BDC Common Stocks Market Recap: Week Ended August 12, 2022

BDC COMMON STOCKS

Week 32

On And On

The BDC rally that began in mid June is beginning to set records of a sort.

For the first time since June 2021, BDCZ – the UBS Exchange Traded Note which owns most BDC stocks and which we use as a price gauge – was in the black for 4 consecutive weeks.

(In the last 8 weeks, BDCZ was up 7 times).

Even more tellingly, the S&P BDC Index – calculated on a “total return” basis – was up 0.4% for 2022 YTD.

Compare that to the S&P 500 index over the same period – also currently in comeback mode – still off (10.2%).

Regular Metrics

In the week, BDCZ was up 2.54%, with 40 of the 43 public BDC stocks we track posting positive or unchanged price performance.

Of those, a remarkable 20 were up by 3.0% or more.

That – along with these several weeks of higher prices – suggests a market investors are anxious to get into.

Also of interest: the week’s biggest price increase was reserved for a BDC that has been mostly out of favor for months.

Turnabout

That’s Cion Investment (CION), which shot up 8.5% in five days, but still remains (21%) down in price YTD and trades at a (35%) discount to net book value per share.

Also underscoring the strength of the BDC market, the two BDCs that dropped more than (3%) this week were out performers who were undertaking secondary common stock issuances: Main Street (MAIN) and PennantPark Floating Rate (PFLT).

Status Report

So much for how the week has gone, let’s discuss where matters stand nearly two-thirds of the way into roller coaster of a year for BDC stocks that saw a 52 week high in April and a 52 week low in June.

At this stage, we have 18 BDCs trading at or above net book value per share – a statistic made a little easier by the many players that reported lower net book value per share in the IIQ 2022, as earnings season runs down.

Less and less BDCs are trading close to their 52 week lows – 2 between (0%-5%) and another 3 in the (5%-10%) range.

Bottom Of Barrel

The former two stocks are Great Elm Capital (GECC) and First Eagle Credit (FCRD).

Both BDCs have long, troubled histories and are seeking to remake themselves – in one case with a new management team and the other with a new external manager.

Unfortunately, as we discussed during the week in the BDC Daily News Feed, that reversal of fortune is not happening going by the second quarter results posted.

More But No Record

At the other end of the spectrum, there are 5 BDCs trading within 5% of their 52 week high, and 9 in the 5%-10% column.

In all that’s 14 names doing very nicely thank-you, but that’s still below the 33 we counted back in the week ended April 1, 2022.

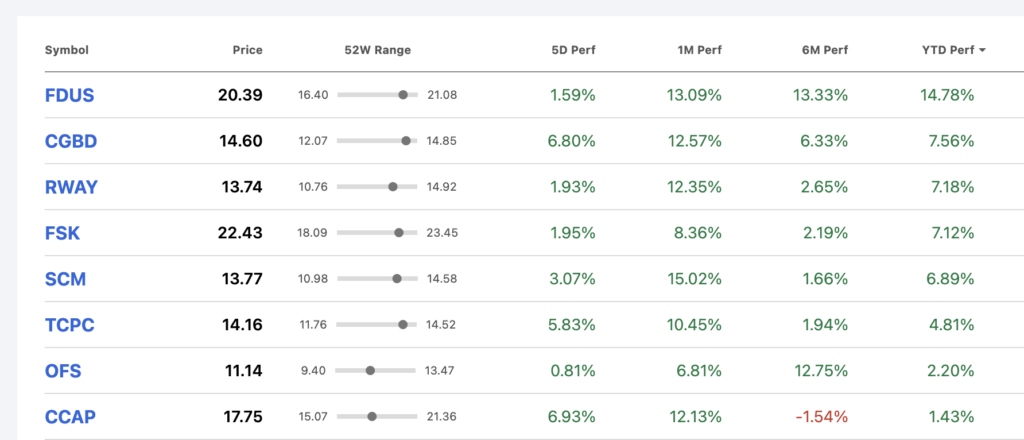

According to Seeking Alpha, so far in 2022 only 8 BDCs are in the black through 32 weeks.

Back in the spring just about every BDC out there could boast of a higher stock price than at the end of 2021.

Betwixt And Between

As a sector – as reflected by BDCZ – the YTD price decline is now (5.2%) at week’s end.

We’ve been much, much lower (16.6% down in 2022) and somewhat higher – +2.6% – leaving plenty of space for future price volatility.

Obvious Question

So why this spectacular rally in the midst of a purportedly slowing economy and at a time of an epic battle by the Fed to bring inflation under control ?

Notions

We’ve got a few explanations – both macro and more BDC-centric:

First, since June there’s been a drastic shift in general sentiment by investors in all U.S. stock markets.

Sigh Of Relief

In a nutshell, the judgement most participants are making is that the slowdown in the U.S. economy won’t be so bad when the storm hits later in 2022 or 2023.

This chart below shows how the NASDAQ, S&P 500 and Dow Jones 30 have increased in price since mid-June, and includes BDCZ as well:

As you can see, there’s been a mighty upward surge of investor confidence, and the BDC sector has joined in throughout.

Amen Corner

From a BDC perspective, both the IIQ 2022 results and the commentary of the managers on their conference calls, have confirmed the broader narrative that whatever downturn might occur will be containable.

In this regard, IIQ 2022 BDC results have supported that argument with only modest drops in asset and net book values – virtually all attributable to what seem like transitory drops in market prices rather than fundamental deterioration in borrowers fortunes.

Up

Furthermore, as many industries are facing the prospect of lower earnings, the BDC sector is headed the other way.

In the second quarter, there has been many instances of BDCs reporting EPS higher than expected and/or higher than in the prior quarter buoyed by a combination of better than might have been expected new loan volume; equity dispositions and – of course – higher rates.

See For Yourselves

Premium subscribers can see the subject quantified in the BDC NAV Change Table, where we’ve added a column that compares IIQ 2022 actual EPS versus the analyst consensus estimate for the period. We’ve also noted which BDCs increased their regular distributions over whatever their prior one was.

Crystal Ball Lit Up

Markets, though, are forward looking and there the picture is even more attractive.

Virtually every BDC that has reported second quarter results couldn’t help guiding its investors to expect more in the third and fourth quarter of this year.

It’s the inescapable math of higher rates mixed in with the drawn out manner in which higher yields work their way through the system as borrowers reset their financing arrangements with a lag from when the Fed changes its rate target and SOFR/LIBOR adapt.

As a result, this is a gift to BDCs that only began to positively affect earnings in the second quarter, and will keep on giving for many quarters to come.

Bountiful

Just a full quarter of the rates at the end of June will boost BDC earnings – as many managers pointed out on conference calls. However, in this quarter we’ve already had another 75 basis point Fed increase and a 50-75 basis points more is likely in the weeks ahead. Even then, the Fed may not be done.

If that wasn’t enough, we’re also learning that the still substantial amount of new loan business being booked is often at higher spreads than in the past, and on better terms.

These higher spread loans take time to accumulate and materially impact yields but this lender-friendly period is already far longer than what we’ve known in the past.

Finally, debt asset values – after dropping sharply (but not monstrously) during the course of the second quarter seem to be on track for a rebound.

Rosy

All this should translate into much higher earnings and net asset value per share for the BDC sector in the IIIQ 2022 – the sort of prospect that investors relish.

Rinse And Repeat

That’s especially the case given that these higher rate conditions – even if they level out – are likely to hold well into 2023.

This means – everything else being equal and assuming no surge in lost income from defaults – higher earnings and dividends for a long time to come.

Big Picture

We’d argue a tectonic shift has occurred which means we’re unlikely to be going back to the interest rate regime that occurred in 2020-2021.

The Fed seems to be walking away from the era of “easy money”.

If that’s true, lenders of every ilk – including BDCs – should benefit from reference rates 10x or more higher than back in early 2020 when the range was 0-0.25% for years to come.

Currently, the Fed Funds rate is 2.5% and is expected to end the year at 3.75% by the futures market, and stay at much the same level through 2023.

Less But Still Good

Over time some of the benefit to BDC lenders of much higher rates will be worn down by lower spreads; possibly lower transaction activity and credit losses but not in the next few quarters.

BDC returns on equity – typically in the high single digits – should move up into the low teens over the next 6 quarters or more.

Fundamental Shift

The stage is being set for a significant revaluation of the BDC sector that should bring prices to record highs and price to earning multiples not seen before.

Dividend levels – both from regular payouts and specials – are likely to increase at almost every BDC, even amongst some of the most troubled names.

Back To The Future

Of course, the fly in this ointment is this question mark of a recession, the prospect of which has already caused investors to run for the hills in April and continues to keep a lid on things.

It’s the greatest unknown in this picture and could yet return to the forefront of investors minds with potentially drastic short term consequences for BDC prices later in the year.

Bottom Lining

We will say, though, that we are ever more convinced – and we started making this argument months ago – that even if we get a “nasty” recession, whatever losses of BDC income are incurred from credit setbacks will be more than offset by the Fed’s gift of “higher rates for longer”.

Moreover – as many BDC managers have eloquently argued – the sector’s shift into much “safer” assets in recent years (not only more first lien loans but also a deliberate diversification and avoidance of cyclical sectors) should keep the lid on defaults.

Add to that the ability of most BDC lenders to “control” their loans and negotiate out long term favorable resolutions even of troubled companies will benefit investors with a long term perspective and lots of patience.

When this prospective recession – if one does occur – is said and done, we expect the sector’s net realized losses will be a tiny fraction of the losses incurred in 2008-2009.

We’ve run a number of scenarios for many BDCs and generally concluded that “real” permanent losses to capital should range between (5%-10%) for most of the BDCs we track.

(We’re hedging ourselves on the outlook for some of the already troubled smaller players).

Even Better

In fact, it’s possible that BDC earnings will actually end up higher when the recession is than they were in late 2021.

(That’s apparently not just our view: judging by the latest analyst projections which we’ve been reviewing, BDC earnings will be shooting up in calendar 2023 and FY 2024 for virtually every BDC).

Check back with us somewhere between 2025-2026 (these things take time) to see if we were right.

Uncertain

In the short run, though, we have no idea what comes next where prices are concerned.

This has been an almighty bounce back, bringing the sector back to price levels not seen since May.

We just need a 9% increase in BDCZ’s price to reach a new 52 week high.

On the other hand, investor sentiment that can markedly improve with a few GDP, CPI and consumer sentiment metrics, as has been the case in recent weeks – can just as readily go the other way if we don’t get the numbers expected.

Short Vs Long

This makes being a short term investor in BDC stocks a very volatile affair.

However for the long term investor, the BDC outlook is unalloyedly positive.*

*= If we’re right.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.