BDC Common Stocks Market Recap: Week Ended August 26, 2022

BDC COMMON STOCKS

Week 35

Divergence

Newcomers to the BDC sector would have been surprised by this week’s results, given the price massacre that happened to the major indices.

The S&P 500 index was down (4.04%) on the week, including dropping by the greatest percentage in a day on Monday, and falling (3%) on Friday after the Fed Chairman’s Jackson Hole speech.

All the sectors that comprise the index were in the red for the week.

The Dow Jones index dropped 1,000 points on Friday alone.

Etc.

Keeping Calm And Carrying On

By contrast, the BDC sector was highly resilient price-wise.

BDCZ – the UBS sponsored exchange traded note which owns most BDC stocks and which we use as a useful price guide – dropped only (0.4%) on the week – a tenth of the drop incurred by the major indices.

(The S&P BDC Index – calculated on a “total return” basis and the most useful measuring tape for the long term investor – was down (0.5%) using a different methodology than BDCZ).

The relative out-performance of the sector, by contrast with everything else, also showed up in the other metrics we typically track weekly.

For example, 26 of the 43 public BDCs we cover – with an AUM over $120bn in total – were in the black this week.

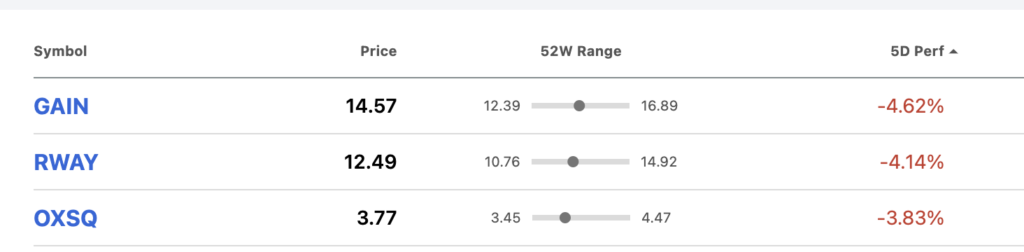

A relatively small group of 3 BDCs dropped (3.0%) – all of them smaller players with relatively low trading volume:

Another interesting statistic at this time of investor despair: the number of BDCs trading over net book value per share increased to 18, from 16 the prior week. This is towards the highest level this metric has been all year.

Sticking Around

Even if we look at BDC prices over the last 4 week, the numbers suggest a sector holding up well.

38 BDCs can boast higher prices over a one month period despite all the toil and turmoil in the broader markets.

The Reason Why

We have a simple theory as to why the BDC sector is greatly outperforming the S&P 500 and the other major indices of late:

Higher interest rates.

For most stocks, the rise in the reference rate and the threat of more hikes – and for a longer period – as the Fed indicated at Jackson Hole, are a clear negative.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.”

Fed Chairman Powell – August 26, 2022

For BDCs those higher rates – and for a longer time frame – are manna from heaven.

Much To Look Forward To

Without doing anything differently BDCs – almost to a man (person ?) – can look forward to much higher net investment income for several quarters to come.

Even when the reference rate stabilizes, earnings should continue to automatically rise as there is a multi-quarter gap between when higher rates are announced and when they show up for a full quarter in a BDC’s P&L.

The first rate rises in the spring are just beginning to be fully reflected in BDC results here in the third quarter of 2022.

By the time this historic series of rate increases is completed, the Fed could end up raising its reference rate from 0.25% at the beginning to 4.0% – or even higher.

If you think that the average BDC debt yield was in the 7%-8% range before this rate rise process began, just think where this could go.

In The Years Ahead

As we’ve seen, this is unlikely to be a flash in the pan of one or two quarters of high rates but a continuing period of higher interest rates, even if there is a step or two down from whatever peak is reached.

We’re speculating now, but we don’t see the Fed returning to a reference rate below 2.0% for a very long time, and certainly not back to 0.25%.

The era of “easy money” – now in the rear view mirror – has left the Fed – and many economic analysts – with a bad taste that may last a generation.

If we’re right, reference rates will – at their very lowest – return to the level before the pandemic in 2019.

More likely, the Fed Funds rate will remain in a range between 2.0% – 3.5% for years to come. Or, at the very least, through 2024.

Big Boost

Speaking very broadly, because every BDC has a different mix of floating rate assets and debt liabilities, this should result in pro-forma earnings increases of 20% or more over the level achieved just before the first rate rise of 2022.

In any given quarter, the highest rates might cause – with a delay – BDC earnings to jump by 30%, or more from their level in IVQ 2021 or IQ 2022.

Twofer

There’s another unusual phenomenon at play which is BDC friendly.

In the past, rates have risen at times of economic expansion when all is right with the world.

Those are times which are borrower friendly and lenders are often forced to slash spreads on new – and even existing loans – to hold onto these assets.

That reduces the benefit of higher rates.

Not this time. Rates are rising as economic conditions – and the outlook – are weakening. Lenders are in the driver’s seat as multiple BDCs made clear on their second quarter earnings conference calls.

This means yields – and compensation overall – as well as loan terms and structures are becoming more favorable to lenders.

Got Legs

In the past, these periods of lender friendly environments have been relatively short and coincided with periods of low new investment activity – usually at the nadir of a credit cycle.

This time is also different in that lender-friendly pricing/terms have been happening for quite some time (several months and counting) and as new loan activity remains surprisingly robust.

Maybe lenders are just benefiting from the closing of deals initiated before the clouds gathered and new investment activity will sharply slow down soon.

We’ve seen contradictory news on this front in recent days so we’ll just have to wait and see, but there’s a chance BDCs can fill up a material portion of their portfolios with loans booked in 2022 with wider spreads and better terms.

This would provide yet another benefit besides the increase in the reference rate – which they’ll also gain – and which will last for years to come.

Befuddled

We can see from the earnings conference calls – and we’ve reviewed nearly 40 for the second quarter – that BDC managers are confused about how to handle this potential windfall.

Most are eager to let shareholders know that better results from an earnings standpoint are round the corner.

A favorite technique is for a BDC to share their calculation of how much higher their IIQ 2022 earnings would have been on a pro-forma basis if the reference rate had been in effect with all its borrowers across the full quarter.

That number alone can be impressive.

Calculated

Then there are the disclosures in each BDC’s 10-Q showing what sort of benefit will accrue on an annual basis from interest rate increases at different levels of basis point hikes.

Those are just pro-forma calculations, and there are many other factors that go into a BDC’s earnings but the potential increase in earnings can be staggering.

After all, BDCs operate in a segment of the market where earnings tend to be very stable and “staggering” is a word rarely used to describe positive earnings changes.

Nobody Knows

On the other hand, the BDCs – like the rest of us – have no real idea how this will all play out – the amount of each rate increase; the potential peak and then the timing of the ascent, the plateau and – eventually – the descent.

To make matters worse – and as we just said – there are many factors that go into the BDC earnings stew and these can help or hinder in the quarters ahead.

No wonder most BDCs have shied away from providing much in the way of specific earnings guidance.

Hot Potato

They are even more reluctant to make promises about distribution levels.

More than anything else BDCs fear raising their regular distributions only to have to cut them down the road, if and when interest rates should be cut by the fiat of the Fed.

There’s too much danger that investors – on hearing of a dividend reduction – might see the move as a sign of financial weakness rather than a routine matter of “cutting the coat to suit the cloth”.

Pity The Analyst

The confusion the BDC managers feel seems to have affected the analysts as well, who are just as unsure – if not more so – about what to project for future earnings and the financial health of the BDCs they cover.

Alone

The result is that BDC investors will be left alone to make wild guesses about likely profitability in the several quarters ahead and into the long term.

For years, the Fed’s reference rate was the central cost in a BDC’s profitability and remained untouched and unchanged.

Now – and also probably for years – this central factor in determining how will your favorite BDC will perform is likely to be a continuing question mark.

For Some Time To Come

Just as BDC investors are receiving a windfall the level of uncertainty about what their reward might be will be going sky high.

This will likely only get worse late in 2022 – and certainly in 2023 – as the impact of higher rates is felt in a rise in borrower defaults, with investment income interrupted and capital written off forever from bankruptcies and restructurings.

Even when that is over – as the economy and rates stabilize – BDC earnings are likely to fluctuate more than they did in the past as equity gains occur from deals that BDCs were forced to restructure.

Just about every BDC out there has the will and the personnel – not to mention the capital needed – to serve as their own “distressed” investor when investments go sideways.

All in all, expect BDC results to fluctuate a great deal for years to come, and as the warning says “individual results will vary” and “past performance is no guarantee of future results”.

Opportunity Knocks But…

For astute stock pickers who get their choices right this could be a golden period but the sector is likely to be highly volatile where prices are concerned given the amount of guesswork involved.

BDC prices are already infamously subject to wide price fluctuations. Things are going to get much worse, both up and down.

Assuming that the Fed does not drive us all into a new Great Recession, the quarters ahead could prove to be the best of times for BDC investing, but the market is likely to require investors to have nerves of steel.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.