Apollo Investment: Announces “Transformative Changes”

Premium FreeNEWS

On August 2, 2022 Apollo Investment (AINV) – at the same time as the BDC reported its IIQ 2022 earnings – announced a number of “transformative changes”. The key items are as follows:

- By August 12, 2022 the BDC will be renamed to become to MidCap Financial Investment Corporation, “reflecting the BDC’s investment strategy of primarily investing in loans originated by MidCap Financial”. The ticker will change to “MFIC”.

- MidCap will shortly invest $30mn in newly issued shares of AINV/MFIC at net asset value, “representing a significant premium to the current market price. This investment serves to i) validate the value of the BDC’s senior investment strategy, ii) provide the BDC with dry powder to invest in loans originated by MidCap Financial, and iii) create a strong alignment of interests with the BDC’s performance”.

- The manager will change its various fee arrangements as follows:

The Company’s base management fee has been permanently reduced to 1.75% on net assets (i.e., equity) from the equivalent of approximately 3.4% on net assets. In other words, the base management fee rate, expressed in terms of gross assets, has been reduced from approximately 1.40% on gross assets, to the equivalent of approximately 0.75% on gross assets. Beyond the nearly halving of management fees in the aggregate, the shift to basing management fees on net assets, rather than gross assets, provides greater alignment and focus on net asset value versus leverage.

The incentive fee on income has also been permanently reduced from 20% to 17.5%. The performance threshold remains 7% and there is no change to the total return requirement or catch-up provision. The changes to the fee structure will be effective for the period beginning January 1, 2023.

In addition, the BDC announced both promotions and changes in the senior management of the adviser and an increase in the quarterly distribution – from the IIIQ 2022 – to $0.32 from $0.31.

ANALYSIS

Face Value

Are the changes announced by AINV truly transformative ? Our initial review of the BDC’s press release, investor presentation and conference call discussion suggests that’s mostly true, but not entirely. Let us explain:

Long Time Coming

Notwithstanding the coming name change, AINV has been transforming itself into primarily a vehicle for holding MidCap Financial investments for several years now. Just this quarter, 98% of all new investments booked were from that source.

Admittedly, management took many years to make substantial progress divesting itself of “legacy” investments in energy; shipping, etc but ceased adding new positions ages ago.

Then there was the decision by the manager to load up AINV with Merx Aviation assets, and give them a slice of the airplane servicing business.

That strategy – which was at complete variance with the type of assets being acquired by MidCap and in contradiction with AINV’s broader stated diversification of assets policy – is now being reversed.

In fact, AINV announced as much last quarter and it seems like the disposition of the Merx aircraft might get completed this year.

All to say that new investment activity going forward will not look all that different than what we’ve seen of late.

Wider Selection

Admittedly, the lower compensation costs will allow AINV to book MidCap loans with lower spreads than in the past and still meet the BDC’s return requirements. This should reduce risk in the portfolio and increase “granularity”.

Never Before

Speaking of lower fees… The decision to tie the management fee going forward to AINV’s net book value – as opposed to asset value – is truly something new. This flies in the face of decades of BDC compensation practice and should be regarded as “investor friendly”.

Not New

The reduction in the level of the incentive fee and the capital gain fee is less revolutionary. This is a path that several other public BDCs have already trodden on. Still, AINV’s shareholders should materially benefit from the incentive fee concession, if not from the capital gain one.

Unmoved

To their credit, Apollo did not fiddle with the total return feature in the existing compensation arrangement – another truly “shareholder friendly” arrangement that boosted the BDC’s earnings in quarters past when net book value was dropping.

Useful

The investment by MidCap in AINV at book value – and not the substantially lower market price – is not “transformative”. Apollo has bought shares in its BDC in the past.

However, this infusion does send a positive message. More importantly, the proceeds will allow AINV to immediately bring its leverage down under 1.5x.

Scale Back

Moreover – and not mentioned in the press release but discussed on the conference call – the manager has decided to pull back its target leverage. Till now AINV has pushed the debt to equity envelope compared to many of its peers, aiming at debt to equity of up to 1.6x. Going forward, 1.5x will be the outer limit and the actual leverage fluctuate between 1.4x-1.45x.

Friendly Suggestion

Apparently, AINV received feedback from its constituencies that the prior target leverage was a little on the high side, and a slight roll down was preferred. Combined with the ever greater diversification of the existing portfolio and the likelihood of booking “safer” first lien loans going forward and getting rid of Merx and most of the higher risk “legacy assets”, the BDC’s risk profile appears poised to greatly improve.

Free Money

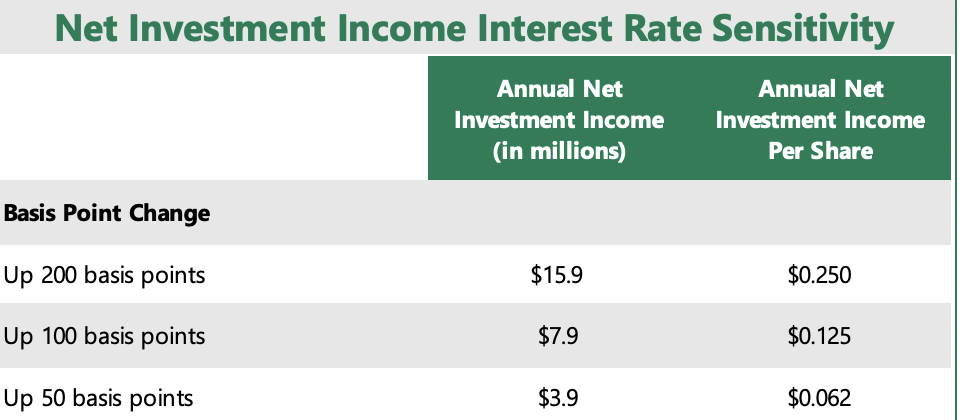

Giving AINV a hand are higher rates. Like other BDCs, AINV was not shy to indicate that the recent increase in short term rates should greatly boost future earnings. Here is an interest rate sensitivity table published in the IIQ 2022 investor presentation:

Multiple Opportunities

In the latest quarter AINV booked Net Investment Income Per Share of $0.37, or $1.48 annualized. The pro-forma benefit from 200 basis points of higher rates would take NIIPS to $1.73.

That’s even before taking into consideration the possibility of benefiting from wider spreads being booked on new loans as market conditions have become more lender-friendly.

Then there is the extra income to be earned once the remaining equity stake in Merx and in non-income producing “legacy” investments once they are sold off.

That process – although slow – is continuing with the shipping assets almost completely gone and oil & gas deals headed in the right direction.

Finally – starting in 2023 – the BDC’s investors will benefit from the lower compensation charges.

Currently, the analyst consensus is for AINV to earn $1.41 in FY 2023 (ending in March) and $1.44 in FY 2024, but those earnings could go significantly higher even as its AUM and leverage decreases.

Up, Up And Away ?

Management promised to pay out – in one form or another – all earnings generated going forward.

As a result, AINV’s EPS could materially improve in the second half of 2022 and in 2023.

In our own projections before the latest news broke, we anticipated AINV’s annual payout might amount to $1.44 a year.

That may prove to be too low and could be revised upward.

We’ll be curious to see if analyst projections shift in the days and weeks ahead.

CONCLUSION

Initial Reaction

At first blush the multiple changes wrought at AINV are substantial and “game changing”.

The BDC will deliberately become a “pure play” in lower risk, middle market first lien loans, brought in by a well regarded platform in Mid Cap Financial.

The concentration risks that AINV has had to contend with through their exposure to energy, shipping and aircraft leasing will be removed.

The new equity capital and a revised leverage strategy will reduce risk.

The new compensation terms will reduce expenses paid to the manager and benefit shareholders.

With the benefit of hindsight, this is a natural step forward for the BDC, building on themes that have been underway for years.

Not So Fast

The immediate challenge (i.e. for the next 6 months or so) will be in completing the divestment of the “legacy” and Merx assets and at a reasonable price.

The intermediate question mark – especially if and when financial conditions deteriorate – is seeing whether MidCap can keep credit losses at a reasonably low level.

Longer term, the newly renamed BDC will need to bring down its cost of debt capital and – after years of trading below book – seek to issue new shares and materially grow the portfolio.

How well AINV performs in the short and medium term will determine the longer term outcome.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.