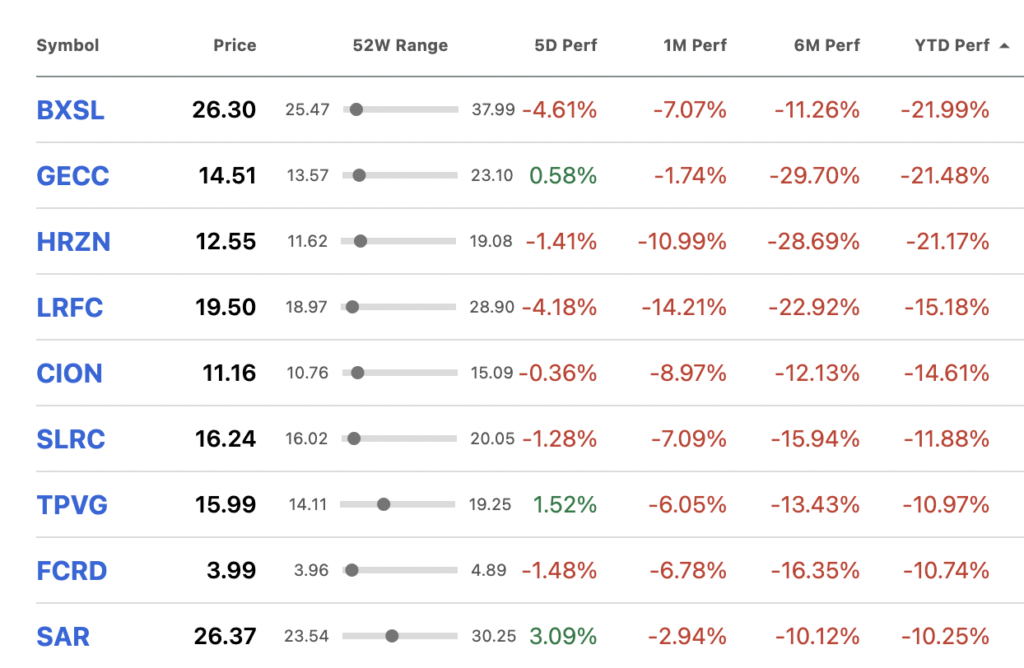

We also note that quite a number of BDCs have seen their stock price punished, with a quarter down (10%) or more, and a chosen few down more than (20%). See the final column of the table below:

Perennial

All of this begs the question as to where the BDC sector is headed for the rest of 2022.

On the one hand, looking at the overall sector data one could make the case that the BDC sector has been extraordinarily resilient at a very difficult time in the markets.

Even now, 17 BDCs are trading at or above net book value – not far from the level we’ve seen when BDC rallies are at full pitch.

Looking Good

What’s more, what we’ve seen of BDC earnings season so far – just over halfway done – is encouraging as to recent performance, if we paint with a broad brush.

Despite huge drops in value in the public market, average BDC NAV Per Share is barely down at (0.3%) over 23 names. See the BDC NAV Change Table.

As Anticipated

Earnings in the IQ 2022 have generally been lackluster but mostly by comparison with a red hot IVQ of 2021 and because of an understandable – and likely temporary – slowdown in leveraged loan activity brought on by the multiple uncertainties about rates, inflation and the war in Ukraine.

Job One

That most important element – credit quality – continues to look good. Yes, there have been a handful of new non accruals reported, which the BDC Credit Reporter has pounced on. However, in a BDC portfolio company universe of 4,000 or so entities, the number of newly non performing borrowing is still very low.

What’s more, here and there, BDCs are resolving long standing troubled credits. As a result, the percentage of underperforming and non performing assets on BDC books remains very low – in line with what the rating agencies are reporting in the broader leveraged loan market.

Breaking Above

Finally, with the Fed’s 50 basis point rate increase this week, virtually all BDC loans have reached their “floors”. This means that the 50 basis point increase expected in June and the several more projected through the rest of the year should boost earnings going forward.

Anticipation

BDC managers have not been shy on their conference calls to estimate what the pro-forma benefits might be of higher rates, even though both analysts and investors know that the actual impact of rising rates in terms of earnings is a complex phenomenon, and not all coming rate increases will show up on the bottom line.

The Other Side Of This Coin

On the other hand, the price volatility of this last week and the relatively large number of BDCs in the red in 2022 suggest that investors still have serious doubts.

Ironically, the more the Fed raises rates – with its hypothetical earnings benefit – the more concerned investors become that the end result will be a recession, and its attendant increase in bad debts, and thus low of book value and profits.

Doing Their Best

Many BDCs have sought to frankly address on their latest conference calls the initial impact that supply chain disruptions; higher inflation and the shortage of labor are having on some of their portfolio companies. However, the final message each BDC seeks to convey is that these challenges can be handled. Here is an example drawn from the Owl Rock (ORCC) conference call:

As of quarter end, more than half of our portfolio companies were in service-oriented sectors, such as software, insurance, financial services and healthcare where customer demand, sales and margins have remained strong. While we certainly have select credits experiencing some cost pressures due to labor, freight or commodity prices, many of our borrowers are leaders in their markets, which often allows them to pass many of these costs on to their end customers through price increases. While they may experience a temporary lag, by and large, we expect most of our companies to be able to manage through the current environment as well.

Owl Rock Capital – IQ 2022 Earnings Conference Call – May 5, 2022

Over at Bain Capital Specialty Finance (BCSF) management sought to be a little more specific about which sectors are being most impacted:

Notwithstanding the strength and health of our portfolio, we remain watchful of inflationary impacts across our portfolio as the COVID-19 pandemic has created supply and demand imbalances across a number of industries. In particular, we have observed an acute impact in the transportation industry and companies which rely heavily on trade and transportation. The transportation sector has seen large price increases over the last year as a result of a confluence of unprecedented freight premium and price increases over the last year and supply chain disruptions. In addition, we have observed labor cost increases across service-based businesses due to labor market tightness from staff shortages and increased demand.

Bain Capital Specialty Finance – IQ 2022 Earnings Conference Call – May 6, 2022

Too Conflicted

At the end of the day, though, BDC investors cannot rely on BDC managers – with their vested interest in keeping shareholders happy and invested – to ring the bell about credit deterioration in their portfolios.

Instead, we’ll be looking independently for an increase in the number of companies – like Dunn Paper recently – seeking “forbearance agreements”; a pick-up in BDC fees for amendments (often a sign that more borrowers are needing waivers, and paying for the privilege) as well as reviewing what the major debt rating agencies are saying about changes in credit quality in the wider leveraged loan market.

Exception To The Rule

In this last regard, we noted the following this week in a BDC Reporter article:

According to Bloomberg Law – relying on data gathered by its parent – the total amount of traded distressed bonds and loans rose about 15% week-over-week to $85.2 billion as of April 29, 2022. That’s the highest level in North America – again according to Bloomberg – in more than a year “amid a broader pickup in large bankruptcies and monthlong U.S. stock selloff”. There were 154 distressed bonds and loans trading as of Friday April 29, 2022, up from 134 a week earlier.

BDC Reporter – Article – May 4, 2022.

The Bloomberg news is at variance with most other reports from Fitch, S&P and Moody’s, which all show recent default and bankruptcy rates to be very low, and below historical norms. Nonetheless, that sort of data – taken with multiple other items – may – in the future – provide an early warning of systematic credit weakness.

Instinctual

Of course, investors often do not need to be shown hard evidence of credit troubles to react. If the general economic environment begins to evidence the recession that has been predicted by a majority of economists, the markets may mark down the BDC sector even in the absence of material problems at the company level.

Never Happened Before

For our part, we cannot envisage a situation later in 2022 or in 2023 should the economy contract where the BDC sector’s value remains – as it is today – just (7%) off its 52 week high.

Our pessimism in this regard is – admittedly – based mostly on how markets have behaved in the past. When recessions come a-knocking – or even the possibility thereof – many investors fold their BDC cards, even in the face of higher earnings and strong fundamentals in the rear view mirror.

Through A Glass Darkly

We’ve also become much more pessimistic in the last few days that the Fed – or anyone else – can keep the U.S. economy from a hard landing. Like many others, we’ve been fretting for some time about how long the Fed has taken to get serious about tackling inflation. This week’s 50 basis point increase is still too little too late, and the supply chain troubles still show no sign of easing – let alone ending.

Sad But True

A recession may be the only way out of this inflation nightmare, and that is certain to have negative consequences for credit and for BDCs, even if we are bullish for the sector over the longer term.

We hope our pessimism – which follows a long period of uncharacteristic optimism – is unwarranted, but only time – and many more weekly Market Recaps – will tell.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.