BDC Common Stocks Market Recap: Week Ended July 15, 2022

BDC COMMON STOCKS

Week 28

Petered Out

Last week – after three weeks of BDC sector prices moving upwards – we wondered whether a fourth week was in store.

Based on the weekly records we maintain, that sort of streak has not occurred in a year.

Here we are one week later, and we have our answer: the BDC sector could not maintain its upward momentum, and dropped in price.

The S&P BDC index which just tracks price change dropped (1.5%).

(We’re not using BDCZ – the UBS Exchange Traded Note which we usually refer to for sector price changes because the numbers were impacted by the payment of its quarterly distribution).

The S&P BDC index which measures total return was also off (1.5%).

Impact On BDC Stocks

Of the 43 public BDC stocks we track, 35 were down in price and only 8 were in the black – reflecting the sourer mood.

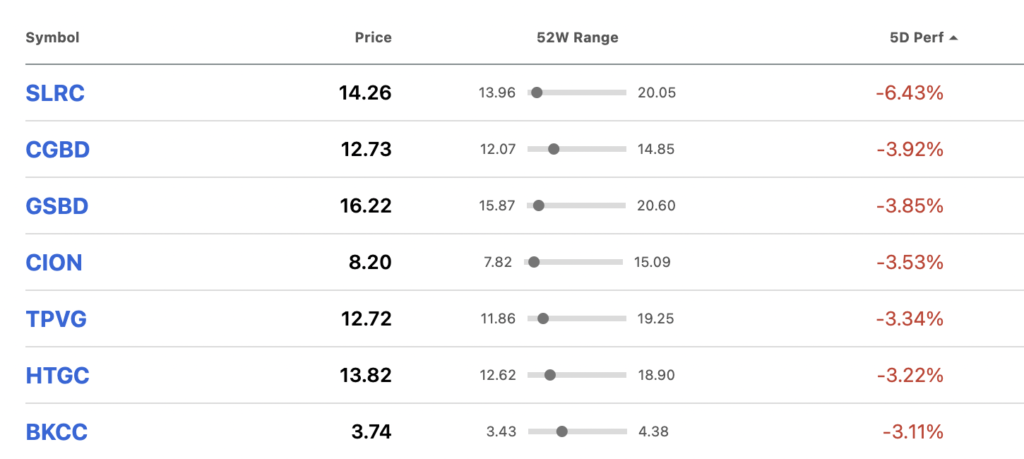

7 BDCs dropped by (3.0%) or more in price – the most in this category in a month.

No BDC increased by 3.0% or more.

Number One

Top of the heap in terms of percentage price growth was Runway Growth Finance (RWAY), up 2.5%.

Boosting RWAY- we believe – was the press release issued by the venture debt BDC on July 14 detailing a very busy IIQ 2022, and much optimism about asset growth going forward.

The day before, RWAY also announced a new hire at the adviser’s firm – also a suggestion of optimism about the way ahead.

Both press releases were reviewed and analyzed at the time in the BDC Reporter’s Daily News Feed, where we offer almost instant analysis about material BDC developments. (There were over 20 postings this week alone).

Instructive

As we’re on the subject, what we’ve learned from RWAY, as well as Horizon Technology Finance (HRZN); Golub Capital (GBDC); Main Street Capital (MAIN), as well as trade sources like Kelly Thompson at Direct Lending Deals (DLD) is that investment activity in the IIQ 2022 was not the anemic, pre-recession slowdown one might have expected.

Instead, we’ve heard from all these anecdotal sources that new loans and equity investments are being made at a rapid pace, probably greater than what occurred in the first quarter of the year.

Moreover, repayments seem to be lagging, as many borrowers stick with the devil they know.

Speaking in broad terms, the BDC sector appears to be increasing its market share in corners of the debt market, including to large cap borrowers as banks and syndicated transactions fall back and in venture debt financing as the public IPO and private venture capital sources dry up.

Right Or Wrong

We’ll know two years from now if this was a bold and profitable move by the BDC sector, which has been carving up a bigger and bigger portion of the private credit market for years, or a terrible mis-step.

In the short run – and we’ll be able to get the specifics when BDC earnings season begins in two weeks – this might mean the aggregate BDC portfolio assets under management, which we calculate to be $120bn (see the BDC Credit Table) – might be headed higher.

For every individual BDC – if this should occur – the bottom line results could vary substantially, so we’ll leave those prognostications to the myriad analysts offering up earnings projections, most of which seem to be constantly changing.

Getting back to the Recap

7 different BDCs were down (3.0%) or more, as this table shows, copied from Seeking Alpha:

Hitting The Bottom

As we noted at the time in the BDC Daily News, two BDCs – Goldman Sachs BDC (GSBD) and Trinity Capital (TRIN) – reached new 52 week lows during the week.

Not Good

Overall – by week’s end – 16 BDCs are trading within 5% of their 52 week lows and 10 between 5%-10% of their low point.

That’s not the worst we’ve seen in this downturn (that was 28/7 in the week ended May 20), but does suggest the BDC sector continues to be out of favor with investors, even if performing before than the S&P 500 or most other broader market indices.

Year-to-date – to make our point – we note that only one BDC (Fidus Investment or FDUS) traded as of Friday at a price higher than the end of 2021.

Surprised

For FDUS, the stock price performance is all the more impressive given that the KBW analyst – not unreasonably – downgraded the stock (along with SLR Investment – SLRC – which has not fared as well) during the week.

While we have great confidence in the management and business of FDUS, we have to admit that we would never have expected that the lower middle market-focused BDC – half of whose portfolio assets are in second lien loans, subordinated debt and warrants – would be the most favored by investors at a time when recession risks down the road loom large.

Likewise – and presumably very frustrating for the managers of CION Investment (CION) – is their status as the BDC with the greatest stock price drop in 2022 – down (37%). That’s even worse than Great Elm (GECC), which has lost a CEO; seen its largest investment written to almost zero and has needed a Rights Offering, but is “only” down (34%).

These are peculiar times.

We doubt that the current list of BDC winners and losers will be the same at the end of this year or by the close of 2023. We’ll try to remember to circle back and contrast and compare as the calendar moves along.

Where Are We

Obviously, the BDC sector – and just about everything else (including BDC Baby Bonds) are not having a very good year.

The best indicator – in our opinion – is the BDC S&P index, which shows we are (8.6%) down on the year on a total return basis.

(From the highest point in April, the index is off -13.5%).

A Plateau Of Sorts

Peering at the charts and all the data we gather every week, we’d say that for the last month the BDC sector – despite all that volatility – has been trading more or less flat.

The lowest point was June 16, 2022, but that did not last long.

Within ten days, the sector was up to its current level and has been fluctuating in a relatively narrow range since.

From a BDC perspective, there’s been no great amount of new developments to light the way ahead and the macro-developments (inflation; oil price; GDP; consumer confidence; interest rate movements) – while dramatic – are confusing.

Dazed And Confused

Investors do not seem sure what to think, or how to act – except not to rush back in.

For the BDC crowd, the next major attraction is BDC earnings season.

The last few days and much of August will see IIQ 2022 results published and explained.

Hungry as we are always for updates, the BDC Reporter is looking forward to the avalanche of results; investor presentations and carefully worded filings.

Different

However, we also accept that nobody expects second quarter of 2022 results to look anything like what we’ll be hearing a year from now or in the summer of 2023.

Here We Are

It is like being on a beach where the waters are moving out – a sure sign that a tsunami is headed your way.

However, just how damaging that coming wave of water might be is unknown.

At best, IIQ 2022 results may give us some early hints at any cracks showing up where individual BDC credit performance is concerned. However, no significant change in the number of non accruals or even in loan valuations is expected, as we’ve already seen with Saratoga Investment’s (SAR) quarterly results through May.

Whatever EPS, dividend and – especially – net asset value a BDC reports will be discounted by a market expecting big changes ahead, as these recent BDC price drops portend.

Attitude Matters

What will be most intriguing during BDC earnings season will not be the results – whatever they are – but the attitude of each BDC manager towards the possible conflagration ahead.

We expect a wide variety of responses, partly a reflection of the markets they serve; the strength of their balance sheets, the data flowing from borrowers about their own results but also intangible factors such as the managers prior experience with downturns.

Another factor to consider are the growth strategies of the asset managers running the BDCs. Do they see the times ahead as a chance to increase their market share by saying yes to existing borrowers and sponsors where others say no ? Are they prepared to see their portfolios shrink, putting their dividend distributions at risk, out of an abundance of caution ?

What Matters Most

We’ll be listening to what each BDC managers says – with much focus on the meta messages but will also looking at what is actually being done.

Is the BDC in question substituting unsecured debt for secured, despite the cost premium ? What sort of assets are being added to the portfolio and at what pace ? What portion of earnings is being retained ? Is liquidity increasing or decreasing ? Does the manager insist that their particular borrowers are well nigh invulnerable to any downturn ?

The Story So Far

At the end of the first quarter – and we’re painting with a broad brush here – most BDCs (we revieed 41 conference calls) appeared to recognize that the environment had undergone a material change – and not for the better – since the end of 2021.

There was much talk of the need for caution, but also confidence that the anticipated increase in rates would be readily absorbed by their borrowers.

Some BDCs admitted that some companies in their portfolios were being challenged by supply chain problems and the higher cost of labor, but most were motoring on. The exceptions to the rule were still expected to remain current on their obligations.

We didn’t hear any BDC planning to reduce their target leverage – and most are close to their self imposed limits – but some quietly suggested they might keep to the low end of their targets for the moment.

We did see some strategic sales of riskier on balance sheet assets into off balance sheet joint ventures, which should aid with BDC asset volatility.

There was no great rush to re-make balance sheets with a greater proportion of longer term, unsecured debt but that was largely because virtually every BDC had participated in what we call the “Great Refinancing” in 2021. Furthermore, the debt markets were essentially for much of 2022, only reviving modestly in recent weeks.

Useful Preview

Back in the spring of 2020 when the pandemic struck and economic conditions worsened at lightning pace, we saw BDCs across the board in March and April taking drastic measures to prepare for what seemed like an inevitable recession.

The markets were certainly signaling this was going to be the case as asset values dropped out of bed. No wonder the level of BDC assets valued at 90% or lower shot up. At one point almost every loan on a BDC’s books was being sharply written down – usually in advance of any real damage having occurred.

As we all know, the Fed and the Treasury came to the rescue and everything turned on a dime in weeks. Loan values recovered very quickly; investment activity picked up; spreads narrowed and BDC stocks shot up in value. Between the end of March and the beginning of June, BDCZ increased in price by 80%.

The Same But Different

For all we know, the coming pro-forma recession may be as bad as what was anticipated in those fraught days in late February-early March 2020, but the slow approach has allowed BDC managers to take a much more measured approach.

That makes sense given the different backdrop, but at some point the very same sort of drama as was expected in 2020 will reach these shores.

Investors should want to know what precautions BDC managers are taking – or not.

It would be a great shame if the BDC sector should squander the longest and loudest warning signal we’ve ever experienced of a coming tsunami.

In the weeks ahead, we’ll begin to determine if everything that could reasonably be done to prepare has been, or will be, done.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.