BDC Common Stocks Market Recap: Week Ended September 2, 2022

BDC COMMON STOCKS

Week 36

In sync

In the prior week, BDC investors seemed to brush off the extreme fear felt elsewhere in the markets by Chairman Powell’s comments at Jackson Hole.

To remind you, the S&P 500 was down (4.04%) in the week ended August 26, 2022 while BDCZ – the Van Eck sponsored exchange traded note which owns most BDC stocks and which we use to measure sector price performance – was off only (0.38%).

This week, the major indices continued to shift downward in price as the mood remains almost universally dark.

Sidebar

By the way, we find this incongruous given that there’s an almost universal consensus that inflation has already peaked and, on Friday, there was a strong payroll report.

Our latest view – admittedly subject to change – is that the economy seems to have sufficient strength to withstand whatever the Fed will be throwing its way without collapsing.

Goldilocks ? Yes, but stranger things have happened, including a global economic expansion during a global pandemic…

Together Again

In any case, this week BDCZ joined the major indices in sharply dropping.

The ETN was down (3.57%), the worst week weekly performance in 8 weeks.

(The S&P 500 was off (3.29%).

A Flood

Of the 43 BDCs we track, 40 were in the red.

That’s the worst such performance since mid June when all the markets – including the BDC sector – reached their 2022 nadir.

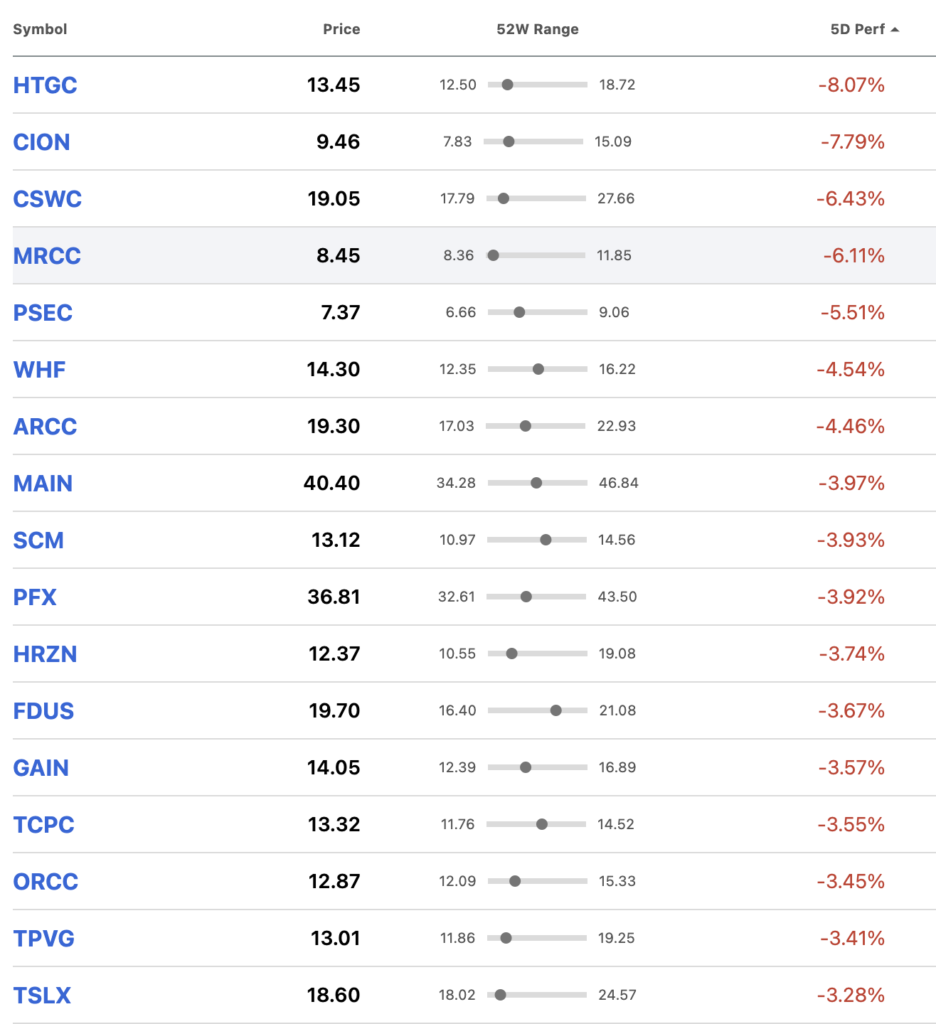

17 BDCs dropped (3.0%) or more during the week – also the worst performance since the week ended June 17, 2022.

At that point, though, 40 BDCs were in the (3.0%)+ loss column.

Just for the record – and if anyone is interested – here are all the BDCs that fell (3.0%) or more in price this week:

Quality

You’ll notice a large number of well known BDC names in there, most of which the analysts expect to increase their earnings both in the next quarter and through 2023.

For what it’s worth, the BDC Reporter projects that 2/3rds of the BDCs above will increase their dividend payouts in 2023 over their 2022 numbers.

Maybe we, and the analysts, are completely wrong or this is a period of profit taking and/or waiting on the sidelines for better entry points by investors looking for an advantage. Or fear.

Back There

Whatever the reason, these last 3 weeks of the BDC sector dropping in price has pushed BDCZ back into “correction” territory in 2022 – off (11.1%).

There are now only 4 BDCs trading in the black 36 weeks into the year.

No BDC is now trading within 5% of its 52 week high and only 11 within 5%-10%.

The number of BDCs trading within 5% of their 52 week low has increased to 4, from 3 the week before.

We also saw – as we pointed as it happened in the BDC Daily News Feed – that two BDCs (Great Elm and Monroe Capital) reached new record 1 year price lows.

Another notable metric that reflects this recent slump: the number of BDCs trading above net book value per share (an investor favorite) fell to 12 from 18.

We rarely see such a big shift in a short period of time.

Reasoning

If you look to the BDC news stream this week for reasons why investors are jogging to the exits, there’s nothing much to be found.

We had delayed annual results from Prospect Capital (PSEC), which came with an auditor’s warnings about the BDC’s internal controls, but investors were not too fazed after the initial surprise.

See PSEC’s stock price chart for the last 5 days:

Otherwise, there were just routine unchanged distribution announcements from Monroe Capital (MRCC); SLR Investment (SLRC) and PennantPark Floating Rate (PFLT) and an increase in Saratoga Investment’s (SAR) payout.

As mentioned, most every time there’s a revision to an analyst’s earnings projections, the numbers are headed higher than before.

On the credit front, we’ve noted a few trouble spots, but most of the recent bankruptcies reported have either not involved BDCs at all or caused negligible damage to the public players we track.

In any case, almost without exception, the credit problems BDCs face are with companies that have been underperforming for some time and for reasons unrelated to the current economic climate.

Relatively Strong

On the M&A side – much to everyone’s surprise – investment activity has not fallen off a cliff, despite the miserable mood.

S&P Global Market Intelligence reports U.S. M&A activity in August was $81bn, far exceeding the $46bn in July and $77bn in June.

Likewise, on many BDC conference calls, managers have been reporting all the way through August substantial deal backlogs and much activity even as everyone promises to be more selective.

Flying Blind

Which is all to say is that we’re seeing “the writing on the wall”, or canaries dropping off their perch or much of anything that warns that Winter Is Coming, except for all the hand wringing on the financial news networks.

Of course, investors are looking ahead as they always do, but are they tilting at windmills ?

We don’t know for sure but continue to lean towards a more optimistic view of how this all plays out.

In the interim – besides analyzing and commenting on BDC news developments – we’ll continue to search for signs of weakness in the broader markets; in credit results; in transaction activity and the like. Keep an eye on the BDC Daily News Feed where we share our findings.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.